Probate in Georgia requires submitting the original will, a death certificate, and a petition for probate to the probate court. Heirs and interested parties may also need to provide identification and proof of relationship to the decedent. Supporting documents such as a list of assets, creditor notices, and affidavits may be necessary to complete the process efficiently.

What Documents Are Required for Probate in Georgia?

| Number | Name | Description |

|---|---|---|

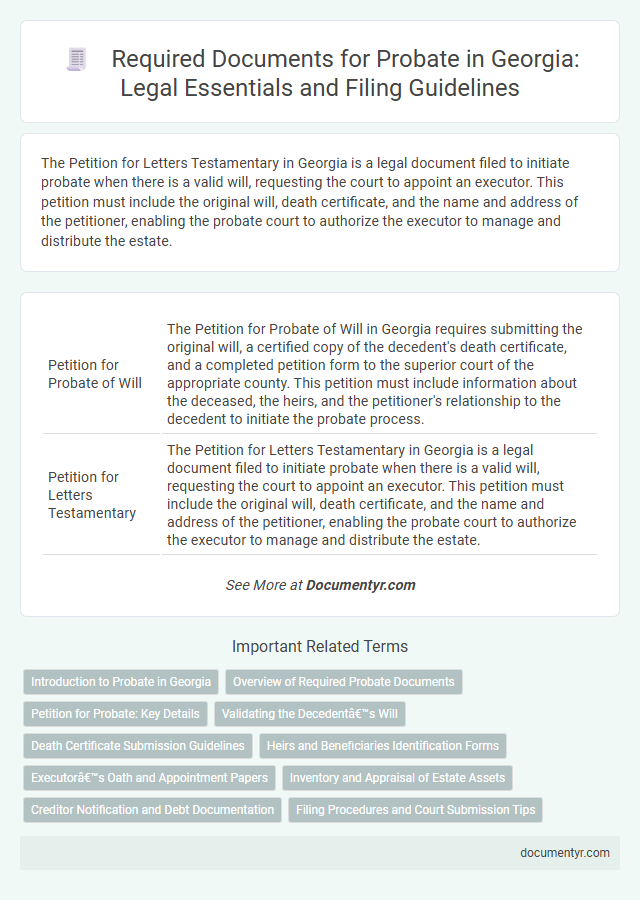

| 1 | Petition for Probate of Will | The Petition for Probate of Will in Georgia requires submitting the original will, a certified copy of the decedent's death certificate, and a completed petition form to the superior court of the appropriate county. This petition must include information about the deceased, the heirs, and the petitioner's relationship to the decedent to initiate the probate process. |

| 2 | Petition for Letters Testamentary | The Petition for Letters Testamentary in Georgia is a legal document filed to initiate probate when there is a valid will, requesting the court to appoint an executor. This petition must include the original will, death certificate, and the name and address of the petitioner, enabling the probate court to authorize the executor to manage and distribute the estate. |

| 3 | Petition for Letters of Administration | The Petition for Letters of Administration is a crucial document required for probate in Georgia when no will exists, formally requesting the court to appoint an administrator for the decedent's estate. This petition must include details about the deceased, rightful heirs, and estimated estate value to initiate the probate process and ensure proper estate administration under Georgia law. |

| 4 | Original Will (if applicable) | The original will must be submitted to the probate court in Georgia to initiate the probate process, serving as the primary legal document that directs the distribution of the decedent's estate. Without the original will, the court may require additional steps or assume the estate is intestate, potentially complicating probate proceedings. |

| 5 | Death Certificate | The death certificate is a mandatory document required for probate in Georgia, serving as official proof of the decedent's passing. This certified record must be submitted to the probate court to initiate the estate administration process. |

| 6 | Notice to Heirs and Beneficiaries | The Notice to Heirs and Beneficiaries is a crucial document in Georgia probate, ensuring all interested parties are formally informed of the probate proceedings in accordance with O.C.G.A. SS 53-7-41. Proper service of this notice allows heirs and beneficiaries the opportunity to contest the will or claim their interests within the statutory timeframe. |

| 7 | Oath of Personal Representative (Executor or Administrator) | The Oath of Personal Representative is a mandatory document in Georgia probate proceedings, requiring the appointed executor or administrator to swear to faithfully execute their duties on behalf of the estate. This oath ensures legal accountability and is filed with the probate court to validate the authority of the personal representative. |

| 8 | Order for Probate | The Order for Probate in Georgia is a critical legal document issued by the probate court that officially appoints an executor or administrator to manage the deceased's estate. This order validates the will, grants authority to distribute assets, and is required alongside the original will, death certificate, and petition for probate when initiating the probate process. |

| 9 | Probate Court Filing Fee Receipt | The Probate Court Filing Fee Receipt is essential proof of payment required during the probate process in Georgia, ensuring that the court fees have been settled before proceeding with estate administration. This receipt must accompany the initial probate petition and is critical for validating the filing and preventing delays in the probate case. |

| 10 | Inventory of Assets | The Inventory of Assets is a crucial document in Georgia probate proceedings, detailing all property owned by the decedent at the time of death, including real estate, bank accounts, personal belongings, and investments. Accurate submission of this inventory ensures proper valuation and distribution of the estate according to Georgia probate laws. |

| 11 | Annual Returns/Reports | Annual Returns or Reports are critical documents required during the probate process in Georgia to provide a comprehensive account of the estate's financial activity, including income, expenses, and distributions. These reports must be submitted periodically to the probate court to ensure transparent administration of the estate and compliance with Georgia probate laws. |

| 12 | Waiver of Bond (if applicable) | The Waiver of Bond is a critical probate document in Georgia, required to release the executor or administrator from posting a surety bond, which protects estate assets from potential mismanagement. This waiver must be approved by the court and is typically granted when the will explicitly waives the bond or all heirs consent in writing. |

| 13 | Letters of Testamentary or Administration (granted by the court) | Letters of Testamentary or Administration, issued by the Georgia probate court, officially authorize the executor or administrator to manage and distribute the deceased's estate. These documents are essential for validating the estate representative's legal authority to handle assets, pay debts, and settle claims during the probate process. |

| 14 | Renunciation of Right to Serve (if applicable) | The Renunciation of Right to Serve document is required in Georgia probate when an heir or nominated executor voluntarily declines their appointment, and it must be notarized and submitted to the probate court to ensure proper administration of the estate. This document helps avoid conflicts and streamlines the probate process by officially recording the individual's waiver of their executor or administrator duties. |

| 15 | Creditor Notice/Affidavit of Publication | The creditor notice or affidavit of publication is a critical document in Georgia probate, serving to inform potential creditors of the decedent's estate and allowing them to file claims within a specified time frame. This document must be published in a local newspaper and filed with the probate court to comply with Georgia probate code requirements and protect the estate from future undisclosed debts. |

| 16 | Application for Year's Support (if applicable) | The Application for Year's Support in Georgia probate requires a sworn statement listing the surviving spouse's marital status, financial needs, and affidavits confirming spousal dependency on the decedent's estate. This document must be filed alongside the application for letters of administration or testamentary to secure statutory financial support for the surviving spouse during probate. |

| 17 | Affidavit of Domicile | The Affidavit of Domicile in Georgia is a critical probate document used to establish the decedent's residence at the time of death, which helps determine the appropriate probate venue. This affidavit must be notarized and filed with the probate court alongside the will and death certificate to initiate the probate process efficiently. |

| 18 | Tax Identification Number Application (EIN for Estate) | To apply for a Tax Identification Number (EIN) for an estate during probate in Georgia, the executor or personal representative must submit IRS Form SS-4, which requires the estate's legal name, address, and Social Security Number of the decedent. Obtaining an EIN is essential for filing the estate tax return and managing financial affairs, ensuring compliance with both federal and Georgia state probate laws. |

| 19 | Notice of Appointment of Executor/Administrator | The Notice of Appointment of Executor/Administrator is a crucial document required for probate in Georgia, officially notifying interested parties of the executor or administrator's authority to manage the decedent's estate. This notice must be published in a local newspaper and filed with the probate court to ensure transparency and allow creditors or heirs to assert claims within the statutory time frame. |

| 20 | Receipts and Releases from Heirs or Beneficiaries | Receipts and releases from heirs or beneficiaries are essential probate documents in Georgia, verifying the distribution of estate assets and preventing future claims against the estate. These documents ensure legal acknowledgment that heirs have received their inheritance, facilitating a smoother probate process. |

Introduction to Probate in Georgia

Probate in Georgia is the legal process through which a deceased person's will is validated and their estate is administered. This process ensures that debts are paid and assets are distributed according to the will or state law.

- Petition for Probate - A formal request filed with the probate court to begin the probate process and appoint an executor or administrator.

- Last Will and Testament - The original will of the deceased, which outlines the distribution of assets and appoints the executor.

- Death Certificate - An official document verifying the death, required to initiate probate procedures.

Understanding these key documents is essential for navigating the probate process efficiently in Georgia.

Overview of Required Probate Documents

Probate in Georgia requires specific legal documents to ensure the proper administration of an estate. These documents establish the validity of the will and authorize the executor to manage the deceased's assets.

Key probate documents include the original will, if available, and the petition for probate filed with the local probate court. Additional filings often include the death certificate, notice of probate, and letters testamentary or letters of administration that grant authority to the personal representative.

Petition for Probate: Key Details

| Document | Key Details |

|---|---|

| Petition for Probate | The Petition for Probate is a fundamental document required to initiate the probate process in Georgia. It must include the decedent's full name, date of death, and the petitioner's relationship to the decedent. This petition formally requests the court to appoint an executor or administrator to manage the estate. Filing this document opens the official probate case and allows for the validation of the will, if one exists. |

| Death Certificate | A certified copy of the decedent's death certificate must accompany the Petition for Probate, serving as proof of death and triggering the probate process. |

| Original Will | If a valid will exists, the original document needs to be submitted with the petition to guide the estate distribution as per the decedent's wishes. |

| Notice of Petition to Probate | This legal notice must be served to heirs and interested parties, informing them of the probate proceedings and providing an opportunity to contest. |

| Letters Testamentary or Letters of Administration | Upon approval of the petition, the court issues these letters, granting authority to You as the executor or administrator to act on behalf of the estate. |

Validating the Decedent’s Will

What documents are required to validate the decedent's will in Georgia probate proceedings? The primary document needed is the original will of the decedent. The probate court also requires a death certificate to authenticate the passing of the individual.

Death Certificate Submission Guidelines

Submitting a certified death certificate is a fundamental requirement for probate in Georgia. The court requires this document to officially verify the decedent's passing before proceeding with estate administration.

You must provide an original or certified copy of the death certificate, obtained from the Georgia Department of Public Health or the county where the death occurred. This document supports the probate petition and helps establish the decedent's identity and date of death.

Heirs and Beneficiaries Identification Forms

In Georgia probate cases, identifying heirs and beneficiaries accurately is essential for a smooth process. Your court may require specific forms such as the Heirship Affidavit or the Beneficiary Designation forms to confirm rightful claims. These documents ensure that assets are distributed according to the decedent's wishes and state laws.

Executor’s Oath and Appointment Papers

Probate in Georgia requires specific documents to validate and administer a deceased person's estate. Key documents include the Executor's Oath and Appointment Papers, which establish legal authority and responsibilities.

- Executor's Oath - This is a sworn statement that you must sign, affirming your commitment to faithfully execute the duties as the estate's executor.

- Appointment Papers - These official documents issued by the probate court confirm your legal appointment as the estate's personal representative.

- Additional Probate Forms - Depending on the case, the court may require the Will, death certificate, and an inventory of the estate's assets to complete probate.

Inventory and Appraisal of Estate Assets

In Georgia, the inventory and appraisal of estate assets are crucial documents required for probate. This inventory lists all assets owned by the decedent at the time of death, including real estate, personal property, and financial accounts. The appraisal provides a fair market value of these assets, ensuring accurate estate assessment for tax and distribution purposes.

Creditor Notification and Debt Documentation

In Georgia probate cases, notifying creditors and providing accurate debt documentation are essential steps to ensure proper estate administration. These documents help protect the estate from unresolved claims and clarify outstanding debts.

- Creditor Notification Requirement - The executor must notify all known creditors of the deceased by publishing a notice in a local newspaper and sending direct notifications.

- Proof of Debt Documentation - Creditors must submit detailed statements or affidavits verifying the nature and amount of the debt owed to validate claims against the estate.

- Submission of Debt Records - The executor compiles and submits all creditor claims and debt documents to the probate court for review and payment authorization.

What Documents Are Required for Probate in Georgia? Infographic