To apply for 501(c)(3) status, a nonprofit must prepare and submit key documents including the Articles of Incorporation, which establish the organization's legal existence, and the bylaws that outline governance structures. The application also requires Form 1023 or Form 1023-EZ, along with a detailed narrative of the nonprofit's activities, financial data, and statements of exempt purpose. Accurate completion and submission of these documents to the IRS are essential for securing tax-exempt status under section 501(c)(3).

What Documents Does a Nonprofit Need to Apply for 501(c)(3) Status?

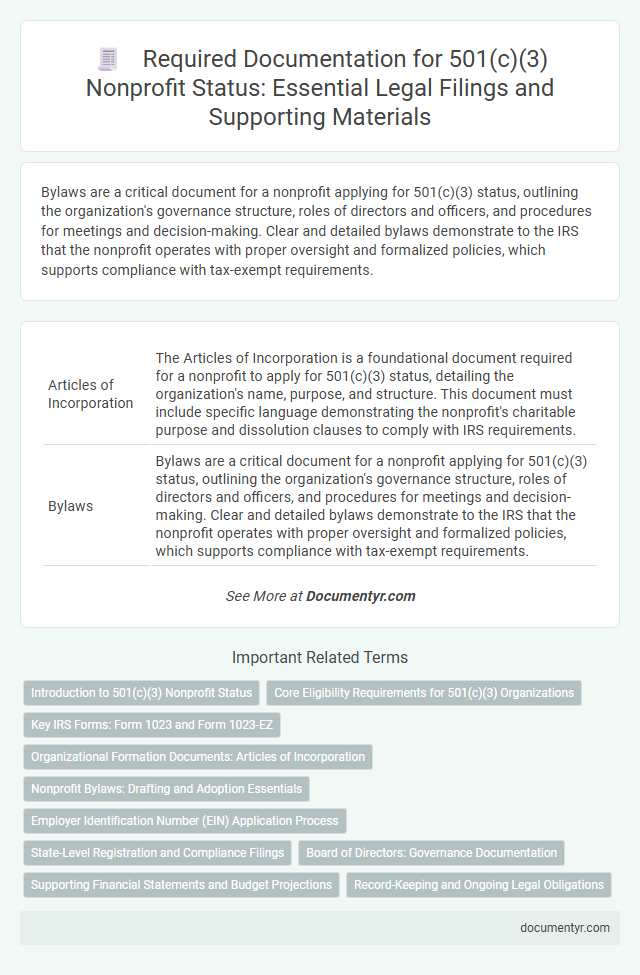

| Number | Name | Description |

|---|---|---|

| 1 | Articles of Incorporation | The Articles of Incorporation is a foundational document required for a nonprofit to apply for 501(c)(3) status, detailing the organization's name, purpose, and structure. This document must include specific language demonstrating the nonprofit's charitable purpose and dissolution clauses to comply with IRS requirements. |

| 2 | Bylaws | Bylaws are a critical document for a nonprofit applying for 501(c)(3) status, outlining the organization's governance structure, roles of directors and officers, and procedures for meetings and decision-making. Clear and detailed bylaws demonstrate to the IRS that the nonprofit operates with proper oversight and formalized policies, which supports compliance with tax-exempt requirements. |

| 3 | EIN Confirmation Letter (IRS Form SS-4) | The EIN Confirmation Letter, obtained using IRS Form SS-4, is essential for a nonprofit's 501(c)(3) application as it verifies the organization's Employer Identification Number, a unique identifier required by the IRS. This letter must be included with the Form 1023 submission to demonstrate that the nonprofit is properly registered for tax purposes. |

| 4 | IRS Form 1023 or Form 1023-EZ | Nonprofits must submit IRS Form 1023 or the streamlined Form 1023-EZ, accompanied by their organizing documents such as articles of incorporation, bylaws, and a detailed description of their planned activities to qualify for 501(c)(3) tax-exempt status. Including a narrative of the organization's exempt purpose, financial data, and compensation information ensures compliance with IRS requirements for tax-exemption approval. |

| 5 | Narrative of Activities | The Narrative of Activities for a 501(c)(3) application must clearly outline the nonprofit's past, present, and planned programs, demonstrating alignment with exempt purposes such as charitable, educational, or religious activities. Precise descriptions of how these activities further the organization's mission and benefit the public are essential for IRS approval. |

| 6 | Financial Statements or Budget | Nonprofits applying for 501(c)(3) status must include detailed financial statements or a proposed budget demonstrating fiscal responsibility and sustainability. The IRS requires a clear presentation of current assets, liabilities, income sources, and projected expenses to assess the organization's ability to fulfill its charitable mission. |

| 7 | Conflict of Interest Policy | A Conflict of Interest Policy is a mandatory document for nonprofits applying for 501(c)(3) status with the IRS to demonstrate commitment to ethical governance and transparency. This policy helps prevent decision-making influenced by personal interests and is essential to maintain public trust and IRS compliance during the application process. |

| 8 | List of Board of Directors | The list of the Board of Directors is a crucial document required for 501(c)(3) status application, detailing each director's name, address, and position. This list demonstrates governance structure and is essential for IRS evaluation of the nonprofit's organizational framework. |

| 9 | Governing Document Amendments (if applicable) | Nonprofits must include any Governing Document Amendments when applying for 501(c)(3) status to ensure the IRS reviews the most current organizational rules and purposes. These amendments should clearly reflect changes aligning the organization's mission and activities with tax-exempt requirements under IRS guidelines. |

| 10 | State Registration or Certificate of Good Standing | A nonprofit applying for 501(c)(3) status typically must submit a State Registration or Certificate of Good Standing, demonstrating compliance with state laws and active corporate status. This documentation verifies that the nonprofit is properly registered, has met state filing requirements, and is authorized to operate within the state jurisdiction. |

Introduction to 501(c)(3) Nonprofit Status

Obtaining 501(c)(3) status grants a nonprofit organization federal tax-exempt recognition under the Internal Revenue Code. This status is essential for nonprofits seeking tax-deductible donations and public trust.

Applying for 501(c)(3) requires submitting specific legal documents to the IRS. Proper documentation ensures compliance with federal regulations and validates the nonprofit's charitable purpose.

Core Eligibility Requirements for 501(c)(3) Organizations

To apply for 501(c)(3) status, a nonprofit must meet specific core eligibility requirements set by the IRS. Essential documents include the Articles of Incorporation and bylaws, which establish the organization's legal and operational framework.

The nonprofit's purpose must be exclusively charitable, religious, educational, scientific, or literary to qualify under section 501(c)(3). Your application must include a detailed narrative of activities demonstrating how the organization operates in alignment with these purposes. Additionally, the IRS requires a completed Form 1023 or Form 1023-EZ, along with financial statements projecting income and expenses for the first few years.

Key IRS Forms: Form 1023 and Form 1023-EZ

Applying for 501(c)(3) status requires specific IRS documents that demonstrate an organization's compliance with nonprofit regulations. Form 1023 and Form 1023-EZ are the primary applications used to request federal tax-exempt status.

- Form 1023 - The comprehensive application for charitable organizations seeking 501(c)(3) status, requiring detailed financial and organizational information.

- Form 1023-EZ - A streamlined, shorter version of Form 1023 designed for smaller nonprofits with less complex operations.

- Supporting Documentation - Both forms require attachments such as articles of incorporation and bylaws to verify the nonprofit's structure and purpose.

Properly completing the appropriate IRS form is essential for obtaining official recognition as a tax-exempt nonprofit entity.

Organizational Formation Documents: Articles of Incorporation

To apply for 501(c)(3) status, a nonprofit must submit Organizational Formation Documents, primarily the Articles of Incorporation. These articles establish the nonprofit's legal existence and include essential information such as the organization's name, purpose, and registered agent. Accurate Articles of Incorporation are crucial to demonstrate compliance with IRS requirements and enable tax-exempt recognition.

Nonprofit Bylaws: Drafting and Adoption Essentials

| Document | Description | Importance in 501(c)(3) Application |

|---|---|---|

| Articles of Incorporation | Legal document filed with the state to formally create the nonprofit corporation. | Establishes the organization's legal existence and includes essential language for tax-exempt status. |

| Nonprofit Bylaws | Internal rules governing the nonprofit's operations, including management structure and member duties. | Required by the IRS to demonstrate proper governance. Properly drafted bylaws increase the likelihood of approval. |

| Form 1023 or 1023-EZ | IRS application form for recognition of tax-exempt status under section 501(c)(3). | Primary document for requesting federal tax exemption; must include detailed organizational structure and activities. |

| Conflict of Interest Policy | Policy ensuring board members disclose personal interests to prevent conflicts. | Signals strong governance practices, improving the credibility of your application. |

| Financial Statements | Documents showing the nonprofit's financial status, such as budgets and statements. | Necessary for the IRS to assess financial integrity and sustainability of your nonprofit. |

| Nonprofit Bylaws: Drafting and Adoption Essentials | Bylaws must clearly define the organization's purpose, board roles, meeting procedures, and amendment process. | Adopted bylaws demonstrate organized governance and compliance with IRS requirements, essential for 501(c)(3) approval. |

Employer Identification Number (EIN) Application Process

Applying for 501(c)(3) status requires a nonprofit to obtain an Employer Identification Number (EIN) from the IRS. The EIN is a unique nine-digit number used to identify the organization for tax purposes.

The application process involves completing IRS Form SS-4, which can be submitted online, by fax, or by mail. Receiving the EIN is essential before filing the Form 1023 application for tax-exempt status.

State-Level Registration and Compliance Filings

State-level registration is a critical step in securing 501(c)(3) status for your nonprofit. Compliance filings ensure ongoing adherence to state regulations and maintain good standing.

- Charitable Solicitation Registration - Most states require nonprofits to register before fundraising to legally solicit donations.

- State Tax Exemption Application - Applying for state sales and income tax exemptions is often necessary after receiving federal tax-exempt status.

- Annual Compliance Reports - Nonprofits must file periodic reports, such as financial disclosures or renewal forms, to comply with state laws.

Board of Directors: Governance Documentation

What specific governance documents related to the Board of Directors are required for a nonprofit applying for 501(c)(3) status? Nonprofits must provide detailed articles of incorporation and bylaws that outline the board's structure and responsibilities. These documents demonstrate compliance with IRS requirements and establish clear governance protocols.

Supporting Financial Statements and Budget Projections

Supporting financial statements and budget projections are critical components for a nonprofit applying for 501(c)(3) status. These documents demonstrate the organization's fiscal responsibility and expected financial sustainability to the IRS.

- Balance Sheet - Provides a snapshot of the nonprofit's assets, liabilities, and net assets at a specific point in time.

- Income Statement - Details revenues, expenses, and changes in net assets over a fiscal period to show financial performance.

- Budget Projections - Offers estimated income and expenditure forecasts for at least the next three years to support financial planning and viability.

What Documents Does a Nonprofit Need to Apply for 501(c)(3) Status? Infographic