Essential documents for real estate closing in Texas include the purchase agreement, title commitment, and the deed transferring property ownership. Buyers must also provide proof of homeowners insurance and a government-issued ID, while sellers need to supply affidavits and disclosures related to property condition. The closing statement outlines all financial details, ensuring transparency between both parties before finalizing the transaction.

What Documents Are Necessary for Real Estate Closing in Texas?

| Number | Name | Description |

|---|---|---|

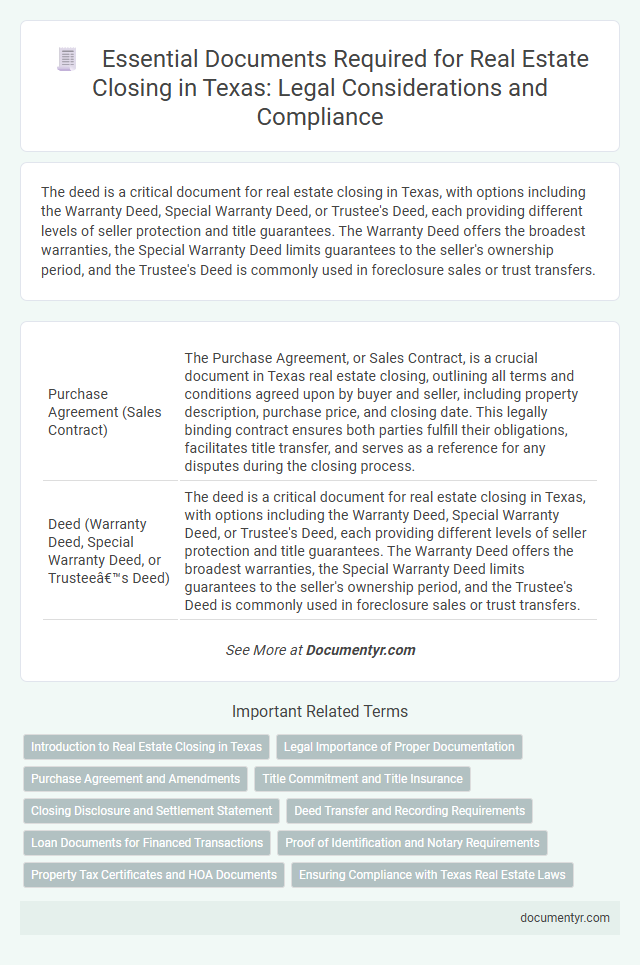

| 1 | Purchase Agreement (Sales Contract) | The Purchase Agreement, or Sales Contract, is a crucial document in Texas real estate closing, outlining all terms and conditions agreed upon by buyer and seller, including property description, purchase price, and closing date. This legally binding contract ensures both parties fulfill their obligations, facilitates title transfer, and serves as a reference for any disputes during the closing process. |

| 2 | Deed (Warranty Deed, Special Warranty Deed, or Trustee’s Deed) | The deed is a critical document for real estate closing in Texas, with options including the Warranty Deed, Special Warranty Deed, or Trustee's Deed, each providing different levels of seller protection and title guarantees. The Warranty Deed offers the broadest warranties, the Special Warranty Deed limits guarantees to the seller's ownership period, and the Trustee's Deed is commonly used in foreclosure sales or trust transfers. |

| 3 | Closing Disclosure (CD) | The Closing Disclosure (CD) is a mandatory document in Texas real estate transactions that itemizes all loan terms, closing costs, and fees, providing transparency to buyers before finalizing the deal. Lenders must deliver the CD to buyers at least three business days prior to closing, ensuring compliance with the Real Estate Settlement Procedures Act (RESPA) and helping prevent last-minute surprises. |

| 4 | Loan Estimate | The Loan Estimate is a critical document in Texas real estate closing, providing borrowers with key details on loan terms, projected payments, and closing costs within three business days of application. This document ensures transparency and helps buyers compare mortgage offers, facilitating informed decisions before finalizing the property purchase. |

| 5 | Promissory Note | The promissory note is a crucial legal document in Texas real estate closings, outlining the borrower's promise to repay the loan under specified terms, including interest rate and payment schedule. This document serves as evidence of the debt and is required to establish the buyer's financial commitment and secure the mortgage lien on the property. |

| 6 | Deed of Trust | The Deed of Trust is a crucial document in Texas real estate closings, serving as the security instrument that places a lien on the property to secure the loan. This document must be properly executed and recorded in the county where the property is located to ensure the lender's legal rights are protected. |

| 7 | Title Commitment | A Title Commitment is a crucial document in Texas real estate closings, outlining the conditions under which the title insurer will issue a title insurance policy, ensuring clear ownership and protection against title defects. This document includes essential details such as property description, current ownership, title exceptions, and requirements that must be satisfied before closing. |

| 8 | Title Insurance Policy | A Title Insurance Policy is essential for real estate closing in Texas, protecting buyers and lenders against title defects or ownership disputes. This policy ensures clear ownership by verifying legal property status and safeguarding against hidden liens or claims. |

| 9 | Survey (Property Survey or Boundary Survey) | A Property Survey or Boundary Survey is essential for Texas real estate closings as it precisely defines the property's legal boundaries and identifies any encroachments or easements affecting the land. This document ensures clear title transfer and prevents future disputes by verifying the physical dimensions and location of the property according to official county records. |

| 10 | Seller’s Disclosure Notice | The Seller's Disclosure Notice is a mandatory document in Texas real estate closings, requiring the seller to detail any known material defects or issues affecting the property. This notice helps protect buyers by providing transparency about property conditions, ensuring compliance with Texas Property Code Section 5.008. |

| 11 | Homeowners’ Association (HOA) Documents | Homeowners' Association (HOA) documents necessary for real estate closing in Texas include the HOA bylaws, declaration of covenants, conditions, and restrictions (CC&Rs), financial statements, and meeting minutes, which provide essential information about community rules, fees, and financial health. These documents ensure buyers are fully informed about their rights, responsibilities, and any pending assessments within the association. |

| 12 | Tax Certificates | Tax certificates are essential documents in Texas real estate closings as they verify that all property taxes have been paid up to the date of sale, preventing any tax liens from affecting the transfer of ownership. These certificates are typically issued by the county tax assessor-collector and must be obtained and reviewed before closing to ensure a clear title for the buyer. |

| 13 | Proof of Homeowners Insurance | Proof of homeowners insurance is a critical document required for real estate closing in Texas, ensuring the property is protected against potential damages or losses. Lenders and title companies typically mandate a valid insurance binder or policy declaration page as evidence prior to finalizing the transaction. |

| 14 | Payoff Statements (for existing liens/mortgages) | Payoff statements are essential documents in Texas real estate closings, detailing the exact amount needed to satisfy existing liens or mortgages on the property. These statements ensure clear title transfer by confirming outstanding balances and any accrued interest, preventing future lien claims. |

| 15 | Bill of Sale (for personal property included in sale) | A Bill of Sale is essential in Texas real estate closings to legally transfer ownership of personal property included in the sale, such as appliances or fixtures. This document must clearly describe the items, state the parties involved, and be signed to ensure enforceability and avoid disputes. |

| 16 | Closing Statement (Settlement Statement or ALTA Statement) | The Closing Statement, also known as the Settlement Statement or ALTA Statement, is a critical document in Texas real estate closings that itemizes all financial transactions between buyer, seller, and lender, ensuring clear accounting of costs and credits. This document includes detailed information such as purchase price, loan amounts, escrow funds, prorated taxes, and closing costs, and is essential for compliance with Texas real estate regulations and lender requirements. |

| 17 | Identification (Government-issued Photo ID) | Government-issued photo identification, such as a valid Texas driver's license or U.S. passport, is mandatory for all parties involved in a real estate closing to verify identity and prevent fraud. Lenders, title companies, and notaries require this ID to ensure compliance with state regulations and secure the transaction. |

| 18 | Affidavit of Title | The Affidavit of Title is a crucial document in Texas real estate closings, ensuring the seller legally owns the property and disclosing any claims, liens, or encumbrances. This affidavit protects buyers and lenders by providing a sworn statement verifying clear title status, essential for a smooth and secure transaction. |

| 19 | Release of Lien (if applicable) | A Release of Lien is essential in a Texas real estate closing when a prior mortgage, judgment, or claim has been paid off, ensuring the property title is clear and marketable. This legal document must be recorded with the county clerk's office to formally remove the lien and protect the buyer's ownership rights. |

| 20 | Power of Attorney (if applicable) | A Power of Attorney document is necessary for real estate closing in Texas if one party authorizes another to act on their behalf, ensuring legal authority to execute closing documents. This notarized and properly executed document must comply with Texas state laws to be valid during the transaction. |

| 21 | Escrow Agreement | An Escrow Agreement is a critical document in Texas real estate closing that outlines the terms under which a neutral third party holds and manages funds or documents until all conditions of the sale are met. This agreement ensures the secure transfer of property by protecting buyer and seller interests until closing obligations are fulfilled. |

| 22 | IRS Form W-9 | IRS Form W-9 is necessary for real estate closing in Texas to provide the buyer with the seller's correct Taxpayer Identification Number (TIN) for reporting purposes. This form ensures compliance with IRS regulations, facilitating accurate tax reporting of the transaction proceeds. |

| 23 | 1099-S Tax Form | The 1099-S Tax Form is essential for reporting the sale or exchange of real estate in Texas, ensuring compliance with IRS regulations by detailing the gross proceeds from the transaction. Sellers and closing agents must provide this form to accurately report capital gains and avoid potential penalties during the property transfer process. |

| 24 | Certificate of Occupancy (for new constructions) | The Certificate of Occupancy is a crucial document in Texas real estate closings for new constructions, verifying that the property complies with local building codes and is safe for occupancy. Lenders and title companies require this certificate to ensure the property meets all legal standards before finalizing the transaction. |

Introduction to Real Estate Closing in Texas

Real estate closing in Texas marks the final step in transferring property ownership from the seller to the buyer. This process requires specific legal documents to ensure a smooth and lawful transaction.

Key documents include the deed, which officially transfers ownership, and the title insurance policy that protects against future claims. Closing statements outline the financial aspects, detailing fees, taxes, and payments. Proper identification and loan documents are also essential to finalize the sale.

Legal Importance of Proper Documentation

Proper documentation is crucial for a seamless real estate closing in Texas, ensuring all legal requirements are met. Missing or incorrect documents can delay the process and create legal complications.

- Deed - Establishes the legal ownership of the property and must be accurately recorded.

- Title Insurance - Protects buyers and lenders from potential title defects or disputes.

- Closing Disclosure - Details all financial terms and costs, providing transparency to all parties involved.

Purchase Agreement and Amendments

| Document | Description | Importance in Real Estate Closing |

|---|---|---|

| Purchase Agreement | The legally binding contract between the buyer and seller outlining terms of the property sale, including price, property details, and closing dates. | Serves as the foundation for the transaction, confirming the mutual consent and specific conditions agreed upon by the parties involved. |

| Amendments to Purchase Agreement | Written modifications or additions to the original purchase agreement that address changes in terms such as price adjustments, closing extensions, or contingencies. | Ensures that any changes during the negotiation or closing process are documented and enforceable, protecting Your legal interests. |

| Title Commitment | A preliminary report from a title company showing the property's legal ownership and any liens or encumbrances. | Confirms clear title transfer to the buyer, avoiding future legal disputes. |

| Seller's Disclosure Notice | Statement from the seller about the condition of the property and any known defects. | Informs You about potential issues impacting property value or habitability. |

| Deed | Legal document transferring ownership from seller to buyer. | Finalizes ownership rights once properly recorded. |

| Closing Statement (HUD-1 or Closing Disclosure) | Detailed summary of all financial transactions including costs, fees, and payment distributions. | Provides transparency for all monetary aspects of the closing. |

Title Commitment and Title Insurance

Title Commitment is a crucial document in Texas real estate closing, providing a detailed report on the property's ownership history and any liens or encumbrances. Title Insurance protects your investment by covering potential legal issues or defects that may arise after closing. These documents ensure the transaction's security and clear ownership transfer during the closing process.

Closing Disclosure and Settlement Statement

In Texas real estate transactions, specific documents are crucial for a smooth closing process. The Closing Disclosure and Settlement Statement are key papers detailing the financial aspects of the deal.

- Closing Disclosure - Outlines the final loan terms, closing costs, and the amount needed to close, provided to the buyer at least three days before closing.

- Settlement Statement - Summarizes all transaction fees, credits, and payments between buyer and seller, ensuring transparency in the financial settlement.

- Importance of Both Documents - They verify that all parties agree on the financial details to avoid disputes during the closing.

Reviewing these documents carefully helps confirm the accuracy of the transaction before finalizing the sale.

Deed Transfer and Recording Requirements

In Texas, the deed transfer is a critical document for real estate closing, establishing legal ownership of the property. The deed must be properly signed, notarized, and delivered to the county clerk for official recording. Recording the deed ensures public notice of ownership and protects Your property rights against future claims.

Loan Documents for Financed Transactions

Loan documents are crucial for real estate closings in Texas, especially for financed transactions. These documents establish the terms and conditions of your mortgage agreement with the lender.

The main loan documents include the Promissory Note, which details your promise to repay the loan, and the Deed of Trust, securing the loan against the property. Other essential documents consist of the Closing Disclosure, Loan Estimate, and the Mortgage Servicing Disclosure Statement, ensuring transparency in fees and loan servicing.

Proof of Identification and Notary Requirements

What documents are necessary for real estate closing in Texas, specifically regarding proof of identification and notary requirements?

Proof of identification is essential to verify the identity of all parties involved in the transaction. Texas law mandates that certain documents must be notarized to ensure the authenticity of signatures and protect against fraud.

Property Tax Certificates and HOA Documents

Real estate closing in Texas requires specific documents to ensure a smooth transfer of ownership. Property tax certificates and HOA documents play a critical role in this process.

- Property Tax Certificates - These certificates verify that all property taxes have been paid up to the closing date to prevent future liens.

- HOA Documents - Homeowners Association (HOA) documents provide details on any fees, rules, or restrictions affecting the property.

- Requirement for Closing - You must obtain and review these documents to avoid legal complications and confirm the property's financial status before closing.

What Documents Are Necessary for Real Estate Closing in Texas? Infographic