Filing for Chapter 7 bankruptcy requires submitting key documents including a completed bankruptcy petition, schedules of assets and liabilities, statement of financial affairs, and recent tax returns. Creditors' lists and proof of income, such as pay stubs or social security statements, are also essential. Accurate documentation ensures compliance with court requirements and facilitates the bankruptcy process.

What Documents Are Needed to File for Bankruptcy Chapter 7?

| Number | Name | Description |

|---|---|---|

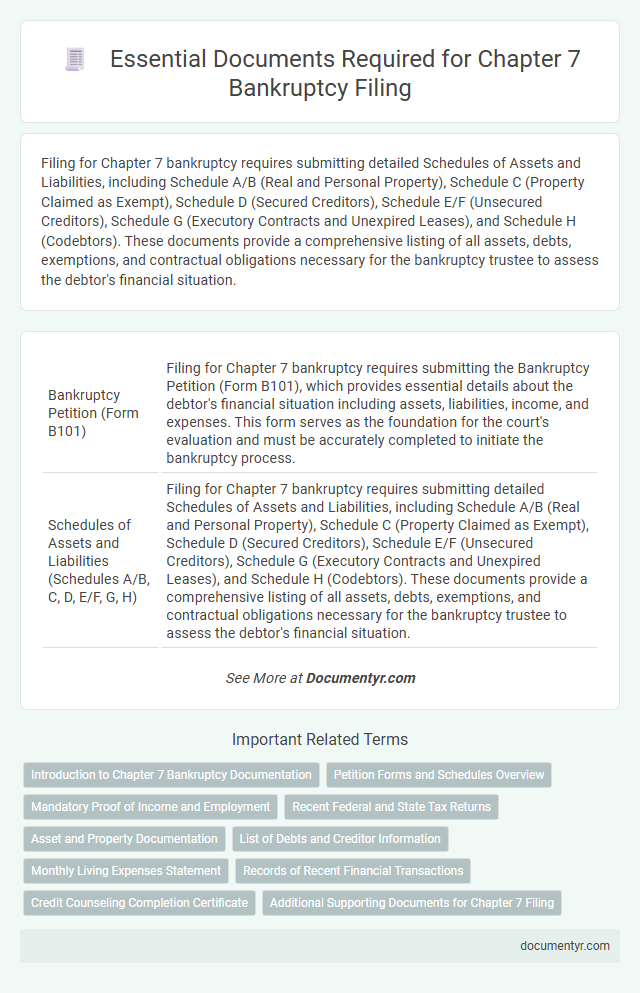

| 1 | Bankruptcy Petition (Form B101) | Filing for Chapter 7 bankruptcy requires submitting the Bankruptcy Petition (Form B101), which provides essential details about the debtor's financial situation including assets, liabilities, income, and expenses. This form serves as the foundation for the court's evaluation and must be accurately completed to initiate the bankruptcy process. |

| 2 | Schedules of Assets and Liabilities (Schedules A/B, C, D, E/F, G, H) | Filing for Chapter 7 bankruptcy requires submitting detailed Schedules of Assets and Liabilities, including Schedule A/B (Real and Personal Property), Schedule C (Property Claimed as Exempt), Schedule D (Secured Creditors), Schedule E/F (Unsecured Creditors), Schedule G (Executory Contracts and Unexpired Leases), and Schedule H (Codebtors). These documents provide a comprehensive listing of all assets, debts, exemptions, and contractual obligations necessary for the bankruptcy trustee to assess the debtor's financial situation. |

| 3 | Schedule of Current Income and Expenditures (Schedules I & J) | Filing for Chapter 7 bankruptcy requires submitting Schedule I, which details your current monthly income from all sources, and Schedule J, which outlines your monthly expenses including housing, utilities, and debts. Accurate completion of these schedules is critical for the court to assess your financial situation and determine eligibility for Chapter 7 relief. |

| 4 | Statement of Financial Affairs (Form B107) | The Statement of Financial Affairs (Form B107) is a critical document required for filing Chapter 7 bankruptcy, detailing the debtor's financial history, transfers of property, income, and lawsuits within specified timeframes. Accurate completion of Form B107 is essential for full disclosure to the bankruptcy court and trustee, ensuring the Chapter 7 process proceeds without delays or challenges. |

| 5 | Statement of Intention (Form B108) | The Statement of Intention (Form B108) is a required document when filing for Chapter 7 bankruptcy, detailing the debtor's plans for secured property, such as whether they intend to surrender, redeem, or reaffirm the collateral. This form helps the court and creditors understand how secured debts will be handled throughout the bankruptcy process. |

| 6 | Credit Counseling Certificate | Filing for Chapter 7 bankruptcy requires a Credit Counseling Certificate obtained from an approved agency within 180 days before filing, verifying completion of a mandatory credit counseling session. This certificate is essential to meet the court's prerequisites and avoid dismissal of the bankruptcy petition. |

| 7 | Pay Stubs or Proof of Income (Last 60 days) | Filing for Chapter 7 bankruptcy requires submitting pay stubs or proof of income from the last 60 days to accurately assess financial status and eligibility. These documents validate your current earnings and help the trustee determine your repayment capability under bankruptcy guidelines. |

| 8 | Federal and State Tax Returns (Last 2 years) | Filing for Chapter 7 bankruptcy requires submitting federal and state tax returns for the last two years to verify income and financial status accurately. These tax documents are essential for the bankruptcy trustee to evaluate exemption eligibility and assess repayment capacity under federal bankruptcy laws. |

| 9 | Bank Statements (Recent months) | Recent months' bank statements are crucial documents in a Chapter 7 bankruptcy filing, as they provide detailed evidence of your financial transactions and cash flow. These statements help the bankruptcy trustee assess your financial situation, identify any possible fraudulent transfers, and confirm your income and expenses. |

| 10 | Documentation of Real Estate Ownership (Deeds, Mortgage Statements) | Filing for Chapter 7 bankruptcy requires submitting documentation of real estate ownership, including property deeds that prove legal title and recent mortgage statements detailing outstanding loan balances. These documents help the bankruptcy trustee evaluate the equity in your real estate assets and determine exemptions or liquidation options. |

| 11 | Vehicle Titles and Loan Statements | Filing for Chapter 7 bankruptcy requires submitting vehicle titles and recent loan statements to verify ownership and outstanding debts on any automobiles. Accurate documentation ensures that the bankruptcy trustee accurately assesses assets and liabilities related to your vehicles. |

| 12 | Statements for Retirement Accounts (401k, IRA) | When filing for Chapter 7 bankruptcy, you must provide detailed statements for all retirement accounts, including 401(k) and IRA documents, to accurately disclose your assets and determine exemption eligibility. These statements should reflect the current balances, contribution history, and any loans or withdrawals related to the accounts. |

| 13 | Life Insurance Policies (with cash value) | When filing for Chapter 7 bankruptcy, it is crucial to include detailed documentation of life insurance policies with cash value, such as the policy statements, current cash surrender value, and account history. These documents help the bankruptcy trustee assess the policy's worth and determine its status as either exempt or non-exempt assets in the liquidation process. |

| 14 | Documentation of Other Assets (e.g., stocks, bonds, jewelry appraisals) | Documentation of other assets for Chapter 7 bankruptcy filing includes detailed inventories and valuation records such as stock certificates, bond statements, and professional appraisals for valuable items like jewelry. Accurate asset documentation ensures proper asset disclosure and helps the bankruptcy trustee determine which assets may be exempt or liquidated during the bankruptcy process. |

| 15 | List of Creditors with Addresses and Account Numbers | A detailed list of creditors, including their complete addresses and account numbers, is essential for filing Chapter 7 bankruptcy to ensure accurate notification and proper debt discharge processing. This list enables the bankruptcy court and trustee to verify claims and manage the debtor's obligations efficiently. |

| 16 | Collection Letters or Lawsuits/Judgments | To file for Chapter 7 bankruptcy, debtors must submit all collection letters, lawsuits, and judgments related to their debts as part of their bankruptcy paperwork. These documents help the court accurately assess outstanding obligations and ensure all claims are disclosed during the bankruptcy process. |

| 17 | Lease Agreements or Rental Contracts | Filing for Chapter 7 bankruptcy requires submitting all pertinent lease agreements or rental contracts to demonstrate current financial obligations related to housing. These documents help outline the terms of occupancy, monthly payments, and any outstanding liabilities, which are essential for accurate asset and debt assessment during the bankruptcy process. |

| 18 | Marital Settlement Agreement or Divorce Decree (if applicable) | Filing for Chapter 7 bankruptcy requires submitting a Marital Settlement Agreement or Divorce Decree if the applicant is divorced or separated, as these documents detail financial obligations and asset division relevant to the bankruptcy case. Providing these legal documents ensures accurate disclosure of income, debts, and property ownership, which is crucial for the trustee's evaluation and the court's decision. |

| 19 | Child Support or Alimony Orders (if applicable) | Bankruptcy Chapter 7 filings require submission of current child support or alimony orders to accurately disclose all financial obligations and ensure proper debt discharge evaluation. Including these legal documents helps protect creditor and debtor rights by clearly detailing ongoing payment responsibilities under family law. |

| 20 | Business Documents (if self-employed) | Self-employed individuals filing for Chapter 7 bankruptcy must provide detailed business documents, including profit and loss statements, balance sheets, tax returns for the past three years, bank statements, and records of business debts and assets. Accurate documentation of income and expenses is essential to establish the financial status and complete the means test required by the bankruptcy court. |

| 21 | Identification (Government-issued photo ID, Social Security Card) | Filing for Chapter 7 bankruptcy requires submitting valid identification documents such as a government-issued photo ID (driver's license or passport) and a Social Security card to verify the debtor's identity and social security number. These documents are essential for the bankruptcy court to accurately process the petition and prevent fraud. |

Introduction to Chapter 7 Bankruptcy Documentation

Filing for Chapter 7 bankruptcy requires submitting specific legal documents that detail your financial situation. These documents include your credit report, recent pay stubs, tax returns, and a list of all your assets and liabilities. Understanding the required paperwork ensures your case proceeds smoothly through the bankruptcy process.

Petition Forms and Schedules Overview

Filing for Chapter 7 bankruptcy requires submitting specific petition forms that initiate the legal process. These forms include the Voluntary Petition, which contains basic information about Your financial situation and the type of bankruptcy being filed.

The accompanying schedules provide a detailed overview of Your assets, liabilities, income, and expenses. Accurate completion of these schedules is essential to ensure the bankruptcy court has a clear understanding of Your financial status.

Mandatory Proof of Income and Employment

Filing for Chapter 7 bankruptcy requires submitting specific documents that verify income and employment status. Mandatory proof of income and employment ensures accurate assessment of your financial situation for the court.

- Recent Pay Stubs - Provide the latest pay stubs covering at least six months to verify ongoing income.

- Tax Returns - Submit federal tax returns from the past two years to demonstrate income consistency.

- Employment Verification Letter - Include a letter from your employer confirming your job status and salary details.

Recent Federal and State Tax Returns

Filing for Chapter 7 bankruptcy requires submission of key documents, including your most recent tax returns. These documents help verify financial status and income for the court's review.

- Federal Tax Returns - Provide copies of your last two years' federal tax returns, including all schedules and attachments, to demonstrate income.

- State Tax Returns - Submit recent state tax returns to ensure complete financial disclosure as required by both federal and state bankruptcy laws.

- Supporting Tax Documentation - Include W-2s, 1099s, and any amendments to tax returns that support the information reported in your tax filings.

Asset and Property Documentation

To file for Chapter 7 bankruptcy, detailed documentation of all assets and property is required. This includes recent bank statements, titles for vehicles, deeds for real estate, and appraisals of valuable possessions. Accurate and comprehensive asset records help the court assess liquidation potential and ensure proper case management.

List of Debts and Creditor Information

What documents are essential for listing debts and creditor information when filing for Chapter 7 bankruptcy? Detailed records of all debts and complete creditor contact information must be compiled. This ensures accurate filing and helps the bankruptcy trustee manage claims efficiently.

Monthly Living Expenses Statement

Filing for Chapter 7 bankruptcy requires submitting a detailed Monthly Living Expenses Statement. This document outlines all essential household costs to provide a clear financial picture for the court.

The Monthly Living Expenses Statement includes categories such as housing, utilities, food, transportation, healthcare, and insurance. Accurate reporting ensures the court can assess disposable income and determine eligibility for Chapter 7 relief. Supporting documents like receipts or bills may be necessary to verify these expenses.

Records of Recent Financial Transactions

When filing for Chapter 7 bankruptcy, you must provide detailed records of recent financial transactions to ensure full transparency. These documents include bank statements, recent credit card statements, and any records of large purchases or payments made within the last 90 days.

Such records help the bankruptcy trustee evaluate your financial activity and identify any potential fraudulent transfers. Gathering these documents early can streamline the filing process and support your case effectively.

Credit Counseling Completion Certificate

| Documents Needed to File for Bankruptcy Chapter 7 | |

|---|---|

| Credit Counseling Completion Certificate | A mandatory document required by the U.S. Bankruptcy Code before filing Chapter 7 bankruptcy. It proves that the debtor has completed the credit counseling session from an approved agency within 180 days prior to filing. The certificate includes the debtor's name, the date the counseling was completed, and a unique certificate number. Filing without this certificate may result in case dismissal or delays. The certificate confirms the debtor has explored credit counseling alternatives to resolve financial difficulties. |

| Additional Required Documents | Recent tax returns (last two years), pay stubs or proof of income, a list of all creditors and debts, a list of assets and property, bank statements, proof of monthly living expenses. These documents support the Chapter 7 petition and provide the court with a clear financial picture. |

What Documents Are Needed to File for Bankruptcy Chapter 7? Infographic