Lenders typically require proof of income, such as pay stubs, tax returns, and employment verification, to assess your financial stability. You must also provide credit history reports and bank statements to evaluate your creditworthiness and savings. Personal identification documents, including a valid ID or passport, are essential to confirm your identity during the mortgage pre-approval process.

What Documents Are Required for a Mortgage Pre-Approval?

| Number | Name | Description |

|---|---|---|

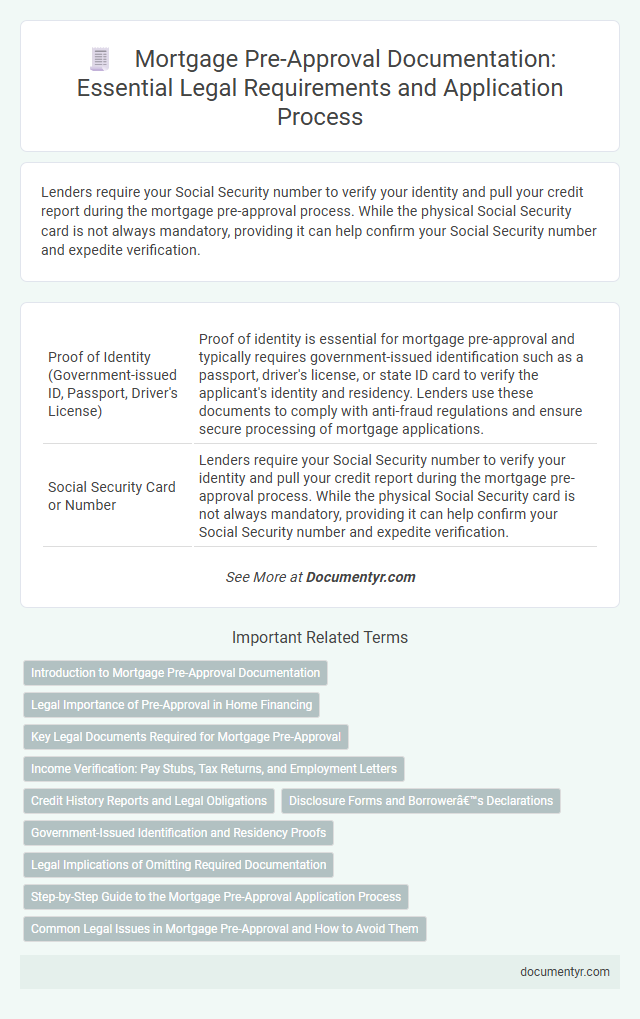

| 1 | Proof of Identity (Government-issued ID, Passport, Driver's License) | Proof of identity is essential for mortgage pre-approval and typically requires government-issued identification such as a passport, driver's license, or state ID card to verify the applicant's identity and residency. Lenders use these documents to comply with anti-fraud regulations and ensure secure processing of mortgage applications. |

| 2 | Social Security Card or Number | Lenders require your Social Security number to verify your identity and pull your credit report during the mortgage pre-approval process. While the physical Social Security card is not always mandatory, providing it can help confirm your Social Security number and expedite verification. |

| 3 | Proof of Income (Recent Pay Stubs) | Recent pay stubs are essential documents for mortgage pre-approval, providing verified evidence of your current income to lenders. These pay stubs typically cover the past 30 days and help establish your ability to repay the loan by reflecting consistent earnings and employment stability. |

| 4 | W-2 Wage Statements (Last 2 Years) | Lenders require W-2 wage statements from the past two years to verify consistent income and employment history during the mortgage pre-approval process. These documents help assess an applicant's financial stability and ability to repay the loan. |

| 5 | Federal Tax Returns (Last 2 Years) | Lenders require federal tax returns from the last two years to verify income consistency and ensure accurate assessment of the borrower's financial standing during mortgage pre-approval. These documents provide crucial evidence of earnings, deductions, and tax payments, enabling a comprehensive evaluation of creditworthiness. |

| 6 | Bank Statements (Last 2-3 Months) | Bank statements from the last 2-3 months are essential for mortgage pre-approval as they provide lenders with detailed evidence of your income, expenses, and financial stability. These statements help verify cash flow consistency, identify potential risks, and assess your ability to meet monthly mortgage payments. |

| 7 | Employment Verification Letter | An employment verification letter is a critical document for mortgage pre-approval, confirming the borrower's current job status, position, salary, and length of employment. Lenders rely on this letter to assess financial stability and ensure the applicant has a reliable income source to repay the mortgage loan. |

| 8 | Credit Report Authorization | Lenders require a credit report authorization form to access your credit history during the mortgage pre-approval process, enabling them to evaluate your creditworthiness accurately. This document allows the lender to verify your financial background, including outstanding debts, payment history, and credit score essential for determining loan eligibility. |

| 9 | Asset Documentation (Retirement Accounts, Investments) | Asset documentation for mortgage pre-approval must include recent statements from retirement accounts such as 401(k)s, IRAs, and pensions, as well as records of other investments like stocks, bonds, and mutual funds. Lenders require these documents to verify the borrower's financial stability and assess the available funds for down payments and reserves. |

| 10 | Current Debt Statements (Credit Cards, Loans, Auto Loans) | Current debt statements, including recent credit card balances, loan statements, and auto loan documentation, are essential for mortgage pre-approval to assess the borrower's debt-to-income ratio accurately. Lenders require these documents to evaluate outstanding obligations and ensure the applicant's financial stability for mortgage qualification. |

| 11 | Rental History or Lease Agreements | Rental history or lease agreements serve as crucial documents for mortgage pre-approval, demonstrating consistent payment behavior and housing stability to lenders. Providing detailed records of past rentals, including lease terms and payment receipts, strengthens the borrower's creditworthiness and supports income verification during the underwriting process. |

| 12 | Gift Letter (If Using Gifted Funds) | A Gift Letter is required for mortgage pre-approval when the down payment includes gifted funds, detailing the donor's name, relationship to the borrower, gift amount, and confirmation that repayment is not expected. Lenders also typically request a copy of the donor's bank statement to verify the source of the gifted funds. |

| 13 | Divorce Decree (If Applicable) | A divorce decree is crucial for mortgage pre-approval when it outlines alimony or child support obligations impacting your financial profile. Lenders require this document to assess income stability and any liabilities affecting your debt-to-income ratio. |

| 14 | Bankruptcy Discharge Papers (If Applicable) | Bankruptcy discharge papers are essential for mortgage pre-approval as they provide proof that previous debts have been legally resolved, impacting creditworthiness assessment. Lenders require these documents to evaluate risk and determine eligibility for mortgage financing accurately. |

| 15 | Proof of Additional Income (Alimony, Child Support, Bonuses) | Proof of additional income for mortgage pre-approval includes court orders or legal agreements for alimony and child support, as well as recent pay stubs or tax returns evidencing bonuses. Lenders require these documents to verify consistent and reliable supplementary income that contributes to your repayment ability. |

| 16 | Proof of Down Payment (Source of Funds) | Proof of down payment for mortgage pre-approval requires documentation verifying the source of funds, such as bank statements, gift letters, or sale of assets records. Lenders demand clear evidence that the funds are legitimate and readily available to ensure borrower credibility and compliance with financial regulations. |

| 17 | Mortgage Statement (If Own Other Property) | A current mortgage statement is essential for mortgage pre-approval when you own other property, providing lenders with detailed information on your existing loan balance, monthly payments, and payment history. This document helps assess your debt-to-income ratio and ensures accurate evaluation of your financial obligations. |

Introduction to Mortgage Pre-Approval Documentation

Mortgage pre-approval is a crucial step in the home buying process that helps determine how much you can afford. Understanding the necessary documents streamlines this phase and increases approval chances.

- Proof of Income - Documents like pay stubs, tax returns, and W-2 forms verify your financial stability.

- Credit Report - Lenders require your credit history to assess creditworthiness and risk.

- Identification - Government-issued IDs confirm your identity and residency status.

Legal Importance of Pre-Approval in Home Financing

Mortgage pre-approval is a critical legal step in the home financing process that confirms a borrower's eligibility to secure a loan. It provides legal assurance to both buyers and sellers regarding the financial validity of the transaction.

- Proof of Identity - Legal verification through government-issued ID ensures the borrower's legitimacy and prevents fraud.

- Income Documentation - Pay stubs, tax returns, and employment verification establish the borrower's ability to repay the mortgage as required by law.

- Credit Report Authorization - Legal consent to access credit history enables lenders to assess financial responsibility, protecting the integrity of the lending process.

Key Legal Documents Required for Mortgage Pre-Approval

Key legal documents required for mortgage pre-approval include proof of identity, such as a government-issued ID or passport, and proof of income, which may consist of recent pay stubs, tax returns, or bank statements. Lenders also require documentation of current debts and assets, including credit reports and account statements, to assess financial stability and repayment ability. Employment verification and a written explanation of any credit issues are often necessary to complete the legal evaluation process for mortgage pre-approval.

Income Verification: Pay Stubs, Tax Returns, and Employment Letters

Income verification is a crucial part of the mortgage pre-approval process, requiring specific documents to confirm your financial stability. Pay stubs provide current proof of earnings, while tax returns offer a comprehensive view of your income history over several years. Employment letters verify your job status and salary, ensuring lenders have accurate information to assess your mortgage eligibility.

Credit History Reports and Legal Obligations

| Document Type | Description | Relevance to Mortgage Pre-Approval |

|---|---|---|

| Credit History Reports | Official records from credit bureaus detailing an applicant's credit accounts, payment history, outstanding debts, and credit inquiries. | Credit reports provide lenders with a comprehensive view of the borrower's creditworthiness, influencing loan approval decisions and interest rates. |

| Credit Scores | Numerical representations derived from credit history data, reflecting credit risk level. | Used by lenders to evaluate the likelihood of timely repayment and assess risk during pre-approval. |

| Identification Documents | Government-issued IDs such as passports or driver's licenses. | Required to verify the borrower's identity and comply with legal verification obligations. |

| Legal Disclosures and Consent Forms | Documents where the applicant authorizes the lender to obtain credit reports and verify personal information. | Mandatory under privacy laws to ensure legal compliance when accessing sensitive credit data. |

| Employment and Income Verification | Pay stubs, tax returns, and employer contact information. | Support assessment of financial stability, critical for lender due diligence and legal contract formation. |

| Debt Statements | Statements from existing loans, credit cards, and other debts. | Used to calculate debt-to-income ratio, essential in evaluating repayment capacity. |

Disclosure Forms and Borrower’s Declarations

Disclosure forms are essential documents required for mortgage pre-approval. These forms provide transparency about loan terms, fees, and potential risks associated with the mortgage process.

Borrower's declarations confirm the accuracy of the financial information provided and disclose any pertinent legal or financial obligations. Your truthful completion of these documents ensures a smoother pre-approval experience.

Government-Issued Identification and Residency Proofs

Obtaining a mortgage pre-approval requires submitting specific documents that verify your identity and residency status. Government-issued identification and residency proofs are essential to confirm your eligibility and streamline the approval process.

- Government-Issued Identification - A valid passport, driver's license, or state ID card serves as primary proof of identity for mortgage pre-approval.

- Proof of Residency - Utility bills, lease agreements, or official mail dated within the last three months validate your current residence.

- Social Security Number or Tax ID - This number is necessary for credit checks and verifying your financial history with lenders.

Submitting accurate identification and residency documents ensures your mortgage pre-approval is processed efficiently.

Legal Implications of Omitting Required Documentation

Mortgage pre-approval requires submitting specific documents such as proof of income, credit reports, and identification to verify the applicant's financial stability. Lenders rely on these documents to assess the risk and determine eligibility for the loan.

Omitting required documentation can lead to legal complications, including delays in the approval process or potential denial of the mortgage application. Furthermore, providing incomplete or misleading information may result in legal penalties or breach of contract claims.

Step-by-Step Guide to the Mortgage Pre-Approval Application Process

Obtaining a mortgage pre-approval requires submitting specific documents that verify your financial stability. This step is crucial for demonstrating your ability to secure a home loan.

The first document needed is proof of income, such as recent pay stubs or tax returns. Lenders also require bank statements to assess your savings and spending habits. Additionally, documentation of your credit history, including credit reports, plays a key role in the evaluation process.

What Documents Are Required for a Mortgage Pre-Approval? Infographic