Probate court requires several key documents, including the original will, the death certificate, and the probate petition to initiate the process. Executors or personal representatives must also submit an inventory of the deceased's assets and creditors' notices. These documents ensure the court can legally validate the will and oversee the distribution of the estate.

What Documents are Needed for Probate Court?

| Number | Name | Description |

|---|---|---|

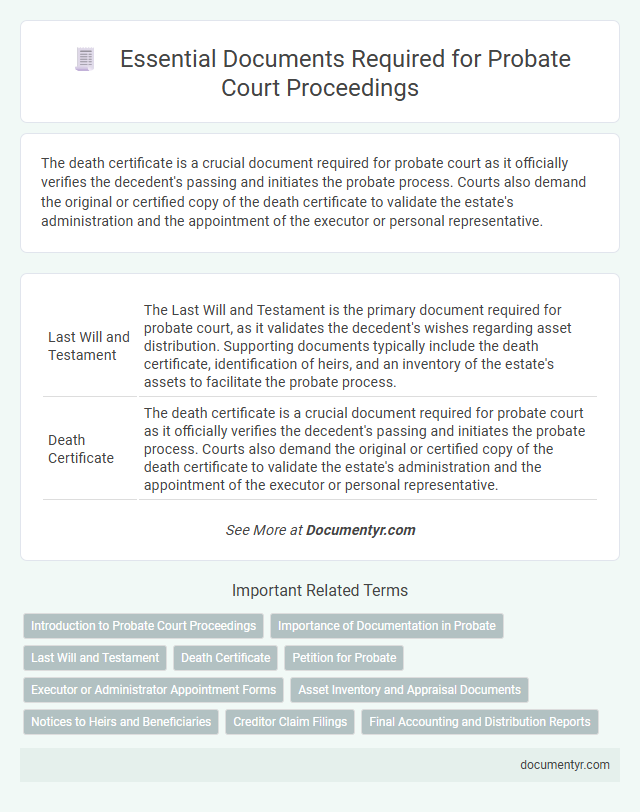

| 1 | Last Will and Testament | The Last Will and Testament is the primary document required for probate court, as it validates the decedent's wishes regarding asset distribution. Supporting documents typically include the death certificate, identification of heirs, and an inventory of the estate's assets to facilitate the probate process. |

| 2 | Death Certificate | The death certificate is a crucial document required for probate court as it officially verifies the decedent's passing and initiates the probate process. Courts also demand the original or certified copy of the death certificate to validate the estate's administration and the appointment of the executor or personal representative. |

| 3 | Petition for Probate | A Petition for Probate is a vital document required to initiate the probate process in court, formally requesting the administration of a deceased person's estate. This petition typically includes the decedent's death certificate, will (if available), and detailed information about heirs, beneficiaries, and the estate's assets. |

| 4 | Letters Testamentary (or Letters of Administration) | Letters Testamentary or Letters of Administration are essential probate court documents granting executors or administrators the legal authority to manage and distribute the deceased's estate. These documents typically require submission of the decedent's original will, death certificate, and a petition for probate to initiate the court process. |

| 5 | Inventory of Assets | An inventory of assets for probate court must include a detailed list of all decedent-owned properties, such as real estate, bank accounts, investments, personal belongings, and liabilities, accurately appraised with current market values. This inventory ensures the court properly assesses the estate's total value for distribution, tax purposes, and creditor claims. |

| 6 | List of Heirs and Beneficiaries | A comprehensive List of Heirs and Beneficiaries is essential for probate court proceedings to establish legal rights and distribute the estate according to the decedent's will or state intestacy laws. This document must include full names, relationships to the decedent, contact information, and sometimes copies of birth or marriage certificates to verify identity and entitlement. |

| 7 | Notice of Probate Filing | The Notice of Probate Filing is a crucial document required in probate court to formally inform heirs and interested parties of the initiation of probate proceedings. This notice must include details such as the decedent's name, case number, and the court's contact information to ensure all relevant parties have an opportunity to respond or contest the probate. |

| 8 | Creditor Notification Proof | Creditor notification proof in probate court typically requires submitting a certified affidavit or sworn statement confirming that all known creditors have been formally notified of the probate proceedings. This document ensures compliance with state probate laws and protects the estate from future claims by providing evidence that creditors had the opportunity to file claims within the designated time frame. |

| 9 | Estate Accounting Statements | Estate accounting statements required for probate court include detailed inventories of assets, income and expense reports, and distributions to heirs or beneficiaries. These documents ensure transparent financial management of the decedent's estate and comply with court standards for probate administration. |

| 10 | Waivers and Consents from Heirs | Waivers and consents from heirs are critical probate court documents that demonstrate agreement to the probate process and may expedite estate administration by reducing disputes. These legal forms typically include signed statements from all interested parties relinquishing objections and consenting to the executor's authority, thereby allowing the court to proceed without a formal hearing. |

| 11 | Affidavit of Heirship | The Affidavit of Heirship is a critical document in probate court used to establish the rightful heirs of a deceased person when no formal will exists, providing a sworn statement detailing the decedent's family history and property ownership. Probate courts require this affidavit along with death certificates, original wills if available, and relevant property deeds to validate claims and transfer assets properly. |

| 12 | Executor’s Oath | The Executor's Oath is a sworn affidavit required in probate court to affirm the executor's commitment to faithfully administer the estate according to legal obligations and the decedent's will. This document, often accompanied by the death certificate, the original will, and a petition for probate, is essential for the executor to gain official court approval and authority to manage estate assets. |

| 13 | Renunciation of Executor (if applicable) | The renunciation of executor document is required if an appointed executor declines to serve, formally notifying the probate court of their decision. This legal declaration must be filed promptly to allow the court to appoint an alternate executor and ensure timely administration of the estate. |

| 14 | Real Estate Appraisal Reports | Real estate appraisal reports are essential documents for probate court as they provide an accurate market value of the deceased's property, ensuring fair asset distribution among heirs. These reports must be prepared by licensed appraisers and submitted alongside the will, death certificate, and inventory of assets to facilitate a transparent probate process. |

| 15 | Tax Clearance Certificates | Tax Clearance Certificates are essential documents in probate court to verify that the decedent's estate has fulfilled all outstanding tax obligations, including income, estate, and inheritance taxes. These certificates, often issued by state or local tax authorities, provide legal confirmation that no tax liabilities remain, allowing the court to proceed with asset distribution to heirs or beneficiaries. |

| 16 | Receipts for Distributions | Receipts for distributions in probate court serve as crucial proof that estate assets have been properly disbursed to beneficiaries, ensuring clear documentation of financial transactions. These receipts must include the date of distribution, recipient's name, amount received, and signatures to prevent disputes and facilitate transparent estate administration. |

| 17 | Final Report and Accounting | The Final Report and Accounting required for probate court include a detailed inventory of the estate's assets, financial transactions during administration, and a statement of distributions to heirs or beneficiaries. This documentation must comply with local probate laws and include verification by the executor or administrator to demonstrate transparent management of the estate. |

| 18 | Order for Final Distribution | An Order for Final Distribution is a critical document in probate court that authorizes the transfer of estate assets to beneficiaries as outlined in the will or by intestate succession laws. To obtain this order, executors must submit the original will, death certificate, inventory of estate assets, creditor notices, and the petition for final distribution demonstrating that debts and taxes have been settled. |

| 19 | Certificate of Appointment (Personal Representative) | The Certificate of Appointment (Personal Representative) is a crucial document required for probate court as it officially authorizes an individual to manage and distribute the deceased's estate. This certificate, issued by the court, verifies the personal representative's legal authority to access assets, settle debts, and administer the probate process. |

| 20 | Bond (if required by court) | Probate court requires a surety bond to protect the estate from potential executor mismanagement, with the bond amount typically set based on the estate's value. The bond document must be filed along with the probate petition and affidavits, ensuring court approval before letters testamentary are issued. |

Introduction to Probate Court Proceedings

What documents are needed for probate court? Probate court proceedings require specific legal documents to validate a will and administer the estate. Key documents include the original will, death certificate, and petition for probate.

Importance of Documentation in Probate

Proper documentation is essential for a smooth probate court process, ensuring the accurate distribution of the deceased's estate. Courts rely on detailed records to validate claims and uphold legal standards.

- Death Certificate - Official proof of death required to initiate probate proceedings.

- Last Will and Testament - Establishes the decedent's intentions regarding asset distribution.

- Asset Inventory - A comprehensive list of all the deceased's financial and tangible assets for court review.

Accurate and complete documentation reduces delays and legal complications during probate administration.

Last Will and Testament

When submitting documents to probate court, the Last Will and Testament is the primary document needed to begin the probate process. This legal paper outlines the decedent's wishes regarding asset distribution and executor appointment.

- Original Last Will and Testament - The probate court requires the original document to validate the decedent's instructions and ensure correct administration of the estate.

- Death Certificate - An official death certificate must be filed along with the will to prove the decedent's passing and activate probate proceedings.

- Petition for Probate - This form formally requests the court to recognize the will and authorize the executor to manage the estate and distribute assets.

Death Certificate

The death certificate is a crucial document required for probate court proceedings. It serves as official proof of death and is necessary to begin the probate process. You must obtain a certified copy of the death certificate to submit along with other probate documents.

Petition for Probate

The Petition for Probate is the primary document required to initiate probate court proceedings. It formally requests the court to recognize the validity of a deceased person's will and appoint an executor or administrator.

This petition includes essential information such as the deceased's full name, date of death, and details of the heirs or beneficiaries. Filing the Petition for Probate allows the court to oversee the distribution of the estate according to legal requirements.

Executor or Administrator Appointment Forms

Probate court requires specific documents to appoint an executor or administrator. These forms confirm the individual's authority to manage the deceased's estate.

The primary document is the Petition for Appointment of Executor or Administrator. This form initiates the probate process and requests the court to grant official powers. Supporting documents include the death certificate and the will, if available, to validate the applicant's role.

Asset Inventory and Appraisal Documents

Probate court requires a comprehensive asset inventory listing all properties, bank accounts, investments, and personal belongings of the deceased. This inventory ensures the accurate distribution of assets according to the will or state law.

Appraisal documents provide the current market value of real estate, valuable personal property, and other significant assets. These documents are essential for determining estate taxes and resolving disputes during probate proceedings.

Notices to Heirs and Beneficiaries

Probate court requires certain key documents to proceed with the administration of an estate. Notices to heirs and beneficiaries are essential to inform all parties of the probate process and their rights.

- Notice of Petition to Administer Estate - This document formally notifies heirs and beneficiaries that a petition has been filed to begin probate proceedings.

- Notice of Hearing - Heirs and beneficiaries receive this notice to inform them of the date and time of the probate court hearing.

- Affidavit of Mailing Notices - This affidavit proves that all required notices were sent to heirs and beneficiaries according to legal requirements.

Creditor Claim Filings

Creditor claim filings require submitting a formal written notice to the probate court detailing the debt owed by the deceased. This document must include the creditor's name, the amount claimed, and the basis for the claim. Timely submission is essential to ensure that the creditor's claim is considered during the probate process.

What Documents are Needed for Probate Court? Infographic