Probate court in California requires several key documents, including the original will, death certificate, and Petition for Probate to initiate the process. Executors must also provide an inventory and appraisal of the estate's assets, along with any creditor claims and final accounting reports. Proper submission of these documents ensures the court can validate the will and oversee the distribution of the estate according to state law.

What Documents Are Necessary for Probate Court in California?

| Number | Name | Description |

|---|---|---|

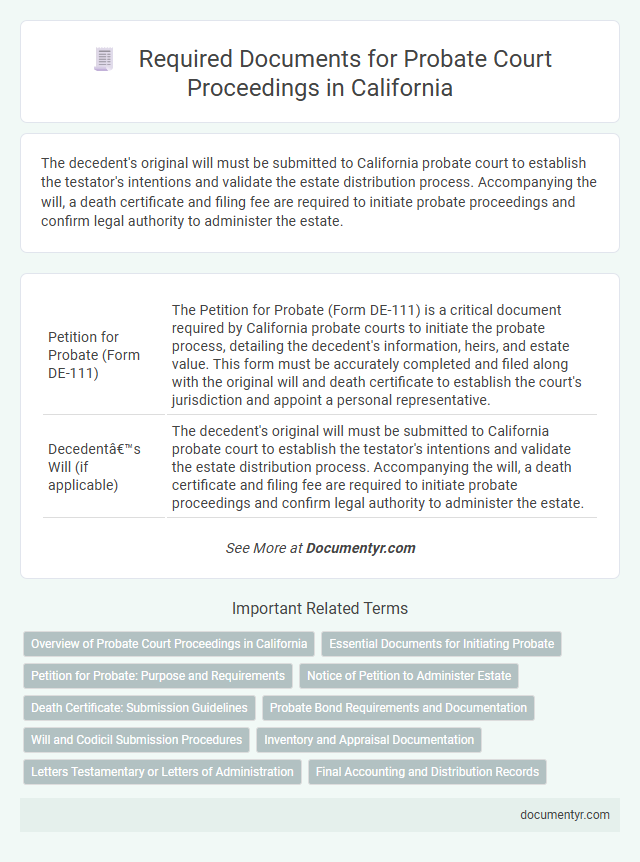

| 1 | Petition for Probate (Form DE-111) | The Petition for Probate (Form DE-111) is a critical document required by California probate courts to initiate the probate process, detailing the decedent's information, heirs, and estate value. This form must be accurately completed and filed along with the original will and death certificate to establish the court's jurisdiction and appoint a personal representative. |

| 2 | Decedent’s Will (if applicable) | The decedent's original will must be submitted to California probate court to establish the testator's intentions and validate the estate distribution process. Accompanying the will, a death certificate and filing fee are required to initiate probate proceedings and confirm legal authority to administer the estate. |

| 3 | Codicils (if applicable) | Codicils, which are legal documents used to modify an existing will, must be submitted to probate court in California alongside the original will and death certificate to ensure accurate validation and administration of the estate. These documents must comply with California Probate Code requirements, including proper witnessing and notarization, to be accepted as valid amendments during the probate process. |

| 4 | Death Certificate | The death certificate is a crucial document required by probate court in California to begin the probate process, providing official verification of the decedent's passing. Probate courts also mandate the original certificate or a certified copy to ensure authenticity and proper handling of the estate. |

| 5 | Duties and Liabilities of Personal Representative (Form DE-147) | Form DE-147, Duties and Liabilities of Personal Representative, outlines the legal responsibilities and potential liabilities of the individual appointed to administer the estate during probate court proceedings in California. This document must be filed to inform the court and interested parties of the personal representative's obligations, including asset management, creditor notifications, and estate distribution according to California Probate Code. |

| 6 | Order for Probate (Form DE-140) | The Order for Probate (Form DE-140) is a critical document required in California probate court to officially appoint the executor or administrator of the estate, granting legal authority to manage and distribute the decedent's assets. This form must be completed accurately and submitted along with the petition for probate, death certificate, and will (if available), ensuring compliance with California Probate Code for the probate process to proceed. |

| 7 | Letters Testamentary/Letters of Administration (Form DE-150/DE-150(A)) | Letters Testamentary or Letters of Administration (Form DE-150/DE-150(A)) are essential probate court documents in California that legally authorize an executor or administrator to manage and distribute the deceased person's estate. These forms serve as official proof of appointed authority, allowing access to financial accounts, properties, and the ability to settle debts and claims on behalf of the estate. |

| 8 | Notice of Petition to Administer Estate (Form DE-121) | The Notice of Petition to Administer Estate (Form DE-121) is a critical document filed with the California probate court to inform heirs, beneficiaries, and creditors about the petition to open probate and appoint an administrator or executor. This notice must be served and published according to California Probate Code requirements, ensuring all interested parties have the opportunity to respond within the specified time. |

| 9 | Proof of Publication of Notice | Proof of publication of notice is a critical document required by California probate courts to confirm that the Notice of Petition to Administer Estate has been published in a legally recognized newspaper for the mandated period, typically once a week for four consecutive weeks. This document ensures that all interested parties have been adequately informed of the probate proceedings in compliance with California Probate Code Section 8120. |

| 10 | Inventory and Appraisal (Form DE-160/DE-161) | The Inventory and Appraisal (Forms DE-160 and DE-161) are essential probate court documents in California that detail and appraise the deceased's estate assets, helping the court determine the estate's value. These legally required forms must be submitted by the personal representative within 90 days of appointment to ensure accurate estate administration and facilitate asset distribution. |

| 11 | Notice of Administration to Creditors (Form DE-157) | Notice of Administration to Creditors (Form DE-157) is a crucial document required by California probate courts to inform all potential creditors about the probate process. Filing this form ensures creditors are officially notified and have the opportunity to submit claims against the estate within the legally specified timeframe. |

| 12 | Creditor’s Claims (Form DE-172) | Creditor's Claims (Form DE-172) must be filed in California probate court to validate any debts owed by the deceased, ensuring all creditor obligations are addressed before asset distribution. This form requires detailed information about the creditor, the debt amount, and the basis for the claim according to California Probate Code SSSS9100-9112. |

| 13 | Affidavit of Publication | The Affidavit of Publication is a critical document in California probate court proceedings, serving as proof that required legal notices have been publicly announced as mandated by law. This affidavit must be filed to demonstrate compliance with statutory notice requirements to creditors and interested parties during the probate process. |

| 14 | Waiver of Bond or Consent to Independent Administration (if applicable) | The Waiver of Bond or Consent to Independent Administration document is essential in California probate court to authorize an executor or administrator to manage the estate without mandatory bond requirements, thus expediting the probate process. This document must be signed by all interested parties, indicating their consent to independent probate administration, which simplifies estate management and reduces court supervision. |

| 15 | Final Account and Report | The Final Account and Report is a critical probate court document in California that details the executor's or administrator's handling of the estate, including all financial transactions, distributions, and fees. This report must be filed alongside supporting documentation such as receipts, bank statements, and a petition for final distribution to obtain court approval and close the probate case. |

| 16 | Petition for Final Distribution | The Petition for Final Distribution in California probate court must include the original will, an inventory and appraisal of the estate's assets, and a detailed accounting of all receipts, disbursements, and fees. Supporting documents such as creditor claims, notices to heirs, and a proposed distribution plan are also required to ensure court approval of the estate's final administration. |

| 17 | Receipts for Distribution | Receipts for distribution, also known as proof of distribution or receipts for final account, are essential probate court documents in California demonstrating that the executor or administrator has delivered estate assets to beneficiaries. These receipts must be signed by each beneficiary, confirming the receipt of their respective inheritances, and are submitted to the court to finalize the probate process and ensure proper compliance with estate distribution requirements. |

| 18 | Tax Clearance Certificates (if applicable) | Tax Clearance Certificates are required in California probate court to confirm that all estate taxes have been paid or waived before assets can be distributed to heirs. These certificates, issued by the California Franchise Tax Board, are essential for ensuring the estate complies with both state and federal tax obligations during probate proceedings. |

| 19 | Spousal Property Petition (Form DE-221, if applicable) | The Spousal Property Petition (Form DE-221) is essential in California probate court to transfer sole ownership of real property or personal property from a deceased spouse to the surviving spouse without formal probate. This form must be properly completed and submitted alongside the death certificate and any other required probate documents to ensure smooth property transfer. |

| 20 | Proof of Service of Notice | Proof of Service of Notice is a critical document required by California probate courts to confirm that all interested parties have been formally informed of the probate proceedings. This proof typically includes a completed Proof of Service form, detailing how and when the notice was delivered in accordance with California Probate Code Sections 1215-1217. |

Overview of Probate Court Proceedings in California

Probate court in California oversees the administration of a deceased person's estate to ensure proper distribution and debt resolution. The court validates wills, appoints executors or administrators, and supervises the estate settlement process.

- Death Certificate - Official document confirming the date and cause of death, required to open probate.

- Last Will and Testament - The decedent's final legal will, essential for guiding asset distribution under court supervision.

- Petition for Probate - A formal request submitted to the court to initiate probate proceedings and appoint an executor or administrator.

Gathering accurate documents is crucial for the efficient progression of probate court cases in California.

Essential Documents for Initiating Probate

Initiating probate in California requires submitting specific essential documents to the probate court. These documents establish the validity of the will and appoint a personal representative.

- Death Certificate - An official copy of the decedent's death certificate is required to verify the death.

- Petition for Probate - This form requests the court to admit the will to probate and appoint an executor or administrator.

- Original Will - The decedent's original will must be filed to prove testamentary intent and distribute assets accordingly.

Petition for Probate: Purpose and Requirements

The Petition for Probate is a critical document filed to initiate the probate process in California. It formally requests the court to appoint a personal representative to administer the estate.

The petition must include essential information such as the decedent's name, date of death, and details of the heirs or beneficiaries. Supporting documents like the original will, if available, and a death certificate are required to validate the petition.

Notice of Petition to Administer Estate

When filing for probate court in California, submitting a Notice of Petition to Administer Estate is essential. This document informs interested parties about the probate proceeding and their right to respond.

- Notice of Petition to Administer Estate - Official notification sent to heirs, beneficiaries, and creditors outlining the probate case details.

- Proof of Service - Documentation confirming that the Notice of Petition was properly delivered to all required parties.

- Petition for Probate - Formal request filed with the court to begin the probate process and appoint an executor or administrator.

Death Certificate: Submission Guidelines

In California probate court, submitting the original or certified copy of the death certificate is essential to initiate the probate process. The death certificate must be issued by the county where the death occurred and include the official registrar's seal. You must provide this document promptly to avoid delays in court proceedings and ensure proper estate administration.

Probate Bond Requirements and Documentation

Probate court in California requires several key documents to initiate the probate process, including the original will, a certified death certificate, and a petition for probate. These documents establish your authority to administer the estate and allow the court to oversee the distribution of assets.

A probate bond is often required to protect beneficiaries and creditors from potential mismanagement by the executor or administrator. The bond amount is determined by the court based on the estate's value and proper documentation, including a surety bond form and proof of premium payment, must be submitted for approval.

Will and Codicil Submission Procedures

When submitting a will or codicil to probate court in California, you must provide the original documents along with a petition for probate. These documents establish the decedent's intentions and are essential for initiating the probate process.

You must file the will or codicil with the probate court in the county where the decedent lived. The court requires a certified copy of the death certificate and a completed petition form. Presenting these documents accurately ensures the court can validate the will and appoint an executor or administrator promptly.

Inventory and Appraisal Documentation

| Document Type | Description | Importance |

|---|---|---|

| Inventory and Appraisal (Form DE-160) | This document lists all assets and property owned by the deceased estate, including real estate, personal belongings, bank accounts, and investments. It is completed by a probate referee who values the estate items. | Essential for establishing the total value of the estate to ensure accurate distribution according to California probate laws. It helps the court track estate assets and verify proper trustee or executor accountability. |

| Probate Referee Report | The official appraisal report prepared by a court-appointed probate referee. This report authenticates the market values assigned to estate assets. | Required to validate the accuracy of the inventory and appraisal form, providing impartial valuations for the court's review. |

| Additional Supporting Documents | May include deeds, titles, financial statements, and receipts supporting asset ownership and valuation. | Helps verify and support the details listed in the Inventory and Appraisal, ensuring comprehensive representation of the estate's assets. |

Your timely and accurate submission of inventory and appraisal documentation facilitates smoother probate proceedings in California courts.

Letters Testamentary or Letters of Administration

What documents are necessary for probate court in California when handling an estate? Letters Testamentary or Letters of Administration are essential documents issued by the court to authorize the executor or administrator to manage the deceased's estate. You must present these documents along with the original will, death certificate, and petition for probate to begin the probate process.

What Documents Are Necessary for Probate Court in California? Infographic