Essential documents for real estate title transfer include the original deed, a completed title transfer form, and proof of identity. Supporting papers such as a property tax receipt, sale agreement, and mortgage clearance certificate may also be necessary. Ensuring all documents are accurate and legally notarized is crucial for a smooth title transfer process.

What Documents are Required for Real Estate Title Transfer?

| Number | Name | Description |

|---|---|---|

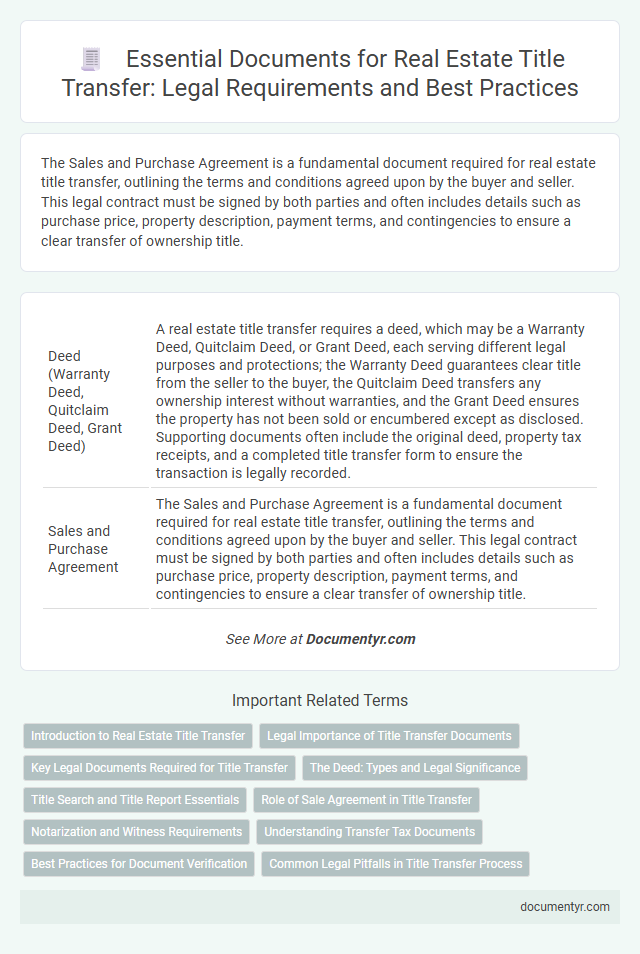

| 1 | Deed (Warranty Deed, Quitclaim Deed, Grant Deed) | A real estate title transfer requires a deed, which may be a Warranty Deed, Quitclaim Deed, or Grant Deed, each serving different legal purposes and protections; the Warranty Deed guarantees clear title from the seller to the buyer, the Quitclaim Deed transfers any ownership interest without warranties, and the Grant Deed ensures the property has not been sold or encumbered except as disclosed. Supporting documents often include the original deed, property tax receipts, and a completed title transfer form to ensure the transaction is legally recorded. |

| 2 | Sales and Purchase Agreement | The Sales and Purchase Agreement is a fundamental document required for real estate title transfer, outlining the terms and conditions agreed upon by the buyer and seller. This legal contract must be signed by both parties and often includes details such as purchase price, property description, payment terms, and contingencies to ensure a clear transfer of ownership title. |

| 3 | Title Certificate or Title Abstract | A Title Certificate or Title Abstract is essential for real estate title transfer as it verifies ownership and details any liens, encumbrances, or legal claims against the property. This document, typically issued by a title company or attorney, ensures the buyer receives a clear and marketable title before the transaction is finalized. |

| 4 | Transfer Tax Declaration Form | The Transfer Tax Declaration Form is a crucial document required for real estate title transfer, detailing the property's sale price and aiding in the accurate calculation of transfer taxes owed to local government authorities. This form ensures compliance with tax regulations and facilitates the legal recording of property ownership changes. |

| 5 | Property Tax Clearance Certificate | A Property Tax Clearance Certificate confirms that all outstanding property taxes have been paid and is essential for a real estate title transfer to ensure clear ownership. This document prevents legal disputes by verifying the seller has no pending tax liabilities on the property. |

| 6 | Real Estate Tax Receipts | Real estate tax receipts are essential documents required for the title transfer process, serving as evidence that all property taxes have been paid up to the date of sale. These receipts protect the buyer from inheriting any outstanding tax liabilities and ensure a clear title transfer in compliance with legal and municipal regulations. |

| 7 | Mortgage Release or Satisfaction of Mortgage | Mortgage Release or Satisfaction of Mortgage is a crucial document required for real estate title transfer, proving that the outstanding debt and lien on the property have been fully paid and satisfied. This document must be recorded with the county recorder's office to ensure clear title and prevent any future claims by the lender. |

| 8 | Seller’s Affidavit of Title | The Seller's Affidavit of Title is a crucial legal document in real estate title transfers that affirms the seller's ownership and discloses any liens, encumbrances, or claims against the property. This affidavit helps protect the buyer by verifying clear title and ensuring that no undisclosed issues affect the transfer process. |

| 9 | Identification Documents (IDs) of Buyer and Seller | For a real estate title transfer, valid identification documents such as government-issued photo IDs, including passports or driver's licenses, are required from both the buyer and seller to verify their identities. These IDs ensure all parties involved comply with legal requirements and prevent potential fraud during the transaction. |

| 10 | Notarized Acknowledgment of Deed | A notarized acknowledgment of deed is essential for real estate title transfer as it verifies the authenticity of the grantor's signature, ensuring the document's legal validity. This notarization must be completed by a licensed notary public who confirms the identity of the signer and the voluntary nature of the execution, which protects against fraud and facilitates the recording of the deed with the county recorder's office. |

| 11 | Land Survey or Plot Plan | A certified land survey or plot plan is essential for real estate title transfer as it precisely defines property boundaries and ensures accurate identification of the parcel. This document must be prepared by a licensed surveyor and is often required by title companies and local government offices to prevent disputes and confirm legal ownership. |

| 12 | Homeowners Association (HOA) Clearance | Homeowners Association (HOA) clearance is a critical document required for real estate title transfer, ensuring all HOA fees and assessments are paid and that the property complies with community rules. This clearance certificate prevents liens and confirms the seller's good standing with the HOA, facilitating a smooth and legally compliant transfer of title. |

| 13 | Statement of Outstanding Assessments or Liens | The Statement of Outstanding Assessments or Liens is a crucial document required for real estate title transfer, detailing any unpaid property taxes, association fees, or legal claims against the property. This statement ensures the buyer is informed of existing financial obligations that could affect ownership and helps clear the title before completing the transaction. |

| 14 | Affidavit of No Encumbrance | An Affidavit of No Encumbrance is a crucial document in real estate title transfer that certifies the property is free from any liens, mortgages, or legal claims, ensuring clear ownership for the buyer. This affidavit is typically required by the registrar or land department to validate the seller's authority to transfer the property without encumbrances. |

| 15 | Power of Attorney (if applicable) | A Power of Attorney must be a notarized document granting the agent authority to act on behalf of the property owner during the real estate title transfer, specifying the scope and duration of the authorization. This document is essential when the owner cannot be physically present to sign closing documents, ensuring legal compliance and protecting transaction validity. |

| 16 | Certificate of Occupancy (if required) | A Certificate of Occupancy is often required in real estate title transfers to verify that the property complies with building codes and is safe for occupancy, serving as a crucial legal document for closing. This certificate ensures clear title transfer by confirming the property's legal use and structural integrity, which lenders and buyers frequently demand during the transaction process. |

| 17 | Death Certificate/Probate Documents (if inherited property) | For real estate title transfer involving inherited property, a certified Death Certificate and probate documents such as the Last Will and Testament or Letters of Administration are essential to establish the decedent's death and authorize the transfer of ownership to the rightful heirs. These documents must be filed with the county recorder or relevant land registry to legally update the title and prevent future disputes. |

| 18 | Corporate Resolution or Secretary Certificate (if selling entity is a corporation) | Corporate Resolution or Secretary Certificate is a crucial document required for real estate title transfer when the selling entity is a corporation; it authorizes specific individuals to execute the sale on behalf of the corporation, ensuring legal compliance and validating the transaction. This documentation must be properly notarized and recorded to confirm the corporation's consent and avoid disputes during the title transfer process. |

| 19 | Marriage Certificate (if applicable for marital properties) | A marriage certificate is a crucial document required for real estate title transfer when the property is classified as marital property, as it establishes joint ownership rights between spouses. This certificate helps verify the marital status of the parties involved, ensuring proper transfer and legal recognition of ownership interests in the title deed. |

| 20 | Consent from Spouse (if required by law) | Consent from the spouse is a crucial document in real estate title transfer when required by law, serving to legally confirm joint ownership rights or waiver thereof. This consent ensures protection of marital property interests and prevents future disputes regarding ownership or transfer validity. |

Introduction to Real Estate Title Transfer

What documents are required for real estate title transfer? Transferring real estate title involves a legal process that ensures the official ownership of a property is updated. Essential documents are needed to verify and complete this ownership change accurately.

Legal Importance of Title Transfer Documents

Real estate title transfer requires specific legal documents to ensure the property's ownership is accurately and officially recorded. These documents protect both the buyer and seller from future disputes and establish clear ownership rights.

Key documents include the deed, which formally conveys ownership, and the title search report, confirming the property's legal status. You must also provide affidavits, tax receipts, and any lien clearances to fulfill legal obligations during the transfer process.

Key Legal Documents Required for Title Transfer

Transferring the title of real estate requires specific legal documents to ensure the ownership change is valid and recorded. Proper documentation protects both the buyer and seller in the transaction.

- Deed - A legal document that transfers ownership from the seller to the buyer, specifying the property's details and parties involved.

- Title Search Report - A report verifying the property's legal ownership and identifying any liens or encumbrances.

- Transfer Tax Declaration - A document filed to record the sale and calculate applicable taxes for the title transfer process.

The Deed: Types and Legal Significance

The deed is a fundamental document required for real estate title transfer, proving ownership and outlining the transfer of property rights. Understanding the types of deeds and their legal significance protects your interests and ensures a valid transaction.

- Warranty Deed - Guarantees the grantor holds clear title to the property and has the right to transfer it.

- Quitclaim Deed - Transfers whatever interest the grantor has without any warranties or guarantees on the title.

- Bargain and Sale Deed - Implies the grantor has title but offers limited protection to the grantee against claims on the property.

Title Search and Title Report Essentials

To complete a real estate title transfer, essential documents include the deed, affidavit of title, and any existing title liens. A thorough title search uncovers the property's ownership history and any encumbrances that could affect your rights.

The title report summarizes findings from the title search, highlighting issues such as unpaid taxes, easements, or legal disputes. Obtaining a clear title report ensures a smooth transfer and protects you from future claims on the property.

Role of Sale Agreement in Title Transfer

The sale agreement is a critical document in the real estate title transfer process. It outlines the terms and conditions agreed upon by the buyer and seller, serving as proof of the transaction.

Your sale agreement must be clear and legally binding to ensure a smooth transfer of the title. This document includes essential details such as the property description, sale price, payment terms, and responsibilities of both parties. Without a properly executed sale agreement, the title transfer cannot proceed efficiently or legally.

Notarization and Witness Requirements

Real estate title transfer requires specific documents, including the deed, identification, and the title transfer form. Notarization is mandatory to verify the authenticity of signatures on the deed and related documents. Witness requirements vary by jurisdiction but often include one or two impartial witnesses to sign the deed alongside the grantor and grantee.

Understanding Transfer Tax Documents

| Document | Description | Purpose |

|---|---|---|

| Deed | The legal document that conveys ownership from the seller to the buyer. | Establishes the new owner's title to the property. |

| Transfer Tax Declaration Form | A form detailing the sale price and property information, submitted to local tax authorities. | Calculates the appropriate transfer tax owed during the transaction. |

| Closing Statement | Itemized list of all costs and fees involved in the transaction. | Provides proof of payment relevant to the transfer tax and other fees. |

| Property Tax Receipts | Receipts confirming payment of outstanding property taxes. | Ensures there are no tax liens before the title transfer. |

| Affidavit of Property Value | A sworn statement by the buyer or seller declaring the property's sale value. | Helps in verifying the declared value for transfer tax purposes. |

| Title Report | Document prepared by a title company outlining ownership history and liens. | Assures clear title and identifies any encumbrances affecting transfer tax obligations. |

Understanding these transfer tax documents is essential for completing your real estate title transfer accurately and in compliance with local tax regulations.

Best Practices for Document Verification

Ensuring the accuracy and authenticity of documents is crucial for a successful real estate title transfer. Proper verification minimizes legal risks and secures rightful ownership.

- Original Deed Verification - Confirm the deed matches the seller's records and is free of alterations.

- Identity Confirmation - Verify government-issued IDs of all parties to prevent fraudulent transactions.

- Title Search Report - Obtain a comprehensive title search to identify any liens, encumbrances, or disputes.

Following these best practices ensures a smooth and legally compliant title transfer process.

What Documents are Required for Real Estate Title Transfer? Infographic