To open a trust account, essential documents include a completed trust account application, a certified copy of the trust deed or agreement, and identification for all trustees involved. Banks may also require proof of the trust's Tax Identification Number (TIN) and relevant resolutions or authorizations from the trust's governing body. Ensuring all documents are accurately prepared helps facilitate smooth account setup and compliance with legal requirements.

What Documents Are Needed to Open a Trust Account?

| Number | Name | Description |

|---|---|---|

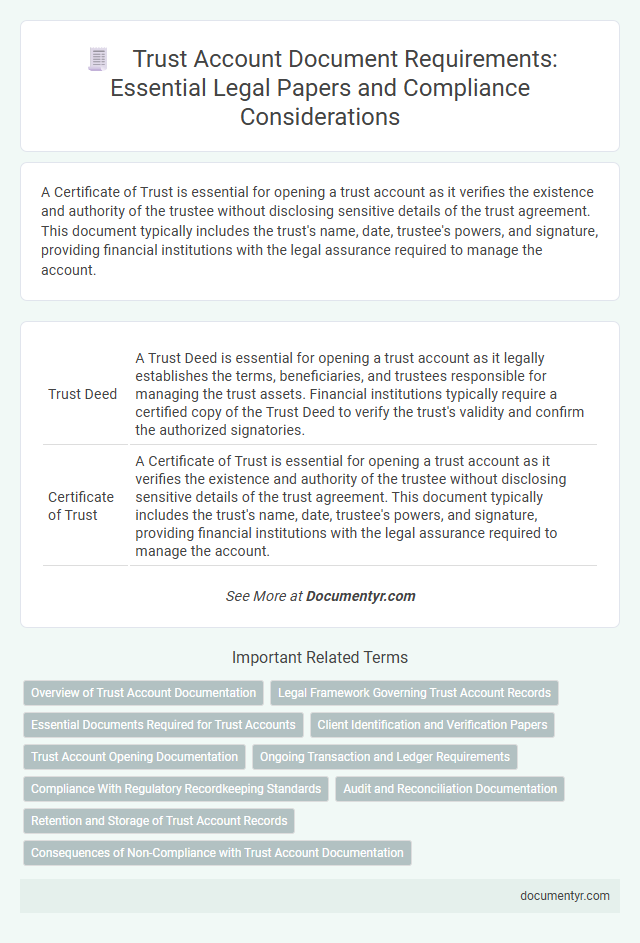

| 1 | Trust Deed | A Trust Deed is essential for opening a trust account as it legally establishes the terms, beneficiaries, and trustees responsible for managing the trust assets. Financial institutions typically require a certified copy of the Trust Deed to verify the trust's validity and confirm the authorized signatories. |

| 2 | Certificate of Trust | A Certificate of Trust is essential for opening a trust account as it verifies the existence and authority of the trustee without disclosing sensitive details of the trust agreement. This document typically includes the trust's name, date, trustee's powers, and signature, providing financial institutions with the legal assurance required to manage the account. |

| 3 | Trustee Identification Documents | Trustee identification documents required to open a trust account typically include a valid government-issued photo ID such as a passport or driver's license, proof of address like a utility bill or bank statement, and the trust agreement outlining the trustee's authority. Financial institutions may also request Social Security numbers or taxpayer identification numbers to verify the trustee's identity and ensure regulatory compliance. |

| 4 | Grantor Identification Documents | Grantor identification documents required to open a trust account typically include a valid government-issued photo ID such as a passport or driver's license, proof of Social Security or Taxpayer Identification Number, and in some cases, additional documentation like a birth certificate or residency proof to verify identity and legal status. Financial institutions may also request notarized copies or certified documents to comply with anti-money laundering regulations and ensure accurate grantor verification. |

| 5 | IRS EIN (Employer Identification Number) Letter | To open a trust account, providing the IRS EIN (Employer Identification Number) letter is essential as it verifies the trust's tax identification and legitimacy. This official document, issued by the IRS, confirms the trust's EIN, enabling financial institutions to accurately establish and manage the account in compliance with legal and tax regulations. |

| 6 | Trustee Resolution (if applicable) | A Trustee Resolution is a critical document required to open a trust account, authorizing designated individuals to act on behalf of the trust. This resolution must be officially recorded and signed to comply with financial institution requirements and verify trustee authority. |

| 7 | Trust Beneficiaries List | A Trust Beneficiaries List is essential when opening a trust account, providing detailed information on all individuals or entities entitled to benefits under the trust, including their full names, contact details, and specific interests or shares. This list ensures accurate tracking and compliance with fiduciary duties, facilitating transparent trust administration and legal verification. |

| 8 | Letter of Instruction to Bank | A Letter of Instruction to the bank is essential when opening a trust account, detailing the trustee's authority, account purpose, and specific transaction guidelines to ensure compliance with legal and fiduciary responsibilities. This document typically accompanies identification, trust agreement copies, and tax identification numbers to facilitate proper account setup and management. |

| 9 | Proof of Address for Trustees | Trustees must provide a valid proof of address, such as a recent utility bill, bank statement, or government-issued correspondence dated within the last three months, to verify their residency when opening a trust account. Financial institutions often require these documents to comply with anti-money laundering regulations and ensure the trustee's identity. |

| 10 | Initial Deposit/Capital Contribution Documentation | Initial deposit or capital contribution documentation for opening a trust account typically includes a bank check, wire transfer confirmation, or proof of funds from a verified financial institution. Trust account providers may also require a detailed ledger or statement outlining the source and amount of the initial capital contribution to ensure compliance with fiduciary regulations. |

| 11 | Bank Account Application Form | A Trust Account Bank Account Application Form requires detailed information about the trust, including the trust name, date of formation, trustee details, and the trust's Tax Identification Number (TIN). Supporting documents such as the Trust Agreement, Trustee Identification, and proof of address are essential to verify the trust's legitimacy and fulfill regulatory compliance. |

| 12 | Trust Tax Residency Certification | Trust Tax Residency Certification requires submitting IRS Form W-8IMY or Form W-9 to verify the trust's tax status and residency, ensuring compliance with federal tax regulations. This certification is essential for opening a trust account, as it establishes the trust's eligibility for tax reporting and withholding purposes. |

| 13 | Minutes of Trust Meeting (if applicable) | Minutes of the trust meeting, if applicable, must include detailed records of decisions made by trust trustees, including authorization to open the trust account, meeting date, attendees, and resolutions passed. These minutes serve as essential legal documentation verifying the legitimacy of the trust's actions and ensuring compliance with regulatory requirements when establishing the account. |

| 14 | Legal Opinion (if required by the bank) | A Legal Opinion may be required by the bank to verify the validity and authority of the trust, confirming that the trust instrument complies with relevant laws and that the trustee has the power to open the account. This document is typically prepared by an attorney and must affirm the trust's legal status, trustee powers, and tax identification number to satisfy the bank's due diligence requirements. |

| 15 | Power of Attorney (if applicable) | To open a trust account, a valid Power of Attorney document must be provided if an agent is authorized to act on behalf of the trust grantor, ensuring legal authority to manage the account. This document must be notarized and specify the scope of powers granted, complying with state laws and financial institution requirements. |

Overview of Trust Account Documentation

Opening a trust account requires specific legal documents to verify the identity of the trustee and the terms of the trust. Essential documents typically include the trust agreement, trustee identification, and a certification of trust or trust resolution. Financial institutions may also request additional paperwork to comply with regulatory and anti-money laundering requirements.

Legal Framework Governing Trust Account Records

What documents are needed to open a trust account under the legal framework governing trust account records? Key documents include a trust deed or agreement, identification of the trustee and beneficiaries, and proof of the trust's existence such as a certificate of trust. Compliance with state and federal regulations requires maintaining accurate records like transaction logs and financial statements for transparency and legal accountability.

Essential Documents Required for Trust Accounts

Opening a trust account requires specific legal documents to ensure compliance and proper account management. These essential documents establish the identity of the trust and its trustees, as well as outline the trust's terms and conditions.

- Trust Agreement - This legal document outlines the terms, beneficiaries, and duties of the trust, serving as the foundational document for account setup.

- Identification Documents of Trustees - Government-issued IDs such as passports or driver's licenses verify the identity of the individuals managing the trust.

- Tax Identification Number (TIN) - The trust's unique tax ID is required for reporting purposes and compliance with tax regulations.

Client Identification and Verification Papers

Opening a trust account requires specific client identification and verification papers to ensure compliance with legal and financial regulations. You must provide government-issued identification such as a passport or driver's license, proof of address like a utility bill, and Social Security Number or Tax Identification Number documentation. These documents confirm your identity and help establish the trust account with the financial institution securely and legally.

Trust Account Opening Documentation

Opening a trust account requires specific legal documentation to ensure compliance and proper account management. Essential documents include the trust agreement, identification for the trustee, and tax identification numbers.

Trust agreement details the terms and obligations of the trust. Identification verifies the trustee's identity, while tax identification numbers facilitate tax reporting and account administration.

Ongoing Transaction and Ledger Requirements

To open a trust account, you must provide identification documents such as a valid government-issued ID and proof of address. The bank may also require your trust agreement or declaration of trust to verify the account's purpose and authorized signatories.

Ongoing transaction records must be meticulously maintained in a ledger to comply with legal and regulatory requirements. Your ledger should detail every deposit, withdrawal, and transfer to ensure full transparency and accountability for all trust funds.

Compliance With Regulatory Recordkeeping Standards

Opening a trust account requires strict adherence to regulatory recordkeeping standards to ensure full compliance. Your documentation must accurately reflect all necessary legal and financial information for audit and verification purposes.

- Identification Documents - Valid government-issued IDs verify the identity of all parties involved in the trust.

- Trust Agreement - The original trust deed outlining the terms, beneficiaries, and trustee responsibilities must be provided.

- Compliance Forms - Documentation such as anti-money laundering (AML) and know your customer (KYC) forms are essential to meet regulatory standards.

Audit and Reconciliation Documentation

| Document Type | Description | Purpose in Audit and Reconciliation |

|---|---|---|

| Trust Account Opening Form | Official form completed to initiate a trust account with a financial institution. | Provides baseline information for audit trail and verification. |

| Identification Documents | Government-issued IDs such as passport or driver's license of trustees and beneficiaries. | Ensures compliance with Know Your Customer (KYC) regulations and aids audit validation. |

| Trust Deed | Legal document defining the terms and conditions of the trust agreement. | Serves as primary evidence for reconciliation and authorization during audits. |

| IRS Tax Identification Number (TIN) | Tax ID number assigned to the trust entity by the Internal Revenue Service. | Necessary for financial reporting and audit verification of tax compliance. |

| Initial Deposit Receipt | Proof of the initial funding made to the trust account. | Helps reconcile account balances and verifies source of funds during audits. |

| Bank Statements | Monthly statements reflecting transactions in the trust account. | Essential for ongoing reconciliation and audit trail of all financial activity. |

| Transaction Logs | Detailed records of deposits, withdrawals, and transfers within the trust account. | Supports transparency and integrity of the trust account in audit processes. |

| Reconciliation Reports | Periodic reports that match account balances with internal records. | Key document for identifying discrepancies and maintaining compliance. |

| Correspondence Records | Communication related to trust account transactions or disputes. | Provides contextual support for audit reviews and reconciliation clarification. |

Retention and Storage of Trust Account Records

Opening a trust account requires specific documentation to ensure legal compliance and proper account management. Proper retention and storage of these trust account records are critical for transparency and regulatory audits.

- Identification Documents - Valid government-issued identification is necessary to verify the identity of all parties involved in the trust.

- Trust Agreement - A legally binding trust agreement outlines the terms, beneficiaries, and trustee responsibilities, serving as the foundational document for the account.

- Retention Requirements - Trust account records must be retained for a minimum period as mandated by law, often ranging from five to seven years, to comply with regulatory standards.

Secure digital or physical storage of trust account documents ensures confidentiality and accessibility for audits and legal purposes.

What Documents Are Needed to Open a Trust Account? Infographic