Freelancers need several key documents for an independent contractor agreement, including a detailed scope of work that outlines project deliverables and deadlines, a payment schedule specifying rates and invoicing terms, and liability clauses to define responsibilities and protect against potential disputes. Tax forms such as W-9 or equivalent are essential to ensure proper tax reporting and compliance, while confidentiality agreements may be necessary to safeguard sensitive information. Maintaining these documents helps freelancers establish clear expectations and legal safeguards in their contracts.

What Documents Does a Freelancer Need for an Independent Contractor Agreement?

| Number | Name | Description |

|---|---|---|

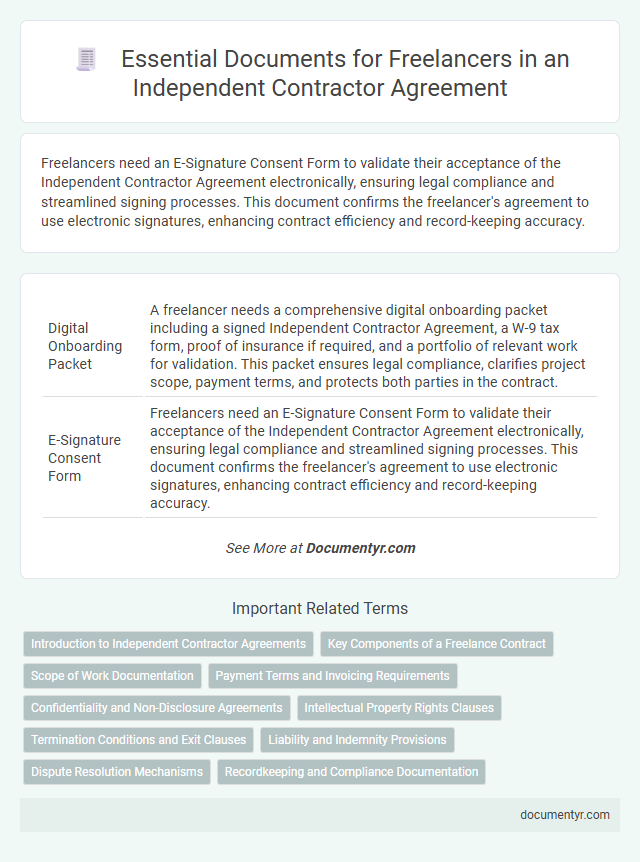

| 1 | Digital Onboarding Packet | A freelancer needs a comprehensive digital onboarding packet including a signed Independent Contractor Agreement, a W-9 tax form, proof of insurance if required, and a portfolio of relevant work for validation. This packet ensures legal compliance, clarifies project scope, payment terms, and protects both parties in the contract. |

| 2 | E-Signature Consent Form | Freelancers need an E-Signature Consent Form to validate their acceptance of the Independent Contractor Agreement electronically, ensuring legal compliance and streamlined signing processes. This document confirms the freelancer's agreement to use electronic signatures, enhancing contract efficiency and record-keeping accuracy. |

| 3 | Scope of Work Addendum | A Scope of Work Addendum outlines detailed project deliverables, timelines, and specific tasks integral to an Independent Contractor Agreement, ensuring clarity between freelancer and client. This document minimizes potential disputes by explicitly defining the extent and limitations of the services provided. |

| 4 | GDPR Compliance Statement | A freelancer needs to include a GDPR Compliance Statement in their Independent Contractor Agreement to ensure proper handling of personal data according to the General Data Protection Regulation. This document outlines responsibilities for data protection, consent management, and data breach protocols essential for maintaining legal compliance in contracts. |

| 5 | AI-Generated Work Disclosure | Freelancers must provide a clear AI-Generated Work Disclosure within their Independent Contractor Agreement to specify the extent of AI involvement in project deliverables. This document enhances transparency, defining ownership rights, liability, and originality standards for AI-assisted content creation. |

| 6 | Remote Work Policy Acknowledgment | Freelancers need to provide a signed Remote Work Policy Acknowledgment as part of their Independent Contractor Agreement, confirming their understanding of company guidelines on remote work practices. This document ensures compliance with work hours, communication protocols, data security measures, and equipment usage requirements specific to remote collaboration. |

| 7 | E-Invoicing Template | Freelancers require an E-Invoicing Template within their Independent Contractor Agreement documentation to ensure accurate billing and compliance with tax regulations. This template must include detailed fields for service descriptions, payment terms, tax identification numbers, and digital signatures to facilitate efficient electronic processing and record-keeping. |

| 8 | Cybersecurity Liability Waiver | A freelancer needs a Cybersecurity Liability Waiver within an Independent Contractor Agreement to clearly define responsibilities and limit liability related to data breaches or cyber incidents. This document ensures both parties acknowledge cybersecurity risks and agree on protocols for incident response, protecting the freelancer from undue legal exposure. |

| 9 | NFT Ownership Clause | Freelancers require a detailed Independent Contractor Agreement including an NFT Ownership Clause that clearly specifies the transfer, licensing, or retention of intellectual property rights related to non-fungible tokens created during the contract. This clause must explicitly outline ownership rights, usage permissions, and any revenue sharing associated with NFT assets to prevent future disputes. |

| 10 | Blockchain Timestamp Verification | Freelancers need a signed Independent Contractor Agreement, a valid government-issued ID, tax forms such as W-9 or W-8BEN, and proof of completed work using blockchain timestamp verification to ensure contract authenticity and immutable record-keeping. Blockchain timestamp verification provides decentralized, tamper-proof evidence of submission dates and project milestones critical for dispute resolution and compliance. |

Introduction to Independent Contractor Agreements

| Introduction to Independent Contractor Agreements | |

|---|---|

| Definition | An Independent Contractor Agreement is a legal contract between a freelancer and a client outlining the scope of work, payment terms, deadlines, and responsibilities. |

| Purpose | Establishes clear expectations, protects both parties legally, and ensures compliance with tax and labor laws. |

| Key Elements | Scope of Work, Payment Terms, Timeline, Confidentiality, Ownership of Work, Termination Clauses |

| Essential Documents for Freelancers | |

| Freelancer Identification | Government-issued ID such as driver's license or passport to verify identity. |

| Tax Information | Completed W-9 form in the US or relevant tax forms in other countries for tax reporting purposes. |

| Portfolio or Work Samples | Evidence of skills and previous projects to establish credibility and match client expectations. |

| Proof of Business Registration | Business license or registration documents if the freelancer operates as a registered business entity. |

| Insurance Documentation | Professional liability insurance or other relevant policies to manage potential risks. |

| Invoices and Payment Records | Templates or previous invoices to streamline payment processing and financial tracking. |

Key Components of a Freelance Contract

Freelancers need a well-structured Independent Contractor Agreement to outline project scope, payment terms, and deadlines. Key components include clear definitions of services provided and responsibilities of both parties.

This contract should also specify confidentiality clauses, intellectual property rights, and termination conditions. Including dispute resolution methods and payment schedules ensures transparency and reduces potential conflicts.

Scope of Work Documentation

Scope of Work documentation is essential for defining the specific tasks and deliverables a freelancer agrees to complete under an Independent Contractor Agreement. This document sets clear expectations between the freelancer and client, minimizing misunderstandings.

It typically includes detailed descriptions of project objectives, timelines, and milestones. Highlighting the scope ensures both parties understand the extent and limits of the work involved. Well-prepared Scope of Work documentation protects freelancers by outlining responsibilities and preventing scope creep during the contract period.

Payment Terms and Invoicing Requirements

When entering into an Independent Contractor Agreement, clear documentation of payment terms and invoicing requirements is essential. These documents protect both parties and ensure timely and accurate compensation.

- Payment Schedule - Specifies the frequency and dates when payments will be made to the contractor.

- Invoice Template - Defines the format and necessary details each invoice must include for payment processing.

- Payment Method Details - Clarifies which payment methods are accepted and how funds will be transferred securely.

Your agreement should include these documents to prevent payment disputes and streamline financial transactions.

Confidentiality and Non-Disclosure Agreements

Freelancers must provide a detailed Independent Contractor Agreement outlining project scope, payment terms, and timelines. Confidentiality and Non-Disclosure Agreements (NDAs) are crucial to protect sensitive client information during and after the contract period.

These documents legally bind the freelancer to safeguard proprietary data and prevent unauthorized sharing with third parties. Properly executed NDAs ensure trust and secure collaboration between freelancers and clients.

Intellectual Property Rights Clauses

When drafting an Independent Contractor Agreement, including clear Intellectual Property Rights clauses is essential. These clauses define ownership and usage rights of work products created during the contract period. You must ensure the agreement explicitly states whether intellectual property rights transfer to the client or remain with the freelancer.

Termination Conditions and Exit Clauses

Freelancers must carefully review the termination conditions and exit clauses included in an Independent Contractor Agreement to protect their rights and responsibilities. These documents outline how and when the contract can be ended, ensuring clarity for both parties involved.

- Termination Clause - Specifies the circumstances under which either party can end the contract early, including notice periods.

- Exit Clause - Details the procedures to follow for a smooth transition upon contract termination, addressing deliverables and final payments.

- Notice Requirements - Defines the length and method of communication required to legally terminate the contract.

Liability and Indemnity Provisions

For an Independent Contractor Agreement, key documents include a detailed contract outlining the scope of work, payment terms, and crucially, liability and indemnity provisions. Liability clauses define the extent of responsibility for damages, while indemnity provisions protect you from potential claims arising during project execution. Ensuring these documents are clear helps safeguard your interests and clarifies risk allocation between parties.

Dispute Resolution Mechanisms

Dispute resolution mechanisms are essential documents included in an Independent Contractor Agreement to clearly define how conflicts will be managed. These mechanisms protect both parties by establishing procedures that minimize legal risks and ensure timely resolutions.

- Arbitration Clause - Specifies the process for resolving disputes through arbitration instead of court litigation.

- Mediation Agreement - Outlines steps for neutral third-party mediation before moving to formal legal action.

- Governing Law and Jurisdiction - Defines the legal jurisdiction and applicable laws under which disputes will be resolved.

What Documents Does a Freelancer Need for an Independent Contractor Agreement? Infographic