To secure a home loan pre-approval, essential documents typically include proof of identity such as a driver's license or passport, income verification like pay stubs, tax returns, or bank statements, and employment details or a letter from an employer. Lenders also require credit reports to assess financial reliability and debt information to evaluate repayment capacity. Having these documents ready streamlines the pre-approval process and helps establish a clear financial profile.

What Documents are Necessary for a Home Loan Pre-Approval?

| Number | Name | Description |

|---|---|---|

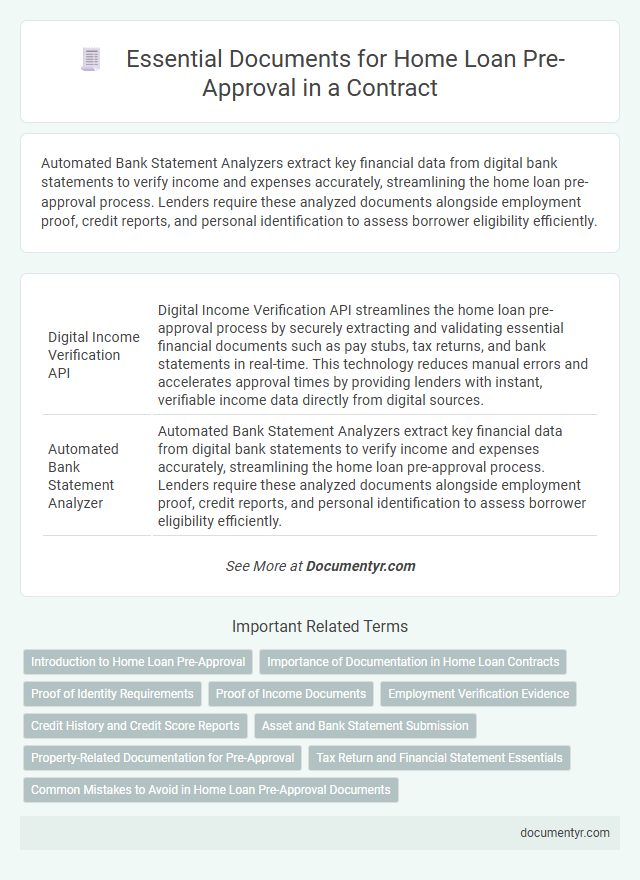

| 1 | Digital Income Verification API | Digital Income Verification API streamlines the home loan pre-approval process by securely extracting and validating essential financial documents such as pay stubs, tax returns, and bank statements in real-time. This technology reduces manual errors and accelerates approval times by providing lenders with instant, verifiable income data directly from digital sources. |

| 2 | Automated Bank Statement Analyzer | Automated Bank Statement Analyzers extract key financial data from digital bank statements to verify income and expenses accurately, streamlining the home loan pre-approval process. Lenders require these analyzed documents alongside employment proof, credit reports, and personal identification to assess borrower eligibility efficiently. |

| 3 | eSign Consent Disclosure | The eSign Consent Disclosure is a critical document for home loan pre-approval, enabling borrowers to electronically receive and sign disclosures and other loan documents. This consent streamlines the approval process by ensuring legal compliance and faster processing times through secure digital signatures. |

| 4 | Credit Pull Authorization Token | A Credit Pull Authorization Token is essential for a home loan pre-approval as it grants the lender permission to access the borrower's credit report, providing insight into credit history and financial behavior. This token ensures compliance with privacy regulations while allowing timely verification of creditworthiness, which is crucial for determining loan eligibility. |

| 5 | Source of Down Payment Declaration | Lenders require a Source of Down Payment Declaration to verify the origin of funds used for the home loan down payment, ensuring compliance with anti-money laundering regulations. This document typically includes bank statements, gift letters, sale agreements, or investment account statements to confirm legitimate and traceable sources. |

| 6 | Proof of Gift Funds Traceability | Proof of gift funds traceability requires official documentation including a gift letter outlining the donor's name, relationship to the borrower, and confirmation that the funds are a gift with no repayment expected, along with bank statements or transaction records showing the transfer of funds from the donor to the borrower. These documents ensure lenders verify the source and legitimacy of gift funds, preventing undisclosed debt or fraudulent income disclosures during the home loan pre-approval process. |

| 7 | Employment Continuity Letter | An Employment Continuity Letter is essential for home loan pre-approval as it verifies the borrower's current job status, salary stability, and likelihood of continued employment. Lenders rely on this document to assess income reliability and reduce default risk during the mortgage approval process. |

| 8 | Rent Payment Ledger (Digital Format) | A rent payment ledger in digital format provides a verifiable record of consistent monthly payments, demonstrating financial responsibility crucial for home loan pre-approval. Lenders use this document to assess creditworthiness and evaluate the borrower's ability to manage mortgage obligations effectively. |

| 9 | Asset Aggregation Report | An Asset Aggregation Report consolidates all financial assets, including bank statements, investment portfolios, and retirement accounts, providing lenders a clear overview of your financial health during home loan pre-approval. This report enhances the accuracy of income verification and strengthens the loan application by demonstrating financial stability. |

| 10 | Mortgage Readiness Certificate | A Mortgage Readiness Certificate is essential for home loan pre-approval as it verifies a borrower's financial stability and creditworthiness, providing lenders with a clear assessment of the applicant's ability to repay the loan. Required documents typically include proof of income, employment verification, credit reports, tax returns, and bank statements to support the certificate's validation process. |

Introduction to Home Loan Pre-Approval

Home loan pre-approval is a crucial step that helps buyers understand their borrowing capacity before house hunting. It provides a conditional commitment from a lender based on initial documentation and credit evaluation.

- Identification Proof - Valid documents such as a passport or driver's license are required to verify the applicant's identity.

- Income Proof - Salary slips, tax returns, or bank statements demonstrate the borrower's repayment ability.

- Credit History - Credit reports help lenders assess financial responsibility and risk before approving the loan.

Importance of Documentation in Home Loan Contracts

What documents are necessary for a home loan pre-approval? A comprehensive set of documents is crucial to verify the applicant's financial standing and ensure contract accuracy. Proper documentation streamlines the loan approval process and minimizes potential disputes in home loan agreements.

Proof of Identity Requirements

| Document Type | Description | Examples | Purpose |

|---|---|---|---|

| Proof of Identity | Verification of the borrower's identity to prevent fraud and confirm legal status. | Passport, Driver's License, National ID Card, Government-issued Photo ID | Establish the borrower's identity and ensure compliance with regulatory requirements in the home loan pre-approval process. |

| Proof of Address | Documents verifying the borrower's current residential address. | Utility Bills, Lease Agreements, Bank Statements, Official Correspondence | Confirm borrower's residency for loan processing and communication purposes. |

| Income Verification | Documents that demonstrate the borrower's financial capability to repay the loan. | Pay Slips, Tax Returns, Employment Letters, Bank Statements | Assess borrower's income stability and capacity for loan repayment. |

| Credit History | Report summarizing the borrower's credit behavior and existing obligations. | Credit Report from credit bureaus | Evaluate creditworthiness and risk in loan approval decision. |

Proof of Income Documents

Proof of income documents are essential for home loan pre-approval to verify your financial stability. Common documents include recent pay stubs, tax returns from the past two years, and bank statements showing consistent income deposits. These papers help lenders assess your ability to repay the loan and determine the maximum loan amount you qualify for.

Employment Verification Evidence

Employment verification evidence is a crucial document for securing home loan pre-approval. Lenders use it to confirm your income stability and job status.

- Recent Pay Stubs - Provide proof of current income and consistency over recent months.

- Employment Verification Letter - A letter from your employer confirming your job position, salary, and duration of employment.

- Tax Returns - Demonstrate your annual earnings and employment history to support income claims.

Submitting accurate employment verification documents increases the likelihood of timely home loan pre-approval.

Credit History and Credit Score Reports

Credit history and credit score reports are essential documents for home loan pre-approval. Lenders use these reports to assess an applicant's financial reliability and borrowing behavior.

A detailed credit history shows past loan repayments, outstanding debts, and any defaults, providing insight into creditworthiness. A high credit score enhances the chances of pre-approval and favorable loan terms.

Asset and Bank Statement Submission

Submitting a comprehensive asset portfolio is crucial for home loan pre-approval. Documents such as property deeds, investment statements, and proof of other valuable assets demonstrate financial stability.

Bank statements provide a clear picture of your financial transactions and income flow over time. Lenders typically require the last three to six months of statements to verify consistent income and savings patterns. Accurate and detailed submission of these documents speeds up the pre-approval process.

Property-Related Documentation for Pre-Approval

Property-related documents are essential for home loan pre-approval to verify the asset's legitimacy and value. These include the sale agreement, property title deed, and proof of property ownership.

Documentation such as the latest property tax receipts, encumbrance certificate, and approved building plan ensures clear legal status. Providing these documents helps streamline the approval process and confirms the property's eligibility for the loan.

Tax Return and Financial Statement Essentials

Tax returns are essential documents for home loan pre-approval, providing lenders with a clear record of your income over the past two years. Financial statements, including bank statements and proof of assets, demonstrate your ability to manage debt and cover loan payments. Submitting accurate tax returns and detailed financial statements accelerates the pre-approval process and builds lender confidence in your application.

What Documents are Necessary for a Home Loan Pre-Approval? Infographic