Business partnership agreements require several essential documents, including the partnership agreement outlining roles, responsibilities, and profit-sharing details. Financial records, business licenses, and identification documents of all partners are also necessary to establish legitimacy and compliance. Clear documentation of decision-making processes and dispute resolution methods ensures a well-structured and enforceable partnership.

What Documents Are Necessary for Business Partnership Agreements?

| Number | Name | Description |

|---|---|---|

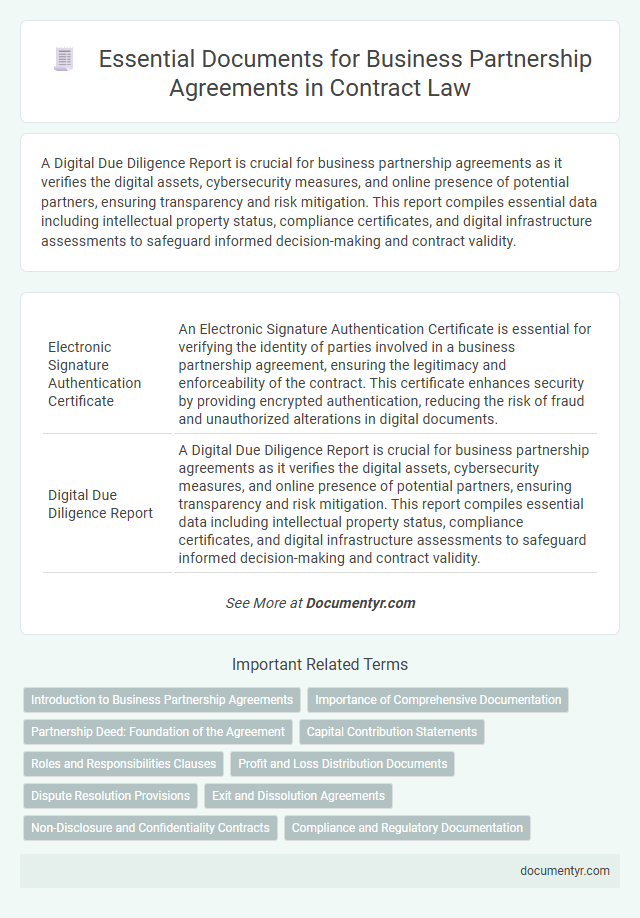

| 1 | Electronic Signature Authentication Certificate | An Electronic Signature Authentication Certificate is essential for verifying the identity of parties involved in a business partnership agreement, ensuring the legitimacy and enforceability of the contract. This certificate enhances security by providing encrypted authentication, reducing the risk of fraud and unauthorized alterations in digital documents. |

| 2 | Digital Due Diligence Report | A Digital Due Diligence Report is crucial for business partnership agreements as it verifies the digital assets, cybersecurity measures, and online presence of potential partners, ensuring transparency and risk mitigation. This report compiles essential data including intellectual property status, compliance certificates, and digital infrastructure assessments to safeguard informed decision-making and contract validity. |

| 3 | GDPR Compliance Addendum | A GDPR Compliance Addendum is essential for business partnership agreements to ensure both parties adhere to data protection regulations under the General Data Protection Regulation (GDPR). This document outlines responsibilities regarding personal data processing, security measures, breach notification protocols, and data subject rights to maintain legal compliance and mitigate risks. |

| 4 | Blockchain Transaction Record | A business partnership agreement must include a blockchain transaction record to ensure transparent and tamper-proof documentation of asset transfers, contributions, and profit distributions. Integrating blockchain technology in these documents enhances security, trust, and verifiable audit trails for all partners involved. |

| 5 | ESG (Environmental, Social, Governance) Clause Disclosure | Business partnership agreements must include ESG clause disclosures detailing environmental policies, social impact commitments, and governance structures to ensure transparency and compliance with sustainability standards. Essential documents include an ESG assessment report, stakeholder engagement records, and governance frameworks aligned with regulatory and ethical guidelines. |

| 6 | Partner Data-Sharing Protocol Agreement | A comprehensive partner data-sharing protocol agreement requires detailed documentation including partner identification details, data classification criteria, data access permissions, confidentiality clauses, and compliance with data protection regulations such as GDPR or CCPA. Clear documentation of data handling procedures, security measures, and breach notification protocols ensures legal protection and operational transparency in business partnerships. |

| 7 | Cross-Border Tax Nexus Documentation | Cross-border tax nexus documentation in business partnership agreements includes tax residency certificates, transfer pricing documentation, and tax identification numbers from all involved jurisdictions. These documents ensure compliance with international tax regulations and prevent double taxation in multinational collaborations. |

| 8 | Intellectual Property Assignment Schedule | A comprehensive Intellectual Property Assignment Schedule is essential for business partnership agreements to clearly delineate ownership rights and responsibilities of intellectual property created or used during the partnership. This document protects each party's proprietary assets by specifying the transfer, licensing, and usage terms of patents, trademarks, copyrights, and trade secrets. |

| 9 | AI Ethics and Usage Statement | Business partnership agreements require a clearly defined AI Ethics and Usage Statement to ensure responsible deployment, data privacy, and compliance with regulatory standards. This document outlines the principles for ethical AI implementation, usage limitations, and accountability measures vital for sustainable collaboration. |

| 10 | Cybersecurity Liability Waiver | A Cybersecurity Liability Waiver is a critical document in business partnership agreements, specifying the allocation of responsibility and limits of liability for data breaches and cyberattacks between partners. Including this waiver ensures clear accountability for cybersecurity risks, protecting all parties from potential financial losses and legal disputes. |

Introduction to Business Partnership Agreements

A business partnership agreement is a legal document that defines the roles, responsibilities, and profit-sharing among partners. Essential documents include the partnership agreement itself, financial statements, and identification records of all partners. Understanding these documents ensures Your business partnership starts on a clear and organized foundation.

Importance of Comprehensive Documentation

Comprehensive documentation is essential for business partnership agreements to clearly define the roles, responsibilities, and expectations of each partner. Properly drafted documents help prevent misunderstandings and legal disputes by outlining terms such as profit sharing, decision-making authority, and dissolution procedures.

Key documents include the partnership agreement, financial statements, and any relevant licenses or permits to ensure compliance with legal requirements. Detailed records provide a solid foundation for trust and transparency, supporting long-term business success and stability.

Partnership Deed: Foundation of the Agreement

A Partnership Deed is the foundation of any business partnership agreement, outlining the roles and responsibilities of each partner. This essential document ensures clarity and legal protection for Your business relationship.

- Identification of Partners - Details the names and addresses of all partners involved in the business.

- Capital Contribution - Specifies each partner's investment and ownership percentage within the partnership.

- Profit and Loss Sharing - Defines how profits and losses will be distributed among the partners.

Capital Contribution Statements

What documents are necessary for business partnership agreements? Capital Contribution Statements are essential as they detail each partner's financial investment in the partnership. These statements ensure transparency and clarify ownership percentages for your business.

Roles and Responsibilities Clauses

Business partnership agreements require specific documents to clearly define roles and responsibilities. These clauses are essential to prevent conflicts and ensure smooth collaboration.

Key documents include the partnership agreement itself, which outlines each partner's duties and decision-making authority. A roles and responsibilities clause specifies individual tasks, management roles, and accountability measures. Detailed documentation protects partners by setting expectations and reducing misunderstandings.

Profit and Loss Distribution Documents

Profit and loss distribution documents are critical components of business partnership agreements, ensuring clarity on financial responsibilities and benefits. These documents outline how profits and losses are shared among partners to prevent disputes and support transparent financial management.

- Profit Distribution Schedule - Details the percentage or proportion of profits each partner is entitled to receive based on the agreed terms.

- Loss Allocation Agreement - Specifies how financial losses will be divided among partners, protecting individual interests and clarifying liability.

- Financial Reporting Requirements - Establishes the documentation and frequency of profit and loss reporting to maintain transparency and accountability among partners.

Dispute Resolution Provisions

Dispute resolution provisions are critical components in business partnership agreements to manage potential conflicts effectively. These documents outline the agreed methods for resolving disputes, safeguarding the partnership's continuity and legal integrity.

- Arbitration Clauses - Specify that disputes will be settled through arbitration rather than court litigation, ensuring a faster and private resolution process.

- Mediation Provisions - Encourage parties to engage in mediation before pursuing formal legal actions, promoting amicable dispute settlement.

- Jurisdiction and Governing Law - Define the legal jurisdiction and the set of laws that will govern dispute resolution to prevent ambiguity in enforcement.

Including clear dispute resolution provisions in your business partnership agreement minimizes risks and protects your interests in case of disagreements.

Exit and Dissolution Agreements

| Document Type | Description | Purpose |

|---|---|---|

| Exit Agreement | Defines terms and conditions for a partner's voluntary or involuntary departure from the business partnership. | Ensures smooth transition and clear understanding of rights, responsibilities, and financial settlements upon exit. |

| Dissolution Agreement | Outlines procedures for terminating the partnership, including asset distribution, debt settlement, and final obligations. | Provides legal framework to close the business partnership in an organized and dispute-free manner. |

| Buy-Sell Agreement | Specifies mechanisms for purchasing a partner's share in case of exit, death, disability, or dispute. | Protects interests of remaining partners and maintains business continuity. |

| Confidentiality Agreement | Restricts disclosure of sensitive business information during and after the partnership dissolution. | Preserves trade secrets and intellectual property integrity. |

| Financial Statements | Includes balance sheets, profit and loss statements, and cash flow reports relevant at the time of exit or dissolution. | Facilitates accurate valuation and fair financial settlements among partners. |

Non-Disclosure and Confidentiality Contracts

Business partnership agreements require several essential documents to establish clear terms and protect all parties involved. Non-disclosure agreements (NDAs) and confidentiality contracts are critical components to safeguard proprietary information and trade secrets.

NDAs define the scope of confidential information and restrict unauthorized sharing, ensuring trust between partners. Confidentiality contracts further detail obligations and legal repercussions in case of breaches, securing business interests effectively.

What Documents Are Necessary for Business Partnership Agreements? Infographic