Nonprofits applying for 501(c)(3) status must submit key documents including Articles of Incorporation that clearly state the organization's nonprofit purpose and dissolution clause, bylaws outlining governance and operational procedures, and a detailed Form 1023 or Form 1023-EZ application demonstrating compliance with IRS requirements. Financial statements and a narrative description of activities should also be included to provide transparency and clarity. Ensuring these documents are accurate and complete increases the likelihood of approval by the IRS.

What Documents Does a Nonprofit Need for 501(c)(3) Status Application?

| Number | Name | Description |

|---|---|---|

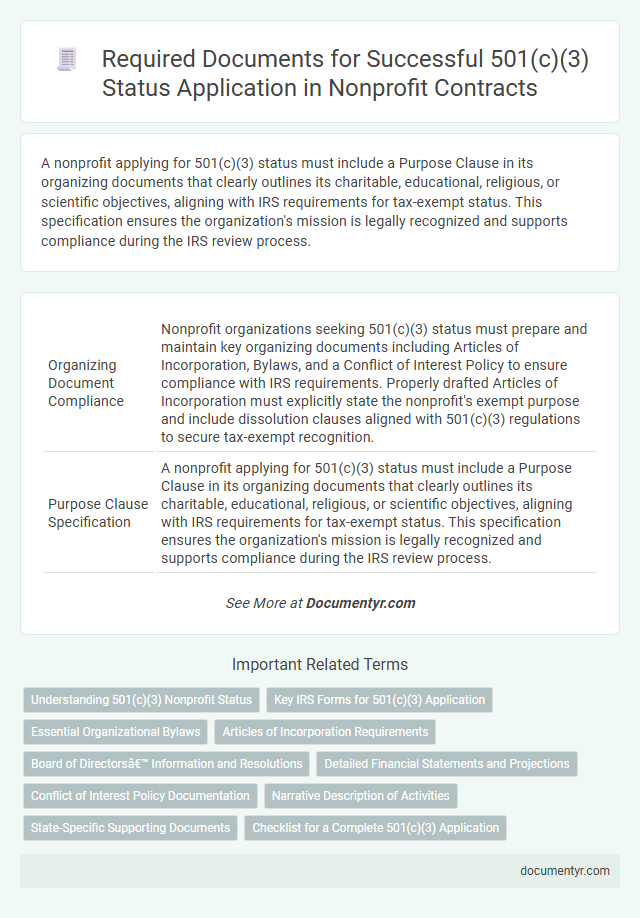

| 1 | Organizing Document Compliance | Nonprofit organizations seeking 501(c)(3) status must prepare and maintain key organizing documents including Articles of Incorporation, Bylaws, and a Conflict of Interest Policy to ensure compliance with IRS requirements. Properly drafted Articles of Incorporation must explicitly state the nonprofit's exempt purpose and include dissolution clauses aligned with 501(c)(3) regulations to secure tax-exempt recognition. |

| 2 | Purpose Clause Specification | A nonprofit applying for 501(c)(3) status must include a Purpose Clause in its organizing documents that clearly outlines its charitable, educational, religious, or scientific objectives, aligning with IRS requirements for tax-exempt status. This specification ensures the organization's mission is legally recognized and supports compliance during the IRS review process. |

| 3 | Dissolution Clause Statement | A nonprofit applying for 501(c)(3) status must include a dissolution clause statement in its governing documents, specifying that upon dissolution, assets will be distributed exclusively to another 501(c)(3) organization or the government for a public purpose. This clause ensures compliance with IRS requirements and protects the organization's charitable assets from private inurement. |

| 4 | IRS Form 1023 Attachments | Nonprofits applying for 501(c)(3) status must submit IRS Form 1023 accompanied by key attachments including organizing documents (articles of incorporation or trust agreement), detailed narratives of activities, financial data such as past and projected budgets, and copies of any brochures, newsletters, or other public communications. Essential schedules also include conflict of interest policies and statements outlining the organization's purpose, ensuring compliance with IRS requirements for tax-exempt recognition. |

| 5 | Conflict of Interest Policy | A Conflict of Interest Policy is a critical document required for a 501(c)(3) status application, ensuring board members disclose any personal interests that could conflict with the nonprofit's mission. This policy helps maintain transparency and protects the organization from decisions that may compromise its tax-exempt status. |

| 6 | Bylaws Adoption Certificate | The Bylaws Adoption Certificate is a crucial document for a nonprofit applying for 501(c)(3) status, as it formally records the approval and adoption of the organization's bylaws by the board of directors. This certificate validates the governance structure and operational rules, which are essential for compliance with IRS requirements during the application process. |

| 7 | EIN Confirmation Letter | The EIN Confirmation Letter, issued by the IRS, is a crucial document required for the 501(c)(3) status application as it verifies the nonprofit's Employer Identification Number, which is essential for tax-exempt status. This letter must be included alongside the Articles of Incorporation and Form 1023 to establish the organization's legal and financial identity. |

| 8 | Incorporation Acknowledgement | Nonprofits applying for 501(c)(3) status must submit the Articles of Incorporation as the primary legal document confirming their formation under state law; this incorporation acknowledgment establishes the organization's existence and outlines its nonprofit purpose. The document should include specific language required by the IRS, such as the purpose clause and dissolution clause, to ensure compliance and eligibility for tax-exempt status. |

| 9 | Public Charity Classification Statement | A nonprofit applying for 501(c)(3) status must include a Public Charity Classification Statement, which identifies the specific category under IRS guidelines such as organizations that receive a substantial part of their support from the public or government sources. This statement is critical for demonstrating the organization's public charity status and eligibility for tax-exempt benefits. |

| 10 | Schedules A-E Supporting Documentation | Nonprofits applying for 501(c)(3) status must include Schedules A-E supporting documentation, which provide detailed information on organizational activities, financial data, compensation of officers, and related entities. These schedules ensure compliance with IRS requirements by transparently outlining operational structures, governance policies, and funding sources critical for tax-exempt status approval. |

Understanding 501(c)(3) Nonprofit Status

Understanding 501(c)(3) nonprofit status is essential for organizations seeking federal tax exemption. Key documents required include Articles of Incorporation, Bylaws, and a detailed narrative describing the organization's activities and purpose. Your application must also include financial statements and Form 1023 to demonstrate compliance with IRS requirements.

Key IRS Forms for 501(c)(3) Application

Applying for 501(c)(3) status requires submitting specific documents to the IRS to establish tax-exempt eligibility. Key IRS forms streamline the application process and verify nonprofit legitimacy.

- Form 1023, Application for Recognition of Exemption - This comprehensive form is the primary document for establishing 501(c)(3) status and includes detailed organizational information and financial data.

- Form 1023-EZ, Streamlined Application - A simplified version of Form 1023, designed for smaller nonprofits, requiring less documentation but still essential for tax-exempt recognition.

- Form SS-4, Application for Employer Identification Number (EIN) - Obtaining an EIN is a required step before submitting Form 1023 and identifies the nonprofit for tax purposes.

Essential Organizational Bylaws

Essential organizational bylaws are a critical document when applying for 501(c)(3) status. These bylaws outline the internal rules governing your nonprofit's operations and decision-making processes.

The IRS requires well-drafted bylaws to ensure your organization meets legal standards and maintains compliance. Properly structured bylaws help establish clear roles for your board members and define membership regulations.

Articles of Incorporation Requirements

When applying for 501(c)(3) status, your Articles of Incorporation must include specific information to meet IRS requirements. These documents serve as the foundation for your nonprofit's legal existence and tax-exempt status.

The Articles of Incorporation should clearly state the nonprofit's name, purpose, and duration. You must include a statement confirming that the organization is organized exclusively for exempt purposes under section 501(c)(3) of the Internal Revenue Code. Additionally, the Articles should detail the distribution of assets upon dissolution to another 501(c)(3) organization or government entity.

Board of Directors’ Information and Resolutions

| Document | Description | Importance for 501(c)(3) Application |

|---|---|---|

| Board of Directors' Information | List of names, addresses, titles, and roles of each board member | IRS requires detailed information about your nonprofit's governing body to ensure proper organizational structure and compliance. |

| Board Resolutions | Formal written decisions adopted by the board regarding the application and nonprofit's operations | These resolutions demonstrate the board's approval of the 501(c)(3) application and commitment to adhering to nonprofit regulations. |

Detailed Financial Statements and Projections

Detailed financial statements are essential for a nonprofit applying for 501(c)(3) status, as they demonstrate the organization's current financial health and stability. These statements typically include balance sheets, income statements, and cash flow reports that provide a clear picture of assets, liabilities, revenues, and expenses. Financial projections are also crucial, outlining expected income and expenditures over the next three to five years to show sustainable operations and effective resource management.

Conflict of Interest Policy Documentation

When applying for 501(c)(3) status, nonprofits must include a Conflict of Interest Policy to ensure transparent governance and compliance with IRS regulations. This policy helps prevent conflicts that could compromise the organization's mission and legal standing.

- Conflict of Interest Policy Document - A written statement outlining how conflicts are identified and managed by the nonprofit's board and staff.

- Board Approval Evidence - Documentation showing the board of directors has reviewed and formally adopted the conflict of interest policy.

- Compliance Procedures - Detailed procedures within the policy explaining disclosure requirements and actions taken when conflicts arise.

Narrative Description of Activities

What is the Narrative Description of Activities required for a 501(c)(3) status application? The Narrative Description of Activities provides a detailed overview of the nonprofit's past, present, and planned operations, demonstrating the organization's alignment with IRS charitable purposes. This document is essential in proving that the nonprofit's activities qualify for tax-exempt status under section 501(c)(3).

State-Specific Supporting Documents

State-specific supporting documents are essential when applying for 501(c)(3) status to ensure compliance with local regulations. These documents vary depending on your state's requirements and help validate your nonprofit's legitimacy.

- State Incorporation Certificate - Proves that your nonprofit is officially registered with the state government.

- State Tax Exemption Application - Required to obtain exemption from state and local taxes, differing by state.

- Charitable Solicitation Registration - Necessary for nonprofits that plan to solicit donations within certain states.

Confirm specific documents required by your state to streamline the 501(c)(3) application process.

What Documents Does a Nonprofit Need for 501(c)(3) Status Application? Infographic