An Independent Contractor Agreement requires essential documents such as a detailed scope of work, payment terms, and project deadlines to clearly define responsibilities. Including confidentiality clauses and intellectual property rights protects both parties' interests. Properly outlining termination conditions and dispute resolution procedures helps prevent future conflicts.

What Documents are Necessary for an Independent Contractor Agreement?

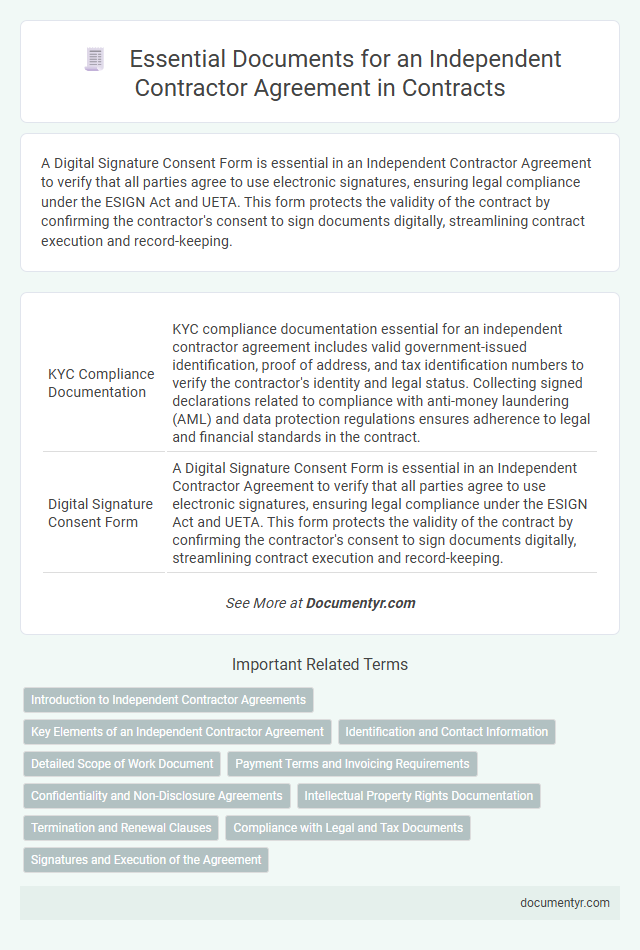

| Number | Name | Description |

|---|---|---|

| 1 | KYC Compliance Documentation | KYC compliance documentation essential for an independent contractor agreement includes valid government-issued identification, proof of address, and tax identification numbers to verify the contractor's identity and legal status. Collecting signed declarations related to compliance with anti-money laundering (AML) and data protection regulations ensures adherence to legal and financial standards in the contract. |

| 2 | Digital Signature Consent Form | A Digital Signature Consent Form is essential in an Independent Contractor Agreement to verify that all parties agree to use electronic signatures, ensuring legal compliance under the ESIGN Act and UETA. This form protects the validity of the contract by confirming the contractor's consent to sign documents digitally, streamlining contract execution and record-keeping. |

| 3 | Data Processing Addendum (DPA) | A Data Processing Addendum (DPA) is essential in an Independent Contractor Agreement to ensure compliance with data protection laws such as GDPR, detailing the roles, responsibilities, and security measures for processing personal data. This document outlines obligations related to data handling, breach notifications, and subcontractor management, safeguarding both parties against legal risks associated with data privacy. |

| 4 | Statement of Work (SOW) Annexure | A Statement of Work (SOW) Annexure is essential in an Independent Contractor Agreement as it defines specific project deliverables, timelines, and payment terms, ensuring clear expectations and accountability. This annexure complements the main contract by detailing the scope of work, performance standards, and acceptance criteria to prevent disputes. |

| 5 | Non-Solicitation Clause Schedule | A Non-Solicitation Clause Schedule in an Independent Contractor Agreement outlines specific restrictions preventing the contractor from soliciting the client's employees, customers, or vendors during and after the contract term. This document must clearly define the duration, scope, and parties covered to ensure enforceability and protect business interests. |

| 6 | Remote Work Policy Attachment | An Independent Contractor Agreement should include a Remote Work Policy Attachment outlining specific guidelines for remote work conditions, communication protocols, security measures, and equipment responsibilities. This document ensures both parties agree on expectations and compliance with work standards in a remote environment to prevent misunderstandings and protect company interests. |

| 7 | Intellectual Property Assignment Agreement | An Independent Contractor Agreement should include a comprehensive Intellectual Property Assignment Agreement that clearly transfers all rights and ownership of work products created during the contract to the hiring party. This document safeguards proprietary information, outlines the scope of intellectual property rights, and helps prevent future disputes over ownership and usage. |

| 8 | Cybersecurity Requirements Checklist | An Independent Contractor Agreement must include a comprehensive Cybersecurity Requirements Checklist detailing data protection protocols, encryption standards, access controls, and incident response procedures to safeguard sensitive information. This checklist ensures compliance with relevant regulations such as GDPR and CCPA while defining contractor responsibilities for maintaining secure systems and reporting breaches promptly. |

| 9 | ESG (Environmental, Social, Governance) Compliance Declaration | An Independent Contractor Agreement must include an ESG Compliance Declaration outlining the contractor's commitment to environmental sustainability, social responsibility, and governance standards. This document ensures accountability by specifying performance metrics, reporting requirements, and adherence to applicable ESG regulations throughout the contract duration. |

| 10 | E-Invoicing Integration Agreement | An Independent Contractor Agreement with E-Invoicing Integration requires documents including the signed contract outlining service scope, payment terms, and confidentiality clauses, alongside technical specifications for e-invoicing systems compliance such as API integration details and data security protocols. Supporting materials like tax identification, proof of business registration, and compliance certifications ensure legal and regulatory adherence. |

Introduction to Independent Contractor Agreements

What documents are necessary for an Independent Contractor Agreement? An Independent Contractor Agreement outlines the terms and conditions between a client and an independent contractor. Essential documents include the contract itself, proof of insurance, and tax forms such as the W-9.

Key Elements of an Independent Contractor Agreement

An Independent Contractor Agreement requires specific documents to ensure clarity and legal protection for both parties involved. Key elements include detailed descriptions of services, payment terms, and project timelines.

Other essential documents encompass confidentiality clauses, intellectual property rights, and dispute resolution procedures. Clear documentation facilitates trust and reduces the risk of misunderstandings between the contractor and client.

Identification and Contact Information

Identification and contact information are essential components of an Independent Contractor Agreement to ensure clear accountability and communication. These documents confirm the legal identity and provide reliable means of contact for both parties.

- Full Legal Name - Specifies the contractor's official name to establish a binding agreement.

- Government-issued Identification - Includes documents like a driver's license or passport to verify the contractor's identity.

- Contact Details - Encompasses phone numbers, email addresses, and physical mailing addresses for effective communication throughout the contract duration.

Detailed Scope of Work Document

Creating an effective independent contractor agreement requires clear and comprehensive documentation. The Detailed Scope of Work Document is essential to outline specific tasks, deliverables, and expectations.

- Defines Responsibilities - Specifies the exact duties and obligations the contractor must fulfill to avoid ambiguity.

- Sets Deliverables and Deadlines - Details all expected outputs and their respective timelines to ensure timely completion.

- Establishes Performance Standards - Clarifies quality benchmarks and criteria for evaluating the contractor's work.

Payment Terms and Invoicing Requirements

| Document Type | Description | Key Elements |

|---|---|---|

| Independent Contractor Agreement | Legal contract defining the scope of work, responsibilities, and relationship between the contractor and client. |

|

| Invoice Template | Standardized format used by contractors to request payment. |

|

| Proof of Payment Instructions | Guidelines within the agreement or supplement documents outlining acceptable proof or confirmation methods for payments made. |

|

Confidentiality and Non-Disclosure Agreements

Independent Contractor Agreements require essential documents to ensure clear terms and protect both parties. Confidentiality and Non-Disclosure Agreements (NDAs) play a crucial role in safeguarding sensitive information during the contract period.

Confidentiality agreements explicitly define what information must remain private, preventing unauthorized disclosure. NDAs legally bind contractors to maintain secrecy about proprietary data, trade secrets, and business strategies. Including these documents in Your contract helps establish trust and security while minimizing the risk of intellectual property theft or data breaches.

Intellectual Property Rights Documentation

Intellectual property rights documentation is a crucial component of an independent contractor agreement. These documents clearly define ownership and usage rights related to the work produced.

- Assignment of Intellectual Property Rights - This document transfers ownership of all intellectual property created by the contractor to the client.

- Confidentiality and Non-Disclosure Agreement - Protects sensitive information and trade secrets during and after the contract term.

- Work for Hire Clause - Specifies that all deliverables are considered the client's property from the moment of creation.

Your independent contractor agreement should include these documents to safeguard intellectual property rights effectively.

Termination and Renewal Clauses

Termination and renewal clauses are essential components of an independent contractor agreement. These clauses clearly outline the conditions under which the contract can be ended or extended.

Necessary documents include a detailed contract specifying the termination notice period, grounds for termination, and renewal terms. You should ensure these clauses protect both parties and comply with relevant legal requirements.

Compliance with Legal and Tax Documents

An Independent Contractor Agreement must include essential legal documents such as the contractor's identification and proof of business registration to ensure compliance with state and federal regulations. Tax documents like the W-9 form are necessary for reporting income and withholding appropriate taxes accurately. Including these documents safeguards both parties by clarifying tax obligations and legal responsibilities under the contract.

What Documents are Necessary for an Independent Contractor Agreement? Infographic