Non-profits require specific documents for grant contracts, including proof of tax-exempt status such as IRS Form 501(c)(3), organizational bylaws, and a detailed project proposal outlining objectives and budget. Financial statements and audit reports demonstrate fiscal responsibility, while letters of support and previous grant histories strengthen credibility. Proper documentation ensures compliance with grantor requirements, facilitating successful contract execution and funding approval.

What Documents Does a Non-Profit Need for Grant Contracts?

| Number | Name | Description |

|---|---|---|

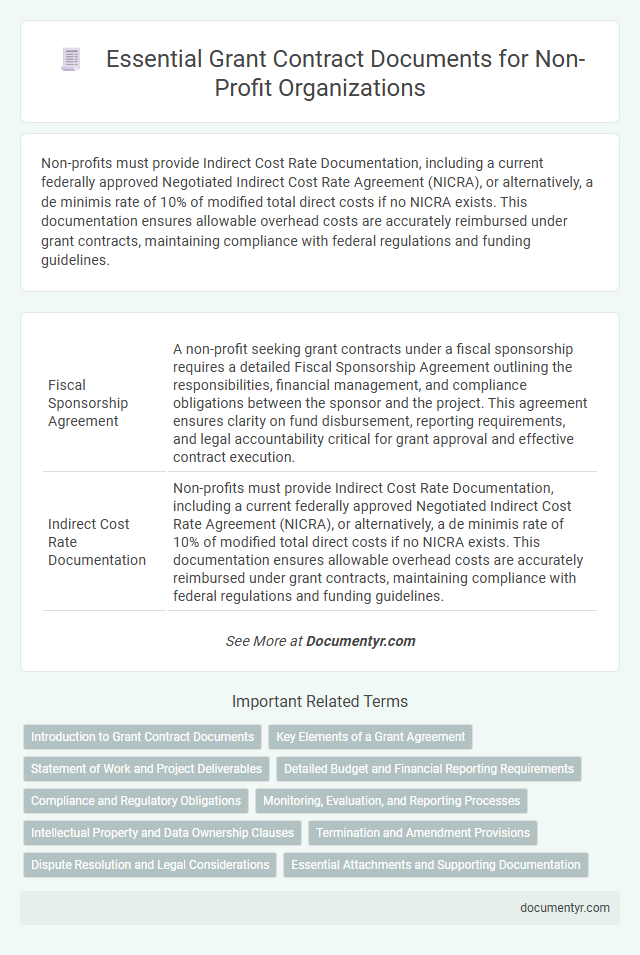

| 1 | Fiscal Sponsorship Agreement | A non-profit seeking grant contracts under a fiscal sponsorship requires a detailed Fiscal Sponsorship Agreement outlining the responsibilities, financial management, and compliance obligations between the sponsor and the project. This agreement ensures clarity on fund disbursement, reporting requirements, and legal accountability critical for grant approval and effective contract execution. |

| 2 | Indirect Cost Rate Documentation | Non-profits must provide Indirect Cost Rate Documentation, including a current federally approved Negotiated Indirect Cost Rate Agreement (NICRA), or alternatively, a de minimis rate of 10% of modified total direct costs if no NICRA exists. This documentation ensures allowable overhead costs are accurately reimbursed under grant contracts, maintaining compliance with federal regulations and funding guidelines. |

| 3 | Logic Model Statement | A non-profit organization needs a clear and detailed Logic Model Statement for grant contracts to demonstrate how resources, activities, and outputs lead to desired outcomes and long-term impact. This document provides funders with a structured framework linking program inputs, processes, and measurable results, ensuring transparency and effectiveness in achieving grant objectives. |

| 4 | Memorandum of Understanding (MOU) | A Non-Profit organization typically requires a Memorandum of Understanding (MOU) as a foundational document for grant contracts, outlining the roles, responsibilities, and expectations between the parties involved. This MOU serves to establish mutual understanding and clarify the scope of the grant, ensuring compliance with funding requirements and legal standards. |

| 5 | Programmatic Reporting Template | Non-profits require a Programmatic Reporting Template to systematically document project progress, outcomes, and compliance with grant objectives, ensuring transparency and accountability to funders. This template typically includes sections for activity descriptions, performance metrics, timeline updates, and budget utilization details critical for grant contract fulfillment. |

| 6 | Key Personnel Disclosure | Key Personnel Disclosure for grant contracts in non-profits includes detailed resumes, roles, and responsibilities of individuals critical to project execution. Accurate documentation ensures compliance with funder requirements and demonstrates organizational capacity to manage the grant effectively. |

| 7 | DEI (Diversity, Equity, Inclusion) Policy Certification | Non-profits applying for grant contracts must provide a DEI Policy Certification to demonstrate commitment to diversity, equity, and inclusion principles within their organizational practices. This certification typically includes documented policies on equitable hiring, inclusive programming, and measurable outcomes to ensure compliance with funders' DEI requirements. |

| 8 | Digital Signature Audit Trail | A non-profit requires a comprehensive digital signature audit trail for grant contracts, which includes timestamped records of all signature events, IP addresses, and authentication methods to ensure compliance and traceability. This audit trail verifies the integrity and authenticity of signed documents, providing essential evidence for audits and legal review. |

| 9 | Data Use and Privacy Addendum | Non-profit organizations must include a Data Use and Privacy Addendum in grant contracts to ensure compliance with data protection laws such as GDPR and HIPAA, outlining how sensitive information will be stored, accessed, and shared. This addendum establishes obligations for data confidentiality, secure handling of personal data, and protocols for breach notification to protect beneficiary and donor information. |

| 10 | Organizational Capacity Assessment | Non-profits require a detailed Organizational Capacity Assessment for grant contracts to demonstrate their ability to manage funds and implement projects effectively. This assessment typically includes governance structure documentation, financial management systems, staff qualifications, and operational policies ensuring compliance and accountability. |

Introduction to Grant Contract Documents

Grant contract documents are essential for non-profit organizations seeking funding. These documents outline the terms, conditions, and obligations related to the grant awarded.

You must prepare specific paperwork to ensure compliance and secure the grant successfully. Key documents typically include the grant agreement, budget proposals, and proof of non-profit status.

Key Elements of a Grant Agreement

What documents does a non-profit need for grant contracts? A non-profit organization must prepare a detailed grant agreement, including the scope of work and budget. Key elements of a grant agreement also feature reporting requirements and compliance guidelines to ensure proper fund usage.

Statement of Work and Project Deliverables

Non-profit organizations require a clear Statement of Work (SOW) when entering grant contracts. This document outlines specific tasks, responsibilities, and timelines essential for project management.

The SOW provides detailed descriptions of activities and expected outcomes tied to the grant objectives. Project Deliverables must be explicitly defined to ensure compliance and facilitate progress tracking. Accurate documentation of deliverables supports transparency and accountability to funders throughout the grant period.

Detailed Budget and Financial Reporting Requirements

Non-profits seeking grant contracts must provide a detailed budget outlining all projected expenses and revenue sources related to the project. Accurate financial reporting requirements typically include quarterly or annual financial statements, receipts, and documentation of fund allocation to ensure compliance with grant terms. You should maintain transparent and organized records to facilitate audits and demonstrate proper use of grant funds.

Compliance and Regulatory Obligations

Non-profit organizations must maintain proper documentation to ensure compliance with grant contract requirements and regulatory obligations. Essential documents include the IRS determination letter, financial statements, and detailed project proposals to demonstrate eligibility and accountability. Your ability to provide these records promptly supports transparency and adherence to both federal and state regulations.

Monitoring, Evaluation, and Reporting Processes

| Document Type | Description | Purpose in Monitoring, Evaluation, and Reporting |

|---|---|---|

| Grant Agreement | Official contract between the non-profit and the funder outlining terms, conditions, and deliverables. | Serves as the baseline for monitoring compliance and reporting progress. |

| Monitoring Plan | Detailed document describing key indicators, data collection methods, and timelines. | Guides systematic tracking of project activities and performance metrics. |

| Evaluation Framework | Framework outlining evaluation criteria, methodologies, and stakeholder roles. | Supports assessment of effectiveness and impact evaluation for continuous improvement. |

| Data Collection Tools | Templates, surveys, and interview guides used to gather qualitative and quantitative data. | Ensures consistent and reliable data to inform monitoring and evaluation. |

| Progress Reports | Periodic reports detailing project status, milestones achieved, and challenges faced. | Provides accountability and insight for funders and internal stakeholders. |

| Financial Reports | Documentation of expenditures and budget utilization aligned with grant terms. | Facilitates transparent financial monitoring and compliance verification. |

| Final Evaluation Report | Comprehensive report summarizing outcomes, lessons learned, and recommendations. | Informs future programming and funder decisions based on evidence of success. |

| Audit Reports | Independent review of financial and operational practices related to the grant. | Validates accuracy and integrity of management processes throughout the grant lifecycle. |

Intellectual Property and Data Ownership Clauses

Non-profits must carefully review grant contracts to ensure clear terms regarding intellectual property and data ownership. These clauses determine the rights and responsibilities related to creations and information generated through funded projects.

- Intellectual Property Assignment Clause - Specifies whether the non-profit or the grantor retains ownership of inventions, patents, and copyrights developed during the grant period.

- Data Ownership Clause - Defines which party holds ownership and control over data collected, stored, or produced as part of the funded project activities.

- Licensing and Usage Rights - Outlines permissions for using, sharing, or publishing intellectual property and data, ensuring compliance with grant conditions and organizational policies.

Ensuring these documents are included and clearly articulated protects the non-profit's interests and facilitates compliance with funding requirements.

Termination and Amendment Provisions

Non-profits must include clear termination and amendment provisions in grant contract documents to protect their interests and ensure compliance. These provisions outline the conditions under which the contract can be ended or modified by either party.

Termination clauses specify valid reasons for contract cancellation, such as breach of terms or funding discontinuation, and detail the notice period required. Amendment provisions describe the process for making changes to contract terms, often requiring written consent from both the non-profit and the grantor.

Dispute Resolution and Legal Considerations

Non-profit organizations must carefully prepare specific documents to manage grant contracts effectively, emphasizing dispute resolution and legal considerations. Proper documentation safeguards the organization's interests and ensures compliance with grant terms during conflicts.

- Grant Agreement - This contract outlines the terms, conditions, and obligations, serving as the primary legal document for dispute resolution.

- Dispute Resolution Clause - Detailed provisions specifying methods such as mediation or arbitration to resolve conflicts without litigation.

- Legal Compliance Certifications - Documents confirming adherence to relevant laws and regulations, reducing risks of legal challenges during grant administration.

What Documents Does a Non-Profit Need for Grant Contracts? Infographic