An LLC operating agreement requires key documents including the LLC's Articles of Organization, which outline the company's basic details and structure, and the members' identification information. It often incorporates financial and ownership details such as capital contributions, profit-sharing ratios, and management responsibilities. Drafting the agreement may also necessitate prior meeting minutes or resolutions authorizing the agreement and specifying roles to ensure legal clarity and operational consistency.

What Documents Do You Need for an LLC Operating Agreement?

| Number | Name | Description |

|---|---|---|

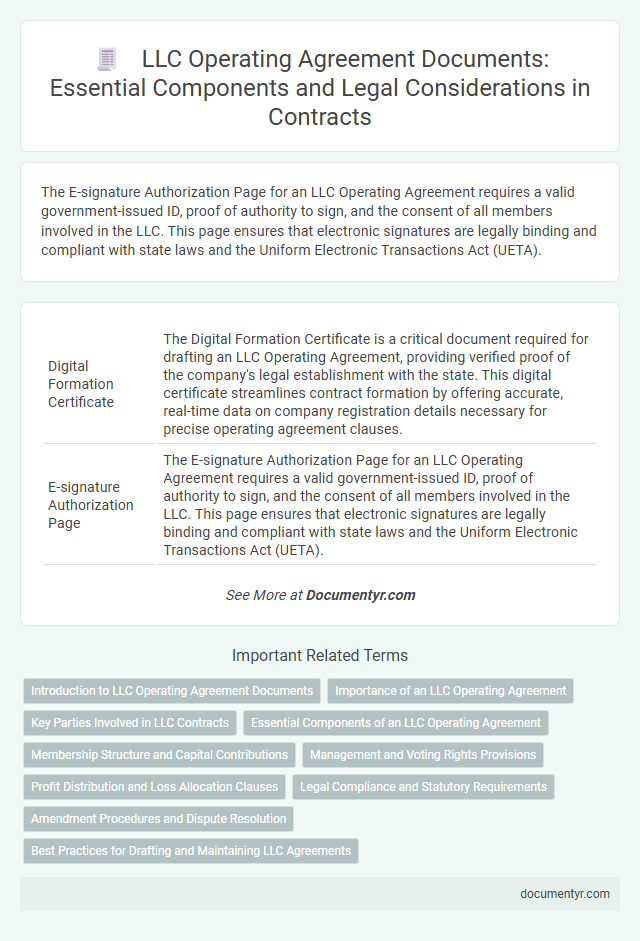

| 1 | Digital Formation Certificate | The Digital Formation Certificate is a critical document required for drafting an LLC Operating Agreement, providing verified proof of the company's legal establishment with the state. This digital certificate streamlines contract formation by offering accurate, real-time data on company registration details necessary for precise operating agreement clauses. |

| 2 | E-signature Authorization Page | The E-signature Authorization Page for an LLC Operating Agreement requires a valid government-issued ID, proof of authority to sign, and the consent of all members involved in the LLC. This page ensures that electronic signatures are legally binding and compliant with state laws and the Uniform Electronic Transactions Act (UETA). |

| 3 | Member Digital Identity Verification | Member digital identity verification for an LLC operating agreement requires official government-issued IDs such as passports or driver's licenses, along with biometric authentication or secure digital signatures to ensure compliance and prevent fraud. Accurate verification of member identities supports legal validation and strengthens the enforceability of the operating agreement. |

| 4 | Blockchain-Stamped Membership Ledger | An LLC Operating Agreement requires a Blockchain-Stamped Membership Ledger to ensure transparent, immutable records of member ownership and transaction history. This ledger serves as a secure digital document verifying member identities, ownership percentages, and changes in membership, enhancing the contract's enforceability and reducing disputes. |

| 5 | AI-Generated Member Disclosures | AI-generated member disclosures in an LLC operating agreement require accurate identification records, including government-issued IDs and digital signatures, to ensure compliance and authenticity. Supporting documents such as previous ownership agreements, member roles clarification, and state-specific regulatory forms enhance transparency and legal enforceability within the contract. |

| 6 | Virtual Office Address Validation | Validating a virtual office address for an LLC operating agreement requires documents such as a rental agreement, utility bills, or official correspondence showing the virtual office location linked to the LLC. These documents ensure compliance with state regulations and establish the legal business address for contract filings. |

| 7 | Beneficial Ownership Attestation | An LLC Operating Agreement requires a Beneficial Ownership Attestation to verify the identities of individuals who own or control a significant interest in the company as mandated by the Corporate Transparency Act. This document typically includes detailed information such as full names, addresses, dates of birth, and identification numbers of all beneficial owners holding 25% or more ownership or control in the LLC. |

| 8 | Web3 Payment Clause Addendum | An LLC Operating Agreement with a Web3 Payment Clause Addendum requires foundational documents such as the original operating agreement, member information, and specific addendum terms detailing cryptocurrency transaction methods, blockchain addresses, and smart contract protocols. Including these documents ensures clarity on decentralized payment processes and legal compliance in digital asset management within the LLC framework. |

| 9 | Remote Notarization Record | For an LLC Operating Agreement, having a Remote Notarization Record ensures the document's legal authenticity and compliance with state regulations by verifying signatures electronically. This record typically includes a digital certificate, timestamp, and video or audio evidence of the notarization process, providing secure proof crucial for remote legal transactions. |

| 10 | ESG (Environmental, Social, Governance) Policy Statement | An LLC Operating Agreement should include a comprehensive ESG (Environmental, Social, Governance) Policy Statement outlining the company's commitment to sustainable practices, social responsibility, and transparent governance. Documents needed to support this statement typically include environmental impact assessments, social responsibility guidelines, stakeholder engagement records, and governance frameworks ensuring compliance with regulatory standards. |

Introduction to LLC Operating Agreement Documents

An LLC Operating Agreement is a crucial document that outlines the ownership and management structure of your Limited Liability Company. Essential documents for drafting this agreement include the Articles of Organization, detailing official company formation and registered agent information. Financial records, member contributions, and roles further support a comprehensive Operating Agreement.

Importance of an LLC Operating Agreement

An LLC Operating Agreement is a crucial document that outlines the management structure and member responsibilities of a Limited Liability Company. It provides legal protection and clarity, reducing potential conflicts among members.

- Articles of Organization - This foundational document is required to legally establish the LLC and serves as a reference for the Operating Agreement.

- Member Information - Detailed information about each LLC member is necessary to define ownership percentages and voting rights accurately in the Operating Agreement.

- Rules and Procedures - Clearly defined operational rules within the agreement ensure smooth business management and protect members' interests.

Key Parties Involved in LLC Contracts

What documents are essential for creating an LLC Operating Agreement? Key documents include the LLC Articles of Organization, member information, and financial contributions. The Operating Agreement outlines roles, responsibilities, and ownership percentages of the key parties involved in the LLC contract.

Essential Components of an LLC Operating Agreement

Creating an LLC Operating Agreement requires specific documents to ensure legal clarity and operational efficiency. Your agreement should outline every fundamental aspect that governs your LLC's structure and member responsibilities.

- Member Information - Details of all LLC members including ownership percentages and roles ensure clear identification and rights.

- Management Structure - Defines whether the LLC is member-managed or manager-managed, establishing decision-making authority.

- Profit and Loss Distribution - Specifies how profits and losses are allocated among members, preventing future disputes.

Membership Structure and Capital Contributions

When drafting an LLC Operating Agreement, essential documents include detailed information on Membership Structure, outlining each member's roles, rights, and ownership percentages. Clear records of Capital Contributions track the financial input of every member, ensuring transparency and proper allocation of profits and losses.

Accurate documentation of membership interests and initial investments supports legal compliance and internal governance. Your Operating Agreement should incorporate these documents to define management protocols and protect member rights effectively.

Management and Voting Rights Provisions

An LLC Operating Agreement requires key documents outlining the management structure and voting rights provisions. These documents include detailed member roles, decision-making protocols, and voting weight distribution. Clear specification of management authority and voting thresholds ensures operational clarity and legal compliance.

Profit Distribution and Loss Allocation Clauses

An LLC Operating Agreement outlines the rules for profit distribution and loss allocation among members. It specifies how earnings and losses are shared based on ownership percentages or agreed terms.

Documents needed include member contributions records and financial statements to support accurate allocation. Detailed clauses within the Operating Agreement ensure clarity on profit sharing and responsibility for losses.

Legal Compliance and Statutory Requirements

To create an LLC operating agreement, you need key documents that ensure legal compliance and satisfy statutory requirements. These include the Articles of Organization filed with your state and any prior agreements among members.

Ensure you have the state-specific LLC formation documents to comply with local laws. Your operating agreement should detail the management structure, capital contributions, and profit distribution. Proper documentation helps protect members' rights and reduces legal disputes.

Amendment Procedures and Dispute Resolution

| Document Requirement | Description |

|---|---|

| Amendment Procedures | An LLC Operating Agreement must include clear guidelines on how amendments are proposed, approved, and documented. This often requires a written proposal submitted by a member, approval by a specified percentage of members, and a formal written record of the amendment to ensure legal enforceability. |

| Dispute Resolution Clause | The agreement should specify methods for resolving internal disputes, such as mediation, arbitration, or litigation. Defining a preferred resolution process helps prevent prolonged conflicts and provides a standardized approach to handle disagreements among members effectively. |

| Supporting Documentation | You may need member votes, written consents, or notarized records related to amendments and dispute resolution to maintain transparency and legal validity within the LLC's governance structure. |

What Documents Do You Need for an LLC Operating Agreement? Infographic