A startup pursuing Series A funding must have essential documents including a detailed business plan, financial projections, and a comprehensive pitch deck outlining the company's value proposition and growth potential. Legal documents such as incorporation papers, intellectual property assignments, and shareholder agreements are crucial to establish ownership and protect investor interests. Clear documentation of prior funding rounds, cap table, and compliance certificates further ensures transparency and builds investor confidence during the due diligence process.

What Documents Does a Startup Need for Series A Funding?

| Number | Name | Description |

|---|---|---|

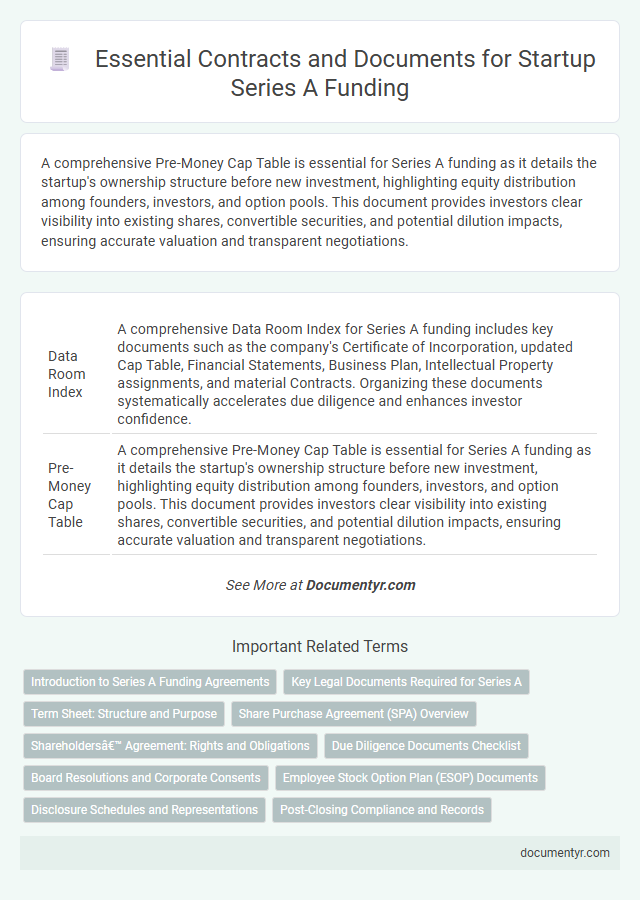

| 1 | Data Room Index | A comprehensive Data Room Index for Series A funding includes key documents such as the company's Certificate of Incorporation, updated Cap Table, Financial Statements, Business Plan, Intellectual Property assignments, and material Contracts. Organizing these documents systematically accelerates due diligence and enhances investor confidence. |

| 2 | Pre-Money Cap Table | A comprehensive Pre-Money Cap Table is essential for Series A funding as it details the startup's ownership structure before new investment, highlighting equity distribution among founders, investors, and option pools. This document provides investors clear visibility into existing shares, convertible securities, and potential dilution impacts, ensuring accurate valuation and transparent negotiations. |

| 3 | Investor Rights Agreement (IRA) | The Investor Rights Agreement (IRA) is a critical document in Series A funding that outlines the rights and obligations of investors, including information rights, registration rights, and rights of first refusal. It safeguards investor interests by granting access to company financials, future share sales, and voting rights essential for maintaining influence post-investment. |

| 4 | Pro Forma Financials | Pro forma financials are essential for Series A funding as they provide projected income statements, balance sheets, and cash flow statements that demonstrate the startup's expected financial performance and growth potential. These documents help investors assess the viability and scalability of the business by illustrating future revenue streams, expenses, and capital requirements based on current assumptions and strategic plans. |

| 5 | Liquidation Preference Summary | A startup seeking Series A funding must provide a comprehensive Liquidation Preference Summary outlining the priority order of payouts to investors in the event of a company sale or liquidation. This document specifies the multiple on invested capital that preferred shareholders are entitled to before common shareholders receive any proceeds, ensuring transparent rights and protections for venture capital investors. |

| 6 | Anti-Dilution Clause Documentation | Anti-dilution clause documentation for Series A funding includes the investor rights agreement and the amended and restated certificate of incorporation, which outline protection mechanisms against ownership percentage dilution. These documents ensure investor equity stakes are preserved by adjusting conversion rates or share prices in future financing rounds or stock issuances. |

| 7 | Customer Cohort Analysis | Customer cohort analysis documents demonstrate recurring revenue patterns and user engagement trends critical for convincing Series A investors of sustainable growth potential. Detailed reports including retention rates, lifetime value, and segment-specific behaviors provide empirical evidence supporting scalable business models in contractual agreements. |

| 8 | Intellectual Property Assignment Agreements | Intellectual Property Assignment Agreements are critical for Series A funding as they legally transfer ownership of all proprietary technology, inventions, and creative work from founders or employees to the startup, ensuring clear IP rights. These agreements protect investor interests by confirming that the company holds exclusive intellectual property necessary for future growth and valuation. |

| 9 | ESG (Environmental, Social, Governance) Policy Statement | A startup seeking Series A funding must provide a comprehensive ESG (Environmental, Social, Governance) Policy Statement outlining its commitment to sustainable practices, social responsibility, and transparent governance. This document demonstrates the startup's alignment with investor expectations on ethical standards, regulatory compliance, and long-term value creation. |

| 10 | SAFE Note Conversion Schedule | The SAFE Note Conversion Schedule outlines the timeline and conditions under which convertible securities convert into equity during Series A funding, providing clarity on valuation caps, discounts, and conversion triggers. This document is critical for startups to detail investor rights and equity distribution, ensuring transparent and efficient negotiation processes. |

Introduction to Series A Funding Agreements

What documents are essential for a startup during Series A funding? Series A funding agreements primarily outline the terms of investment between a startup and investors. These documents establish key rights, obligations, and protections for both parties.

Key Legal Documents Required for Series A

Series A funding requires key legal documents to ensure compliance and protect investor interests. Foundational documents include the Term Sheet outlining investment terms, the Shareholders' Agreement detailing rights and obligations, and the Subscription Agreement confirming the investor's commitment. Companies must also provide Due Diligence materials, including incorporation documents, intellectual property assignments, and financial statements to support transparency and facilitate the funding process.

Term Sheet: Structure and Purpose

The term sheet is a non-binding document outlining the key terms and conditions of the Series A funding round. It serves as the foundation for drafting the final investment agreements between the startup and investors.

The structure of a term sheet typically includes valuation, investment amount, equity ownership, board composition, liquidation preferences, and voting rights. Its purpose is to align expectations and protect the interests of both parties. Clear and precise term sheets facilitate smoother negotiations and reduce potential disputes during the funding process.

Share Purchase Agreement (SPA) Overview

| Document | Description |

|---|---|

| Share Purchase Agreement (SPA) | The Share Purchase Agreement is a crucial legal contract in Series A funding. It outlines the terms and conditions under which existing shareholders sell shares to new investors. The SPA defines the purchase price, number of shares, representations and warranties from both parties, and closing conditions. |

| Purpose of SPA | Ensures clear transfer of ownership and protects interests of investors and founders. It legally binds both parties to the agreed terms of the equity transaction, preventing disputes. |

| Key Provisions |

|

| Importance in Series A | Act as the foundational document governing equity transfer. Often negotiated extensively to align the startup's and investor's interests. Critical for regulatory compliance and investor confidence. |

Shareholders’ Agreement: Rights and Obligations

The Shareholders' Agreement is a critical document for startups seeking Series A funding. It defines the rights and obligations of each shareholder to ensure clear governance and protection of interests.

- Voting Rights - Specifies how decisions are made and the voting power of each shareholder to maintain control balance.

- Transfer Restrictions - Limits share transfers to prevent unwanted third-party involvement and preserve company integrity.

- Exit Provisions - Details conditions for selling shares or exiting the company, protecting investors during liquidity events.

This agreement safeguards both the startup's management structure and investor interests throughout the funding process.

Due Diligence Documents Checklist

Securing Series A funding requires thorough preparation of due diligence documents to ensure a smooth investment process. Essential documents include financial statements, cap tables, intellectual property filings, and legal contracts such as shareholder agreements and employment agreements. Your readiness with a comprehensive due diligence checklist demonstrates professionalism and builds investor confidence.

Board Resolutions and Corporate Consents

Board resolutions are essential documents required during Series A funding for startups as they formally approve significant decisions, including the issuance of new shares and the acceptance of investment terms. These resolutions ensure that all actions comply with corporate governance rules and reflect the consent of the board of directors.

Corporate consents complement board resolutions by documenting the agreement of shareholders or specific committees to key financial and operational changes. These consents validate the legal authority behind funding activities, protecting both the startup and investors during the Series A financing process.

Employee Stock Option Plan (ESOP) Documents

Employee Stock Option Plan (ESOP) documents are essential for startups seeking Series A funding, as they outline the terms and conditions of stock options granted to employees. Properly prepared ESOP documents help attract and retain talent while ensuring legal compliance and investor confidence.

- ESOP Term Sheet - Specifies the key terms of the stock option plan, including vesting schedules and exercise prices.

- Stock Option Agreement - Details the rights and obligations of employees receiving stock options under the ESOP.

- Board Resolutions - Official approvals from the startup's board authorizing the creation and issuance of the ESOP shares.

Disclosure Schedules and Representations

Securing Series A funding requires a well-prepared contract with detailed Disclosure Schedules and clear Representations. These documents help establish transparency and trust between your startup and potential investors.

- Disclosure Schedules - Comprehensive lists accompanying the main agreement that specify exceptions to the general representations and warranties.

- Representations - Statements of fact made by your startup regarding its legal, financial, and operational status.

- Accuracy and Completeness - Ensuring all disclosed information is precise and thorough to avoid future disputes or funding delays.

What Documents Does a Startup Need for Series A Funding? Infographic