Independent contractor agreements require key documents such as a detailed contract outlining the scope of work, payment terms, and project deadlines. Proof of the contractor's business registration, tax identification number, and any relevant licenses or certifications must be included to ensure legal compliance. Clear documentation helps protect both parties and establishes expectations for the independent working relationship.

What Documents Are Needed for Independent Contractor Agreements?

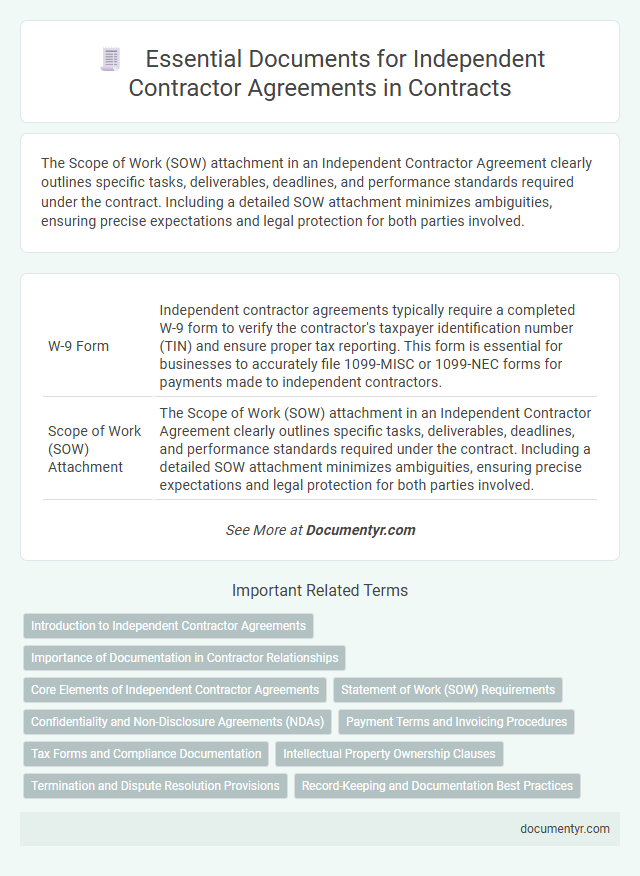

| Number | Name | Description |

|---|---|---|

| 1 | W-9 Form | Independent contractor agreements typically require a completed W-9 form to verify the contractor's taxpayer identification number (TIN) and ensure proper tax reporting. This form is essential for businesses to accurately file 1099-MISC or 1099-NEC forms for payments made to independent contractors. |

| 2 | Scope of Work (SOW) Attachment | The Scope of Work (SOW) attachment in an Independent Contractor Agreement clearly outlines specific tasks, deliverables, deadlines, and performance standards required under the contract. Including a detailed SOW attachment minimizes ambiguities, ensuring precise expectations and legal protection for both parties involved. |

| 3 | Non-Disclosure Agreement (NDA) Addendum | Independent contractor agreements often require a Non-Disclosure Agreement (NDA) addendum to protect confidential information and trade secrets shared during the project. This addendum specifies confidentiality terms, duration, and penalties for breaches, ensuring legal protection for sensitive business data. |

| 4 | Cybersecurity Compliance Certificate | Independent contractor agreements require a Cybersecurity Compliance Certificate to ensure contractors adhere to data protection standards and mitigate risks of cyber threats. This certificate verifies the contractor's commitment to maintaining secure information systems in accordance with industry regulations and contractual obligations. |

| 5 | Remote Work Policy Acknowledgment | An independent contractor agreement should include a Remote Work Policy Acknowledgment document to establish clear guidelines on work hours, communication protocols, data security, and company expectations for remote tasks. This acknowledgment ensures legal compliance and protects both the contractor and company by formalizing remote work responsibilities and standards. |

| 6 | Data Processing Addendum (DPA) | A Data Processing Addendum (DPA) is essential in independent contractor agreements to ensure compliance with data protection regulations such as GDPR, outlining the responsibilities and obligations regarding personal data processing between parties. This document specifies data security measures, breach notification protocols, and rights related to data subject access, safeguarding both the contractor and client in data handling practices. |

| 7 | Intellectual Property (IP) Assignment Clause | An Independent Contractor Agreement must include an Intellectual Property (IP) Assignment Clause to clearly transfer ownership of all work products created by the contractor to the hiring party. This clause ensures the hiring company retains exclusive rights to patents, copyrights, trademarks, and trade secrets developed during the contract period. |

| 8 | E-signature Consent Documentation | E-signature consent documentation, including the contractor's explicit agreement to use electronic signatures, is essential for validating independent contractor agreements under the Electronic Signatures in Global and National Commerce (ESIGN) Act. Proper records must include a clear acknowledgment of consent to electronically sign, methods for withdrawing consent, and retention of the consent documentation to ensure enforceability and legal compliance. |

| 9 | Diversity & Inclusion Certification | Independent contractor agreements require key documents such as a signed contract, proof of business registration, and diversity & inclusion certifications to ensure compliance with inclusive hiring practices. Diversity & inclusion certification demonstrates a contractor's commitment to equitable business practices, enhancing corporate social responsibility and meeting client requirements. |

| 10 | Payment Terms Schedule (Digital Wallet Integration) | Independent Contractor Agreements require a detailed Payment Terms Schedule that specifies amounts, frequency, and methods of payment, including digital wallet integration such as PayPal, Venmo, or cryptocurrency wallets for streamlined, secure transactions. Clearly defining digital wallet addresses and transaction timelines ensures transparency and reduces payment disputes in contract execution. |

Introduction to Independent Contractor Agreements

Independent contractor agreements are essential legal documents that define the working relationship between a business and a contractor. These agreements outline the scope of work, payment terms, and responsibilities, ensuring clarity and protection for both parties. To create a comprehensive contract, you need key documents such as proof of insurance, tax forms, and a detailed project description.

Importance of Documentation in Contractor Relationships

Proper documentation is essential in independent contractor agreements to clearly define the scope of work, payment terms, and deadlines. This clarity helps prevent misunderstandings and potential legal disputes between parties.

Key documents include the signed contract, tax forms like the W-9, and proof of insurance if required. You must maintain these records to ensure compliance with tax regulations and protect both your interests and those of the contractor.

Core Elements of Independent Contractor Agreements

Independent contractor agreements require specific documents to ensure clarity and legal protection. Core elements include the scope of work, payment terms, and timelines.

Your agreement should detail the contractor's responsibilities, project deadlines, and compensation structure. Confidentiality and intellectual property terms must be explicitly stated. Including termination conditions protects both parties in case of disputes.

Statement of Work (SOW) Requirements

Independent contractor agreements require clear documentation to define project scope and deliverables. The Statement of Work (SOW) is essential to outline specific tasks, timelines, and responsibilities.

- Scope Definition - The SOW must specify the exact services the contractor will provide to avoid misunderstandings.

- Deliverables and Deadlines - It should include detailed descriptions of deliverables along with their submission dates.

- Performance Criteria - The document needs to establish benchmarks and quality standards to measure successful completion of work.

Confidentiality and Non-Disclosure Agreements (NDAs)

Independent contractor agreements require specific documentation to ensure clear terms and protect sensitive information. Confidentiality and Non-Disclosure Agreements (NDAs) are crucial components in these contracts.

- Confidentiality Agreement - Protects proprietary information shared between parties during the contract term.

- Non-Disclosure Agreement (NDA) - Legally binds the contractor to keep sensitive business information private.

- Scope of Confidential Information - Defines what types of information are considered confidential under the agreement.

Including these documents in independent contractor agreements safeguards business interests and maintains trust.

Payment Terms and Invoicing Procedures

| Document | Description |

|---|---|

| Independent Contractor Agreement | Defines the scope of work, responsibilities, and legal obligations between the contractor and client. |

| Payment Terms | Specifies the amount, frequency, and method of payment to the contractor. Clear payment terms help avoid disputes and ensure timely compensation. |

| Invoicing Procedures | Details how the contractor must submit invoices, including required information such as invoice number, date, description of services, and payment due date. Proper invoicing procedures facilitate smooth payment processing. |

| Tax Documentation | Forms such as W-9 for U.S. contractors provide necessary tax information related to independent contractor payments. |

| Work Deliverables | Documentation of services or products completed, often tied to payment milestones outlined in the agreement. |

| Contact Information | Ensures clear communication channels for submitting invoices and resolving payment questions. |

To ensure smooth financial transactions, your agreement must clearly outline payment terms and invoicing procedures. This minimizes confusion and protects both parties.

Tax Forms and Compliance Documentation

Independent contractor agreements require specific tax forms and compliance documentation to ensure legal and financial accuracy. Proper documentation helps protect both parties from potential tax liabilities and regulatory issues.

- W-9 Form - This form collects the contractor's Taxpayer Identification Number (TIN) for accurate IRS reporting.

- 1099-NEC Form - Employers use this form to report nonemployee compensation paid to contractors during the tax year.

- Proof of Business Compliance - Documents such as business licenses or permits verify the contractor's legal authorization to operate.

Intellectual Property Ownership Clauses

Independent contractor agreements must include clear intellectual property ownership clauses to define who retains rights to work products. These clauses protect both parties by specifying ownership and usage rights of any creations made during the contract.

Key documents include the agreement itself, outlining intellectual property terms, and any related assignments or licenses. Precise documentation prevents disputes over copyrights, patents, trademarks, and ensures compliance with applicable laws.

Termination and Dispute Resolution Provisions

Independent contractor agreements must include clear termination provisions outlining conditions under which the contract may be ended by either party. Dispute resolution provisions are essential to specify methods such as mediation or arbitration for resolving conflicts without litigation. You should ensure these documents protect your interests and provide a structured process in case of disagreements.

What Documents Are Needed for Independent Contractor Agreements? Infographic