Small businesses need essential documents such as a clearly defined vendor agreement outlining the scope of work, payment terms, and delivery timelines. It is important to include confidentiality clauses and terms for dispute resolution to protect business interests. Proper record-keeping of invoices, purchase orders, and vendor certifications ensures transparency and compliance throughout the contract lifecycle.

What Documents Does a Small Business Need for Vendor Agreements?

| Number | Name | Description |

|---|---|---|

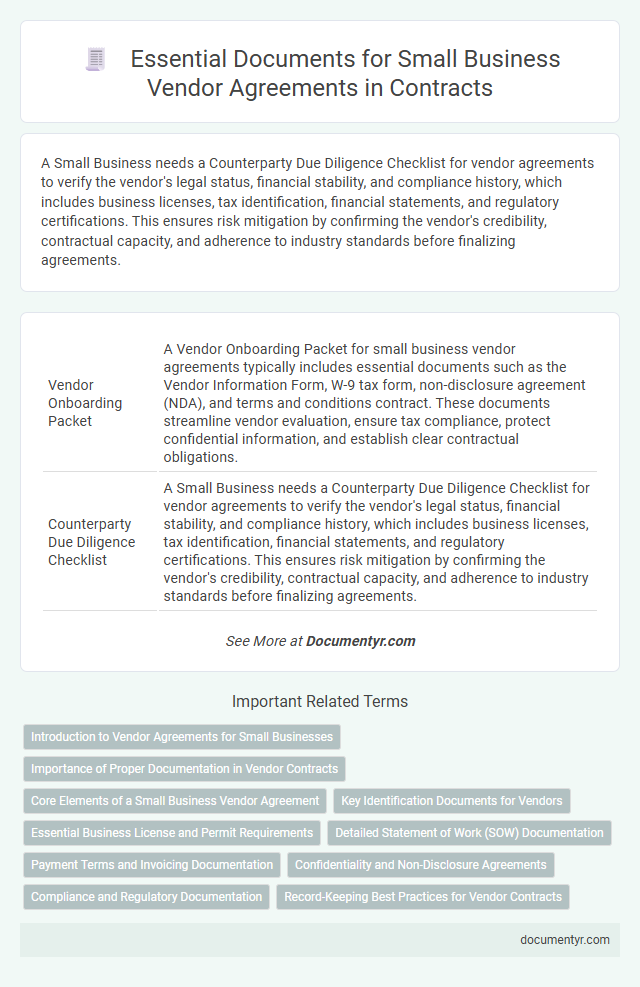

| 1 | Vendor Onboarding Packet | A Vendor Onboarding Packet for small business vendor agreements typically includes essential documents such as the Vendor Information Form, W-9 tax form, non-disclosure agreement (NDA), and terms and conditions contract. These documents streamline vendor evaluation, ensure tax compliance, protect confidential information, and establish clear contractual obligations. |

| 2 | Counterparty Due Diligence Checklist | A Small Business needs a Counterparty Due Diligence Checklist for vendor agreements to verify the vendor's legal status, financial stability, and compliance history, which includes business licenses, tax identification, financial statements, and regulatory certifications. This ensures risk mitigation by confirming the vendor's credibility, contractual capacity, and adherence to industry standards before finalizing agreements. |

| 3 | KYC (Know Your Customer) Documentation | Small businesses require KYC documentation such as government-issued identification, business registration certificates, tax identification numbers, and proof of address to verify vendor legitimacy and ensure compliance in vendor agreements. Proper KYC documentation minimizes risks, prevents fraud, and establishes trust between businesses during contract formation. |

| 4 | Electronic Signature Compliance Certificate | Small businesses need an Electronic Signature Compliance Certificate to ensure their vendor agreements meet legal standards under laws such as the ESIGN Act and UETA, validating the authenticity and enforceability of electronic signatures. This certificate documents compliance with security protocols and audit trails, providing legal protection and reducing disputes in digital contract management. |

| 5 | Data Processing Addendum (DPA) | A Data Processing Addendum (DPA) is essential for small businesses to ensure compliance with data protection laws like the GDPR when entering vendor agreements, specifying the responsibilities and security measures vendors must follow when handling personal data. Including a DPA in vendor contracts safeguards sensitive information and establishes clear protocols for data management and breach notification. |

| 6 | ESG (Environmental, Social, Governance) Disclosure Form | Small businesses need a comprehensive ESG Disclosure Form within vendor agreements to ensure suppliers adhere to environmental sustainability, social responsibility, and governance standards. This document promotes transparency and mitigates risks by requiring vendors to disclose their ESG practices and compliance status. |

| 7 | Cybersecurity Risk Assessment Report | A Small Business needs a Cybersecurity Risk Assessment Report to identify potential vulnerabilities and ensure data protection within vendor agreements. This report helps evaluate the vendor's security measures, reducing the risk of data breaches and regulatory non-compliance. |

| 8 | Vendor Master File | A Small Business needs a comprehensive Vendor Master File containing vendor identification details, tax information, payment terms, contract agreements, and compliance certifications to streamline vendor agreements. Maintaining updated records in the Vendor Master File ensures accurate transaction processing and facilitates audit trails for contract management. |

| 9 | NDIA (Non-Disclosure & Invention Assignment) Agreement | A Non-Disclosure and Invention Assignment (NDIA) Agreement is essential for protecting a small business's confidential information and intellectual property when entering vendor agreements. This document ensures vendors cannot disclose sensitive data and assigns any inventions or developments made during the partnership to the business, safeguarding proprietary assets. |

| 10 | UBO (Ultimate Beneficial Owner) Declaration | A small business requires a UBO (Ultimate Beneficial Owner) Declaration to clearly identify individuals who ultimately own or control the vendor company, ensuring transparency and compliance with anti-money laundering regulations. This document, alongside vendor agreements and due diligence paperwork, protects the business from fraud and legal risks by verifying the true ownership structure. |

Introduction to Vendor Agreements for Small Businesses

Vendor agreements are essential contracts that define the terms between small businesses and their suppliers or service providers. These documents clarify expectations, responsibilities, and payment terms, reducing the risk of disputes. Small businesses benefit from clear vendor agreements to ensure smooth operations and maintain strong professional relationships.

Importance of Proper Documentation in Vendor Contracts

Proper documentation in vendor contracts protects your small business from disputes and ensures clear terms are established. Essential documents, such as purchase orders, service agreements, and confidentiality clauses, define responsibilities and expectations.

Accurate vendor agreements facilitate smooth transactions and reduce legal risks. Maintaining detailed records helps track compliance, payments, and deliverables, strengthening business relationships and safeguarding your interests.

Core Elements of a Small Business Vendor Agreement

Understanding the necessary documents for vendor agreements is crucial for small businesses to establish clear terms and protect their interests. Core elements ensure both parties have a mutual understanding of obligations and expectations.

- Scope of Work - Defines the products or services to be provided along with specific responsibilities.

- Payment Terms - Details pricing, invoicing schedules, and payment deadlines to maintain financial clarity.

- Termination Clauses - Outlines conditions under which the agreement can be terminated by either party.

Key Identification Documents for Vendors

Small businesses must gather key identification documents to establish vendor agreements effectively. These documents verify the vendor's legitimacy and ensure smooth contractual relations.

Essential identification documents include the vendor's business license, tax identification number (TIN), and proof of insurance. The business license confirms the vendor's legal operation, while the TIN is necessary for tax reporting and compliance. Proof of insurance protects against potential liabilities during the contract period.

Essential Business License and Permit Requirements

Small businesses must secure essential business licenses and permits to legally engage in vendor agreements. These documents validate the business's compliance with local, state, and federal regulations.

Depending on the industry, licenses such as a general business license, sales tax permit, and health permits may be required. Proper documentation ensures smooth contractual relationships and protects against legal disputes.

Detailed Statement of Work (SOW) Documentation

For small businesses, a Detailed Statement of Work (SOW) is essential in vendor agreements to clearly define tasks, deliverables, and timelines. Your SOW ensures mutual understanding and reduces risks of miscommunication with vendors.

- Scope of Work - Specifies the exact services or products the vendor will provide to avoid ambiguity.

- Deliverables and Milestones - Lists all expected outputs along with deadlines to track progress effectively.

- Payment Terms - Details payment schedules linked to deliverables to align compensation with performance.

Payment Terms and Invoicing Documentation

| Document Type | Description | Importance for Payment Terms and Invoicing |

|---|---|---|

| Vendor Agreement Contract | Legal document outlining the terms and conditions between your business and the vendor. | Specifies payment schedules, methods, late fees, and invoicing procedures to avoid disputes. |

| Payment Terms Appendix | A detailed section or addendum specifying payment deadlines, discounts for early payment, and penalties. | Clarifies expectations regarding when and how payments should be made, ensuring cash flow consistency. |

| Invoice Templates | Standardized documents used by vendors to request payment for goods or services provided. | Ensures all invoices include necessary details like purchase order numbers, dates, itemized costs, and payment instructions. |

| Purchase Orders | Documents issued by you authorizing the purchase and setting predefined payment terms. | Helps match invoicing details with approved transactions for accurate payment processing. |

| Payment Confirmation Receipts | Proof of payment issued after completion of a transaction. | Records payments made to vendors and supports reconciliation of accounts and audit trails. |

| Credit Terms Agreement | Specific terms outlining credit limits, interest on overdue payments, and payment period extensions. | Protects your business by clearly defining payment expectations and risk mitigation. |

Confidentiality and Non-Disclosure Agreements

What documents are essential for a small business when forming vendor agreements? Confidentiality and Non-Disclosure Agreements (NDAs) play a crucial role in protecting sensitive information between parties. These documents ensure that proprietary data remains secure and prevent unauthorized sharing during the business relationship.

Compliance and Regulatory Documentation

Small businesses must secure compliance and regulatory documentation to ensure vendor agreements adhere to legal standards. Essential documents include business licenses, tax identification numbers, and industry-specific permits. These documents safeguard both parties by confirming lawful operations and reducing the risk of contractual disputes.

What Documents Does a Small Business Need for Vendor Agreements? Infographic