Subcontractors on government projects must provide essential documents including a signed subcontract agreement, proof of insurance, and valid business licenses. They are also required to submit compliance certifications such as the SBA's 8(a) certification, Davis-Bacon wage rate affidavits, and any applicable safety and labor law documentation. Accurate and timely submission of these documents ensures adherence to federal regulations and protects both the subcontractor and the prime contractor.

What Documents Are Required for a Subcontractor on a Government Project?

| Number | Name | Description |

|---|---|---|

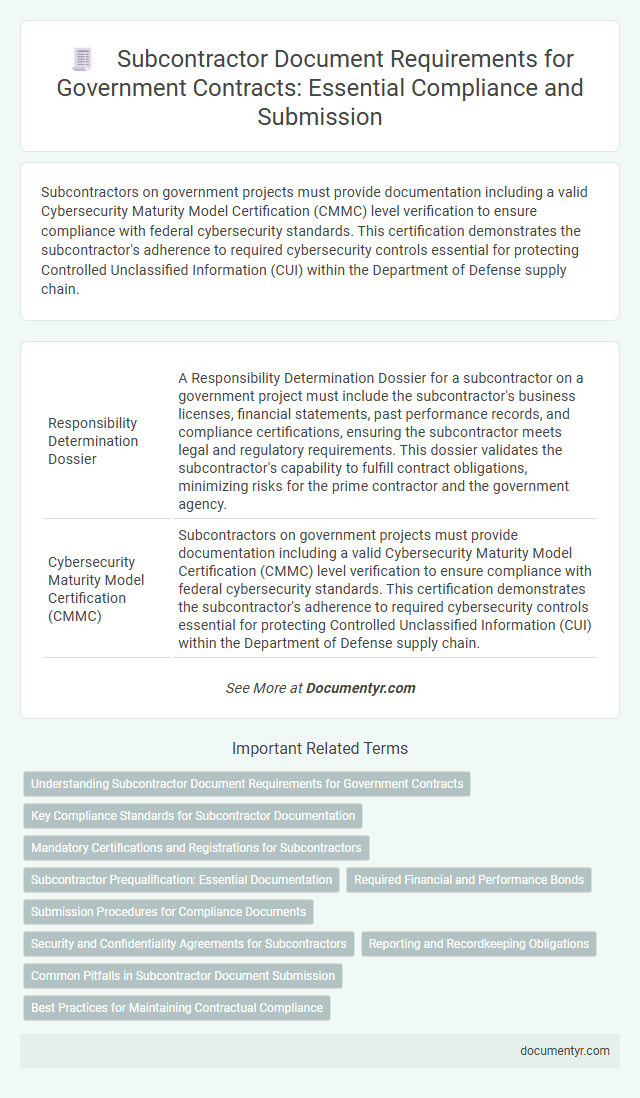

| 1 | Responsibility Determination Dossier | A Responsibility Determination Dossier for a subcontractor on a government project must include the subcontractor's business licenses, financial statements, past performance records, and compliance certifications, ensuring the subcontractor meets legal and regulatory requirements. This dossier validates the subcontractor's capability to fulfill contract obligations, minimizing risks for the prime contractor and the government agency. |

| 2 | Cybersecurity Maturity Model Certification (CMMC) | Subcontractors on government projects must provide documentation including a valid Cybersecurity Maturity Model Certification (CMMC) level verification to ensure compliance with federal cybersecurity standards. This certification demonstrates the subcontractor's adherence to required cybersecurity controls essential for protecting Controlled Unclassified Information (CUI) within the Department of Defense supply chain. |

| 3 | Third-Party Flow-Down Compliance Matrix | A Third-Party Flow-Down Compliance Matrix is essential for subcontractors on government projects to ensure all federal contract requirements are accurately transferred and adhered to by lower-tier subcontractors. This matrix documents compliance obligations such as FAR clauses, cybersecurity mandates, and labor standards, which must be included in subcontracts to maintain regulatory alignment and audit readiness. |

| 4 | Small Business Subcontracting Plan Addendum | The Small Business Subcontracting Plan Addendum is a crucial document required for subcontractors on government projects, outlining specific commitments to small business participation and compliance with federal regulations. This addendum must detail measurable goals, reporting requirements, and flow-down clauses to ensure transparency and accountability in subcontracting practices. |

| 5 | Organizational Conflict of Interest (OCI) Mitigation Plan | A Subcontractor on a government project must provide an Organizational Conflict of Interest (OCI) Mitigation Plan detailing strategies to identify, disclose, and resolve potential conflicts to ensure impartiality and compliance with federal regulations. This plan typically includes conflict identification processes, separation of duties, firewalls, and certification statements to prevent unfair competitive advantages in accordance with FAR 9.5 requirements. |

| 6 | SAM (System for Award Management) Registration Certificate | A subcontractor on a government project must provide a SAM (System for Award Management) Registration Certificate to verify their eligibility and compliance with federal requirements. This certificate ensures the subcontractor is actively registered, allowing them to receive payments and perform work under the prime contract. |

| 7 | Buy American Act Certification | Subcontractors on government projects must submit a Buy American Act Certification to confirm that their materials comply with sourcing requirements established under the Buy American Act. This certification is critical for demonstrating adherence to federal procurement regulations and ensuring eligibility for contract awards. |

| 8 | Disclosure of Lobbying Activities Form (SF-LLL) | The Disclosure of Lobbying Activities Form (SF-LLL) is a critical document required for subcontractors working on government projects to ensure transparency in lobbying efforts. This form must be submitted to disclose any lobbying activities or expenditures related to obtaining or influencing government contracts, complying with the Byrd Amendment and federal regulations. |

| 9 | Affirmative Action Program Documentation | Subcontractors on government projects must provide Affirmative Action Program documentation, including an Affirmative Action Plan (AAP) that complies with the Office of Federal Contract Compliance Programs (OFCCP) requirements. This documentation demonstrates the subcontractor's commitment to equal employment opportunity and details specific policies, goals, and workforce analysis to ensure non-discriminatory hiring practices. |

| 10 | Digital Invoice Processing Authorization (DIPA) | Subcontractors on government projects must provide a Digital Invoice Processing Authorization (DIPA) form to enable electronic submission and secure processing of invoices, ensuring compliance with federal payment protocols. This document streamlines payment workflows by authorizing government agencies to process invoices digitally, reducing administrative delays and enhancing audit transparency. |

Understanding Subcontractor Document Requirements for Government Contracts

Subcontractors on government projects must submit specific documents to ensure compliance with federal regulations and contract requirements. Understanding these document requirements is crucial for seamless project execution and legal adherence.

- Signed Subcontract Agreement - Establishes the legal relationship and outlines the scope, terms, and conditions between the prime contractor and subcontractor.

- Certificate of Insurance - Provides proof of required insurance coverage to mitigate risks and align with government project standards.

- Compliance Certifications - Includes documents demonstrating adherence to labor laws, safety standards, and federal contracting regulations such as the Davis-Bacon Act and the Federal Acquisition Regulation (FAR).

Accurate and timely submission of these documents helps subcontractors maintain eligibility and avoid project delays on government contracts.

Key Compliance Standards for Subcontractor Documentation

Subcontractors on government projects must provide specific documents to meet key compliance standards. These include certificates of insurance, performance bonds, and signed subcontract agreements that align with contract requirements.

Proof of licensure, tax identification, and safety compliance records are essential to verify eligibility and regulatory adherence. Your timely submission of these documents ensures smooth project execution and minimizes legal risks.

Mandatory Certifications and Registrations for Subcontractors

Subcontractors on government projects must provide mandatory certifications such as the Small Business Administration (SBA) certification or the System for Award Management (SAM) registration to ensure eligibility. Compliance with the Federal Acquisition Regulation (FAR) requirements, including proof of valid business licenses and tax identification numbers, is essential. Verification of certifications like the Service-Disabled Veteran-Owned Small Business (SDVOSB) or Women-Owned Small Business (WOSB) status may also be required depending on project specifications.

Subcontractor Prequalification: Essential Documentation

Subcontractor prequalification on a government project requires specific documentation to verify capabilities and compliance. Essential documents establish trust and ensure eligibility for contract participation.

Your prequalification package typically includes business licenses, proof of insurance, and safety records. Financial statements and past project performance reports demonstrate your stability and expertise. Compliance certifications, such as labor standards and bonding, are also mandatory to meet government regulations.

Required Financial and Performance Bonds

Subcontractors on government projects must provide specific documents to ensure compliance and project security. Required financial and performance bonds are critical to protect all parties involved.

- Performance Bond - Guarantees completion of the subcontractor's work according to contract terms, protecting the project owner.

- Payment Bond - Ensures that subcontractors and suppliers receive payment, safeguarding against liens and payment disputes.

- Bid Bond - Demonstrates financial responsibility and commitment to the project, often required during the bidding process.

Submission Procedures for Compliance Documents

| Document Type | Description | Submission Procedure |

|---|---|---|

| Certificates of Insurance | Proof of general liability, workers' compensation, and other required insurance coverage as specified by the government contract. | Submit digitally via the designated government contract portal with all policy details and expiration dates clearly indicated. |

| Performance Bonds | Surety bonds guaranteeing the completion of subcontracted work according to contract terms. | Upload scanned originals along with signed acceptance forms through the government project's document management system. |

| Safety Compliance Certifications | Documentation confirming adherence to OSHA standards and other relevant safety regulations. | Submit copies through the official project compliance submission interface before the start of on-site work. |

| Subcontractor Agreement | Legally binding contract outlining scope, responsibilities, and payment terms between the subcontractor and the primary contractor. | Provide signed agreements as hard copies and upload digital versions for government review within specified deadlines. |

| Tax Identification Number (TIN) and W-9 Form | Essential IRS documentation for tax reporting and payment processing purposes. | Submit completed W-9 forms and TIN details electronically through the government contractor registration portal. |

| Compliance Reports | Periodic reports tracking subcontractor adherence to labor laws, environmental standards, and contract requirements. | Regular submissions required via the government project's compliance tracking system as per contract timeline. |

Security and Confidentiality Agreements for Subcontractors

What documents are required for a subcontractor on a government project regarding security and confidentiality agreements? Subcontractors must provide signed Non-Disclosure Agreements (NDAs) to ensure sensitive information is protected. Security clearance documentation may also be required to comply with government regulations and maintain project confidentiality.

Reporting and Recordkeeping Obligations

Subcontractors on government projects must maintain detailed records including contracts, change orders, and correspondence to ensure full compliance with reporting requirements. Accurate documentation supports audits and strengthens transparency throughout the project lifecycle.

Reports such as progress updates, labor certifications, and cost records are essential for meeting federal regulations. Your obligation to preserve and submit these documents promptly safeguards contract integrity and helps avoid potential disputes or penalties.

Common Pitfalls in Subcontractor Document Submission

Subcontractors on government projects must provide essential documents such as certificates of insurance, bonds, tax identification, and signed subcontract agreements to ensure compliance. Common pitfalls include submitting incomplete forms, missing deadlines, and failing to provide accurate proof of licensing or insurance coverage. To avoid delays, your submissions should be thoroughly checked and organized according to the project's specific government requirements.

What Documents Are Required for a Subcontractor on a Government Project? Infographic