A commercial lease application requires essential documents such as a completed application form, financial statements, proof of business registration, and credit reports. Landlords often request references from previous landlords and personal or business tax returns to assess financial stability. Providing a detailed business plan and identification may also be necessary to strengthen the application and expedite approval.

What Documents Are Necessary for a Commercial Lease Application?

| Number | Name | Description |

|---|---|---|

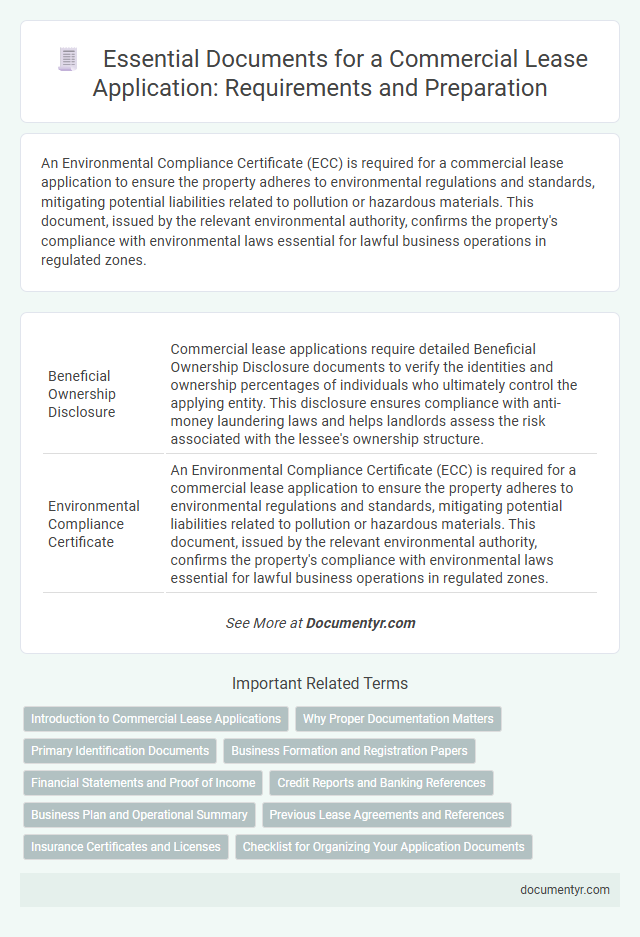

| 1 | Beneficial Ownership Disclosure | Commercial lease applications require detailed Beneficial Ownership Disclosure documents to verify the identities and ownership percentages of individuals who ultimately control the applying entity. This disclosure ensures compliance with anti-money laundering laws and helps landlords assess the risk associated with the lessee's ownership structure. |

| 2 | Environmental Compliance Certificate | An Environmental Compliance Certificate (ECC) is required for a commercial lease application to ensure the property adheres to environmental regulations and standards, mitigating potential liabilities related to pollution or hazardous materials. This document, issued by the relevant environmental authority, confirms the property's compliance with environmental laws essential for lawful business operations in regulated zones. |

| 3 | Digital Identity Verification Report | A Digital Identity Verification Report is essential for a commercial lease application as it confirms the authenticity of the applicant's identity using biometric data and government-issued IDs, mitigating risks of fraud and unauthorized lease agreements. This report, often generated through advanced AI-driven platforms, enhances the credibility of the lease process by ensuring compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations. |

| 4 | ESG (Environmental, Social, Governance) Statement | A commercial lease application requires an ESG (Environmental, Social, Governance) Statement to demonstrate the tenant's commitment to sustainable business practices, including energy efficiency, social responsibility, and transparent governance policies. This document supports landlords in assessing the lessee's compliance with environmental regulations, social impact standards, and corporate governance criteria essential for responsible property management. |

| 5 | Smart Lease Addendum | A Smart Lease Addendum enhances a commercial lease application by integrating digital signatures and automated compliance checks, streamlining the approval process and ensuring all contractual obligations are clearly documented. Key documents necessary for submission include the tenant's business license, financial statements, proof of insurance, and a completed Smart Lease Addendum form, which facilitates real-time updates and record-keeping. |

| 6 | Cyber Liability Insurance Proof | Cyber liability insurance proof is essential for a commercial lease application as it demonstrates the tenant's ability to mitigate risks associated with data breaches and cyber threats. Providing this documentation ensures compliance with landlord requirements and protects both parties from potential financial and legal liabilities related to cyber incidents. |

| 7 | AI-generated Financial Risk Assessment | Commercial lease applications require key documents such as proof of income, tax returns, business financial statements, and credit reports, which are essential for an AI-generated financial risk assessment. These documents enable AI algorithms to analyze financial stability and predict potential lease default risks with high accuracy. |

| 8 | Blockchain-Recorded Rent Ledger | A Blockchain-Recorded Rent Ledger provides a transparent and tamper-proof history of rental payments, essential for verifying financial reliability in a commercial lease application. Including this ledger alongside standard documents like business licenses and financial statements strengthens the credibility and accelerates the approval process. |

| 9 | Diversity, Equity & Inclusion (DEI) Certification | Commercial lease applications require essential documents such as a completed application form, proof of business registration, financial statements, and DEI Certification to demonstrate commitment to diversity, equity, and inclusion in business practices. Including DEI Certification highlights the tenant's dedication to fostering an equitable work environment, which can be a critical factor for landlords prioritizing social responsibility. |

| 10 | Data Privacy Policy Acknowledgment | A Data Privacy Policy Acknowledgment is essential for a commercial lease application to ensure compliance with data protection regulations and secure tenant information handling. This document confirms that applicants understand how their personal and business data will be collected, stored, and used in accordance with privacy laws. |

Introduction to Commercial Lease Applications

Applying for a commercial lease requires submitting specific documents that verify the tenant's business credentials and financial stability. These documents help landlords assess the suitability of the tenant for the property.

Common requirements include business licenses, financial statements, and proof of insurance. Providing accurate and complete documentation streamlines the approval process for commercial lease applications.

Why Proper Documentation Matters

Proper documentation ensures transparency and protects the interests of both landlords and tenants in a commercial lease agreement. Key documents verify financial stability and the legal right to occupy the space.

Essential documents include financial statements, business licenses, and proof of insurance. Accurate documentation helps prevent disputes and facilitates smoother lease approval processes.

Primary Identification Documents

| Primary Identification Documents | Description |

|---|---|

| Government-Issued Photo ID | Valid driver's license or passport to verify identity and nationality of the applicant. |

| Business Registration Certificate | Official certificate confirming the legal registration of the company or business entity applying for the lease. |

| Tax Identification Number (TIN) | Registered TIN or equivalent tax document for verifying business legitimacy and tax compliance. |

| Proof of Address | Utility bills, bank statements, or lease agreements showing the current address of the business or applicant. |

| Authorized Signatory Authorization | Documents such as corporate resolutions or power of attorney that confirm the applicant's authority to sign lease agreements. |

Business Formation and Registration Papers

Business formation and registration papers are essential documents for a commercial lease application. These papers verify the legal existence and structure of the business seeking the lease.

Typical documents include articles of incorporation, partnership agreements, or a certificate of formation depending on the business type. These documents confirm the legitimacy of the entity and its authorized representatives. Landlords require these papers to ensure the tenant is properly registered and compliant with local regulations.

Financial Statements and Proof of Income

Submitting accurate financial documentation is essential for a commercial lease application. These documents verify the tenant's ability to meet lease obligations.

- Financial Statements - Comprehensive balance sheets and income statements demonstrate the business's financial health and stability.

- Proof of Income - Recent tax returns or bank statements confirm consistent revenue streams and cash flow.

- Credit Report - A credit report provides insight into the tenant's creditworthiness and financial responsibility.

Providing thorough financial documentation streamlines the lease approval process and builds landlord confidence.

Credit Reports and Banking References

What documents are necessary for a commercial lease application regarding credit reports and banking references?

Applicants must provide a recent credit report to demonstrate their financial reliability and payment history. Banking references are crucial as they verify the applicant's financial stability and relationship with their financial institution.

Business Plan and Operational Summary

Submitting a commercial lease application requires essential documents that demonstrate the viability and preparedness of your business. A comprehensive business plan and an operational summary are critical components to showcase your business strategy and daily operations.

- Business Plan - This document outlines your business goals, target market, financial projections, and strategies to ensure success in the leased space.

- Operational Summary - A detailed overview of your business operations, including staffing, hours of operation, and service or product delivery methods.

- Supporting Financial Documents - While not the main focus, these documents validate the financial stability required to meet lease obligations.

Previous Lease Agreements and References

Previous lease agreements provide essential proof of your rental history and demonstrate your reliability as a tenant. References from past landlords or property managers offer valuable insights into your behavior, payment punctuality, and property care. Including these documents in your commercial lease application strengthens your credibility and supports your candidacy for the desired space.

Insurance Certificates and Licenses

Submitting a commercial lease application requires specific documents to verify your business credentials and compliance. Insurance certificates and licenses play a crucial role in demonstrating your eligibility and safeguarding both parties.

- Insurance Certificates - These documents prove your business holds required liability and property insurance, protecting against potential risks.

- Business Licenses - Official licenses confirm that your business operates legally within the jurisdiction and adheres to industry regulations.

- Compliance Verification - Providing updated insurance certificates and valid licenses ensures that your lease application meets the landlord's legal and safety standards.

What Documents Are Necessary for a Commercial Lease Application? Infographic