Residential lease applications typically require a completed application form, proof of income such as pay stubs or bank statements, and a valid government-issued ID for identity verification. Landlords may also request references from previous landlords, a credit report, and a rental history to assess an applicant's reliability. Ensuring all documents are accurate and up-to-date can streamline the approval process for securing a rental property.

What Documents Are Needed for Residential Lease Applications?

| Number | Name | Description |

|---|---|---|

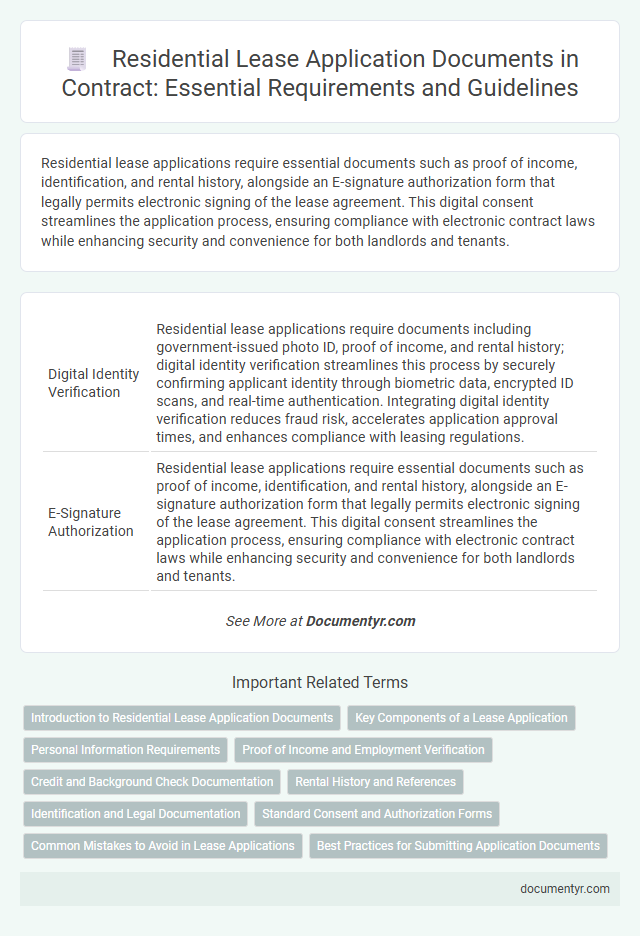

| 1 | Digital Identity Verification | Residential lease applications require documents including government-issued photo ID, proof of income, and rental history; digital identity verification streamlines this process by securely confirming applicant identity through biometric data, encrypted ID scans, and real-time authentication. Integrating digital identity verification reduces fraud risk, accelerates application approval times, and enhances compliance with leasing regulations. |

| 2 | E-Signature Authorization | Residential lease applications require essential documents such as proof of income, identification, and rental history, alongside an E-signature authorization form that legally permits electronic signing of the lease agreement. This digital consent streamlines the application process, ensuring compliance with electronic contract laws while enhancing security and convenience for both landlords and tenants. |

| 3 | Income Blockchain Proof | Residential lease applications require documents verifying tenant income, including pay stubs, tax returns, or employer letters; emerging trends incorporate blockchain-based income proof for enhanced verification security and transparency. Blockchain income proofs use encrypted, immutable records of earnings, reducing fraud risk and streamlining the application review process for landlords and property managers. |

| 4 | Credit Karma Report | A Credit Karma report is essential for residential lease applications as it provides landlords with detailed credit history, including payment behavior and outstanding debts, which helps assess tenant reliability and financial stability. This report complements other documents like proof of income and identification to create a comprehensive tenant profile for lease approval. |

| 5 | Remote Work Attestation Letter | A Remote Work Attestation Letter is essential for residential lease applications as it verifies a tenant's employment status and income stability while working remotely, providing landlords with assurance of consistent rent payments. This document typically includes employer details, remote work confirmation, and the duration of remote employment, supporting the applicant's financial credibility. |

| 6 | Pet DNA Registration Certificate | A Pet DNA Registration Certificate is increasingly required in residential lease applications to verify responsible pet ownership and ensure accurate identification of pets. Providing this document helps landlords enforce pet policies, facilitate liability claims, and maintain a secure living environment for all residents. |

| 7 | Green Lease Addendum | A Green Lease Addendum requires applicants to submit documentation demonstrating energy-efficient upgrades, certifications, or compliance with sustainability standards alongside standard lease application materials. This may include utility bills, green building certifications like LEED, and agreements outlining tenant and landlord responsibilities for maintaining eco-friendly practices. |

| 8 | Rental Application Soft-Pull Form | A Rental Application Soft-Pull Form is essential for residential lease applications as it allows landlords to perform a preliminary credit check without impacting the applicant's credit score, providing a quick assessment of financial reliability. This document, alongside the standard rental application and identification proof, helps streamline tenant screening while maintaining privacy and accuracy in evaluating creditworthiness. |

| 9 | Social Media Screening Consent | Residential lease applications often require a Social Media Screening Consent form, allowing landlords to review applicants' social media profiles to assess character and verify information. This document ensures transparency and compliance with privacy laws while helping landlords make informed leasing decisions. |

| 10 | Automated Rental Reference Report | An Automated Rental Reference Report is essential for residential lease applications as it provides verified tenant history, including previous rental payment patterns, eviction records, and lease compliance data. This report streamlines the screening process by consolidating critical rental information into a comprehensive, accurate, and easily accessible document for landlords. |

Introduction to Residential Lease Application Documents

Applying for a residential lease requires submitting several key documents to verify your identity, financial stability, and rental history. Understanding which documents are needed can streamline the application process and increase your chances of approval.

- Proof of Identity - A government-issued ID such as a driver's license or passport confirms your identity and residency status.

- Income Verification - Recent pay stubs, tax returns, or bank statements demonstrate your ability to meet rent payments consistently.

- Rental History - Previous lease agreements or landlord references provide insight into your reliability as a tenant and rental payment record.

Key Components of a Lease Application

Residential lease applications require several essential documents to verify the applicant's identity, financial status, and rental history. These documents ensure landlords can make informed decisions and protect their property rights.

Key components of a lease application include a completed application form with personal details, proof of income such as pay stubs or tax returns, and a credit report to assess financial reliability. Landlords often request rental history references and a government-issued ID to confirm identity and previous tenant behavior. Additional documents might include employment verification and bank statements for thorough applicant evaluation.

Personal Information Requirements

When applying for a residential lease, providing accurate personal information is essential to verify identity and background. Landlords require key documents to assess the applicant's eligibility and reliability.

- Proof of Identity - A government-issued photo ID such as a driver's license or passport is necessary to confirm the applicant's identity.

- Proof of Income - Recent pay stubs, tax returns, or bank statements demonstrate the applicant's financial ability to pay rent.

- Rental History - Contact information for previous landlords or a rental ledger provides insight into the applicant's rental behavior and reliability.

Providing comprehensive personal information helps streamline the approval process and ensures transparent communication between landlords and applicants.

Proof of Income and Employment Verification

Proof of income and employment verification are essential documents for residential lease applications. They help landlords assess a tenant's ability to pay rent reliably.

- Proof of Income - Documents such as pay stubs, tax returns, or bank statements demonstrate the applicant's financial stability.

- Employment Verification - A letter from the employer or recent employment contracts confirm the applicant's current job status.

- Consistency - Providing recent and matching documents ensures accurate evaluation of the tenant's income and employment.

Credit and Background Check Documentation

For residential lease applications, credit and background check documentation is essential to verify financial responsibility and rental history. You will typically need to provide a recent credit report, proof of income, and authorization for the landlord to conduct background checks. These documents help landlords assess your reliability and ensure a secure rental agreement.

Rental History and References

| Document | Description | Importance in Lease Application |

|---|---|---|

| Rental History Report | Detailed record of previous rental addresses, durations of tenancy, and rent payment history. | Verifies consistent rental payments and responsible tenancy behavior, helping landlords assess reliability. |

| Reference Letters from Previous Landlords | Written statements from past landlords confirming tenant's payment timeliness, property care, and adherence to lease terms. | Offers direct insight into tenant's character and lease compliance, strengthening application credibility. |

| Contact Information for References | Phone numbers and email addresses of previous landlords or property managers. | Enables landlords to verify information provided and conduct background checks on tenant behavior. |

| Proof of Rental Payments | Receipts, bank statements, or canceled checks confirming timely rent payments. | Demonstrates financial responsibility and reliability in meeting rental obligations. |

Identification and Legal Documentation

What documents are required for a residential lease application? Identification and legal documentation are essential to verify your identity and ensure compliance with leasing regulations. Commonly requested documents include a government-issued photo ID and proof of legal residency.

Standard Consent and Authorization Forms

When applying for a residential lease, submitting the Standard Consent and Authorization Forms is essential. These documents grant the landlord permission to verify your background and credit history.

Providing accurate information on these forms speeds up the application process and ensures compliance with legal requirements. Landlords use these consents to confirm your identity and assess your rental suitability securely.

Common Mistakes to Avoid in Lease Applications

When applying for a residential lease, essential documents include a completed application form, proof of income, identification, and rental history. These verify your eligibility and streamline the approval process.

Common mistakes to avoid in lease applications include submitting incomplete forms or providing inconsistent information. Ensuring accuracy and completeness prevents delays and increases the chances of approval.

What Documents Are Needed for Residential Lease Applications? Infographic