New employees must provide essential documents such as a valid government-issued ID, Social Security number or tax identification, and completed tax withholding forms for onboarding at a corporate job. Employment eligibility verification, typically Form I-9 in the U.S., is required to confirm the right to work. Other important documents may include signed contracts, direct deposit forms, and any certifications relevant to the job role.

What Documents Does a New Employee Need for Onboarding at a Corporate Job?

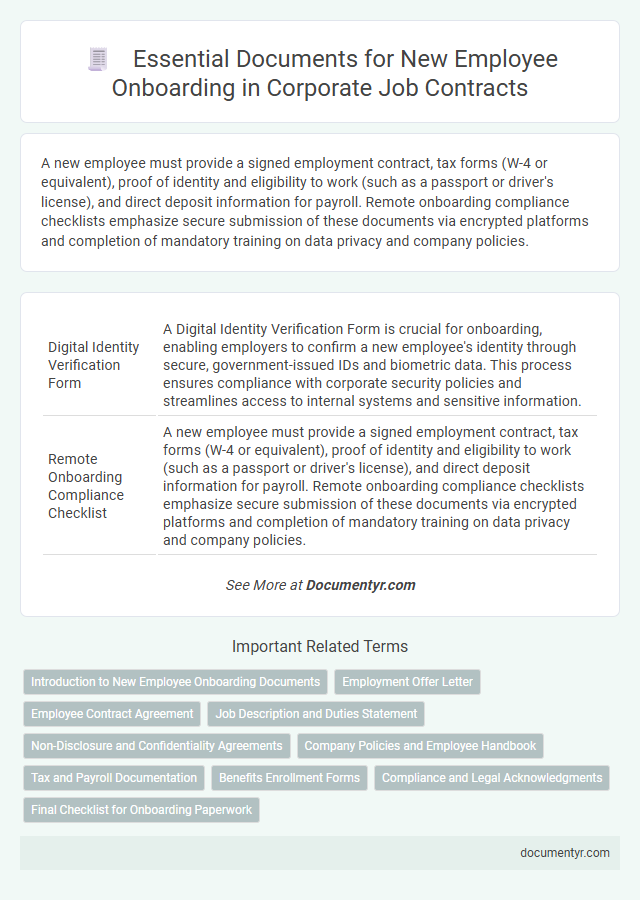

| Number | Name | Description |

|---|---|---|

| 1 | Digital Identity Verification Form | A Digital Identity Verification Form is crucial for onboarding, enabling employers to confirm a new employee's identity through secure, government-issued IDs and biometric data. This process ensures compliance with corporate security policies and streamlines access to internal systems and sensitive information. |

| 2 | Remote Onboarding Compliance Checklist | A new employee must provide a signed employment contract, tax forms (W-4 or equivalent), proof of identity and eligibility to work (such as a passport or driver's license), and direct deposit information for payroll. Remote onboarding compliance checklists emphasize secure submission of these documents via encrypted platforms and completion of mandatory training on data privacy and company policies. |

| 3 | E-signature Consent Authorization | New employees must provide a signed E-signature Consent Authorization form to confirm their agreement to electronically sign and submit employment documents, ensuring compliance with legal and company policies. This authorization facilitates a streamlined onboarding process by allowing digital handling of contracts, tax forms, and confidentiality agreements. |

| 4 | Employee Acknowledgment of Hybrid Work Policy | A new employee must provide a signed Employee Acknowledgment of Hybrid Work Policy form, confirming their understanding of remote work expectations, office attendance requirements, and communication protocols. This document ensures compliance with the company's hybrid work guidelines and supports streamlined HR record-keeping during onboarding. |

| 5 | Data Privacy and Cybersecurity Disclosure | New employees must provide signed cybersecurity disclosure forms and data privacy agreements outlining company policies and legal compliance requirements. These documents ensure protection of sensitive information and adherence to data protection regulations during employment. |

| 6 | Diversity, Equity, and Inclusion (DEI) Self-Disclosure | New employees typically need to submit a DEI self-disclosure form during onboarding to help companies track workforce diversity and promote inclusive hiring practices. This document supports corporate commitments to equity by allowing employees to voluntarily share demographic information confidentially. |

| 7 | Corporate Social Responsibility (CSR) Agreement | New employees must provide a signed Corporate Social Responsibility (CSR) Agreement to confirm their understanding and commitment to the company's ethical policies and sustainability goals. This document is essential for aligning employee conduct with corporate values and regulatory compliance during the onboarding process. |

| 8 | Bring Your Own Device (BYOD) Security Waiver | New employees must sign a Bring Your Own Device (BYOD) Security Waiver to acknowledge responsibility for securing personal devices used for work and to comply with the company's cybersecurity policies. This document is essential for mitigating risks associated with data breaches and ensuring that personal devices meet corporate security standards during onboarding. |

| 9 | AI Ethics and Usage Guidelines Acceptance | New employees must submit signed AI Ethics and Usage Guidelines acceptance forms to ensure compliance with corporate standards on artificial intelligence deployment and data privacy. This document is critical for maintaining ethical conduct and responsible technology use within the organization. |

| 10 | Biometric Data Collection Consent Form | New employees must provide a signed Biometric Data Collection Consent Form to authorize the company to collect and use biometric information such as fingerprints or facial recognition for security and identification purposes. This form ensures compliance with data privacy laws and protects both the employee's rights and the organization's responsibilities during onboarding. |

Introduction to New Employee Onboarding Documents

Starting a new corporate job involves submitting specific documents crucial for the onboarding process. These documents ensure compliance with company policies and legal requirements during your transition.

- Identification Documents - Government-issued ID such as a passport or driver's license verifies your identity for employment eligibility.

- Employment Eligibility Verification - Form I-9 or equivalent confirms your legal authorization to work in the country.

- Tax Forms - W-4 or local tax withholding forms establish correct tax deductions from your salary.

Employment Offer Letter

The employment offer letter is a critical document required for onboarding at a corporate job. It outlines the terms of your employment, including job title, salary, and start date. This letter serves as the formal agreement between you and the employer, ensuring clarity and legal compliance during the hiring process.

Employee Contract Agreement

New employees must provide a signed employee contract agreement to complete the onboarding process at a corporate job. This document outlines the terms of employment, including job responsibilities, salary, and confidentiality clauses.

The employee contract agreement legally binds both parties and ensures clarity on company policies and expectations. Submitting this contract is essential for HR to finalize employment and grant access to company systems.

Job Description and Duties Statement

| Document | Description | Importance in Onboarding |

|---|---|---|

| Job Description | Provides a detailed overview of the employee's role, responsibilities, required qualifications, and reporting structure within the company. | Ensures clarity on job expectations and aligns new employees with corporate goals and performance standards. |

| Duties Statement | Specifies the key tasks and duties the employee is expected to perform, including specific deliverables and daily activities. | Helps employees understand their core responsibilities and prioritize tasks effectively from the start. |

Non-Disclosure and Confidentiality Agreements

New employees must submit several critical documents during onboarding to comply with company policies and legal requirements. Non-Disclosure and Confidentiality Agreements are essential to protect sensitive corporate information and intellectual property.

- Non-Disclosure Agreement (NDA) - This contract ensures you agree not to reveal proprietary company data or trade secrets during and after employment.

- Confidentiality Agreement - This document requires the employee to maintain the confidentiality of internal communications, client information, and strategic plans.

- Signed Agreement Return - Employers require a signed copy of these agreements as proof of legal consent and understanding of confidentiality obligations.

Company Policies and Employee Handbook

New employees must review company policies thoroughly to understand workplace expectations and compliance requirements. These policies outline essential rules, benefits, and conduct standards critical for seamless integration into the corporate environment.

The employee handbook serves as a comprehensive guide detailing rights, responsibilities, and procedures. Your signed acknowledgment of these documents is required to confirm awareness and agreement with company standards.

Tax and Payroll Documentation

New employees must provide specific tax and payroll documents to complete the onboarding process at a corporate job. These documents ensure correct tax withholding and salary processing from the start.

- Form W-4 - Determines federal income tax withholding based on personal allowances and filing status.

- State Tax Withholding Form - Specifies state income tax deductions, which vary depending on the employee's state of residence.

- Direct Deposit Authorization - Authorizes the employer to deposit payroll payments directly into the employee's bank account.

You should prepare these documents before your first day to streamline payroll setup and avoid payment delays.

Benefits Enrollment Forms

New employees must complete benefits enrollment forms as part of the onboarding process to secure health insurance, retirement plans, and other corporate benefits. These forms typically require personal information, beneficiary details, and plan selections. Timely submission of benefits enrollment documents ensures seamless access to employee perks and coverage from the start date.

Compliance and Legal Acknowledgments

New employees must provide essential documents to ensure compliance and legal acknowledgment during onboarding at a corporate job. These documents verify identity, eligibility to work, and acceptance of company policies.

Key documents typically include a government-issued ID, Social Security card or work authorization, and signed employment contracts. Employees must also complete tax forms such as the W-4 and acknowledge company policies on confidentiality and workplace conduct. Proper collection of these documents protects both the employee and employer under labor laws and corporate regulations.

What Documents Does a New Employee Need for Onboarding at a Corporate Job? Infographic