Small business vendor agreements typically require key documents such as the fully executed contract, proof of business registration, and tax identification information. Vendors may also need to provide insurance certificates, payment terms, and compliance certifications relevant to the scope of work. Maintaining clear and organized documentation ensures smooth contract management and legal protection for both parties.

What Documents are Required for Small Business Vendor Agreements?

| Number | Name | Description |

|---|---|---|

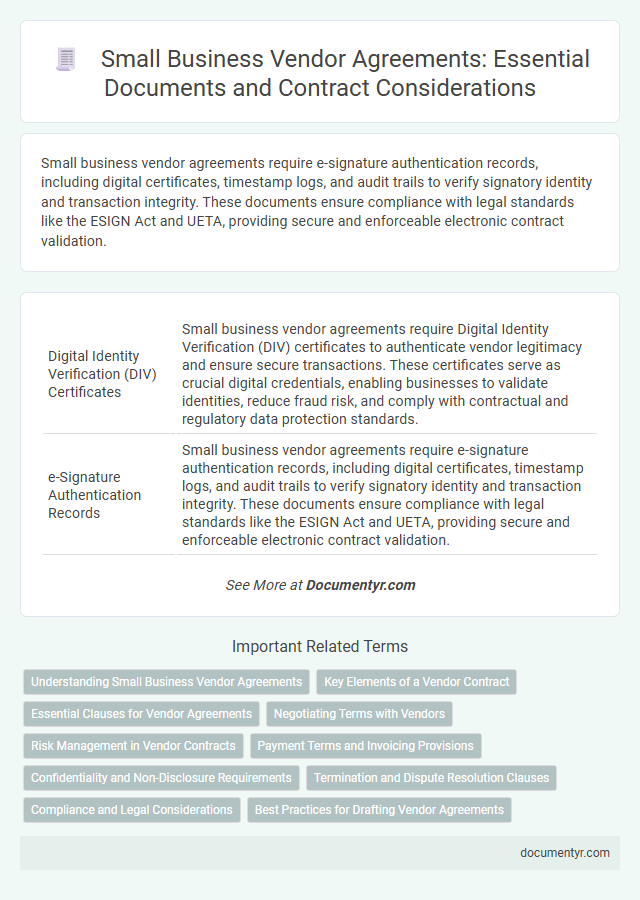

| 1 | Digital Identity Verification (DIV) Certificates | Small business vendor agreements require Digital Identity Verification (DIV) certificates to authenticate vendor legitimacy and ensure secure transactions. These certificates serve as crucial digital credentials, enabling businesses to validate identities, reduce fraud risk, and comply with contractual and regulatory data protection standards. |

| 2 | e-Signature Authentication Records | Small business vendor agreements require e-signature authentication records, including digital certificates, timestamp logs, and audit trails to verify signatory identity and transaction integrity. These documents ensure compliance with legal standards like the ESIGN Act and UETA, providing secure and enforceable electronic contract validation. |

| 3 | ESG (Environmental, Social, Governance) Compliance Disclosures | Small business vendor agreements require ESG compliance disclosures including environmental impact assessments, social responsibility policies, and governance structures to ensure adherence to sustainability standards. These documents validate the vendor's commitment to ethical practices, risk management, and regulatory compliance within supply chain contracts. |

| 4 | Anti-Money Laundering (AML) Declarations | Small business vendor agreements require Anti-Money Laundering (AML) declarations, including government-issued identification, proof of business registration, and completed AML compliance questionnaires to verify vendor legitimacy and prevent financial crimes. These documents enable effective risk assessment and adherence to regulatory standards under AML laws. |

| 5 | Cybersecurity Due Diligence Statements | Small business vendor agreements require cybersecurity due diligence statements that detail data protection policies, incident response plans, and compliance with relevant cybersecurity regulations such as GDPR or CCPA. These documents ensure the vendor's security measures align with industry standards and mitigate risks related to data breaches and cyber threats. |

| 6 | Beneficial Ownership Disclosure Forms | Small business vendor agreements often require Beneficial Ownership Disclosure Forms to identify individuals with significant control or ownership in the company, ensuring transparency and compliance with anti-money laundering regulations. These forms collect detailed information such as names, ownership percentages, and addresses of beneficial owners to verify the legitimacy of business relationships. |

| 7 | Data Processing Addendums (DPA) | Small business vendor agreements often require a Data Processing Addendum (DPA) to comply with data protection regulations such as GDPR or CCPA, ensuring proper handling of personal data. The DPA outlines the responsibilities of both parties regarding data security, processing activities, and breach notification protocols. |

| 8 | Supplier Diversity Certification | Small business vendor agreements typically require supplier diversity certification documents, including proof of minority, women, veteran, or disadvantaged business status issued by recognized certifying agencies such as the National Minority Supplier Development Council (NMSDC) or the Small Business Administration (SBA). These certifications validate eligibility and enhance opportunities for inclusion in corporate and government procurement programs focused on supplier diversity. |

| 9 | Blockchain Transaction Logs | Small business vendor agreements require blockchain transaction logs as secure, tamper-proof evidence of contract execution and payment verification. These logs provide an immutable digital ledger that ensures transparency, auditability, and real-time tracking of all contractual transactions. |

| 10 | Zero Trust Security Attestation | Small business vendor agreements require key documents such as a Zero Trust Security Attestation, outlining adherence to strict identity verification and access controls, along with standard contract terms and proof of business registration. Incorporating a Zero Trust Security Attestation ensures compliance with cybersecurity protocols, reducing risk and enhancing trust in vendor relationships. |

Understanding Small Business Vendor Agreements

Understanding small business vendor agreements is essential for establishing clear terms between parties involved in a contract. Proper documentation ensures legal protection and smooth business transactions.

- Vendor Information - Detailed business details including legal name, address, and contact information verify the vendor's identity.

- Scope of Work - A clear description of the services or products provided defines expectations and deliverables.

- Payment Terms - Documented payment schedules and methods outline how and when compensation occurs to avoid disputes.

Key Elements of a Vendor Contract

Small business vendor agreements require essential documents to ensure clear terms and protect both parties. Key elements include the scope of work, payment terms, and delivery schedules.

Contracts should also contain confidentiality clauses, dispute resolution methods, and termination conditions. Proper documentation helps prevent misunderstandings and promotes a smooth business relationship.

Essential Clauses for Vendor Agreements

Small business vendor agreements require specific documents to ensure clarity and legal protection. Essential clauses within these agreements define the responsibilities, payment terms, and confidentiality obligations between parties.

Key documents include the vendor agreement contract, proof of insurance, and business licenses. Essential clauses cover scope of work, payment schedules, termination conditions, and dispute resolution methods. Clearly outlining these elements helps prevent misunderstandings and secures a smooth business relationship.

Negotiating Terms with Vendors

| Document Type | Purpose |

|---|---|

| Vendor Agreement | Defines the scope, terms, and responsibilities between the small business and the vendor |

| Negotiated Terms Summary | Details specific clauses agreed upon during negotiation, including pricing, delivery schedules, and service levels |

| Non-Disclosure Agreement (NDA) | Protects confidential information shared during the negotiation and business relationship |

| Purchase Orders | Formalizes orders placed under the vendor agreement, specifying quantities and terms |

| Insurance Certificates | Verifies vendor compliance with required insurance policies to mitigate business risks |

| W-9 Form (U.S.) | Collects vendor tax identification information necessary for payment processing and tax reporting |

| Amendment Documents | Records any negotiated changes to the original agreement terms after initial signing |

| Communication Records | Contains correspondence outlining negotiation points to support clarity and accountability |

When negotiating terms with vendors, ensure all relevant documents are carefully reviewed and organized. This approach protects your business interests and builds a transparent vendor relationship.

Risk Management in Vendor Contracts

Small business vendor agreements require essential documents such as the contract itself, proof of business insurance, and non-disclosure agreements to ensure clear terms and protect sensitive information. Risk management in vendor contracts focuses on including indemnity clauses, liability limits, and compliance requirements to minimize potential legal and financial exposure. Maintaining thorough documentation and clearly defined responsibilities helps small businesses mitigate risks and establish reliable vendor relationships.

Payment Terms and Invoicing Provisions

Small business vendor agreements require clear payment terms and invoicing provisions to ensure prompt and accurate transactions. These documents establish the framework for payment schedules, methods, and dispute resolution related to invoices.

- Payment Terms Document - Specifies the timing, method, and conditions of payments between parties.

- Invoice Template - Standardizes the format and necessary details included in all vendor invoices.

- Dispute Resolution Clause - Outlines procedures for handling payment disputes and discrepancies.

Confidentiality and Non-Disclosure Requirements

What documents are required for small business vendor agreements with confidentiality and non-disclosure requirements? A comprehensive vendor agreement should include a confidentiality clause specifying the type of information protected. Your agreement must clearly outline non-disclosure obligations to safeguard sensitive business data.

Termination and Dispute Resolution Clauses

Small business vendor agreements must include clearly defined termination clauses outlining conditions under which either party may end the contract. This helps prevent misunderstandings and protects both parties' interests in case of non-performance or breach.

Dispute resolution clauses specify methods for resolving conflicts, often prioritizing mediation or arbitration before litigation. These clauses streamline conflict management and reduce legal costs, ensuring smoother business relationships.

Compliance and Legal Considerations

Small business vendor agreements require essential documents such as proof of business registration, tax identification numbers, and relevant licenses to ensure compliance with federal and state regulations. Legal considerations include clearly defined terms of service, confidentiality clauses, and dispute resolution mechanisms to protect both parties. To safeguard your interests, it is crucial to include compliance certifications and liability insurance documentation in the vendor contract.

What Documents are Required for Small Business Vendor Agreements? Infographic