Small business grant applications require essential documents such as a detailed business plan outlining objectives, target market, and financial projections. Proof of business registration, tax identification numbers, and legal compliance certificates are also necessary. Financial statements, including income statements and cash flow reports, support the application by demonstrating the business's economic health and funding needs.

What Documents Are Needed for a Small Business Grant Application?

| Number | Name | Description |

|---|---|---|

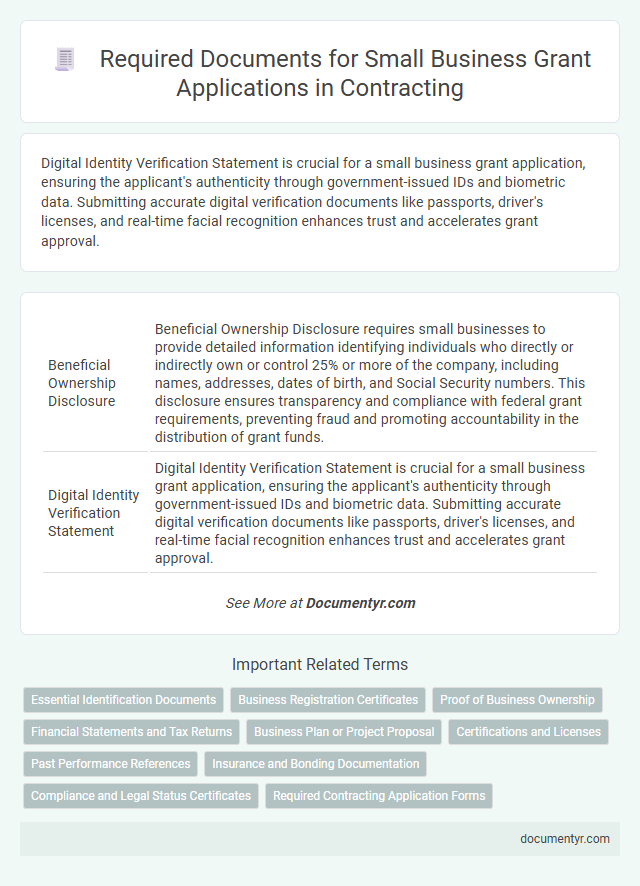

| 1 | Beneficial Ownership Disclosure | Beneficial Ownership Disclosure requires small businesses to provide detailed information identifying individuals who directly or indirectly own or control 25% or more of the company, including names, addresses, dates of birth, and Social Security numbers. This disclosure ensures transparency and compliance with federal grant requirements, preventing fraud and promoting accountability in the distribution of grant funds. |

| 2 | Digital Identity Verification Statement | Digital Identity Verification Statement is crucial for a small business grant application, ensuring the applicant's authenticity through government-issued IDs and biometric data. Submitting accurate digital verification documents like passports, driver's licenses, and real-time facial recognition enhances trust and accelerates grant approval. |

| 3 | Environmental, Social, and Governance (ESG) Report | A thorough Environmental, Social, and Governance (ESG) report is essential for a small business grant application to demonstrate sustainable practices and ethical management. This document should include metrics on environmental impact, social responsibility initiatives, and governance structures to align with grant criteria and investor expectations. |

| 4 | Community Impact Narrative | A Community Impact Narrative for a small business grant application requires a detailed description of how the business contributes to local economic growth, job creation, and social welfare improvements. This document must include quantitative data on community benefits, testimonials from local stakeholders, and specific examples of projects or initiatives that demonstrate measurable positive outcomes. |

| 5 | Minority/Women-Owned Business Certification | Minority/Women-Owned Business Certification requires submitting proof of ownership and control, such as personal identification, business licenses, and certification from authorized agencies like the National Minority Supplier Development Council or the Women's Business Enterprise National Council. Supporting documents often include detailed business plans, financial statements, and tax returns to validate eligibility for small business grant applications. |

| 6 | Business Resilience Plan | A comprehensive Business Resilience Plan is essential for a small business grant application, detailing strategies for risk management, operational continuity, and financial stability during crises. This document demonstrates the business's preparedness to withstand disruptions, increasing the likelihood of grant approval by showcasing long-term sustainability and adaptability. |

| 7 | Cybersecurity Compliance Certificate | A Cybersecurity Compliance Certificate is essential for a small business grant application to verify adherence to industry security standards and protect sensitive data. Submitting this certificate along with financial statements, business licenses, and a project proposal strengthens the grant application's credibility and demonstrates commitment to risk management. |

| 8 | Social Media Analytics Summary | A Social Media Analytics Summary is essential for a small business grant application as it demonstrates online engagement, audience growth, and marketing effectiveness through key metrics like follower count, post reach, and interaction rates. This document provides grant reviewers with evidence of the business's digital presence and brand influence, supporting the case for funding approval. |

| 9 | Pre-Award Risk Assessment Form | The Pre-Award Risk Assessment Form is a critical document that evaluates the financial stability, compliance history, and managerial capabilities of a small business before grant approval. This form helps grantors identify potential risks and ensure the applicant meets eligibility criteria for funding. |

| 10 | Sustainability Commitment Letter | A Sustainability Commitment Letter is essential for a small business grant application, demonstrating the company's dedication to environmentally responsible practices and long-term sustainable growth. This document often includes specific actions, goals, and metrics that align with grant providers' criteria for promoting eco-friendly initiatives. |

Essential Identification Documents

Essential identification documents are crucial for a small business grant application to verify the legitimacy of the business and its owners. Commonly required documents include a government-issued photo ID, such as a driver's license or passport, and a Federal Employer Identification Number (EIN) issued by the IRS. Business licenses, articles of incorporation, and any permits related to the business operation also serve as critical identification credentials in the application process.

Business Registration Certificates

Business registration certificates are essential documents required for a small business grant application. They prove the legal existence and legitimacy of your business entity to grant providers.

- Proof of Legal Status - Business registration certificates confirm your business is officially recognized by government authorities.

- Verification of Business Name - These documents verify the registered name under which your business operates and applies for the grant.

- Compliance with Local Regulations - Registration certificates demonstrate that your business adheres to required local, state, or national regulations.

Proof of Business Ownership

Proof of business ownership is a crucial document required for a small business grant application. This evidence verifies your legal claim to the business, ensuring eligibility for funding.

Common documents include business licenses, registration certificates, or articles of incorporation. These records must clearly display the business name and ownership details to satisfy grant requirements.

Financial Statements and Tax Returns

Applying for a small business grant requires submitting specific financial documents to demonstrate eligibility and financial health. Two of the most critical documents are financial statements and tax returns, which provide detailed insights into the business's performance and compliance.

- Financial Statements - Include balance sheets, income statements, and cash flow statements to show the business's overall financial condition.

- Tax Returns - Provide proof of income and legitimacy by showing consistent filing and accurate reporting of business earnings.

- Supporting Schedules - Detailed breakdowns of expenses and revenues that accompany the primary statements, enhancing transparency.

Submitting accurate and complete financial statements and tax returns significantly increases the chances of grant approval for small businesses.

Business Plan or Project Proposal

A detailed business plan or project proposal is essential for a small business grant application. This document outlines the business goals, strategies, target market, and financial projections. It demonstrates the feasibility and potential impact of the business, helping grantors assess the project's viability.

Certifications and Licenses

Certifications and licenses are essential documents required for a small business grant application. They validate the legal status and credibility of the business.

Common certifications include business licenses, tax identification numbers, and industry-specific permits. These documents ensure compliance with local, state, and federal regulations.

Past Performance References

What past performance references are required for a small business grant application? Lenders and grant providers often seek detailed records of your previous projects to assess your reliability and success rate. Providing clear, verifiable references strengthens your application by demonstrating your proven track record.

Insurance and Bonding Documentation

| Document Type | Description | Purpose in Grant Application |

|---|---|---|

| General Liability Insurance Certificate | Proof of coverage protecting against claims of bodily injury or property damage arising from business operations. | Demonstrates risk management and protects the grant provider from potential liabilities connected to business activities. |

| Workers' Compensation Insurance | Evidence of insurance covering medical expenses and lost wages for employees injured on the job. | Shows compliance with legal requirements and ensures employee safety, which is crucial for grant approval. |

| Professional Liability Insurance | Coverage for claims related to errors or omissions in professional services offered by the business. | Provides assurance to the grant agency about the quality and reliability of professional services. |

| Surety Bond | A bond guaranteeing the business will fulfill contractual obligations or grant requirements. | Acts as a financial assurance tool protecting the grantor against non-compliance or project failure. |

| Bid Bond | A bond submitted with a bid to ensure the business will honor the terms if awarded the contract. | Demonstrates seriousness and financial reliability during the grant application or project selection process. |

| Maintenance Bond | Guarantees maintenance and repair work will be performed after project completion. | Ensures long-term commitment to project quality and accountability. |

| Documentation Tips | Include current, valid insurance certificates and bonding documents with clear policy numbers and coverage dates. | Supports the credibility of your application and confirms readiness to meet grant conditions. |

Compliance and Legal Status Certificates

Compliance and legal status certificates are essential documents for a small business grant application. These documents verify that your business meets regulatory requirements and operates within the law.

- Business Registration Certificate - This certificate proves your business is officially registered with state or local authorities.

- Tax Compliance Certificate - This document confirms that your business is current with tax filings and payments to government agencies.

- Licenses and Permits - Relevant operating licenses and permits demonstrate your business complies with industry-specific regulations.

What Documents Are Needed for a Small Business Grant Application? Infographic