To secure business loan approval, essential documents include financial statements such as balance sheets, income statements, and cash flow statements demonstrating the company's fiscal health. Loan applicants must provide tax returns, legal documents like business licenses and articles of incorporation, along with a detailed business plan outlining the purpose of the loan and repayment strategy. Lenders may also require personal financial information from business owners, including credit reports and personal identification, to assess creditworthiness and risk.

What Documents are Needed for Business Loan Approval?

| Number | Name | Description |

|---|---|---|

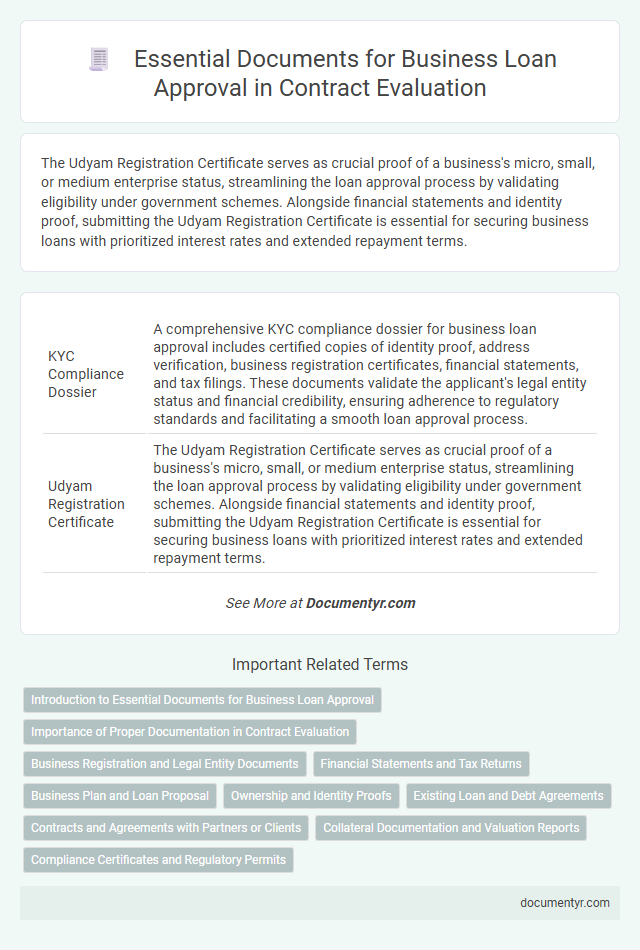

| 1 | KYC Compliance Dossier | A comprehensive KYC compliance dossier for business loan approval includes certified copies of identity proof, address verification, business registration certificates, financial statements, and tax filings. These documents validate the applicant's legal entity status and financial credibility, ensuring adherence to regulatory standards and facilitating a smooth loan approval process. |

| 2 | Udyam Registration Certificate | The Udyam Registration Certificate serves as crucial proof of a business's micro, small, or medium enterprise status, streamlining the loan approval process by validating eligibility under government schemes. Alongside financial statements and identity proof, submitting the Udyam Registration Certificate is essential for securing business loans with prioritized interest rates and extended repayment terms. |

| 3 | GST Reconciliation Statement | A GST Reconciliation Statement is essential for business loan approval as it verifies the accuracy of GST returns filed against the company's financial records, ensuring compliance and transparency. Lenders require this document to assess the business's tax payment consistency and financial credibility before sanctioning the loan. |

| 4 | Digital Bank Statement Validation | Digital bank statement validation requires submitting recent, usually three to six months, of electronic bank statements that clearly display transaction history, account holder details, and bank logos, ensuring authenticity and compliance with lender requirements. Accurate extraction and verification of these digital documents streamline the approval process, reducing fraud risk and enhancing credit assessment accuracy for business loan contracts. |

| 5 | Alternate Data Underwriting File | Alternate data underwriting files for business loan approval typically include financial statements, bank transaction histories, payment records from utilities or rent, tax returns, and cash flow analyses. These documents provide a comprehensive view of the borrower's creditworthiness when traditional credit scores or collateral are insufficient. |

| 6 | MSME Credit Health Report | The MSME Credit Health Report, which includes detailed credit history, repayment behavior, bank statements, and financial statements, is essential for assessing loan eligibility and risk management in business loans. Lenders use this report alongside the loan application, identity proof, GST registration, and business licenses to ensure comprehensive evaluation of the borrower's financial stability and creditworthiness. |

| 7 | e-NACH Mandate Proof | For business loan approval, submitting the e-NACH mandate proof is essential as it verifies electronic authorization for automatic debit of EMIs, ensuring seamless repayment. This document is critical for lenders to confirm the borrower's commitment to signed auto-debit agreements, reducing default risk. |

| 8 | Business Cash Flow Forecast Sheet | A Business Cash Flow Forecast Sheet is essential for business loan approval as it provides lenders with detailed projections of future cash inflows and outflows, demonstrating the company's ability to meet loan repayments. This document, alongside financial statements and tax returns, validates the business's financial health and repayment capacity, crucial for securing funding. |

| 9 | Environmental, Social, Governance (ESG) Self-Assessment | Banks and lenders require an Environmental, Social, Governance (ESG) Self-Assessment report as part of the business loan approval process to evaluate the company's sustainability practices and risk management. This document typically includes detailed data on environmental impact, social responsibility initiatives, and governance structures to ensure compliance with regulatory standards and investor expectations. |

| 10 | Embedded Finance Authorization Letter | An Embedded Finance Authorization Letter is crucial for business loan approval as it grants lenders permission to access and verify a company's financial data directly through integrated financial platforms. This document streamlines the approval process by enabling secure, real-time validation of cash flow, transaction history, and creditworthiness. |

Introduction to Essential Documents for Business Loan Approval

Securing a business loan requires a thorough preparation of specific documentation. Understanding the essential documents needed can streamline your approval process.

- Financial Statements - Detailed records such as profit and loss statements, balance sheets, and cash flow statements demonstrate your business's financial health.

- Business Plan - A comprehensive plan outlines your business model, strategy, and how the loan will contribute to growth.

- Tax Returns - Personal and business tax returns provide lenders with a history of your financial performance and reliability.

Importance of Proper Documentation in Contract Evaluation

Proper documentation is crucial for business loan approval as it enables clear contract evaluation and risk assessment. Accurate and complete documents facilitate faster decision-making and ensure compliance with lending standards.

- Financial Statements - Comprehensive profit and loss statements, balance sheets, and cash flow reports verify the business's financial health.

- Business Plan - A detailed plan outlines the loan purpose, projected growth, and repayment strategy, supporting contract clarity.

- Legal Documents - Contracts, licenses, and ownership papers establish the legitimacy and operational authority of the business.

Business Registration and Legal Entity Documents

Business registration documents are essential for securing loan approval. These documents verify that your business is legally recognized and operating within regulatory guidelines.

Legal entity documents confirm the structure and ownership of your business, such as articles of incorporation or partnership agreements. Lenders require these to assess liability and decision-making authority. Proper documentation ensures your loan application undergoes a smooth evaluation process.

Financial Statements and Tax Returns

Financial statements are essential documents for business loan approval, providing a clear picture of your company's financial health. These include balance sheets, income statements, and cash flow statements that lenders analyze to assess profitability and stability.

Tax returns offer a verified record of your business's income over time, confirming the financial data presented in your statements. Providing accurate and complete tax returns helps establish trust and accelerates the loan approval process.

Business Plan and Loan Proposal

For business loan approval, a detailed business plan is essential to outline your company's goals, market analysis, and financial projections. A well-prepared loan proposal must clearly state the loan amount, repayment terms, and purpose of the funds. These documents provide lenders with the necessary insight to assess the viability and creditworthiness of your business.

Ownership and Identity Proofs

Ownership and identity proofs are critical documents required for business loan approval. These documents verify the legitimacy of the business owner and establish legal ownership.

Common ownership proofs include business registration certificates, partnership deeds, and shareholding documents. Identity proofs typically encompass government-issued IDs such as passports, driver's licenses, or national ID cards.

Existing Loan and Debt Agreements

Existing loan and debt agreements are critical documents required for business loan approval. These documents provide lenders with a clear picture of the applicant's current financial obligations and repayment history.

- Current Loan Agreements - Detail outstanding loans including terms, interest rates, and repayment schedules to assess financial liabilities.

- Debt Covenants - Outline conditions and restrictions imposed by existing lenders to evaluate compliance and risk factors.

- Payment History Records - Demonstrate consistency and timeliness in repaying previous debts to establish creditworthiness.

Lenders use these documents to determine the borrower's capacity to manage additional debt responsibly.

Contracts and Agreements with Partners or Clients

| Document Type | Description |

|---|---|

| Partnership Agreements | Official contracts outlining the terms, roles, and profit-sharing mechanisms between business partners. Lenders require these to verify the legitimacy and structure of your business relationships. |

| Client Contracts | Agreements with clients that specify the services or products to be delivered, payment terms, and timelines. These documents demonstrate stable revenue streams and business commitments. |

| Service Level Agreements (SLAs) | Contracts detailing the quality and standards agreed upon with clients or partners. SLAs provide evidence of your commitment to maintaining business obligations, enhancing lender confidence. |

| Non-Disclosure Agreements (NDAs) | Legal documents protecting confidential information exchanged between your business and partners or clients. NDAs establish trust and secure critical business details during loan evaluation. |

| Joint Venture Agreements | Contracts that define the terms of collaboration with other businesses on specific projects. These documents highlight cooperative efforts and financial arrangements relevant to loan assessments. |

Collateral Documentation and Valuation Reports

For business loan approval, collateral documentation is essential to verify the assets offered as security. These documents typically include property deeds, vehicle titles, or equipment ownership papers that demonstrate clear ownership and lien status. Valuation reports, prepared by certified appraisers, provide an accurate assessment of the collateral's current market value, ensuring the lender's risk is adequately covered.

What Documents are Needed for Business Loan Approval? Infographic