For SBA loan approval, key documents include the business's financial statements, tax returns from the past three years, and a detailed business plan outlining operations and projections. Personal financial statements and credit reports from all owners with 20% or more stake are also required to assess financial stability. Additionally, legal documents such as business licenses, articles of incorporation, and a contract pet agreement, if applicable, must be submitted to verify legitimacy and contractual obligations.

What Documents are Necessary for SBA Loan Approval?

| Number | Name | Description |

|---|---|---|

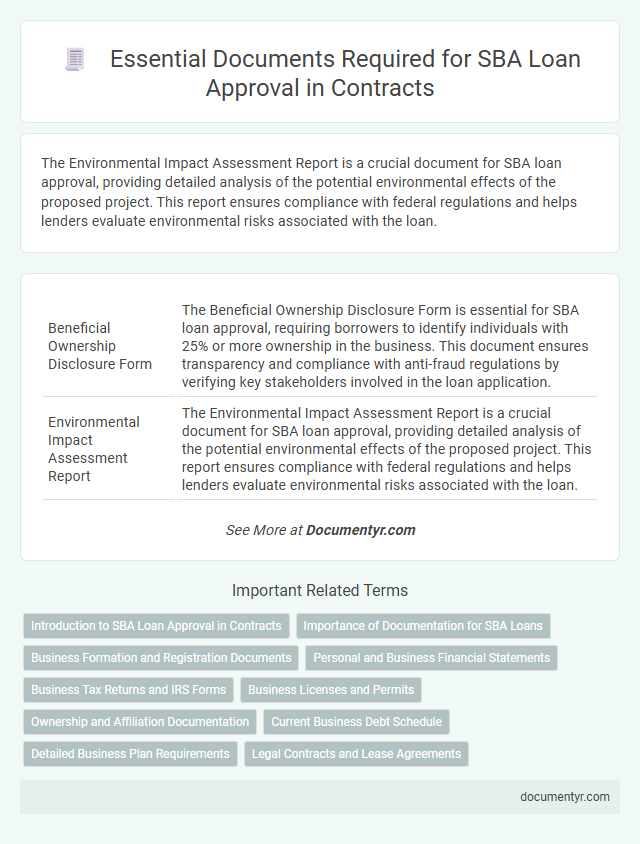

| 1 | Beneficial Ownership Disclosure Form | The Beneficial Ownership Disclosure Form is essential for SBA loan approval, requiring borrowers to identify individuals with 25% or more ownership in the business. This document ensures transparency and compliance with anti-fraud regulations by verifying key stakeholders involved in the loan application. |

| 2 | Environmental Impact Assessment Report | The Environmental Impact Assessment Report is a crucial document for SBA loan approval, providing detailed analysis of the potential environmental effects of the proposed project. This report ensures compliance with federal regulations and helps lenders evaluate environmental risks associated with the loan. |

| 3 | Digital Identity Verification Certificate | The SBA loan approval process requires a Digital Identity Verification Certificate to confirm the borrower's identity securely and prevent fraud. This certificate is a crucial document that validates personal and business information, ensuring compliance with SBA regulations. |

| 4 | Economic Injury Disaster Loan (EIDL) Supporting Docs | Essential documents for SBA Economic Injury Disaster Loan (EIDL) approval include personal and business financial statements, tax returns from the past three years, a completed SBA loan application form (SBA Form 5 or 5C), and a detailed disaster loan application. Proof of business ownership, a schedule of liabilities, and documentation verifying the disaster's impact on business revenue are critical to substantiate the claim and demonstrate the necessity of the loan. |

| 5 | UCC-1 Financing Statement | The UCC-1 Financing Statement is a crucial document in SBA loan approval as it establishes the lender's secured interest in the borrower's assets under the Uniform Commercial Code. Lenders require a properly filed UCC-1 statement to protect their security interest and prioritize repayment in case of borrower default. |

| 6 | PPP Loan Forgiveness Documentation | SBA loan approval, particularly for PPP loan forgiveness, requires comprehensive documentation including payroll records, bank statements, and IRS tax forms such as Form 941 and Form 940 to verify eligible expenses. Supporting documents like mortgage interest statements, lease agreements, utility bills, and certification of employee retention are essential to substantiate the loan forgiveness application. |

| 7 | Cash Flow Projection Statement | A Cash Flow Projection Statement is essential for SBA loan approval as it demonstrates the borrower's ability to generate sufficient revenue to meet loan obligations. This document provides detailed monthly inflows and outflows, enabling lenders to assess financial stability and repayment capacity. |

| 8 | Disaster Loan Use of Funds Certification | The Disaster Loan Use of Funds Certification is a critical document verifying that SBA disaster loan funds will be applied strictly to approved expenses such as property repair, replacement of damaged equipment, or working capital. Submission of this certification ensures compliance with SBA loan terms and is mandatory for loan approval and fund disbursement. |

| 9 | Cybersecurity Compliance Affidavit | The Cybersecurity Compliance Affidavit is a crucial document for SBA loan approval, demonstrating that the business adheres to federal cybersecurity standards, protecting sensitive financial and operational data from breaches. This affidavit validates the company's commitment to secure data practices, significantly influencing the SBA's risk assessment and loan authorization process. |

| 10 | Franchise Agreement Validation | Franchise agreement validation requires submitting a fully executed franchise contract that outlines the franchise relationship, fees, and obligations to ensure compliance with SBA loan criteria. Lenders often demand proof of franchise approval, including validation of the franchisor's eligibility and authorization to operate, as part of the SBA loan approval process. |

Introduction to SBA Loan Approval in Contracts

Securing an SBA loan requires submitting specific documents that verify the borrower's eligibility and financial stability. These documents play a crucial role in the contract approval process between the lender and the borrower.

Key documents include the loan application form, personal and business financial statements, and tax returns. Proper documentation ensures the SBA can assess risk and compliance effectively within the loan contract framework.

Importance of Documentation for SBA Loans

Comprehensive documentation is essential for SBA loan approval to demonstrate your business's financial health and creditworthiness. Accurate records help lenders assess risk and ensure compliance with SBA lending requirements.

Key documents include tax returns, financial statements, business licenses, and personal background information. Proper documentation expedites the approval process and increases the likelihood of loan acceptance.

Business Formation and Registration Documents

| Document Type | Description | Purpose for SBA Loan Approval |

|---|---|---|

| Business Formation Documents | Includes Articles of Incorporation, Articles of Organization, or Partnership Agreements depending on business structure (corporation, LLC, partnership) | Proof of legitimate business entity and legal existence required for SBA verification and loan processing |

| Business Registration Certificate | Official proof of business registration issued by state or local government | Confirms the business is registered and authorized to operate within the jurisdiction |

| Employer Identification Number (EIN) | IRS-issued unique identifier for federal tax purposes | Required to verify tax status and facilitate financial documentation review |

| Operating Agreement or Bylaws | Internal governance documents outlining management structure and operational protocols | Demonstrates business management framework and decision-making authority for SBA underwriting |

| Business License | License or permit required for specific business activities regulated by local or state authorities | Validates compliance with local regulations pertinent to the business industry |

Personal and Business Financial Statements

Personal and business financial statements are crucial documents for SBA loan approval. These statements provide a clear overview of the applicant's financial health, including assets, liabilities, income, and expenses. Accurate and detailed financial data helps lenders assess the borrower's ability to repay the loan.

Business Tax Returns and IRS Forms

Business tax returns are critical documents required for SBA loan approval, as they provide a detailed overview of the company's financial performance and profitability over recent years. These returns help lenders assess the borrower's ability to repay the loan by verifying income, expenses, and business viability. IRS forms, especially Form 4506-T, are necessary for the SBA to obtain transcripts of tax returns directly from the IRS, ensuring the accuracy and authenticity of the submitted financial data.

Business Licenses and Permits

Business licenses and permits are essential documents for SBA loan approval, demonstrating your compliance with local, state, and federal regulations. These documents verify that your business operates legally within the required jurisdictions.

Ensure you provide valid copies of all relevant licenses and permits specific to your industry and location. Common examples include health permits, zoning permits, and professional licenses. Lenders use these documents to assess the legitimacy and risk profile of your business before approving an SBA loan.

Ownership and Affiliation Documentation

Ownership and affiliation documentation is critical for SBA loan approval to verify the legitimacy and structure of your business. These documents provide clarity on who controls the business and any connections that may affect eligibility.

- Business Ownership Agreements - These include partnership agreements, shareholder agreements, or operating agreements that define ownership percentages and responsibilities.

- Personal Background and Financial Statements - Personal financial statements and background checks ensure owners meet SBA credit criteria and demonstrate financial stability.

- Affiliation Disclosure Forms - Documents revealing any affiliations or business relationships that could influence size standards or loan qualifications.

Current Business Debt Schedule

What role does the Current Business Debt Schedule play in SBA loan approval? The Current Business Debt Schedule provides a detailed list of all existing debts your business holds, including amounts, lenders, and payment terms. Lenders use this information to assess your current financial obligations and determine your ability to take on new debt.

Detailed Business Plan Requirements

For SBA loan approval, a detailed business plan is a crucial document that outlines your company's objectives, strategies, and financial projections. This plan demonstrates the viability and growth potential of your business to lenders.

- Executive Summary - Provides a concise overview of the business, mission, and key objectives.

- Market Analysis - Includes detailed research on industry trends, target market, and competitive landscape.

- Financial Projections - Contains profit and loss forecasts, cash flow statements, and balance sheets for at least three years.

What Documents are Necessary for SBA Loan Approval? Infographic