To apply for student loan forgiveness, gather essential documents such as your student loan statements, proof of employment or income, and a completed application form specific to the forgiveness program. Verifying your loan type and repayment history is crucial for eligibility. Submitting accurate identification and tax returns can strengthen your application and expedite processing.

What Documents are Needed to Apply for Student Loan Forgiveness?

| Number | Name | Description |

|---|---|---|

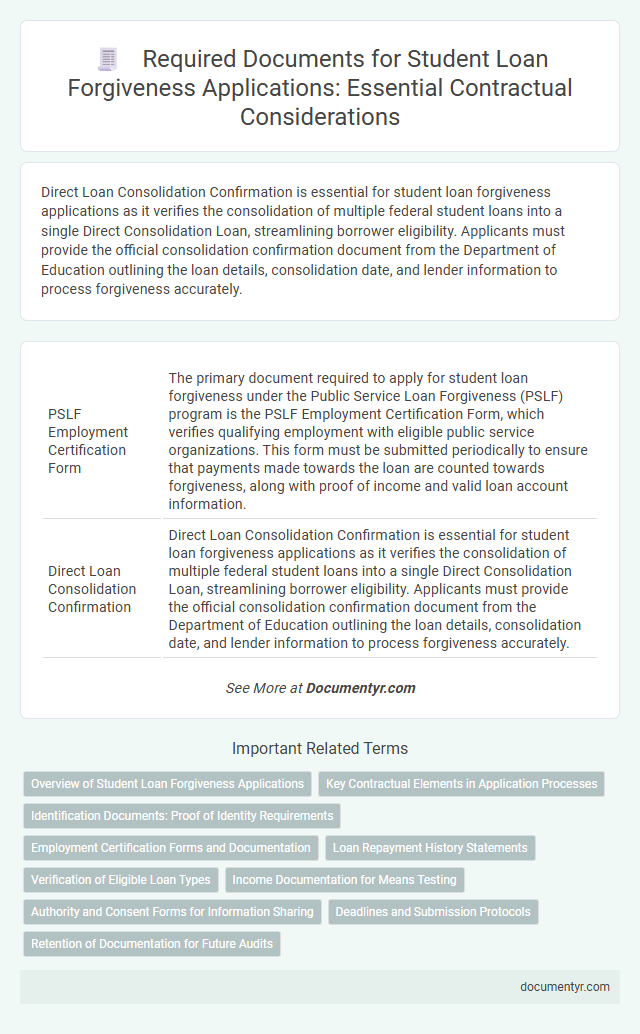

| 1 | PSLF Employment Certification Form | The primary document required to apply for student loan forgiveness under the Public Service Loan Forgiveness (PSLF) program is the PSLF Employment Certification Form, which verifies qualifying employment with eligible public service organizations. This form must be submitted periodically to ensure that payments made towards the loan are counted towards forgiveness, along with proof of income and valid loan account information. |

| 2 | Direct Loan Consolidation Confirmation | Direct Loan Consolidation Confirmation is essential for student loan forgiveness applications as it verifies the consolidation of multiple federal student loans into a single Direct Consolidation Loan, streamlining borrower eligibility. Applicants must provide the official consolidation confirmation document from the Department of Education outlining the loan details, consolidation date, and lender information to process forgiveness accurately. |

| 3 | Income-Driven Repayment (IDR) Plan Application | To apply for student loan forgiveness under an Income-Driven Repayment (IDR) plan, borrowers must submit Form IDR, which requires documentation of income such as recent tax returns or alternative proof of income if taxes are unavailable. Additionally, loan account information and Social Security number are necessary to complete the application accurately and ensure eligibility for forgiveness programs. |

| 4 | Temporary Expanded PSLF (TEPSLF) Request | To apply for student loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness (TEPSLF) program, borrowers must submit the TEPSLF application form along with their most recent loan statement and proof of qualifying repayment plans, such as income-driven repayment documentation. Supporting documents may also include employment certification forms verifying public service employment during the repayment period to establish eligibility under TEPSLF guidelines. |

| 5 | Federal Student Aid (FSA) ID Verification | Applicants seeking student loan forgiveness must submit proof of identity through the Federal Student Aid (FSA) ID verification process, which requires a valid Social Security number, a valid email address, and a mobile phone number or access to a landline phone for verification codes. Supporting documents may include a government-issued photo ID and completed borrower data confirmation forms to ensure full compliance with federal loan forgiveness program requirements. |

| 6 | Loan Servicer Communication Logs | Loan servicer communication logs documenting all interactions and correspondence related to the student loan are essential for verifying eligibility during the student loan forgiveness application process. These logs provide a detailed record of repayment history, payment adjustments, and borrower requests that support the accuracy and completeness of the forgiveness claim. |

| 7 | Employment Period Statement | An Employment Period Statement is a critical document required for student loan forgiveness applications, as it verifies the duration and terms of qualifying employment under the loan forgiveness program. This statement must be issued by the employer and detail the specific dates of employment, job title, and confirmation that the position meets the eligibility criteria for loan forgiveness. |

| 8 | IDR Recertification Notice | An IDR Recertification Notice is essential for applying for student loan forgiveness under income-driven repayment plans, as it verifies the borrower's updated income and family size, ensuring accurate calculation of monthly payments. Borrowers must submit recent tax returns or alternative income documentation alongside the notice to complete the application process. |

| 9 | COVID-19 Forbearance Documentation | To apply for student loan forgiveness related to COVID-19 forbearance, borrowers must provide official loan statements reflecting the forbearance period, proof of eligibility such as income documentation or employment status, and any correspondence confirming automatic payment suspensions granted by the loan servicer. Supporting materials should also include the original promissory note and documentation of any deferment or forbearance granted under COVID-19 relief programs to substantiate eligibility for forgiveness. |

| 10 | Borrower Defense Application Evidence | Borrower defense application evidence for student loan forgiveness requires detailed documentation proving school misconduct, including enrollment agreements, financial aid statements, correspondence with the institution, and transcripts. Supporting materials such as letters from attorneys or witnesses, copies of complaints filed with regulatory agencies, and any official notices regarding the school's closures or lawsuits significantly strengthen the application. |

Overview of Student Loan Forgiveness Applications

Applying for student loan forgiveness requires submitting specific documents to verify eligibility. Commonly requested items include proof of income, employment history, and loan statements.

Additional documentation might involve certification forms from employers or proof of qualifying payments. Ensuring all required paperwork is complete can expedite the application review process.

Key Contractual Elements in Application Processes

| Document Type | Description | Importance in Contractual Process |

|---|---|---|

| Loan Agreement | Official contract between borrower and lender outlining terms and conditions of the student loan. | Defines the initial obligations, repayment terms, and eligibility for forgiveness programs. |

| Employment Certification Form | Verification document confirming employment status with a qualifying organization for Public Service Loan Forgiveness (PSLF). | Serves as legal proof required to meet the contractual employment criteria for specific forgiveness programs. |

| Proof of Income | Recent pay stubs, tax returns, or other income documentation required for Income-Driven Repayment (IDR) plans. | Validates eligibility and payment amounts under income-based forgiveness agreements. |

| Payment History Records | Statements or account summaries showing loan repayment progress. | Demonstrates compliance with the contractual repayment schedule necessary to qualify for forgiveness. |

| Forgiveness Application Form | The formal request document to apply for loan forgiveness under the relevant program. | Initiates the contractual modification process where the lender reviews eligibility and approves forgiveness. |

| Identification Documents | Government-issued ID such as a driver's license or passport to verify borrower identity. | Ensures contractual legitimacy and prevents fraud during application processing. |

Identification Documents: Proof of Identity Requirements

Identification documents are essential to verify your identity when applying for student loan forgiveness. These documents help confirm your eligibility and prevent fraud in the application process.

- Government-issued photo ID - A valid passport, driver's license, or state ID card typically serves as primary proof of identity.

- Social Security Number (SSN) - Providing your SSN is necessary for identity verification and to access your loan records.

- Proof of residency - Documents such as utility bills or lease agreements may be required to confirm your current address.

Employment Certification Forms and Documentation

Employment Certification Forms are essential documents required to apply for student loan forgiveness, verifying your qualifying employment with eligible employers. Documentation typically includes detailed records of your job title, duration of employment, and employer's certification confirming that your role meets the forgiveness program criteria. Providing accurate and complete employment records ensures the application process proceeds smoothly and increases the likelihood of approval.

Loan Repayment History Statements

Loan repayment history statements are essential documents when applying for student loan forgiveness. These statements provide a comprehensive record of your payments, helping verify eligibility for forgiveness programs.

- Federal Loan Servicer Statements - Detailed records from your loan servicer showing all payments made towards your federal student loans.

- Payment Confirmation Receipts - Official receipts or records confirming each loan payment processed.

- Account Statements - Monthly or annual statements outlining principal balances, interest accruals, and payment applications.

Including accurate loan repayment history statements ensures a smoother verification process for student loan forgiveness applications.

Verification of Eligible Loan Types

Verification of eligible loan types is a crucial step in applying for student loan forgiveness. Gathering the correct documents ensures that your loan qualifies under the forgiveness program.

- Loan Statements - Official loan statements from your lender verify the type and amount of your student loans.

- Loan Servicer Documentation - Documents from your loan servicer confirm the eligibility of your loan type for forgiveness.

- Federal Student Aid Records - Accessing your account on the Federal Student Aid website provides authoritative information about your loan eligibility.

Income Documentation for Means Testing

Income documentation is crucial for means testing when applying for student loan forgiveness. Borrowers must provide accurate proof of income to determine eligibility and repayment options.

Acceptable income documents include recent pay stubs, tax returns, and W-2 forms. Self-employed applicants may need to submit 1099 forms or profit and loss statements to verify earnings.

Authority and Consent Forms for Information Sharing

Applying for student loan forgiveness requires submitting specific documents, including Authority and Consent Forms for Information Sharing. These forms grant permission to relevant agencies to access and verify your loan and employment information.

Authority and Consent Forms are crucial for confirming eligibility and processing the forgiveness application efficiently. They allow authorized entities such as the Department of Education to collect necessary data from employers and loan servicers. Providing accurate and signed consent forms helps avoid delays and ensures compliance with federal regulations.

Deadlines and Submission Protocols

To apply for student loan forgiveness, applicants must submit a completed application form, proof of income, and detailed loan statements from all loan servicers. Meeting the specified deadlines is crucial, with the primary submission window typically closing on December 31 of the application year. All documents must be submitted through the official federal student aid portal or sent via certified mail to ensure timely processing and confirmation of receipt.

What Documents are Needed to Apply for Student Loan Forgiveness? Infographic