To apply for an SBA small business loan, you must provide key documents including personal and business financial statements, tax returns, and a detailed business plan outlining your operations and goals. Lenders also require legal documents such as business licenses, articles of incorporation, and contracts with suppliers or clients. Collateral documentation and proof of equity investment may be necessary to secure loan approval and demonstrate financial stability.

What Documents Are Required for an SBA Small Business Loan?

| Number | Name | Description |

|---|---|---|

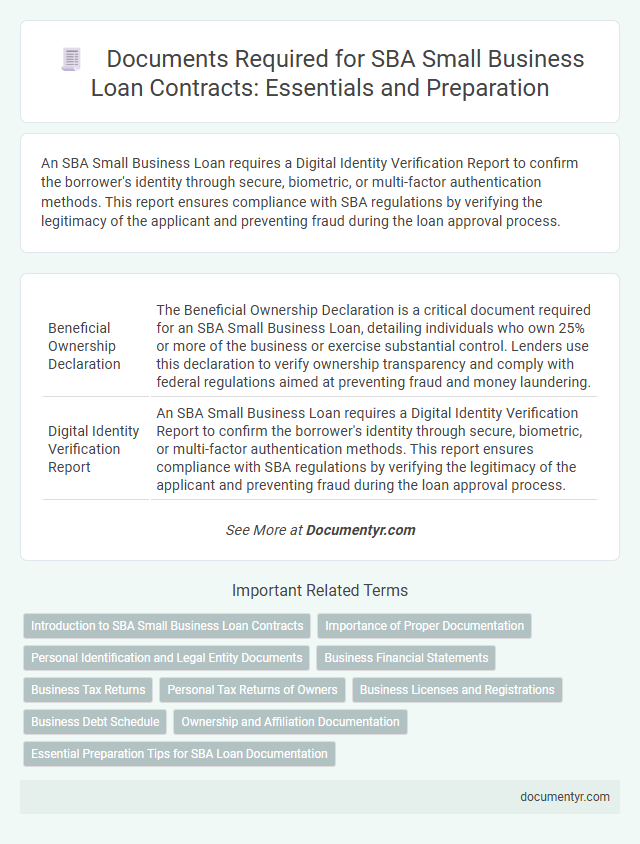

| 1 | Beneficial Ownership Declaration | The Beneficial Ownership Declaration is a critical document required for an SBA Small Business Loan, detailing individuals who own 25% or more of the business or exercise substantial control. Lenders use this declaration to verify ownership transparency and comply with federal regulations aimed at preventing fraud and money laundering. |

| 2 | Digital Identity Verification Report | An SBA Small Business Loan requires a Digital Identity Verification Report to confirm the borrower's identity through secure, biometric, or multi-factor authentication methods. This report ensures compliance with SBA regulations by verifying the legitimacy of the applicant and preventing fraud during the loan approval process. |

| 3 | Environmental Impact Affidavit | The Environmental Impact Affidavit is a critical document required for an SBA Small Business Loan, demonstrating compliance with environmental regulations and confirming that the proposed business activities will not adversely affect the environment. This affidavit supports the SBA's due diligence process by ensuring that the project aligns with federal environmental guidelines and mitigates potential ecological risks. |

| 4 | E-signature Compliance Certificate | The E-signature Compliance Certificate is a critical document for SBA small business loans, certifying that electronic signatures used throughout the loan application process meet legal standards set by the ESIGN Act and UETA. This certificate ensures the authenticity and enforceability of digital contracts, accelerating loan approval times while maintaining regulatory compliance. |

| 5 | Forgiveness Eligibility Documentation | Forgiveness eligibility documentation for an SBA small business loan requires detailed payroll records, including IRS Form 941, proof of employee retention, and evidence of covered expenses such as mortgage interest, rent, and utilities paid during the covered period. Additionally, businesses must submit bank statements, payment receipts, and certification forms to verify compliance with SBA loan forgiveness criteria. |

| 6 | PPP Loan Reconciliation Statement | The PPP Loan Reconciliation Statement is a critical document for SBA small business loan applications, detailing how funds were utilized according to SBA guidelines. Accurate completion of this statement ensures proper loan forgiveness and compliance with SBA loan terms. |

| 7 | Cybersecurity Policy Disclosure | An SBA small business loan application requires comprehensive documentation, including a cybersecurity policy disclosure to demonstrate the borrower's commitment to protecting sensitive information and mitigating cyber risks. Lenders evaluate this disclosure to ensure the business adheres to industry standards and regulatory compliance for data security. |

| 8 | Automated Cash Flow Forecast | An Automated Cash Flow Forecast for an SBA Small Business Loan integrates real-time financial data and predictive analytics, providing lenders with a detailed projection of future cash inflows and outflows essential for contract assessment. This document supports the loan application by demonstrating the borrower's ability to meet repayment obligations, enhancing underwriting accuracy and contract validation. |

| 9 | Minority-Owned Business Certification | To qualify for an SBA Small Business Loan, minority-owned businesses must provide certification documents such as a completed SBA Form 1010 and proof of minority status through state or federal minority business certification programs. Additional required paperwork includes business financial statements, tax returns, and a detailed business plan to demonstrate eligibility and creditworthiness. |

| 10 | Resilience and Continuity Plan Appendix | The Resilience and Continuity Plan Appendix is a crucial document for an SBA Small Business Loan application, detailing strategies to maintain operations during disruptions. This appendix must include risk assessments, recovery procedures, and communication plans to demonstrate the business's preparedness and commitment to sustainability. |

Introduction to SBA Small Business Loan Contracts

What documents are required for an SBA small business loan contract? SBA small business loan contracts necessitate specific documentation to ensure clarity and legal compliance. These documents help outline the terms, obligations, and protections for both the lender and borrower.

Importance of Proper Documentation

| Document Type | Purpose | Importance |

|---|---|---|

| Business Plan | Outlines business goals, strategies, and financial projections | Demonstrates loan feasibility and repayment plan, increases lender confidence |

| Personal and Business Tax Returns | Provides proof of income and financial stability | Verifies ability to repay the loan and assesses financial history |

| Financial Statements | Includes balance sheets, profit and loss statements, and cash flow statements | Offers clear view of current business health and financial performance |

| Personal Background and Resume | Details personal credit history and business experience | Evaluates borrower's reliability and management skills |

| Business Licenses and Registrations | Confirms legal authorization to operate | Ensures compliance with federal, state, and local laws |

| Loan Application Form | Official form requesting loan and specifying terms | Serves as primary document for loan processing and approval |

| Collateral Documentation | Documents assets pledged to secure the loan | Reduces lender risk and may improve loan terms |

| Importance of Proper Documentation | Proper documentation ensures a smooth loan application process and faster approval. It establishes transparency, verifies the financial health of the business, and reduces the risk of loan denial. Accurate and complete documents facilitate lender trust and optimize loan conditions. | |

Personal Identification and Legal Entity Documents

Obtaining an SBA small business loan requires specific personal identification and legal entity documents. These documents verify your identity and establish the legal status of your business to ensure compliance with lending standards.

- Government-issued Photo ID - You must provide a valid driver's license, passport, or state ID to confirm your identity.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - These numbers are essential for personal credit verification and background checks.

- Business Formation Documents - Submit your Articles of Incorporation, Partnership Agreement, or other legal documents that prove your business's existence and structure.

Business Financial Statements

Business financial statements are essential documents required for an SBA small business loan application. These statements typically include the balance sheet, income statement, and cash flow statement, providing a comprehensive view of the company's financial health. Lenders use these documents to assess the business's profitability, liquidity, and ability to repay the loan.

Business Tax Returns

Business tax returns are a critical component of the SBA small business loan application process. These documents provide lenders with detailed insights into your company's financial performance over recent years.

Lenders typically request at least three years of business tax returns to assess revenue stability and profitability. Accurate and complete tax returns help streamline the approval process by demonstrating your business's financial health.

Personal Tax Returns of Owners

Personal tax returns of all business owners are essential documents for an SBA small business loan application. These returns provide the lender with a comprehensive view of the owners' financial history and ability to repay the loan. Accurate and complete personal tax returns increase the chances of loan approval and demonstrate financial transparency.

Business Licenses and Registrations

Business licenses and registrations are essential documents when applying for an SBA small business loan. They verify that your business operates legally within its industry and jurisdiction.

- Valid Business License - Confirms your business is authorized by local or state authorities to operate.

- Registration with State Agencies - Demonstrates compliance with state-level requirements and identification as a legal entity.

- Proof of DBA (Doing Business As) Registration - Validates the official trade name your business uses if different from its legal name.

Business Debt Schedule

When applying for an SBA Small Business Loan, providing accurate and detailed documentation is crucial. A Business Debt Schedule is an essential document that outlines all current business debts.

- Comprehensive Listing - The Business Debt Schedule must include all outstanding loans, credit lines, and lease obligations of the business.

- Creditor Information - Each debt entry should specify the creditor's name, loan balance, interest rate, and payment terms.

- Payment Status - The schedule should clearly state the current payment status such as current, delinquent, or in default for each debt.

This document enables lenders to assess the business's debt obligations and financial stability during the SBA loan approval process.

Ownership and Affiliation Documentation

When applying for an SBA small business loan, ownership and affiliation documentation is crucial to establish the borrower's control and relationships with other entities. These documents verify the legal ownership structure and disclose any affiliations that may affect loan eligibility or terms.

Required ownership documents include individual or corporate ownership certificates, partnership agreements, and any trust agreements if applicable. Affiliation documentation involves providing details on related businesses, common ownership, or management connections that could influence the loan underwriting process. These records ensure compliance with SBA size and affiliation standards, preventing conflicts of interest and ensuring accurate assessment of the applicant's eligibility.

What Documents Are Required for an SBA Small Business Loan? Infographic