Freelancers working with international clients must have a signed contract outlining project scope, payment terms, and deadlines to ensure clear mutual understanding. Essential documents also include invoices specifying currency and tax information, and proof of identity or business registration to comply with legal and tax regulations. Maintaining accurate records of communication and deliverables helps resolve disputes and supports smooth collaboration across borders.

What Documents Are Necessary for Freelance Work With International Clients?

| Number | Name | Description |

|---|---|---|

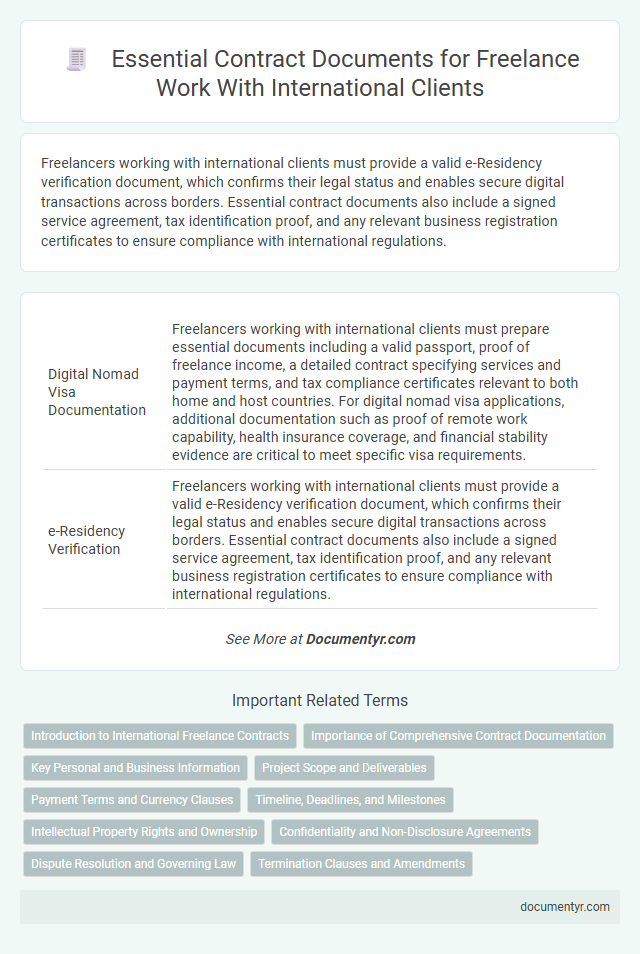

| 1 | Digital Nomad Visa Documentation | Freelancers working with international clients must prepare essential documents including a valid passport, proof of freelance income, a detailed contract specifying services and payment terms, and tax compliance certificates relevant to both home and host countries. For digital nomad visa applications, additional documentation such as proof of remote work capability, health insurance coverage, and financial stability evidence are critical to meet specific visa requirements. |

| 2 | e-Residency Verification | Freelancers working with international clients must provide a valid e-Residency verification document, which confirms their legal status and enables secure digital transactions across borders. Essential contract documents also include a signed service agreement, tax identification proof, and any relevant business registration certificates to ensure compliance with international regulations. |

| 3 | Remote Work Compliance Forms | Remote work compliance forms essential for freelance work with international clients include tax identification documents, proof of eligibility to work remotely across borders, and signed non-disclosure agreements (NDAs) to safeguard confidential information. Additionally, contracts specifying payment terms, intellectual property rights, and data protection compliance under regulations like GDPR ensure legal clarity and secure transactions. |

| 4 | Cross-Border Tax Declaration | Freelancers working with international clients must provide a completed W-8BEN form or equivalent tax residency certification to clarify tax withholding and prevent double taxation under relevant tax treaties. Maintaining detailed invoices, contracts specifying payment terms, and proof of foreign tax payments are essential for accurate cross-border tax declaration and compliance with both local and international tax authorities. |

| 5 | International Payment Authorization | International payment authorization requires a signed contract specifying currency, payment method, and transaction terms, accompanied by vendor identification documents such as passports or business licenses to ensure compliance with cross-border financial regulations. Including a secure payment agreement detailing authorized payment gateways or escrow accounts further protects both freelancers and international clients from fraud and payment disputes. |

| 6 | Global KYC (Know Your Customer) Certificates | Freelancers working with international clients must provide Global KYC (Know Your Customer) certificates to verify identity and comply with anti-money laundering regulations, ensuring secure and lawful transactions. Essential documents include government-issued ID, proof of address, and client-specific compliance forms to facilitate transparent global freelance contracts. |

| 7 | GDPR-Compliant Data Processing Addendum | A GDPR-Compliant Data Processing Addendum (DPA) is essential for freelance contracts with international clients to ensure lawful handling of personal data under the EU GDPR framework. This document establishes clear responsibilities for data protection, outlines data processing activities, and safeguards both parties from compliance risks during cross-border collaborations. |

| 8 | E-Signature Audit Trail | An E-Signature audit trail is crucial for freelance contracts with international clients as it legally records the signing process, time stamps, and IP addresses, ensuring authenticity and compliance with regulations like eIDAS and ESIGN Act. This digital documentation enhances contract security, reduces disputes, and streamlines cross-border transaction verification. |

| 9 | Local Labor Law Exemption Letters | Local labor law exemption letters are essential documents for freelance work with international clients as they confirm the freelancer's legal status and exempt them from certain local employment regulations. These letters protect both parties by clarifying compliance requirements and preventing disputes related to labor laws across different jurisdictions. |

| 10 | Multi-Currency Invoicing Statement | Freelancers working with international clients must include a multi-currency invoicing statement in their contracts, specifying currency conversion rates, payment methods, and applicable fees to ensure transparent and accurate financial transactions. This document also outlines invoicing schedules and tax obligations according to international standards, facilitating seamless cross-border payments and compliance. |

Introduction to International Freelance Contracts

International freelance contracts establish clear agreements between freelancers and clients across different countries. These contracts define project scope, payment terms, deadlines, and intellectual property rights to ensure mutual understanding. Proper documentation protects both parties and helps navigate legal and tax regulations in various jurisdictions.

Importance of Comprehensive Contract Documentation

Comprehensive contract documentation is essential for freelance work with international clients to ensure clarity and legal protection. Proper documentation minimizes misunderstandings and safeguards intellectual property rights across different jurisdictions.

- Clear Scope of Work - Defines project deliverables and timelines to align client and freelancer expectations.

- Payment Terms - Specifies payment amounts, schedules, currencies, and methods to prevent financial disputes.

- Confidentiality and IP Clauses - Protects sensitive information and clarifies ownership of work products.

Key Personal and Business Information

Freelance work with international clients requires specific documents to ensure smooth transactions and legal compliance. Key personal and business information must be clearly documented to protect both parties.

- Identification Documents - Passport or government-issued ID verifies your identity and residency status.

- Business Registration - Official business licenses or certificates confirm your company's legitimacy in your home country.

- Tax Information - Tax identification numbers and relevant tax forms ensure compliance with international tax regulations.

Project Scope and Deliverables

Defining the project scope and deliverables is essential for freelancing with international clients to ensure clear expectations. Precise documentation helps prevent misunderstandings and protects both parties legally.

- Project Scope Document - Outlines the specific tasks, goals, and limitations of the project in detail.

- Deliverables List - Specifies all expected outputs with descriptions, formats, and deadlines.

- Change Request Form - Establishes a formal procedure for managing scope changes during the project.

Thorough project scope and deliverables documentation streamlines collaboration and safeguards contractual commitments.

Payment Terms and Currency Clauses

| Document Type | Importance | Details |

|---|---|---|

| Contract Agreement | Essential | Specifies the scope of work, deliverables, and obligations for both parties. |

| Payment Terms Clause | Critical | Defines payment schedule, methods, deadlines, late fees, and invoicing process to ensure timely compensation. |

| Currency Clause | Vital | Establishes the currency for payments and outlines procedures in case of exchange rate fluctuations affecting the contract value. |

| Invoice Template | Supportive | Standardizes billing format including currency, payment details, and tax information for smooth financial transactions. |

| Tax Compliance Documents | Required | Ensures adherence to international tax regulations and clarifies tax obligations regarding cross-border payments. |

Timeline, Deadlines, and Milestones

For freelance work with international clients, a clear contract outlining the timeline is essential to avoid misunderstandings. This document should specify project start and end dates to set precise expectations.

Deadlines and milestones must be detailed within the contract to track progress effectively. Your agreement should include dates for deliverables and review periods to ensure timely completion and client satisfaction.

Intellectual Property Rights and Ownership

When working as a freelancer with international clients, it is essential to have a clear contract outlining Intellectual Property Rights (IPR) and ownership. This contract ensures both parties understand who retains the rights to the work produced and how those rights can be used.

The contract should explicitly state whether the freelancer or the client owns the copyrights, and under what conditions any licenses are granted. Including clauses on confidentiality, work-for-hire agreements, and transfer of rights protects both parties from future disputes. Proper documentation helps clarify usage permissions and safeguards original creative content across different jurisdictions.

Confidentiality and Non-Disclosure Agreements

When working as a freelancer with international clients, having a clear Confidentiality Agreement is essential to protect sensitive information. This document outlines the obligations of both parties regarding the handling and sharing of confidential data.

Non-Disclosure Agreements (NDAs) specifically prevent unauthorized disclosure of proprietary details, ensuring trust and legal security throughout the project. Including these agreements in your contract helps define the scope of confidentiality and remedies for breaches.

Dispute Resolution and Governing Law

What documents are necessary to address dispute resolution in freelance contracts with international clients? A clear dispute resolution clause specifying mediation, arbitration, or legal proceedings ensures conflicts are managed effectively. This clause reduces ambiguity and protects both parties' interests across borders.

Which governing law should be included in freelance contracts with international clients? The contract must identify the applicable jurisdiction's laws to govern the agreement, providing legal clarity. Specifying governing law prevents jurisdictional conflicts and streamlines dispute enforcement internationally.

What Documents Are Necessary for Freelance Work With International Clients? Infographic