Startups need key documents such as the Stock Purchase Agreement, which outlines the terms of equity ownership, and the Investor Rights Agreement, detailing voting rights and information access. Founders should also prepare the Founder's Agreement to clarify equity splits and roles, alongside the Cap Table reflecting all ownership stakes. These documents ensure clear, legally binding terms for equity distribution and protect both the startup and investors.

What Documents Does a Startup Need for Equity Agreements?

| Number | Name | Description |

|---|---|---|

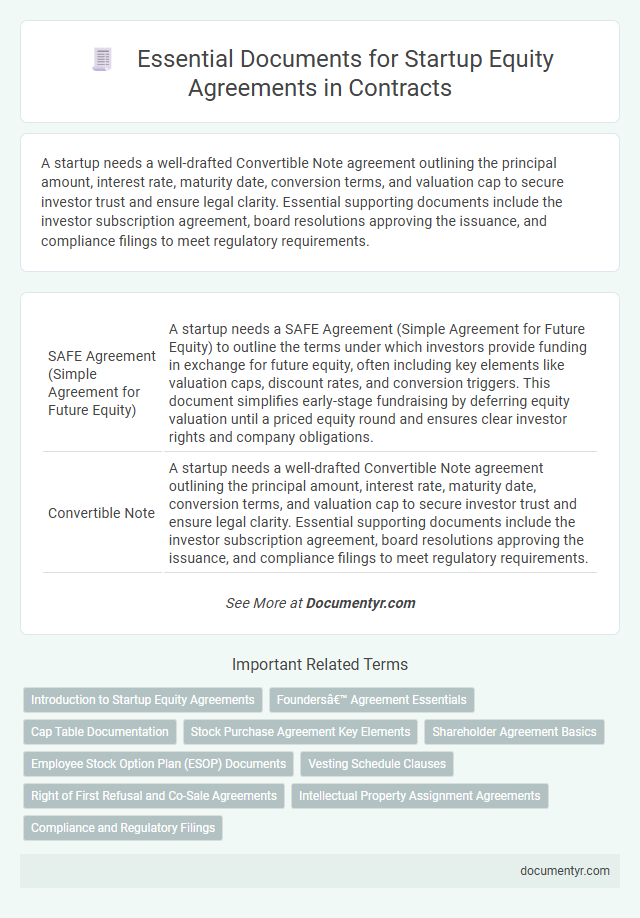

| 1 | SAFE Agreement (Simple Agreement for Future Equity) | A startup needs a SAFE Agreement (Simple Agreement for Future Equity) to outline the terms under which investors provide funding in exchange for future equity, often including key elements like valuation caps, discount rates, and conversion triggers. This document simplifies early-stage fundraising by deferring equity valuation until a priced equity round and ensures clear investor rights and company obligations. |

| 2 | Convertible Note | A startup needs a well-drafted Convertible Note agreement outlining the principal amount, interest rate, maturity date, conversion terms, and valuation cap to secure investor trust and ensure legal clarity. Essential supporting documents include the investor subscription agreement, board resolutions approving the issuance, and compliance filings to meet regulatory requirements. |

| 3 | Cap Table (Capitalization Table) | A comprehensive capitalization table (cap table) is essential for a startup's equity agreements, detailing ownership percentages, types of equity, and investor information to ensure clarity and accuracy in equity distribution. This document supports tracking shares, stock options, warrants, and convertible securities, facilitating transparent negotiations and future funding rounds. |

| 4 | Pro Rata Rights Letter | A Pro Rata Rights Letter grants startup investors the contractual right to maintain their ownership percentage in future financing rounds by purchasing additional shares. This document is essential in equity agreements to protect investors' stakes and ensure fair participation in subsequent capital raises. |

| 5 | Founders’ Stock Purchase Agreement | The Founders' Stock Purchase Agreement is essential for startups to outline the terms and conditions under which founders acquire their shares, including purchase price, vesting schedules, and rights. This document ensures clear ownership structure and protects founders' equity interests in the early development of the company. |

| 6 | Reverse Vesting Agreement | A Reverse Vesting Agreement is a crucial document in startup equity agreements that ensures founders earn their shares over time by subjecting unvested shares to repurchase rights if they leave early. This agreement protects the startup by incentivizing commitment and aligning founder contributions with long-term company growth. |

| 7 | Employee Stock Option Pool (ESOP) Plan | A startup must prepare an Employee Stock Option Pool (ESOP) Plan document outlining the terms and conditions of stock option grants, including vesting schedules, exercise price, and eligibility criteria. Essential accompanying documents include the board resolution approving the ESOP, the stock option agreement for individual employees, and updated equity capitalization tables reflecting the option pool's impact. |

| 8 | Side Letter Agreement | A Side Letter Agreement is a crucial document in startup equity agreements, providing tailored terms that supplement the main investment contract without altering its core provisions. It often addresses specific investor rights, confidentiality clauses, or bespoke management arrangements, ensuring flexibility and clarity in the equity transaction. |

| 9 | 83(b) Election Form | The 83(b) Election Form is a crucial document for startups issuing equity agreements, allowing founders or employees to pay taxes on the fair market value of restricted stock at the time of grant rather than at vesting, potentially reducing tax liability. Filing this form within 30 days of the equity grant date ensures tax benefits and compliance with IRS regulations, making it an essential part of equity compensation documentation. |

| 10 | Equity Incentive Plan Document | An Equity Incentive Plan Document outlines the framework for granting stock options and other equity awards to employees, advisors, and investors, ensuring legal compliance and clear terms for ownership rights and vesting schedules. This document is essential for startups to attract and retain talent by providing structured equity compensation aligned with company growth. |

Introduction to Startup Equity Agreements

Equity agreements are essential legal documents that define ownership percentages and rights within a startup. These contracts establish clear terms for investors, founders, and employees about how equity is allocated and managed.

You need specific documents to formalize these agreements and protect all parties involved. Proper documentation ensures transparency and helps prevent future disputes related to ownership and control.

Founders’ Agreement Essentials

Equity agreements in startups require specific documents to clearly define ownership and responsibilities among founders. A well-drafted founders' agreement is essential to outline equity distribution, roles, and decision-making processes.

This agreement should include vesting schedules, intellectual property rights, and dispute resolution mechanisms. You need to ensure these elements are documented to protect all parties and support long-term business stability.

Cap Table Documentation

Cap table documentation is essential for startups entering equity agreements as it provides a detailed record of ownership stakes, including shares, options, and convertible securities. This document helps track equity distribution among founders, investors, and employees, ensuring clarity during fundraising and ownership changes. Maintaining an accurate and updated cap table supports transparency and legal compliance throughout the startup's growth stages.

Stock Purchase Agreement Key Elements

| Document | Purpose | Key Elements |

|---|---|---|

| Stock Purchase Agreement (SPA) | Defines terms and conditions for the purchase and sale of company stock between the startup and investors or founders. |

|

| Founders' Agreement | Outlines roles, responsibilities, and equity ownership among startup founders. | Equity split, vesting schedules, and decision-making authority. |

| Cap Table | Tracks ownership percentages, equity dilution, and investor stakes. | List of shareholders, types of equity, and share distribution. |

| Board Resolutions | Formal approvals by the board for equity issuance or agreements. | Authorization of stock issuance and approval of SPA terms. |

Your startup's equity agreements rely heavily on a well-drafted Stock Purchase Agreement, which balances legal protection and clarity for all parties involved.

Shareholder Agreement Basics

Equity agreements are crucial for startups to define ownership and protect shareholder interests. Understanding the key documents involved helps in establishing clear rights and responsibilities among founders and investors.

- Shareholder Agreement - Outlines the rights, obligations, and protections for shareholders, ensuring aligned interests and decision-making processes.

- Equity Issuance Documents - Include stock purchase agreements and subscription agreements that specify terms of share allocation and price.

- Founders' Agreement - Details the initial ownership structure, vesting schedules, and dispute resolution mechanisms among founding members.

Having these documents in place creates a transparent framework for managing equity and avoiding future conflicts.

Employee Stock Option Plan (ESOP) Documents

Employee Stock Option Plan (ESOP) documents are essential for startups to formalize equity agreements with employees. Key documents include the ESOP plan agreement, grant letters specifying option details, and board resolutions approving the plan. These papers outline the terms, vesting schedules, and exercise rights, ensuring legal compliance and clear communication.

Vesting Schedule Clauses

Equity agreements for startups require precise documentation to protect all parties involved. Your agreement must clearly outline the vesting schedule clauses to ensure fair distribution of ownership over time.

- Equity Agreement - This document details the ownership percentage and the terms under which equity vests to founders or employees.

- Vesting Schedule Clause - Defines the timeline and conditions under which equity awards become fully owned by the recipient.

- Stock Restriction Agreement - Specifies restrictions on stock transfer or sale tied to the vesting schedule to maintain control within the startup.

Right of First Refusal and Co-Sale Agreements

Equity agreements in startups require specific legal documents to protect stakeholder interests and govern share transfers. Key among these are the Right of First Refusal and Co-Sale Agreements, which regulate how shares can be sold or transferred.

- Right of First Refusal (ROFR) - This document grants existing shareholders the priority to purchase shares before they are sold to an outside party, ensuring control over ownership changes.

- Co-Sale Agreement - This agreement allows minority shareholders to sell their shares alongside majority shareholders, providing protection and liquidity options.

- Equity Agreement Documentation - Properly drafted agreements clarify the terms of share transfers, rights, and obligations, reducing disputes and preserving startup value.

Intellectual Property Assignment Agreements

What documents does a startup need for equity agreements regarding intellectual property? Intellectual Property Assignment Agreements are crucial to ensure that all creations and innovations developed by founders and employees are legally owned by the startup. These agreements clearly transfer ownership of patents, trademarks, copyrights, and trade secrets to the company, protecting its equity structure and future value.

What Documents Does a Startup Need for Equity Agreements? Infographic