To file for probate in California, essential documents include the original will, if available, and a certified copy of the decedent's death certificate. The petitioner must complete and submit the probate petition form along with a Notice of Petition to Administer Estate. Additional paperwork may involve an inventory and appraisal of the estate's assets, as well as creditor claims and court filings depending on the case complexity.

What Documents Are Needed for Probate in California?

| Number | Name | Description |

|---|---|---|

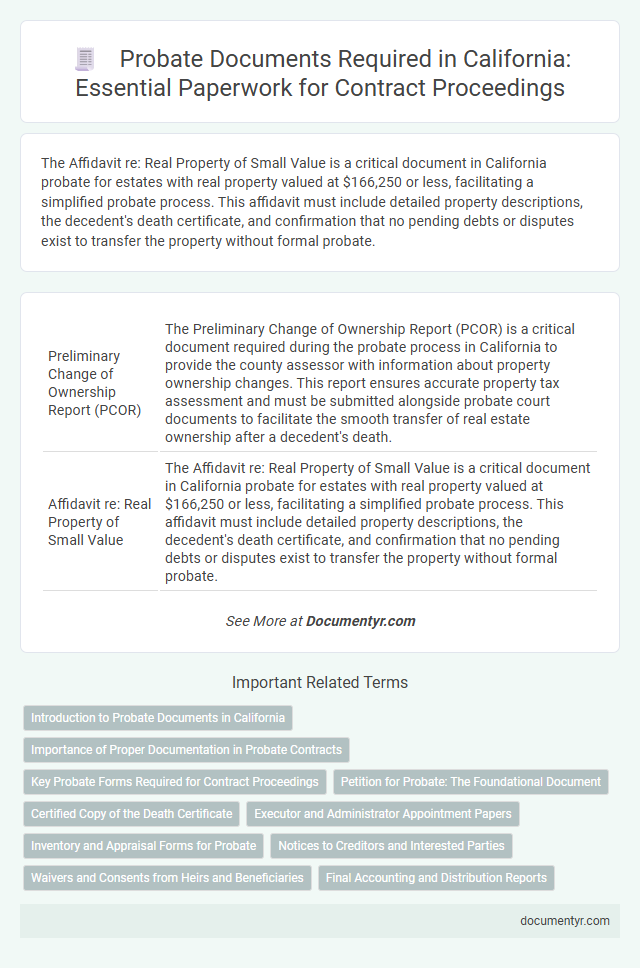

| 1 | Preliminary Change of Ownership Report (PCOR) | The Preliminary Change of Ownership Report (PCOR) is a critical document required during the probate process in California to provide the county assessor with information about property ownership changes. This report ensures accurate property tax assessment and must be submitted alongside probate court documents to facilitate the smooth transfer of real estate ownership after a decedent's death. |

| 2 | Affidavit re: Real Property of Small Value | The Affidavit re: Real Property of Small Value is a critical document in California probate for estates with real property valued at $166,250 or less, facilitating a simplified probate process. This affidavit must include detailed property descriptions, the decedent's death certificate, and confirmation that no pending debts or disputes exist to transfer the property without formal probate. |

| 3 | Heggstad Petition Documentation | Heggstad Petition documentation in California probate requires a petition to establish the decedent's trust or transfer property without formal probate, including the original will, death certificate, and an affidavit detailing the assets and beneficiaries. Supporting documents such as a property deed, beneficiary statements, and proof of mailing to interested parties are crucial to validate the petition under California Probate Code Section 850 et seq. |

| 4 | Spousal Property Petition Packet | The Spousal Property Petition Packet in California probate requires crucial documents such as the Petition for Distribution of Property to Spouse or Registered Domestic Partner, a Notice of Hearing, and a Preliminary Declaration of Due Diligence. These forms facilitate the transfer of community and quasi-community property to the surviving spouse or domestic partner without formal probate proceedings. |

| 5 | Certified Letters Testamentary | Certified Letters Testamentary are essential legal documents issued by the California probate court that authorize an executor to manage and distribute a deceased person's estate. These letters serve as official proof of the executor's authority, enabling them to handle financial institutions, transfer assets, and settle debts during the probate process. |

| 6 | Notice of Proposed Action (NPA) | The Notice of Proposed Action (NPA) is a critical document in California probate proceedings, required to inform heirs, beneficiaries, and interested parties about actions the executor or administrator intends to take regarding the estate. This notice ensures transparency and provides a legal opportunity for objections or claims before court approval of estate transactions or distributions. |

| 7 | Inventory and Appraisal (DE-160/DE-161) | The Inventory and Appraisal forms (DE-160 and DE-161) are essential probate documents in California, detailing the deceased's assets and their appraised values. These forms must be filed with the court within 90 days of appointment to facilitate accurate estate valuation and distribution. |

| 8 | Waiver of Bond Application | The Waiver of Bond Application in California probate requires submitting the petition for probate, the decedent's original will, a death certificate, and the applicant's affidavit requesting bond waiver based on financial qualifications. Supporting documents such as proof of the estate's value, a completed bond application form, and a proposed order for the bond waiver are also essential for court approval. |

| 9 | Objection to Probate Distribution | Objection to probate distribution in California requires submitting formal documents such as a written objection specifying the grounds for disagreement, a petition to contest the proposed distribution, and supporting evidence like affidavits or relevant financial records. These documents must comply with California Probate Code sections and be filed within the statutory timeframes to challenge the executor's allocation of estate assets effectively. |

| 10 | Digital Asset Access Authorization Form | The Digital Asset Access Authorization Form is essential for probate in California, granting fiduciaries legal access to a decedent's online accounts and digital assets. This form ensures proper management and distribution of emails, social media profiles, cryptocurrency wallets, and other digital property during estate administration. |

Introduction to Probate Documents in California

Probate in California requires specific legal documents to ensure the proper administration of an estate. Understanding the necessary probate documents is essential for a smooth court process.

- Petition for Probate - This document initiates the probate case and requests the court to appoint an executor or administrator.

- Will and Codicils - The original will and any amendments must be filed to verify the decedent's testamentary intentions.

- Inventory and Appraisal - A detailed list and valuation of the estate's assets must be submitted to the court for transparent estate management.

Importance of Proper Documentation in Probate Contracts

| Document | Description | Importance in Probate Contracts |

|---|---|---|

| Original Will | The legally valid will of the deceased person, outlining the distribution of assets. | Serves as the primary document guiding probate proceedings and contract enforcement. |

| Death Certificate | Official certificate confirming the death of the decedent issued by local authorities. | Validates the start of the probate process and legal acknowledgment of death. |

| Petition for Probate | Formal application submitted to the probate court to begin estate administration. | Establishes legal authority to manage estate contracts and execute the will. |

| Letters Testamentary or Letters of Administration | Court-issued documents granting the executor or administrator the power to act on behalf of the estate. | Ensure the executor's authority to enter into and enforce contracts related to estate assets. |

| Inventory and Appraisal | Detailed list and valuation of the decedent's assets prepared under court supervision. | Provides accurate asset information crucial for contract terms and estate distribution. |

| Creditor Claims | Documentation of outstanding debts and claims against the estate. | Protects estate by addressing contractual obligations and preventing unauthorized claims. |

| Final Accounting | Detailed financial record of estate administration activities, including contracts executed. | Establishes transparency and legal compliance in handling estate contracts and assets. |

Key Probate Forms Required for Contract Proceedings

Probate in California requires specific legal documents to ensure valid contract proceedings related to the estate administration. Proper filing of key probate forms is essential for court approval and distribution of assets.

- Petition for Probate (Form DE-111) - Initiates the probate process by formally requesting the court to appoint an executor or administrator for the estate.

- Notice of Petition to Administer Estate (Form DE-121) - Informs heirs, beneficiaries, and creditors about the probate proceeding and upcoming hearings.

- Letters Testamentary or Letters of Administration - Official documents issued by the court authorizing the executor or administrator to manage and settle the estate contracts and obligations.

Petition for Probate: The Foundational Document

In California probate cases, the Petition for Probate serves as the foundational document initiating the legal process. This document is essential to validate the will and appoint an executor or administrator to manage the estate.

- Petition for Probate - This is the primary document filed with the court to begin probate proceedings and establish legal authority over the estate.

- Certified Copy of the Death Certificate - Required to verify the decedent's death and is submitted along with the petition.

- Original Will, If Available - The court reviews the original will to confirm the decedent's intentions and appoint the executor.

Your timely submission of these documents ensures the probate process starts smoothly and complies with California state requirements.

Certified Copy of the Death Certificate

When handling probate in California, a Certified Copy of the Death Certificate is a crucial document needed to initiate the process. This official certificate serves as proof of the decedent's death and is required by the court to validate the probate case. You must obtain multiple certified copies from the county where the death occurred to ensure that all legal and financial institutions involved receive accurate documentation.

Executor and Administrator Appointment Papers

For probate in California, essential documents include the Executor or Administrator appointment papers, which grant legal authority to manage the deceased's estate. These papers, typically issued by the probate court, confirm your role in administering the estate and ensure compliance with state laws. Providing accurate appointment documents is crucial for a smooth probate process and to avoid legal complications.

Inventory and Appraisal Forms for Probate

In California probate cases, Inventory and Appraisal forms are essential documents that provide a detailed account of the decedent's estate assets. These forms must be submitted to the court to facilitate an accurate valuation of property for probate purposes.

The Inventory and Appraisal lists all real and personal property owned by the decedent at the time of death, along with its estimated value. You are required to file these forms within 90 days after your appointment as executor or administrator to ensure compliance with California probate laws.

Notices to Creditors and Interested Parties

Probate in California requires specific documents to ensure proper legal processing, including Notices to Creditors and Interested Parties. These notices serve to inform all relevant individuals about the probate proceedings.

Notices to Creditors must be published in a local newspaper and mailed to known creditors to allow them to make claims against the estate. Interested Parties, such as heirs and beneficiaries, also receive formal notices to protect their rights. Ensuring timely and accurate notice is crucial for a smooth probate process in California.

Waivers and Consents from Heirs and Beneficiaries

What waivers and consents from heirs and beneficiaries are required for probate in California? Waivers and consents help simplify the probate process by indicating that heirs or beneficiaries agree to waive certain legal rights. These documents typically include signed waivers of bond, consents to probate, and affidavits of heirship.

What Documents Are Needed for Probate in California? Infographic