Small businesses need to provide a completed Form SS-4, which includes the legal name, address, and type of entity, to apply for an EIN. Additionally, the responsible party's Social Security Number or Individual Taxpayer Identification Number is required for identification. Supporting documents such as articles of incorporation or a partnership agreement may be necessary to verify the business structure.

What Documents Does a Small Business Need to Apply for an EIN?

| Number | Name | Description |

|---|---|---|

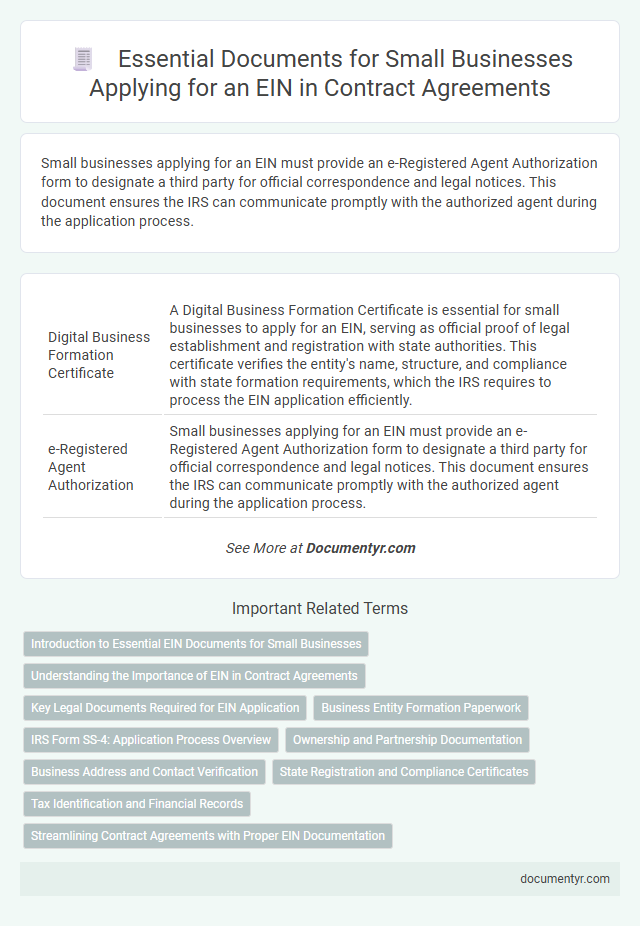

| 1 | Digital Business Formation Certificate | A Digital Business Formation Certificate is essential for small businesses to apply for an EIN, serving as official proof of legal establishment and registration with state authorities. This certificate verifies the entity's name, structure, and compliance with state formation requirements, which the IRS requires to process the EIN application efficiently. |

| 2 | e-Registered Agent Authorization | Small businesses applying for an EIN must provide an e-Registered Agent Authorization form to designate a third party for official correspondence and legal notices. This document ensures the IRS can communicate promptly with the authorized agent during the application process. |

| 3 | Virtual Principal Office Proof | A small business applying for an EIN must provide documentation establishing the virtual principal office's legitimacy, such as a lease agreement, business registration certificate, or a utility bill showing the business address. IRS requirements emphasize verifying the physical location tied to the EIN application to ensure compliance and avoid fraud. |

| 4 | Digital Operating Agreement | A small business applying for an EIN typically needs a Digital Operating Agreement that clearly outlines ownership structure and management responsibilities to establish legal and operational legitimacy. This document is essential for confirming business authority during the IRS application process and ensuring accurate identification of the entity. |

| 5 | Cloud-Based Corporate Bylaws | Small businesses applying for an EIN must provide foundational documents like articles of incorporation, which can be supplemented by cloud-based corporate bylaws that streamline governance and ensure compliance with state regulations. Utilizing cloud-based corporate bylaws facilitates real-time updates, secure access, and easy sharing with the IRS and other relevant authorities during the EIN application process. |

| 6 | EIN Readiness Documentation Kit | A Small Business EIN Readiness Documentation Kit includes essential documents such as the completed Form SS-4, a valid business identification (such as Articles of Incorporation or a partnership agreement), and an IRS consent form if applicable. Having these documents prepared streamlines the EIN application process and ensures compliance with IRS requirements. |

| 7 | Sole Proprietor Identity Bundle | A small business applying for an EIN as a sole proprietor must provide a government-issued photo ID, such as a driver's license or passport, alongside their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). This identity bundle verifies the sole proprietor's personal information and supports the IRS in processing the EIN application accurately. |

| 8 | Blockchain Notarized LLC Resolution | A Blockchain Notarized LLC Resolution serves as a verified document demonstrating the authorization of a small business to apply for an EIN, providing immutable proof of the LLC members' consent. This notarized resolution enhances the credibility and security of the EIN application process by leveraging blockchain technology for verification and record-keeping. |

| 9 | Digital Beneficial Ownership Declaration | A small business must submit a Digital Beneficial Ownership Declaration as part of the EIN application to verify the identities of individuals who directly or indirectly own 25% or more of the entity or exercise substantial control. This declaration ensures compliance with anti-money laundering regulations and enhances transparency in the IRS's record-keeping process. |

| 10 | Electronic Business Tax Classification Statement | Small businesses must submit an Electronic Business Tax Classification Statement when applying for an EIN to accurately classify their entity type for tax purposes. This document ensures the IRS correctly identifies the business structure, facilitating compliance with federal tax regulations. |

Introduction to Essential EIN Documents for Small Businesses

Applying for an Employer Identification Number (EIN) is a crucial step for small businesses to establish their federal tax identity. Essential documents are necessary to complete the EIN application accurately and efficiently. Understanding these documents helps streamline the process and ensures compliance with IRS requirements.

Understanding the Importance of EIN in Contract Agreements

Obtaining an Employer Identification Number (EIN) is essential for small businesses to establish legal and financial credibility. The EIN serves as a unique identifier in contract agreements, ensuring clear business identity and compliance with tax regulations.

- Form SS-4 Application - This form is required to apply for an EIN and provides the IRS with necessary business details.

- Valid Identification - A government-issued ID of the responsible party is needed to verify the applicant's identity during the EIN application process.

- Legal Business Structure Documents - Articles of incorporation, partnership agreements, or sole proprietorship registrations help confirm the legal status of the business applying for the EIN.

Key Legal Documents Required for EIN Application

Applying for an Employer Identification Number (EIN) requires specific legal documents to verify your small business's identity and structure. Key documents include the Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) of the responsible party, along with the business formation documents such as Articles of Incorporation, Partnership Agreements, or a DBA certificate. The IRS also requires the completed Form SS-4, which identifies the business entity and its purpose.

Business Entity Formation Paperwork

Business entity formation paperwork is essential when applying for an Employer Identification Number (EIN) for your small business. These documents verify your business structure and legal existence.

Common formation documents include Articles of Incorporation, Articles of Organization, and Partnership Agreements, depending on your business type. Providing these ensures the IRS correctly identifies your business entity for tax purposes.

IRS Form SS-4: Application Process Overview

| IRS Form SS-4: Application Process Overview for EIN | |

|---|---|

| Purpose of Form SS-4 | Form SS-4 is used by small businesses to apply for an Employer Identification Number (EIN) required for tax administration and business identification. |

| Required Information | Business name, trade name, type of entity, reason for applying, principal officer's details, and business start date are essential fields. |

| Application Methods | Form SS-4 can be completed online through the IRS EIN Assistant, submitted via fax, or mailed to the IRS depending on preference and urgency. |

| Online Application | Online submission is the fastest option, providing immediate EIN issuance once the form is completed accurately. |

| Fax Submission | Faxing Form SS-4 typically results in EIN issuance within four business days after IRS receives the application. |

| Mail Submission | Processing by mail usually requires four to six weeks; this method is suitable for applicants not in a rush. |

| After Completion | Upon receiving the EIN, your small business will be officially recognized for tax purposes, enabling account setup with banks, hiring employees, and fulfilling legal requirements. |

Ownership and Partnership Documentation

Small businesses must provide specific ownership and partnership documents when applying for an Employer Identification Number (EIN). These documents verify the legal structure and ownership details required by the IRS.

- Ownership Documentation - Legal proof of business ownership such as Articles of Incorporation for corporations or a Certificate of Formation for LLCs is necessary to establish the entity's legitimacy.

- Partnership Agreement - A formal partnership agreement outlining the roles, responsibilities, and ownership percentages of each partner is essential for partnerships applying for an EIN.

- Social Security Numbers or ITINs - Identification numbers of owners or partners must be provided to link the EIN application to responsible individuals.

Business Address and Contact Verification

What documents are required to verify the business address and contact information when applying for an EIN? The IRS mandates clear proof of the physical business address, such as a utility bill or lease agreement. A business phone number or email address must also be provided to complete the EIN application process.

State Registration and Compliance Certificates

When applying for an EIN, your small business may need state registration documents to verify legal formation and business name registration. These documents demonstrate your business compliance with state laws and are often required during the application process.

Compliance certificates such as sales tax permits or professional licenses confirm your adherence to industry-specific regulations. Providing these certificates ensures your business meets all state requirements before receiving an EIN.

Tax Identification and Financial Records

Applying for an Employer Identification Number (EIN) requires specific tax identification and financial records to verify your small business's legitimacy. Proper documentation ensures smooth processing and compliance with IRS regulations.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - Required to establish the identity of the principal officer or owner applying for the EIN.

- Business Formation Documents - Articles of incorporation, partnership agreements, or LLC formation paperwork prove the legal existence of the business.

- Financial Information - Details such as the business's accounting basis and estimated number of employees support the IRS in classifying the business type.

Submitting accurate tax identification and financial records expedites the EIN application process for small businesses.

What Documents Does a Small Business Need to Apply for an EIN? Infographic