To apply for college financial aid through FAFSA, students need to gather key documents such as their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Parents of dependent students must also provide their financial information, including tax returns and bank statements. Having these documents ready ensures an accurate and timely FAFSA submission, maximizing potential aid opportunities.

What Documents are Required for College Financial Aid (FAFSA)?

| Number | Name | Description |

|---|---|---|

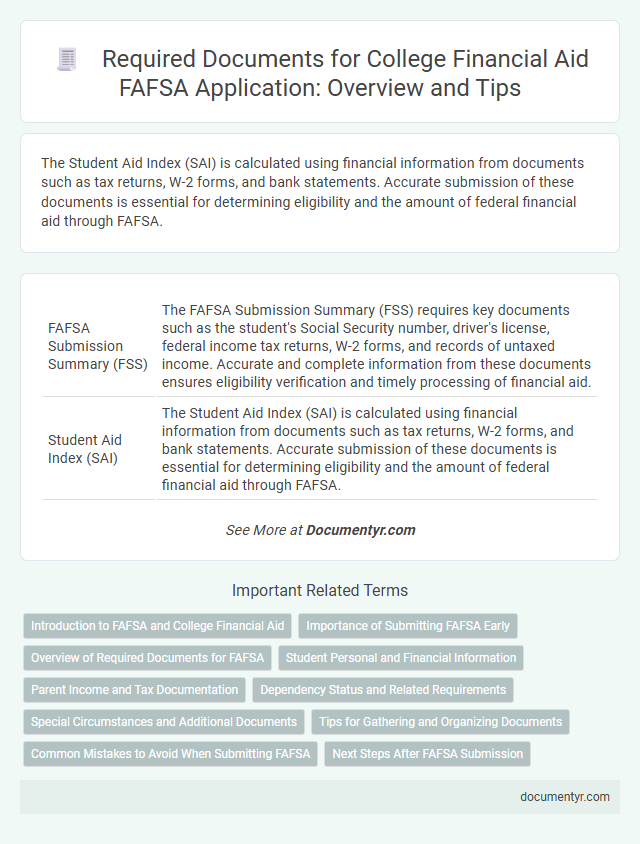

| 1 | FAFSA Submission Summary (FSS) | The FAFSA Submission Summary (FSS) requires key documents such as the student's Social Security number, driver's license, federal income tax returns, W-2 forms, and records of untaxed income. Accurate and complete information from these documents ensures eligibility verification and timely processing of financial aid. |

| 2 | Student Aid Index (SAI) | The Student Aid Index (SAI) is calculated using financial information from documents such as tax returns, W-2 forms, and bank statements. Accurate submission of these documents is essential for determining eligibility and the amount of federal financial aid through FAFSA. |

| 3 | IRS Data Retrieval Tool Confirmation | The IRS Data Retrieval Tool (IRS DRT) confirmation is a critical document for verifying income information directly from the IRS to complete the FAFSA accurately. This confirmation ensures the financial data submitted is authentic and prevents delays in processing college financial aid applications. |

| 4 | Asset Protection Allowance Documentation | Asset Protection Allowance documentation requires proof of assets such as bank statements, investment account summaries, and retirement account statements to accurately calculate the protected asset amount on the FAFSA. These documents ensure that the allowance reflects the student's and parents' actual financial resources, reducing the assessed contribution toward college costs. |

| 5 | Non-Tax Filer Statement | Non-tax filers must provide a signed Non-Tax Filer Statement confirming they did not earn income from work and are not required to file a federal tax return. Supporting documentation, such as W-2 forms or proof of income, should accompany this statement to verify the financial situation for accurate FAFSA processing. |

| 6 | Parent PLUS Loan Award Letter | The Parent PLUS Loan Award Letter is essential for securing federal loans through FAFSA, detailing the approved loan amount and terms for parents borrowing on behalf of their dependent students. This document serves as official confirmation from the lender, required for completing the loan acceptance process and disbursement of funds. |

| 7 | Financial Aid Verification Worksheet | The Financial Aid Verification Worksheet requires documents such as the student's and parents' tax returns, W-2 forms, and proof of income to verify reported financial information. Accurate submission of these documents ensures the Department of Education can confirm eligibility and process the FAFSA for financial aid awards. |

| 8 | Special Circumstances Appeal Letter | A Special Circumstances Appeal Letter for FAFSA financial aid must include detailed explanations and supporting documents such as recent tax returns, pay stubs, letters from employers, medical bills, or divorce decrees to verify changes in financial status. This appeal provides the financial aid office with critical information beyond standard FAFSA data to reconsider aid eligibility based on unique hardships. |

| 9 | Dependency Override Documentation | Dependency override documentation requires official records such as court orders, letters from social workers, or statements from clergy verifying situations like abuse, neglect, or extraordinary circumstances that justify independent status on the FAFSA. These documents must be submitted to the college's financial aid office to reevaluate dependency status and ensure accurate financial aid eligibility. |

| 10 | Selective Service Registration Status | Selective Service Registration status is required for males aged 18 to 25 when applying for FAFSA to determine eligibility for federal financial aid. Applicants must provide proof of registration or evidence of exemption to comply with federal regulations and secure aid consideration. |

Introduction to FAFSA and College Financial Aid

The Free Application for Federal Student Aid (FAFSA) is a crucial step for students seeking financial aid for college. It determines eligibility for federal grants, loans, and work-study programs.

Submitting accurate documents is essential to complete the FAFSA application successfully. These documents verify income, tax information, and family financial status to assess aid eligibility.

Importance of Submitting FAFSA Early

Submitting your FAFSA early is crucial for maximizing your chances of receiving college financial aid. Many aid programs distribute funds on a first-come, first-served basis, so delays can reduce available resources.

The documents required for FAFSA include your Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Parents' financial information is also necessary if you are a dependent student. Having these documents ready before starting the application helps ensure timely submission and increases your eligibility for aid.

Overview of Required Documents for FAFSA

Applying for college financial aid through FAFSA requires gathering several key documents to complete the process accurately. Understanding the necessary paperwork helps streamline your application and ensures timely submission.

- Social Security Number - Needed to verify identity and eligibility for federal aid.

- Federal Income Tax Returns - Required to report income information from you and your parents, typically the previous year's tax documents.

- Bank Statements and Records of Investments - Used to provide details on assets that may affect financial aid eligibility.

Student Personal and Financial Information

Submitting accurate personal and financial information is essential for completing the FAFSA application. Having the correct documents ready ensures a smoother financial aid process.

- Social Security Number - Required to verify identity and eligibility for federal aid.

- Federal Income Tax Returns - Needed to report income from you and, if applicable, your parents for calculating aid eligibility.

- Bank Statements and Investment Records - Used to provide details about assets and savings that impact financial aid decisions.

Parent Income and Tax Documentation

For college financial aid through FAFSA, parent income and tax documentation are essential. These documents verify your family's financial situation to determine eligibility.

Required documents include most recent federal income tax returns, W-2 forms, and records of any untaxed income. Collecting these papers ensures accurate reporting of parent income on the FAFSA application.

Dependency Status and Related Requirements

What documents are required to determine dependency status for FAFSA? The FAFSA application requires specific documentation to verify your dependency status, which affects your eligibility for federal financial aid. Typically, proof of birth date, marital status, and parental information is essential to establish whether you are a dependent or independent student.

Special Circumstances and Additional Documents

Applying for college financial aid through FAFSA requires several standard documents, but special circumstances often demand additional paperwork. Understanding these requirements ensures a smoother application process.

- Proof of Identity - A valid government-issued ID such as a driver's license or passport is necessary to verify your identity.

- Income Verification - Tax returns, W-2 forms, or recent pay stubs are required to report accurate financial information.

- Documentation of Special Circumstances - For unique situations like job loss, divorce, or disability, additional letters, court documents, or benefit statements must be submitted.

Gathering all relevant documents ahead of time helps avoid delays and supports a complete FAFSA submission.

Tips for Gathering and Organizing Documents

Gather essential documents such as your Social Security number, federal income tax returns, W-2 forms, and bank statements before starting your FAFSA application. Organize these documents in a dedicated folder to ensure easy access and prevent misplacement during the application process. Keeping digital and physical copies can save time and reduce stress when updating or verifying your financial information.

Common Mistakes to Avoid When Submitting FAFSA

| Document | Description | Common Mistakes to Avoid |

|---|---|---|

| Social Security Number (SSN) | Required to verify identity and citizenship status. | Entering an incorrect SSN or mistyping digits leads to application rejection or delays. |

| Federal Income Tax Returns | Used to determine Expected Family Contribution (EFC). | Submitting outdated or incorrect tax information results in inaccurate aid assessment. Avoid mixing tax years. |

| W-2 Forms and Other Income Records | Proof of income from employment and other earnings. | Failing to report all income sources or losing W-2s causes application errors. |

| Bank Statements | Shows current cash savings and assets. | Not updating bank information or omitting accounts can affect aid eligibility. |

| Records of Untaxed Income | Includes child support received and untaxed social security benefits. | Neglecting to report untaxed income leads to incomplete or inaccurate FAFSA submissions. |

| Driver's License | Optional; aids in identity verification. | Entering incorrect license numbers can complicate application verification. |

| Alien Registration Number (if applicable) | Needed for non-citizen applicants eligible for aid. | Ommiting or mistyping this number prevents application processing. |

| Dependency Status Documents | Proof of dependency helps determine financial responsibility. | Providing incomplete or outdated dependency documentation can affect aid decisions. |

| Student and Parent Tax Identification Numbers | Used to connect tax information between student and parents. | Mixing up student and parent tax IDs causes confusion and delays. |

| Legal Documents Related to Divorce or Separation | Establishes custodial parent for financial reporting. | Failing to submit legal custody papers when required can affect aid determination. |

What Documents are Required for College Financial Aid (FAFSA)? Infographic