VA home loan approval requires several key documents, including the Certificate of Eligibility (COE) that verifies military service. Lenders also need proof of income, such as pay stubs, W-2 forms, and tax returns, to assess financial stability. Credit reports and a completed loan application form are essential to evaluate creditworthiness and loan eligibility.

What Documents Are Needed for VA Home Loan Approval?

| Number | Name | Description |

|---|---|---|

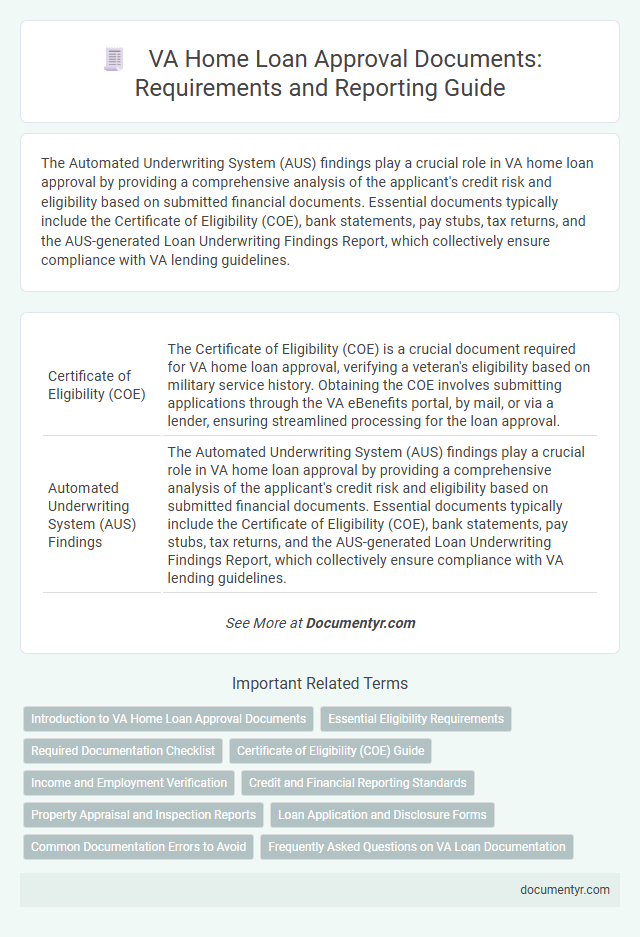

| 1 | Certificate of Eligibility (COE) | The Certificate of Eligibility (COE) is a crucial document required for VA home loan approval, verifying a veteran's eligibility based on military service history. Obtaining the COE involves submitting applications through the VA eBenefits portal, by mail, or via a lender, ensuring streamlined processing for the loan approval. |

| 2 | Automated Underwriting System (AUS) Findings | The Automated Underwriting System (AUS) findings play a crucial role in VA home loan approval by providing a comprehensive analysis of the applicant's credit risk and eligibility based on submitted financial documents. Essential documents typically include the Certificate of Eligibility (COE), bank statements, pay stubs, tax returns, and the AUS-generated Loan Underwriting Findings Report, which collectively ensure compliance with VA lending guidelines. |

| 3 | VA Residual Income Worksheet | The VA Residual Income Worksheet is crucial for VA home loan approval, as it calculates the borrower's remaining income after major expenses, ensuring financial stability. Lenders require this document along with proof of income, credit history, and the Certificate of Eligibility to verify eligibility and repayment ability. |

| 4 | Statement of Service (Active Duty) | The Statement of Service for active duty is a critical document required for VA home loan approval, verifying current military status and service dates directly from the Department of Defense. This document ensures veteran eligibility and supports the loan application process by confirming active duty service. |

| 5 | VA Form 26-1880 | VA Form 26-1880, the Request for a Certificate of Eligibility (COE), is a crucial document required to verify a veteran's eligibility for a VA home loan. This form must be submitted to the Department of Veterans Affairs to obtain the COE, which lenders use to approve the VA home loan application. |

| 6 | Non-Borrowing Spouse Credit Authorization | Non-borrowing spouse credit authorization requires a signed form allowing the lender to access the spouse's credit report without obligating them to the loan, ensuring accurate assessment of the veteran's combined financial profile. This document is crucial for VA home loan approval when the non-borrowing spouse's income or credit impacts the loan evaluation. |

| 7 | Verification of VA Disability Compensation | Verification of VA disability compensation requires submitting a Disability Award Letter or VA Form 21-526EZ to confirm eligibility and the compensation amount. Lenders use this documentation to assess income stability and verify that the borrower meets VA loan benefit criteria. |

| 8 | Tri-Merged Credit Report | A Tri-Merged Credit Report, combining credit data from Equifax, Experian, and TransUnion, is crucial for VA home loan approval as it provides a comprehensive view of the applicant's creditworthiness, debt history, and payment patterns. Lenders rely on this report to assess risk, verify financial stability, and ensure eligibility for the VA loan program. |

| 9 | IRRRL Entitlement Form | The IRRRL Entitlement Form is essential for VA home loan approval, as it verifies the borrower's eligibility and streamlines the refinancing process under the Interest Rate Reduction Refinance Loan program. Lenders require this form along with the Certificate of Eligibility, proof of income, and credit documentation to ensure compliance with VA guidelines. |

| 10 | VA Funding Fee Exemption Letter | The VA funding fee exemption letter is a critical document required for VA home loan approval, verifying a veteran's eligibility for exemption from the funding fee based on service-connected disability or other qualifying factors. Lenders use this letter to process the loan without charging the VA funding fee, streamlining the approval process and reducing the overall loan cost. |

Introduction to VA Home Loan Approval Documents

What documents are essential for VA home loan approval? Understanding the necessary paperwork streamlines the loan application process. These documents verify eligibility and financial stability for VA-backed home loans.

Essential Eligibility Requirements

To obtain VA home loan approval, applicants must provide specific documents demonstrating eligibility and financial stability. These documents support the verification of veteran status, income, and creditworthiness essential for loan qualification.

- Certificate of Eligibility (COE) - Confirms the borrower's entitlement to a VA home loan based on military service.

- Proof of Income - Includes recent pay stubs, W-2 forms, or tax returns establishing stable income.

- Credit Report - Provides a detailed history of credit usage and repayment to assess loan risk.

Submitting these essential eligibility documents ensures the VA loan lender can accurately evaluate the borrower's qualification.

Required Documentation Checklist

Obtaining a VA home loan approval requires submitting specific documents to verify eligibility and financial stability. Proper organization of these documents ensures a smooth and efficient loan processing experience.

- Certificate of Eligibility (COE) - Confirms the borrower's eligibility for a VA loan based on military service records.

- Credit Report - Provides the lender with the borrower's credit history and score for assessing financial reliability.

- Income Verification - Includes recent pay stubs, tax returns, and W-2 forms to demonstrate stable and sufficient income levels.

- Employment Verification - Confirms current employment status and job stability through employer contact or written statements.

- VA Loan Application (Form 26-1880) - Official form required to initiate the loan process and request the COE.

- Bank Statements - Shows available assets and ability to cover closing costs and reserves if necessary.

Certificate of Eligibility (COE) Guide

| Document | Description | Purpose |

|---|---|---|

| Certificate of Eligibility (COE) | The COE confirms eligibility for the VA home loan program. It is issued by the Department of Veterans Affairs based on military service records. | Proves your entitlement to VA loan benefits, a critical step in loan approval. |

| Proof of Military Service | Documents such as DD Form 214 or a Statement of Service for active duty personnel. | Supports the application for the COE by verifying service history. |

| Credit Report | A detailed credit history from credit bureaus. | Assesses financial responsibility and creditworthiness for loan qualification. |

| Income Verification | Pay stubs, tax returns, or W-2 forms. | Confirms the ability to repay the loan by verifying steady income. |

| Purchase Agreement | A contract between buyer and seller outlining the terms of the home sale. | Required to process VA loan funding and finalize approval. |

| Appraisal Report | Assessment of the home's value conducted by a VA-approved appraiser. | Ensures the property meets VA minimum property requirements and supports loan amount. |

Income and Employment Verification

Income and employment verification are critical components for VA home loan approval. Lenders require proof to ensure you have a stable income to meet mortgage obligations.

Documents such as recent pay stubs, W-2 forms, and tax returns provide evidence of your earnings. Verification letters from employers may also be requested to confirm job status and income consistency.

Credit and Financial Reporting Standards

VA home loan approval requires comprehensive credit and financial documentation to verify the borrower's eligibility and repayment ability. Lenders prioritize accurate credit reports adhering to standard reporting guidelines to assess debt-to-income ratios and creditworthiness.

Key documents include credit reports from major bureaus, recent bank statements, and proof of income such as W-2s or tax returns. Compliance with financial reporting standards ensures transparent evaluation of the borrower's fiscal stability, facilitating smooth VA loan approval.

Property Appraisal and Inspection Reports

Property appraisal and inspection reports are essential documents for VA home loan approval. The appraisal verifies the property's market value and ensures it meets the VA's minimum property requirements. Your lender requires these reports to confirm the home's condition and value before finalizing the loan.

Loan Application and Disclosure Forms

Loan application and disclosure forms are essential documents required for VA home loan approval. These forms include the Uniform Residential Loan Application (URLA) and the VA-specific Loan Certificate of Eligibility (COE). They provide detailed information about your financial status, employment history, and loan terms to ensure eligibility and transparency throughout the approval process.

Common Documentation Errors to Avoid

Applicants seeking VA home loan approval must provide specific documents to verify eligibility and financial stability. Commonly required paperwork includes the Certificate of Eligibility (COE), proof of income, credit history, and property appraisal reports.

Errors in documentation can delay approval or cause application denial. Common mistakes include submitting expired COEs, incomplete income statements, or inconsistent financial information. Ensuring all documents are current, accurate, and thoroughly reviewed helps prevent avoidable setbacks in the VA loan process.

What Documents Are Needed for VA Home Loan Approval? Infographic