Small businesses seeking an SBA loan must prepare key documents including a detailed business plan, financial statements such as profit and loss statements, balance sheets, and cash flow projections. Personal and business tax returns, bank statements, and legal documents like business licenses and leases are also essential. These documents provide the SBA with a comprehensive view of the business's financial health and operational structure, increasing the likelihood of loan approval.

What Documents Does a Small Business Need for an SBA Loan?

| Number | Name | Description |

|---|---|---|

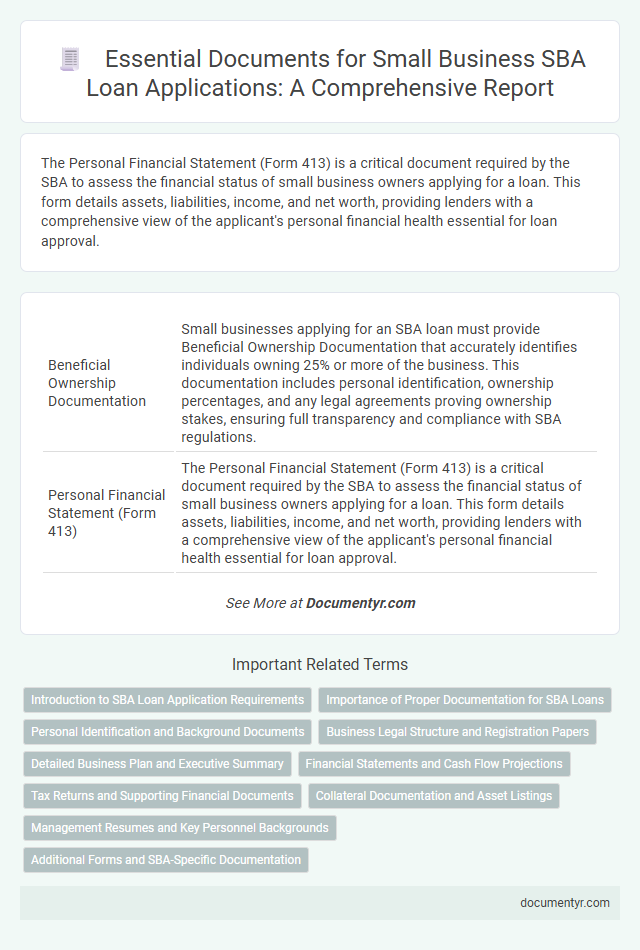

| 1 | Beneficial Ownership Documentation | Small businesses applying for an SBA loan must provide Beneficial Ownership Documentation that accurately identifies individuals owning 25% or more of the business. This documentation includes personal identification, ownership percentages, and any legal agreements proving ownership stakes, ensuring full transparency and compliance with SBA regulations. |

| 2 | Personal Financial Statement (Form 413) | The Personal Financial Statement (Form 413) is a critical document required by the SBA to assess the financial status of small business owners applying for a loan. This form details assets, liabilities, income, and net worth, providing lenders with a comprehensive view of the applicant's personal financial health essential for loan approval. |

| 3 | SBA Loan Application (Form 1919) | SBA Loan Application (Form 1919) is a critical document required for securing an SBA loan, detailing the borrower's business information, financial statements, and personal background. Completing Form 1919 accurately ensures compliance with SBA guidelines, expediting the loan approval process for small businesses. |

| 4 | Debt Schedule Analysis | A comprehensive debt schedule analyzing current liabilities, including outstanding loans, credit lines, and repayment terms, is critical for SBA loan approval to demonstrate financial stability and repayment capacity. Detailed documentation should include itemized debt descriptions, monthly payment amounts, interest rates, and maturity dates to provide a clear picture of the business's financial obligations. |

| 5 | Business Debt Reconciliation Report | A Business Debt Reconciliation Report is essential for an SBA loan application as it provides a detailed summary of all outstanding debts, payment histories, and creditor information, allowing the SBA to assess the borrower's financial obligations accurately. This report ensures transparency and helps verify the business's ability to manage existing debt while determining eligibility for loan approval. |

| 6 | EIDL Advance Disclosure | Small businesses applying for an SBA loan must provide an EIDL Advance Disclosure, detailing any COVID-19 Economic Injury Disaster Loan advances received to ensure proper loan eligibility and avoid duplicate benefits. This disclosure typically includes the amount received, date of disbursement, and uses of the advance funds. |

| 7 | Organizational Chart with Ownership Percentages | An organizational chart with ownership percentages is essential for an SBA loan application, clearly outlining the company's structure and the specific equity held by each owner. This document provides the SBA with transparency on decision-making authority and financial responsibilities, ensuring compliance with loan qualification requirements. |

| 8 | Trailing Twelve Months (TTM) Financials | Trailing Twelve Months (TTM) financial statements, including comprehensive profit and loss reports, balance sheets, and cash flow statements, provide a detailed view of a small business's recent financial performance critical for securing an SBA loan. These documents demonstrate ongoing revenue trends and expense management, enabling lenders to assess the business's current financial health and repayment ability accurately. |

| 9 | Digital Tax Filing Confirmation | Small businesses applying for an SBA loan must provide a Digital Tax Filing Confirmation as proof of timely and accurate tax submissions, ensuring compliance with federal regulations. This document verifies the business's financial history and supports the loan approval process by confirming tax obligations have been met. |

| 10 | COVID-19 Impact Statement | A COVID-19 Impact Statement details how the pandemic affected a small business's operations, revenue, and financial health, demonstrating the necessity for SBA loan assistance. This document supports loan applications by providing critical context on revenue loss, supply chain disruptions, or operational challenges caused by COVID-19. |

Introduction to SBA Loan Application Requirements

Applying for an SBA loan requires specific documentation to demonstrate the financial health and legitimacy of your small business. Understanding these requirements helps streamline the application process and increases the chances of loan approval.

- Business Financial Statements - These include profit and loss statements, balance sheets, and cash flow statements that provide a clear picture of your business's financial status.

- Personal and Business Tax Returns - Lenders require recent tax returns to verify income and assess creditworthiness for both the business and the owner.

- Legal Documents - Essential documents such as business licenses, articles of incorporation, and loan application forms establish the legal identity and compliance of your business.

Importance of Proper Documentation for SBA Loans

Proper documentation is crucial for securing an SBA loan as it validates your business's financial health and operational history. Accurate and complete documents enhance the likelihood of loan approval and ensure compliance with SBA requirements.

- Business Financial Statements - These include income statements, balance sheets, and cash flow statements that demonstrate your company's financial stability.

- Tax Returns - Personal and business tax returns from the last three years provide a historical view of income and expenses, ensuring transparency for lenders.

- Ownership and Legal Documents - Articles of incorporation, business licenses, and ownership agreements confirm your legal authority to operate and apply for the loan.

Personal Identification and Background Documents

Small businesses seeking an SBA loan must prepare specific personal identification and background documents to verify identity and assess eligibility. These documents are critical for the SBA to conduct thorough background and credit checks.

- Valid Government-issued ID - This includes a driver's license or passport to confirm the identity of the business owner.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) - Required for credit checks and tax verification purposes.

- Background Authorization Forms - Signed documents that allow the SBA to conduct criminal and financial background checks.

Ensuring all personal identification and background documents are accurate and complete streamlines the SBA loan approval process.

Business Legal Structure and Registration Papers

Securing an SBA loan requires a thorough presentation of your business's legal structure and registration papers. These documents prove your business's legitimacy and eligibility for funding.

Key documents include articles of incorporation, partnership agreements, or sole proprietorship registration papers that clarify your business structure. Your business license or registration certificate confirms your company operates legally within your state. Lenders use these documents to verify your business identity and compliance with regulatory standards.

Detailed Business Plan and Executive Summary

| Document | Description | Purpose |

|---|---|---|

| Detailed Business Plan | A comprehensive document outlining the business goals, strategies, market analysis, competitive landscape, operational plan, and financial projections. It includes sections such as company description, product/service offerings, marketing strategy, management structure, and detailed financial forecasts covering income statements, cash flow, and balance sheets. | Provides the SBA with a clear understanding of the business model and the viability of the venture. Demonstrates the entrepreneur's preparedness, risk assessment, and ability to generate revenue, which supports loan approval decisions. |

| Executive Summary | A concise overview of the overall business plan highlighting key points such as business objectives, mission statement, target market, unique selling propositions, and summary of financial needs. Typically 1-2 pages in length, it encapsulates the essence of the business in a compelling and clear manner. | Captures the lender's attention, quickly conveying critical information that summarizes the business' purpose and loan request. Serves as the first impression and encourages further review of the full business plan. |

Financial Statements and Cash Flow Projections

Small businesses seeking an SBA loan must provide accurate financial statements, including balance sheets, income statements, and cash flow statements, to demonstrate their financial health. Detailed cash flow projections are essential to show the business's ability to repay the loan and manage future expenses. These documents help lenders assess the risk and viability of the loan application effectively.

Tax Returns and Supporting Financial Documents

Tax returns are a critical component of the SBA loan application process for small businesses. They provide verified proof of income, business revenue, and financial stability over several years.

Supporting financial documents, such as balance sheets, profit and loss statements, and cash flow statements, offer a detailed view of your business's financial health. These documents help lenders evaluate your ability to repay the loan and assess business performance trends.

Collateral Documentation and Asset Listings

What types of collateral documentation are required for an SBA loan? Collateral documentation must clearly prove ownership and value of assets pledged against the loan. This includes detailed records such as titles, deeds, and appraisals to support the loan application.

How important is an asset listing for securing an SBA loan? An asset listing provides a comprehensive inventory of business property and equipment used as collateral. Accurate and up-to-date asset listings strengthen the lender's confidence in the borrower's repayment ability.

Management Resumes and Key Personnel Backgrounds

Management resumes are critical documents for an SBA loan application as they demonstrate the leadership team's experience and qualifications. Detailed backgrounds of key personnel highlight the skills and industry expertise essential for business success. These documents provide lenders with confidence in the management's ability to execute the business plan effectively.

What Documents Does a Small Business Need for an SBA Loan? Infographic