To file an unemployment benefit claim, essential documents include a valid identification card, Social Security number, and recent pay stubs or proof of earnings. Employment history records such as employer addresses and dates of employment help verify eligibility. Additionally, bank account details may be required for direct deposit of benefits.

What Documents are Required for Unemployment Benefit Claims?

| Number | Name | Description |

|---|---|---|

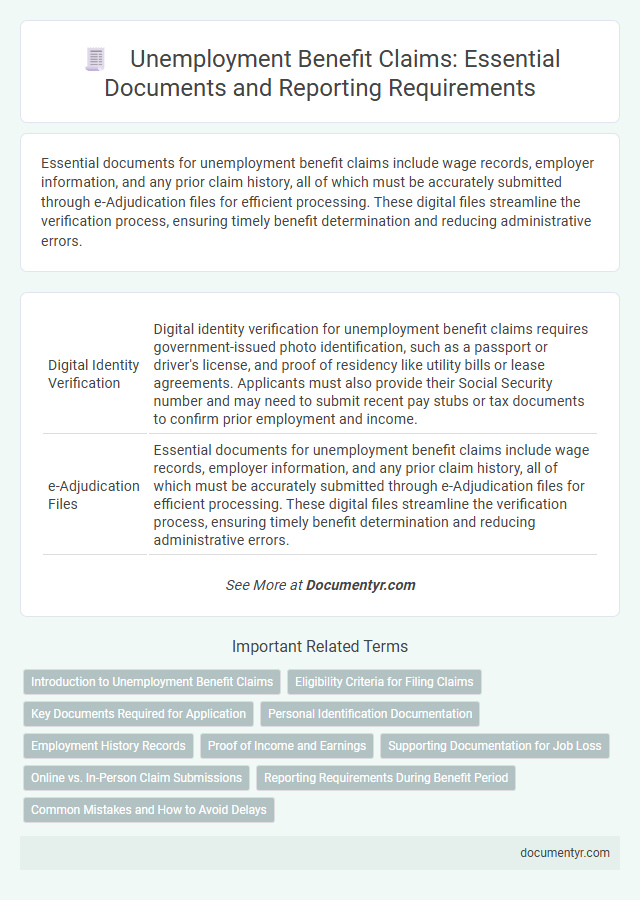

| 1 | Digital Identity Verification | Digital identity verification for unemployment benefit claims requires government-issued photo identification, such as a passport or driver's license, and proof of residency like utility bills or lease agreements. Applicants must also provide their Social Security number and may need to submit recent pay stubs or tax documents to confirm prior employment and income. |

| 2 | e-Adjudication Files | Essential documents for unemployment benefit claims include wage records, employer information, and any prior claim history, all of which must be accurately submitted through e-Adjudication files for efficient processing. These digital files streamline the verification process, ensuring timely benefit determination and reducing administrative errors. |

| 3 | Biometric Authorization Forms | Biometric authorization forms are essential for verifying identity in unemployment benefit claims, ensuring secure and accurate processing of applicant information. These documents typically include fingerprints, facial recognition data, or other biometric identifiers required by state labor departments to prevent fraud and streamline claim approvals. |

| 4 | Cross-State Wage Transcript | A Cross-State Wage Transcript is a crucial document for unemployment benefit claims, especially when applicants have worked in multiple states and need to consolidate their earnings. This transcript provides the comprehensive wage history required by state unemployment agencies to accurately calculate benefit eligibility and amounts. |

| 5 | Pandemic Self-Attestation Letter | The Pandemic Self-Attestation Letter serves as critical documentation for unemployment benefit claims, verifying an individual's eligibility due to pandemic-related employment disruptions. Claimants must submit this letter alongside standard identification and employment records to satisfy state-specific requirements for processing benefits. |

| 6 | Remote Employment Proof | Proof of remote employment for unemployment benefit claims typically includes pay stubs, remote work agreements, and communication records confirming work performed from home. Additionally, documentation such as timesheets, digital work logs, and employer certification letter verifying remote job duties strengthens the claim's validity. |

| 7 | AI-Generated Payroll Extract | Claimants must submit an AI-generated payroll extract verifying employment history, earnings, and tax withholdings to support unemployment benefit claims. This automated document enhances accuracy and expedites the validation process by providing detailed wage records directly from employer payroll systems. |

| 8 | Blockchain Employment Record | Blockchain employment records provide a secure and tamper-proof verification of work history, essential for accurately substantiating unemployment benefit claims. Integrating blockchain-verified documents with traditional identification and income proof streamlines the claim process and reduces fraud. |

| 9 | Gig Economy Earnings Summary | Unemployment benefit claims for gig economy workers require detailed earnings documentation, including transaction histories from freelance platforms, income summaries from payment processors like PayPal or Venmo, and tax documents such as 1099 forms. Providing accurate gig economy earnings summaries ensures eligibility verification and proper benefit calculation. |

| 10 | Work Search Log Upload | Claimants must upload a detailed Work Search Log to their unemployment benefit application, documenting all job search activities with dates, employer contacts, and outcomes. The uploaded log serves as essential proof of active employment seeking, ensuring compliance with state requirements for continued benefit eligibility. |

Introduction to Unemployment Benefit Claims

Unemployment benefit claims provide financial assistance to individuals who have lost their jobs involuntarily. Understanding the required documents is crucial for a smooth application process.

You need to gather personal identification, employment history, and proof of income to support your claim. These documents verify eligibility and help expedite the processing of benefits.

Eligibility Criteria for Filing Claims

To file an unemployment benefit claim, you need specific documents to verify your eligibility. These typically include proof of prior employment and identification.

Eligibility criteria require documentation such as your Social Security number, recent pay stubs, and a government-issued ID. Some states may ask for bank details for direct deposit setup. Accurate records of employment history enhance the claim process efficiency.

Key Documents Required for Application

Filing for unemployment benefits requires submitting specific documents to verify eligibility and employment history. Providing accurate paperwork ensures a smoother application process.

- Proof of Identity - Valid government-issued photo ID such as a driver's license or passport confirms your identity.

- Employment History - Recent pay stubs or W-2 forms show your work history and earnings for qualification purposes.

- Separation Notice - A letter from your employer detailing the reason for job separation supports the claim review.

Gathering these key documents ahead of time streamlines the unemployment benefits application.

Personal Identification Documentation

| Document Type | Description | Purpose | Examples |

|---|---|---|---|

| Government-Issued Photo ID | Official document that verifies identity through personal photo and details | Confirms claimant's identity to prevent fraud and ensure eligibility | Driver's License, State ID Card, Passport |

| Social Security Card | Card containing the Social Security Number (SSN) issued by the government | Verifies social security number for claim processing and records matching | Physical Social Security Card, Official SSN printout from the Social Security Administration |

| Birth Certificate | Certified record of birth issued by a government authority | Used as proof of identity and age when other photo IDs are unavailable | State or County-issued Birth Certificate |

| Residency Proof | Documents that prove current residency within the state or claim jurisdiction | Establishes residency eligibility for state-specific unemployment benefits | Utility Bills, Lease Agreements, Bank Statements |

| Immigration Status Documents | Documentation verifying legal status for non-citizens | Confirm eligibility for unemployment benefits under immigration laws | Permanent Resident Card (Green Card), Employment Authorization Document (EAD), Visa |

Employment History Records

Employment history records are essential documents for filing unemployment benefit claims. These records include pay stubs, W-2 forms, and employer contact information that verify your work history. Accurate employment history helps determine eligibility and the amount of benefits you may receive.

Proof of Income and Earnings

Submitting the correct documentation is essential for processing unemployment benefit claims accurately. Proof of income and earnings verifies eligibility and ensures the claimant receives the appropriate benefit amount.

- Recent Pay Stubs - Pay stubs from the last 4-6 weeks demonstrate earned wages and employment status.

- W-2 Forms - Annual W-2 tax forms confirm total earnings reported to the IRS for the previous year.

- 1099 Forms - For self-employed individuals or contractors, 1099 forms validate income through non-employee compensation.

Supporting Documentation for Job Loss

Supporting documentation is essential for verifying eligibility when filing an unemployment benefit claim. Accurate proof of job loss ensures timely processing and approval of the claim.

Commonly required documents include a separation notice or layoff letter from the employer. Pay stubs or wage statements for the previous several months help confirm employment history and earnings.

Online vs. In-Person Claim Submissions

Submitting documents for unemployment benefit claims varies depending on whether the process is online or in-person. Each method requires specific documentation to verify eligibility and identity efficiently.

- Identification Documents - Government-issued ID such as a driver's license or passport is essential for both online and in-person claims to confirm your identity.

- Proof of Employment - Recent pay stubs, W-2 forms, or employer statements are necessary to establish prior employment and earnings history.

- Personal Information - Social Security number, contact details, and bank information must be provided accurately during online submissions, while in-person claims allow physical document presentation.

Reporting Requirements During Benefit Period

What documents are required for unemployment benefit claims during the benefit period? Claimants must submit proof of ongoing job search activities and weekly certification forms. Maintaining accurate records of interviews, applications, and earnings reports ensures compliance with reporting requirements.

What Documents are Required for Unemployment Benefit Claims? Infographic