To apply for an SBA disaster loan, you need essential documents such as your completed loan application form, personal and business tax returns for the past three years, and financial statements including profit and loss statements. You must also provide a detailed list of disaster-related damages, proof of identity, and any insurance claim information related to the loss. Accurate documentation ensures a smoother loan approval process and timely assistance.

What Documents are Needed for an SBA Disaster Loan Application?

| Number | Name | Description |

|---|---|---|

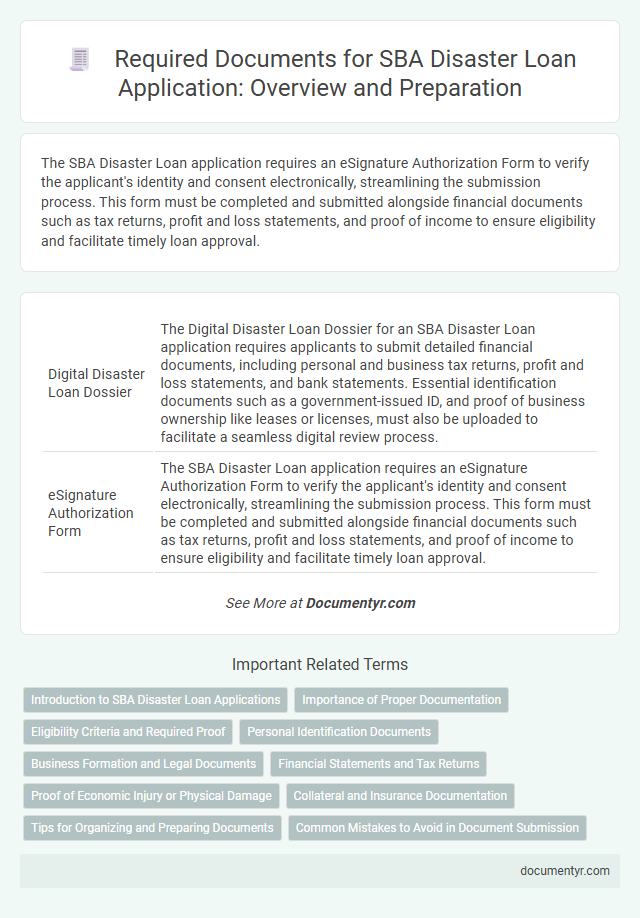

| 1 | Digital Disaster Loan Dossier | The Digital Disaster Loan Dossier for an SBA Disaster Loan application requires applicants to submit detailed financial documents, including personal and business tax returns, profit and loss statements, and bank statements. Essential identification documents such as a government-issued ID, and proof of business ownership like leases or licenses, must also be uploaded to facilitate a seamless digital review process. |

| 2 | eSignature Authorization Form | The SBA Disaster Loan application requires an eSignature Authorization Form to verify the applicant's identity and consent electronically, streamlining the submission process. This form must be completed and submitted alongside financial documents such as tax returns, profit and loss statements, and proof of income to ensure eligibility and facilitate timely loan approval. |

| 3 | Virtual Income Verification Statement | The Virtual Income Verification Statement is a critical document for an SBA disaster loan application, providing electronic confirmation of an applicant's income through authorized sources such as the IRS or financial institutions. This verification accelerates the approval process by ensuring accurate and timely validation of income information required to assess eligibility and repayment ability. |

| 4 | Remote SBA Form 5 Upload | Submitting an SBA Disaster Loan application requires precise documentation, including completed SBA Form 5 (the Personal Financial Statement), business tax returns, and proof of collateral; the Remote SBA Form 5 Upload system streamlines this process by allowing applicants to securely submit their personal financial details electronically. Ensuring accurate and timely upload of SBA Form 5 remotely accelerates loan processing and helps disaster-affected businesses access critical financial assistance efficiently. |

| 5 | COVID-19 Impacted Ledger | Applicants seeking an SBA Disaster Loan for COVID-19 impact must provide a detailed ledger showing income reduction and expenses incurred due to the pandemic, along with tax returns from the previous three years, profit and loss statements, and payroll documentation. Supporting documents such as personal financial statements, business licenses, and bank statements are also essential to verify the financial condition and eligibility. |

| 6 | Online Hazard Insurance Declaration | The Online Hazard Insurance Declaration requires applicants to submit proof of current hazard insurance coverage for the damaged property, including policy declarations and coverage limits. Accurate documentation ensures compliance with SBA guidelines and expedites the approval process for disaster loan applications. |

| 7 | SBA Connect Documentation Bundle | The SBA Connect Documentation Bundle requires essential documents such as federal tax returns, personal financial statements, profit and loss statements, and business authorization forms to process disaster loan applications efficiently. Including accurate and complete SBA Connect documents ensures faster verification and approval, supporting timely financial assistance for affected small businesses. |

| 8 | Cloud-Based Schedule of Liabilities | A cloud-based schedule of liabilities streamlines the SBA disaster loan application by securely organizing and updating financial obligations in real-time, ensuring accuracy and accessibility for review. This digital document enables applicants to present comprehensive debt information, supporting SBA's assessment of creditworthiness and repayment capacity. |

| 9 | AI-Enhanced Tax Transcript Tool | The AI-Enhanced Tax Transcript Tool streamlines SBA Disaster Loan applications by automatically retrieving and verifying required tax documents, including IRS Form 4506-T and detailed income statements, ensuring accuracy and compliance. This technology reduces processing time and minimizes errors, facilitating faster loan approvals for disaster-affected businesses. |

| 10 | Fast-Track Business Entity Validation | Fast-Track Business Entity Validation requires applicants to submit proof of business ownership such as articles of incorporation, a business license, or a certificate of good standing, along with a valid government-issued ID and tax documents like a recent tax return or IRS Form 4506-T. This streamlined validation process helps expedite eligibility verification by confirming the legal existence and tax compliance of the business. |

Introduction to SBA Disaster Loan Applications

Applying for an SBA disaster loan requires specific documentation to verify eligibility and financial impact. Understanding the necessary documents helps streamline the process and improves the chances of approval.

SBA disaster loan applications typically require proof of identity, financial statements, and documentation of the disaster-related losses. You must provide tax returns, insurance information, and a detailed description of the damage sustained. Preparing these documents in advance facilitates a smoother application experience and timely assistance.

Importance of Proper Documentation

| Document Type | Purpose | Importance of Proper Documentation |

|---|---|---|

| Personal Identification | Verification of identity and eligibility | Ensures accurate applicant identification, preventing delays in processing |

| Proof of Business Ownership | Confirms ownership structure and eligibility | Facilitates validation of business legitimacy and appropriate loan allocation |

| Financial Statements | Demonstrates financial condition and ability to repay | Accurate financial data is critical for SBA to assess loan risk and borrower capacity |

| Tax Returns | Provides historical financial information | Verifies income and business activity, supporting credibility of the application |

| Disaster Damage Documentation | Evidence of losses due to disaster | Essential to validate the necessity of the disaster loan and calculate loan amount |

| Business License and Registrations | Confirms compliance with legal requirements | Proper documentation prevents legal complications and supports SBA's regulatory standards |

| Loan Application Form (SBA Form 5) | Official application and agreement document | Completed forms with accurate data expedite loan approval and processing |

The SBA Disaster Loan Application process demands careful collection and submission of the correct documents. Proper documentation streamlines the assessment and approval of the loan, ensuring that your application reflects true eligibility and disaster impact. Missing or inaccurate documents can cause processing delays or lead to denial, highlighting the critical importance of thorough record preparation.

Eligibility Criteria and Required Proof

Applicants seeking an SBA Disaster Loan must meet specific eligibility criteria, including being a small business, private nonprofit organization, or homeowner affected by a declared disaster. Proof of identity, business ownership, and disaster-related damages is essential to establish eligibility.

Required documents include tax returns, financial statements, and a personal credit report to demonstrate the ability to repay the loan. Additionally, applicants must provide proof of property ownership, insurance information, and damage estimates or repair bids.

Personal Identification Documents

Personal identification documents are essential for verifying the identity of applicants during the SBA disaster loan application process. These documents help ensure the legitimacy and eligibility of the borrower.

- Government-issued photo ID - A valid driver's license, passport, or state ID is required to confirm the applicant's identity and citizenship status.

- Social Security Number (SSN) - Providing an SSN supports background checks and credit verification necessary for loan approval.

- Proof of residency - Documents such as utility bills or lease agreements verify the applicant's physical address within the disaster-affected area.

Business Formation and Legal Documents

What business formation and legal documents are required for an SBA Disaster Loan application? Your application must include proof of business registration such as Articles of Incorporation or a Business License. Legal documents like partnership agreements or bylaws are essential to verify the structure and ownership.

Financial Statements and Tax Returns

When applying for an SBA Disaster Loan, it is essential to provide accurate financial statements to demonstrate the current financial condition of the business. These documents typically include balance sheets, profit and loss statements, and cash flow statements, which help the SBA assess the applicant's ability to repay the loan.

Tax returns for the past three years are also required to verify income and business activity. Providing complete and accurate tax documentation ensures the loan review process proceeds smoothly and expedites approval decisions.

Proof of Economic Injury or Physical Damage

Providing adequate proof of economic injury or physical damage is crucial for a successful SBA Disaster Loan application. Documenting the extent of losses ensures that your application accurately reflects your need for financial assistance.

- Financial Records - Submit profit and loss statements, tax returns, and bank statements to demonstrate the economic impact on your business.

- Damage Documentation - Include photos, repair estimates, and insurance claims to verify physical harm to property or inventory.

- Business Operation Records - Provide payroll records, customer invoices, and supplier contracts to support claims of interrupted business activity.

Collateral and Insurance Documentation

Applying for an SBA Disaster Loan requires specific collateral and insurance documentation to support your application. These documents validate your ability to repay and secure the loan.

- Collateral Documentation - Documentation such as real estate deeds, vehicle titles, and equipment lists demonstrate assets available to secure the loan.

- Insurance Policies - Copies of current insurance policies including property, flood, and hazard insurance confirm protection against damages.

- Appraisals and Valuations - Professional appraisals provide objective value assessments of your collateral assets.

Providing detailed collateral and insurance documents strengthens your SBA Disaster Loan application.

Tips for Organizing and Preparing Documents

Gathering the necessary documents for an SBA disaster loan application ensures a smooth submission process. Essential paperwork includes tax returns, financial statements, and proof of loss due to the disaster. Organizing these documents in clearly labeled folders helps streamline review and approval.

Maintain copies of all submitted forms and keep digital backups to prevent loss. Include detailed information such as business licenses, insurance policies, and personal identification to meet SBA requirements. A checklist tailored to SBA guidelines greatly enhances preparation efficiency.

Review each document for accuracy and completeness before submission to avoid delays. Use chronological order or categorize by document type for easy reference during follow-up. Preparing your documents methodically increases the likelihood of a timely loan approval.

What Documents are Needed for an SBA Disaster Loan Application? Infographic