To claim a tax refund, you must provide supporting documents such as the completed tax return form, proof of income like wage slips or 1099 forms, and receipts for deductible expenses. These documents verify your income and entitlements, ensuring accurate refund processing. Keep copies of all submitted documents for your records and future reference.

What Documents are Needed to Claim a Tax Refund?

| Number | Name | Description |

|---|---|---|

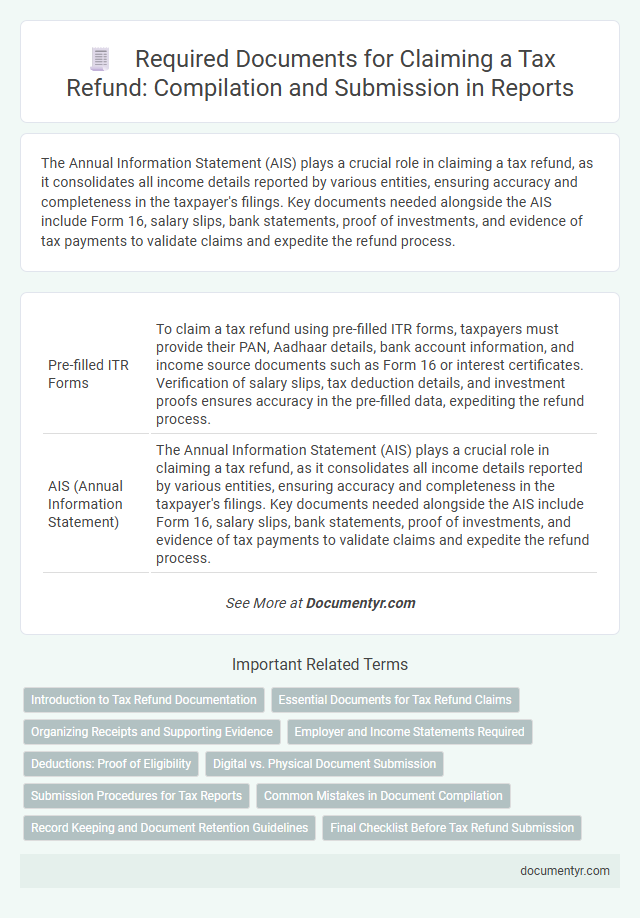

| 1 | Pre-filled ITR Forms | To claim a tax refund using pre-filled ITR forms, taxpayers must provide their PAN, Aadhaar details, bank account information, and income source documents such as Form 16 or interest certificates. Verification of salary slips, tax deduction details, and investment proofs ensures accuracy in the pre-filled data, expediting the refund process. |

| 2 | AIS (Annual Information Statement) | The Annual Information Statement (AIS) plays a crucial role in claiming a tax refund, as it consolidates all income details reported by various entities, ensuring accuracy and completeness in the taxpayer's filings. Key documents needed alongside the AIS include Form 16, salary slips, bank statements, proof of investments, and evidence of tax payments to validate claims and expedite the refund process. |

| 3 | Form 26AS Reconciliation | Form 26AS Reconciliation is crucial for claiming a tax refund as it provides a consolidated statement of tax credits, detailing TDS (Tax Deducted at Source), TCS (Tax Collected at Source), and advance tax paid, ensuring accurate matching with income declared in the tax return. Submitting Form 26AS along with supporting documents such as Form 16, income proofs, and bank statements enables the tax department to verify discrepancies and process the refund efficiently. |

| 4 | e-PAN Verification | To claim a tax refund, essential documents include the verified e-PAN, Form 26AS, and the Income Tax Return (ITR) acknowledgment. e-PAN verification ensures accurate taxpayer identification, facilitating smooth processing of the refund claim. |

| 5 | Digital Signature Certificate (DSC) | To claim a tax refund, a Digital Signature Certificate (DSC) is essential for authenticating the electronic filing of the Income Tax Return (ITR), ensuring secure and verifiable submission. The DSC acts as a digital equivalent of a physical signature, validating the taxpayer's identity and enabling seamless processing of refund claims by the tax authorities. |

| 6 | e-Verification Code (EVC) | To claim a tax refund, submitting the e-Verification Code (EVC) is essential as it validates the taxpayer's identity electronically during the income tax e-filing process. The EVC serves as a secure and quick alternative to physical verification, ensuring the authenticity of the refund claim without the need for submitting a signed ITR-V form. |

| 7 | TDS Trace Utility | To claim a tax refund, essential documents include Form 16, Form 26AS, bank statements, and a TDS certificate, all of which can be cross-verified using the TDS TRACES Utility for accuracy. The TDS TRACES platform enables taxpayers to download TDS certificates, view deducted tax details, and rectify discrepancies, streamlining the refund claim process. |

| 8 | e-Bank Statement Upload | To claim a tax refund, an e-Bank Statement upload is essential as it provides accurate proof of income and tax payments directly from financial institutions, streamlining verification. This digital document eliminates manual errors and accelerates the refund process by ensuring transparent transaction records. |

| 9 | Foreign Tax Credit (FTC) Documentation | To claim a Foreign Tax Credit (FTC) tax refund, taxpayers need to provide IRS Form 1116 along with original foreign tax payment receipts, foreign income statements such as foreign wage statements or dividend reports, and proof of foreign tax withheld. Supporting documents must also include detailed records of the foreign taxes paid, currency conversion calculations, and copies of any foreign tax returns filed. |

| 10 | Refund Reissue Request Form | To claim a tax refund, submitting the Refund Reissue Request Form is essential as it serves as the official document to initiate the reissuance process for lost or undelivered checks. This form must be accurately completed and accompanied by relevant identification and proof of the original refund claim to ensure timely processing by the tax authorities. |

Introduction to Tax Refund Documentation

Claiming a tax refund requires specific documentation to verify income, taxes paid, and eligibility. Proper preparation of these documents ensures a smooth and timely refund process.

Essential documents include the completed tax return form, proof of income such as W-2 or 1099 forms, and receipts for deductible expenses. Taxpayers must also provide identification documents and any relevant proof of tax payments made during the year. Accurate submission of these records helps tax authorities validate claims and prevent errors or delays in processing refunds.

Essential Documents for Tax Refund Claims

Claiming a tax refund requires submitting specific essential documents to the tax authorities. These documents verify your income, deductions, and taxes paid throughout the fiscal year.

Key documents include your original tax return form, proof of income such as W-2 or 1099 forms, and receipts for deductible expenses. Additionally, official identification and bank account details for direct deposit are necessary to process the refund efficiently.

Organizing Receipts and Supporting Evidence

Organizing receipts and supporting evidence is essential for a successful tax refund claim. Collect all relevant receipts, invoices, and proof of payment that correspond to deductible expenses. Proper documentation ensures accurate verification and speeds up the refund process with tax authorities.

Employer and Income Statements Required

Employers must provide accurate income statements to support your tax refund claim. These documents include the W-2 form in the United States or the P60 form in the UK, detailing your earnings and taxes paid.

Income statements serve as proof of reported wages and withholdings necessary for tax authorities. Submitting these documents alongside your refund application helps verify your eligibility and income details efficiently.

Deductions: Proof of Eligibility

Claiming a tax refund requires submission of specific documents that prove your eligibility for deductions. Proper documentation ensures accurate verification and maximizes refund claims.

- Receipts and Invoices - Official receipts for expenses such as medical bills, education fees, or charitable donations must be provided to validate deduction claims.

- Employment Certificates - Proof of employment status and income details help confirm eligibility for work-related deductions and tax credits.

- Government-issued Identification - A valid ID like a social security card or tax identification number is essential to authenticate the claimant's identity and tax records.

Digital vs. Physical Document Submission

Claiming a tax refund requires specific documents such as your completed tax return form, proof of income, and identification. Digital submission involves uploading scanned copies or digital versions of these documents through authorized online tax portals, which offers faster processing and convenience. Physical submissions require original documents or certified copies mailed or delivered to tax offices, often resulting in longer processing times due to manual handling.

Submission Procedures for Tax Reports

What documents are needed to claim a tax refund? Required documents typically include the completed tax return form, proof of income such as W-2 or 1099 forms, and receipts for deductible expenses. Submission procedures mandate attaching all relevant documents to the tax report before filing electronically or by mail.

Common Mistakes in Document Compilation

| Document | Description | Common Mistakes |

|---|---|---|

| Income Statement (W-2, 1099) | Shows total earnings and taxes withheld from all employers and contractors. | Submitting incomplete or missing forms; mixing different tax years. |

| Tax Return Form (1040, 1040EZ) | Official form filed with the IRS to report income, deductions, and claim refunds. | Filing unsigned or with incorrect personal information; omitting schedules or attachments. |

| Receipts for Deductible Expenses | Proof of expenses such as medical costs, charitable donations, or education fees. | Submitting faded or illegible receipts; including non-qualifying expenses. |

| Proof of Identity | Documents like a driver's license or passport to verify identity during filing. | Providing expired or mismatched identification details. |

| Bank Account Information | Details required for direct deposit of the refund into your account. | Entering incorrect routing or account numbers; failing to update account changes. |

| Supporting Schedules and Forms | Additional forms related to credits, exemptions, or special circumstances. | Forgetting to attach relevant schedules; using outdated versions of forms. |

Record Keeping and Document Retention Guidelines

Proper documentation is essential to successfully claim a tax refund and ensure compliance with tax authorities. Maintaining accurate records facilitates verification and expedites the refund process.

- Income Statements - Collect all W-2s, 1099s, and other income reports to substantiate earnings claimed on tax returns.

- Receipts and Invoices - Retain receipts for deductible expenses and invoices related to tax credits to validate claims.

- Tax Returns and Supporting Schedules - Keep copies of filed tax returns and all associated schedules for reference and audit purposes.

Records should be retained for a minimum of three to seven years, as recommended by the IRS, to support any future inquiries or audits.

What Documents are Needed to Claim a Tax Refund? Infographic