To apply for financial aid through FAFSA, students need to gather key documents including their Social Security number, federal income tax returns, W-2 forms, and records of any untaxed income. Dependency status determines whether parental financial information is also required. Accurate and up-to-date documentation ensures a smooth application process and maximizes eligibility for aid.

What Documents Does a Student Need to Apply for Financial Aid (FAFSA)?

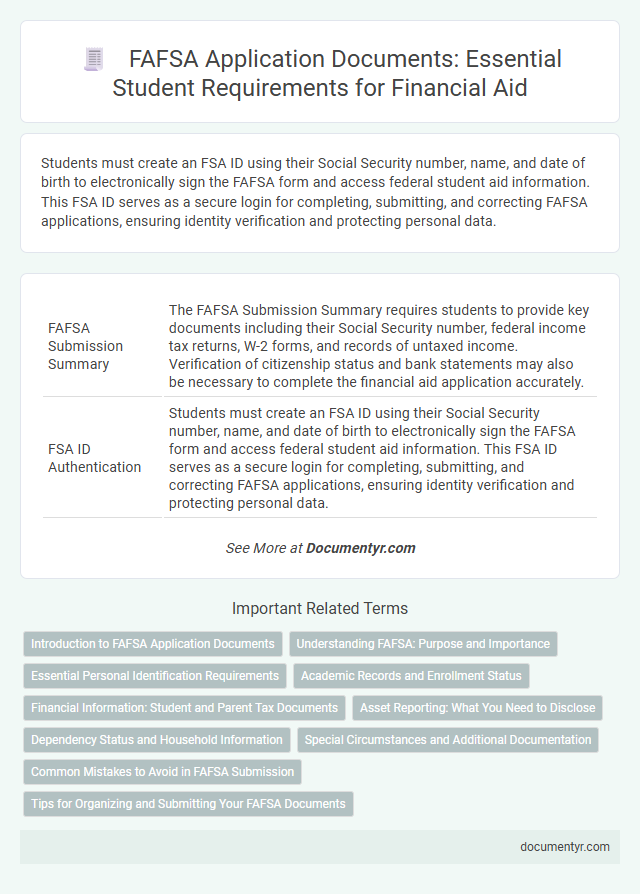

| Number | Name | Description |

|---|---|---|

| 1 | FAFSA Submission Summary | The FAFSA Submission Summary requires students to provide key documents including their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Verification of citizenship status and bank statements may also be necessary to complete the financial aid application accurately. |

| 2 | FSA ID Authentication | Students must create an FSA ID using their Social Security number, name, and date of birth to electronically sign the FAFSA form and access federal student aid information. This FSA ID serves as a secure login for completing, submitting, and correcting FAFSA applications, ensuring identity verification and protecting personal data. |

| 3 | IRS Data Retrieval Tool (DRT) Confirmation | The IRS Data Retrieval Tool (DRT) confirmation is crucial for verifying accurate income information directly from IRS tax returns when applying for FAFSA. This automated process reduces errors and expedites the financial aid application by securely transferring tax data into the FAFSA form. |

| 4 | Asset Protection Allowance | Students applying for financial aid through FAFSA must provide detailed financial documents, including tax returns and asset statements, to accurately calculate the Asset Protection Allowance, which reduces the value of assets considered in the Expected Family Contribution. Proper documentation ensures that the allowance is applied, safeguarding a portion of assets from affecting aid eligibility. |

| 5 | Noncustodial Parent Statement | The Noncustodial Parent Statement is a required document for students applying for financial aid through FAFSA when their parents are divorced or separated, providing essential financial information from the parent who does not live with the student. This form helps determine the student's eligibility for federal aid by accurately reflecting the noncustodial parent's income and assets. |

| 6 | Selective Service Registration Waiver | Students required to complete the FAFSA must provide proof of Selective Service registration or qualify for a waiver by demonstrating they are male, born before 1960, or under the age of 18 at the time of application. The Selective Service Registration Waiver is essential for those exempt from registration yet seeking federal financial aid eligibility. |

| 7 | Federal Tax Return Transcript | A Federal Tax Return Transcript is a crucial document required for completing the FAFSA application, as it provides the IRS-verified income information necessary to determine financial aid eligibility. Students and their parents can obtain this transcript online through the IRS website or request it by mail, ensuring accurate reporting of tax data for federal aid assessment. |

| 8 | Untaxed Income Documentation | Students must provide documentation of untaxed income when applying for FAFSA, including records of child support received, veteran's noneducation benefits, and workers' compensation. These documents are essential to accurately report income for financial aid eligibility and may include tax returns, statements from benefits offices, or official payment records. |

| 9 | Dependency Override Request | A student submitting a Dependency Override Request for FAFSA must provide documentation such as a detailed personal statement, letters from third-party professionals (e.g., school counselors or social workers), and legal records supporting unusual circumstances that justify independent status. These documents help the financial aid administrator make informed decisions beyond standard dependency criteria, ensuring accurate assessment of the student's financial need. |

| 10 | SAI (Student Aid Index) Calculator | To accurately use the SAI (Student Aid Index) Calculator when applying for FAFSA, students need key documents such as their Social Security number, federal income tax returns, W-2 forms, and records of untaxed income. Additionally, parents' financial information is required for dependent students to determine the Expected Family Contribution, ensuring precise adjustment in the Student Aid Index. |

Introduction to FAFSA Application Documents

Applying for financial aid through FAFSA requires several important documents to ensure accuracy and completeness. Understanding the necessary paperwork can simplify the application process.

These documents typically include your Social Security number, federal income tax returns, W-2 forms, and bank statements. Having these records on hand helps verify your financial situation. Collecting all required documents before starting your FAFSA application can save time and prevent delays.

Understanding FAFSA: Purpose and Importance

FAFSA (Free Application for Federal Student Aid) is a critical step in securing financial aid for college. It helps determine eligibility for federal, state, and institutional aid programs.

- Purpose of FAFSA - FAFSA collects financial information to assess your need for grants, loans, and work-study opportunities.

- Importance of Accuracy - Accurate data ensures the correct calculation of the Expected Family Contribution (EFC) for aid eligibility.

- Eligibility Determination - FAFSA results influence the types and amounts of financial aid available to the student.

Essential Personal Identification Requirements

Applying for financial aid through the FAFSA requires specific personal identification documents to verify the student's identity and eligibility. These essential documents ensure accurate processing and help secure the appropriate aid packages.

- Social Security Number (SSN) - The SSN is mandatory for identification and to confirm U.S. citizenship or eligible noncitizen status.

- Driver's License or State ID - This document helps verify the student's current residential address and legal identification.

- Alien Registration Number - Required for eligible noncitizens to prove lawful presence in the United States.

Having these essential personal identification requirements ready streamlines the FAFSA application process and avoids delays.

Academic Records and Enrollment Status

Academic records play a crucial role in the FAFSA application process, providing proof of your current enrollment and satisfactory academic progress. These documents include transcripts, enrollment verification letters, and class schedules, which confirm your status as an eligible student. Accurate academic information ensures proper financial aid determination based on your educational standing and enrollment status.

Financial Information: Student and Parent Tax Documents

What financial information is required for the FAFSA application? Financial aid applications demand accurate tax documents from both the student and parents. These include IRS tax returns, W-2 forms, and any records of untaxed income to verify reported financial data.

Asset Reporting: What You Need to Disclose

| Asset Reporting: What You Need to Disclose |

|---|

When applying for financial aid through the FAFSA, students must report specific assets accurately. Reporting assets impacts the Expected Family Contribution (EFC) calculation and eligibility for need-based aid. Required asset disclosures include:

|

Dependency Status and Household Information

Determining your dependency status is crucial when applying for financial aid through FAFSA. Dependency status affects which household information and documents you must provide during the application process.

For dependent students, parent income and tax return documents are required, alongside student financial information. Independent students need to submit their own financial data and legal documents verifying their status if applicable.

Special Circumstances and Additional Documentation

Applying for financial aid through FAFSA requires specific documents, especially when special circumstances are involved. Providing additional documentation ensures accurate assessment of a student's financial need.

- Proof of Income - Tax returns, W-2 forms, or income statements may need adjustments to reflect changes like job loss or reduced hours.

- Verification of Special Circumstances - Documents such as layoff notices, divorce decrees, or medical bills support requests for special consideration.

- Additional Financial Records - Bank statements, retirement account summaries, or proof of untaxed income help clarify the student's current financial situation.

Common Mistakes to Avoid in FAFSA Submission

When applying for financial aid using the FAFSA, students must gather essential documents such as their Social Security number, federal income tax returns, W-2 forms, and bank statements. Having these documents ready ensures an accurate and timely application process.

Common mistakes to avoid include entering incorrect Social Security numbers and failing to report accurate income information. Double-checking all entries and verifying data against official documents helps prevent application delays or denials.

What Documents Does a Student Need to Apply for Financial Aid (FAFSA)? Infographic