To complete FAFSA verification, you must submit documents such as your federal income tax returns, W-2 forms, and proof of any untaxed income. You may also need to provide documentation verifying your household size and number of family members in college. Accurate submission of these documents ensures timely processing of your financial aid application.

What Documents Must You Submit for FAFSA Verification?

| Number | Name | Description |

|---|---|---|

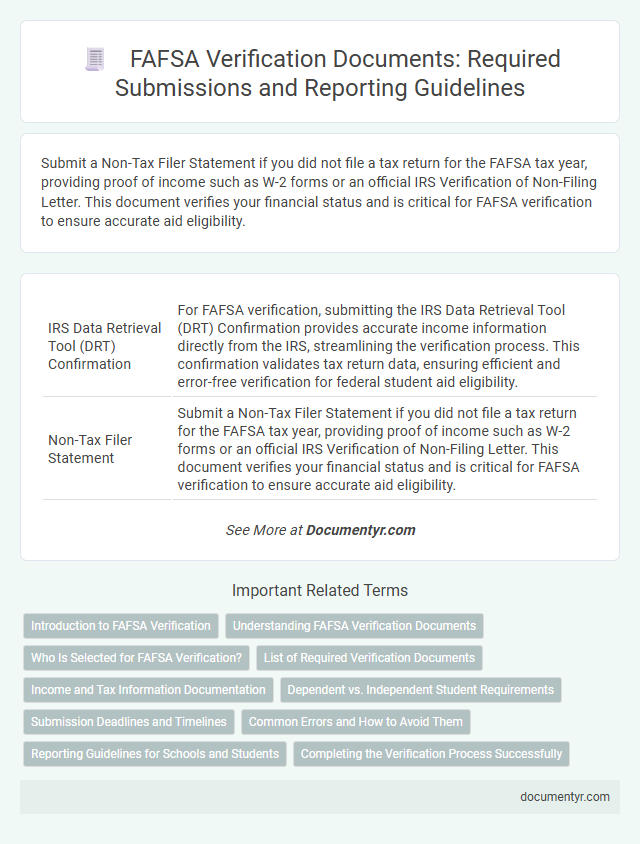

| 1 | IRS Data Retrieval Tool (DRT) Confirmation | For FAFSA verification, submitting the IRS Data Retrieval Tool (DRT) Confirmation provides accurate income information directly from the IRS, streamlining the verification process. This confirmation validates tax return data, ensuring efficient and error-free verification for federal student aid eligibility. |

| 2 | Non-Tax Filer Statement | Submit a Non-Tax Filer Statement if you did not file a tax return for the FAFSA tax year, providing proof of income such as W-2 forms or an official IRS Verification of Non-Filing Letter. This document verifies your financial status and is critical for FAFSA verification to ensure accurate aid eligibility. |

| 3 | Selective Service Verification Letter | The Selective Service Verification Letter is a crucial document required for FAFSA verification to confirm the applicant's registration status with the Selective Service System. Submitting this letter ensures compliance with federal aid eligibility criteria, particularly for male students aged 18 to 25. |

| 4 | Parent Asset Verification Form | The Parent Asset Verification Form requires accurate reporting of parental financial information, including current bank statements, investment records, and real estate assets, to confirm the accuracy of the FAFSA application. Submitting detailed and up-to-date documentation ensures compliance with federal verification procedures and facilitates timely financial aid processing. |

| 5 | Household Size Verification Worksheet | The Household Size Verification Worksheet requires you to list all individuals living in your household who receive more than half of their support from you or will continue to get support through the FAFSA award year, including yourself, your spouse if married, and dependent children. Submitting the completed worksheet along with proof of household members' residency and relationship, such as birth certificates or tax returns, is essential to verify your reported family size during the FAFSA verification process. |

| 6 | Identity/Statement of Educational Purpose | To complete FAFSA verification for Identity/Statement of Educational Purpose, you must submit a valid government-issued photo ID, such as a passport or driver's license, along with a signed statement of educational purpose confirming your intent to enroll and complete your education. This documentation ensures the accuracy and authenticity of your application information, preventing identity fraud and confirming your commitment to educational objectives. |

| 7 | Amended Tax Return (1040X) Submission | Submitting an amended tax return (Form 1040X) for FAFSA verification requires documentation including the original tax return, the amended 1040X form, and any IRS correspondence validating the changes. These documents help ensure accurate financial information is reported and aid in resolving discrepancies flagged during the FAFSA verification process. |

| 8 | SNAP Benefits Verification Letter | The FAFSA verification process requires submitting a SNAP Benefits Verification Letter to confirm receipt of Supplemental Nutrition Assistance Program benefits during the prior year. This official letter from the state agency verifies eligibility and aids in accurately determining federal student aid awards. |

| 9 | Untaxed Income Verification | FAFSA verification requires submitting documents that confirm untaxed income, such as IRS Form 4506-T, non-filing letters, or records of child support received. These documents help verify income that is not reflected on tax returns, ensuring accurate financial aid eligibility. |

| 10 | High School Completion Status Document | Submitting a High School Completion Status document is essential for FAFSA verification, and acceptable forms include a high school diploma, GED certificate, or transcripts showing completion date. Providing accurate verification of your high school completion ensures eligibility for federal student aid and prevents delays in processing your FAFSA application. |

Introduction to FAFSA Verification

FAFSA Verification is a process used by the U.S. Department of Education to confirm the accuracy of information submitted on the Free Application for Federal Student Aid. During verification, students must provide specific documents to verify income, household size, and other financial details. Proper submission of these documents ensures eligibility for federal student aid and prevents delays in financial aid disbursement.

Understanding FAFSA Verification Documents

What documents must you submit for FAFSA verification? The verification process requires specific documents to confirm the accuracy of the information provided on your FAFSA application. Commonly requested documents include tax returns, W-2 forms, and verification worksheets from your college financial aid office.

Who Is Selected for FAFSA Verification?

FAFSA verification is a process used to confirm the accuracy of information submitted on the Free Application for Federal Student Aid. Certain applicants are selected for verification based on specific criteria established by the U.S. Department of Education.

- Random Selection - Some applicants are chosen randomly by the Central Processing System for verification purposes.

- Data Discrepancies - Verification may be required if the FAFSA contains inconsistent or conflicting information.

- Federal or State Requirements - Certain federal or state guidelines mandate verification for applicants with specific characteristics or circumstances.

Students selected for FAFSA verification must submit documentation such as tax returns, W-2 forms, and other financial records to complete the process.

List of Required Verification Documents

The FAFSA verification process requires submitting specific documents to confirm the accuracy of your application information. The exact documents depend on the verification group assigned to your application by the school or the Department of Education.

Common required verification documents include a copy of your and your parents' federal income tax returns, W-2 forms, and proof of any untaxed income such as Social Security benefits or child support. Verification may also require completing and submitting the IRS Data Retrieval Tool information or an IRS tax transcript. Additional documents might include signing a verification worksheet provided by the school and providing household size and number in college details.

Income and Tax Information Documentation

FAFSA verification requires specific income and tax documentation to confirm the accuracy of your financial information. These documents help the financial aid office verify your eligibility for federal student aid programs.

- Tax Return Transcript - A transcript from the IRS that summarizes your tax return information, often required to confirm reported income.

- W-2 Forms - Wage and tax statements from all employers, used to verify earned income reported on the FAFSA.

- Verification of Non-Filing Letter - Issued by the IRS to confirm that you or your parents did not file a tax return for the relevant year.

Dependent vs. Independent Student Requirements

FAFSA verification requires specific documents based on your dependency status. Understanding the difference between dependent and independent student requirements ensures accurate submission.

- Dependent Student Proof of Income - Submit parents' tax returns and W-2 forms to verify household income.

- Independent Student Proof of Income - Submit your own tax returns and W-2 forms for accurate income verification.

- Household Size and Number in College - Provide documentation verifying family size and the number of family members attending college, varying by dependency status.

Submission Deadlines and Timelines

| Document Type | Description | Submission Deadline | Typical Timeline |

|---|---|---|---|

| Verification Worksheet | Form provided by the FAFSA processing center to confirm accurate data. | Within 30 days of request or by school's deadline. | Processing time is approximately 1-2 weeks after submission. |

| Tax Transcripts | IRS Tax Return Transcript or tax documents validating income information. | Must be submitted before the end of the financial aid award period. | IRS provides transcripts within 5-10 business days electronically. |

| Proof of Income | Pay stubs or other documentation verifying earned income when tax returns are not filed. | Aligned with school's verification deadline, often within 30 days. | Verification completion usually takes 1-3 weeks. |

| Dependency Documentation | Legal papers or letters confirming dependency status changes. | Submission required prior to finalizing financial aid package. | Processing may take up to 2 weeks. |

| Others as Requested | Additional documents like signed statements or clarifications. | Varies by institution, generally requested promptly. | Dependent on school's review schedule, usually within 1-3 weeks. |

Common Errors and How to Avoid Them

FAFSA verification requires submitting documents such as tax returns, W-2 forms, and proof of identity to confirm the accuracy of your financial information. Common errors include missing signatures, incorrect Social Security numbers, and inconsistent income details.

Avoid delays by double-checking all entries for accuracy and completeness before submission. Ensure all required documents match the information provided on your FAFSA to prevent verification rejections.

Reporting Guidelines for Schools and Students

FAFSA verification requires submitting accurate documentation to confirm information provided on the application. Both schools and students must adhere to specific reporting guidelines to ensure proper validation.

Students typically need to submit tax transcripts, proof of identity, and household size verification. Schools are responsible for reviewing these documents and reporting findings to the Department of Education promptly.

What Documents Must You Submit for FAFSA Verification? Infographic