Mortgage approval for first-time homebuyers requires essential documents such as proof of income, including recent pay stubs, tax returns, and W-2 forms. Lenders also need credit history reports and identification documents like a valid driver's license or passport. Additionally, bank statements and information about any existing debts help verify financial stability for mortgage qualification.

What Documents are Necessary for First-Time Homebuyer Mortgage Approval?

| Number | Name | Description |

|---|---|---|

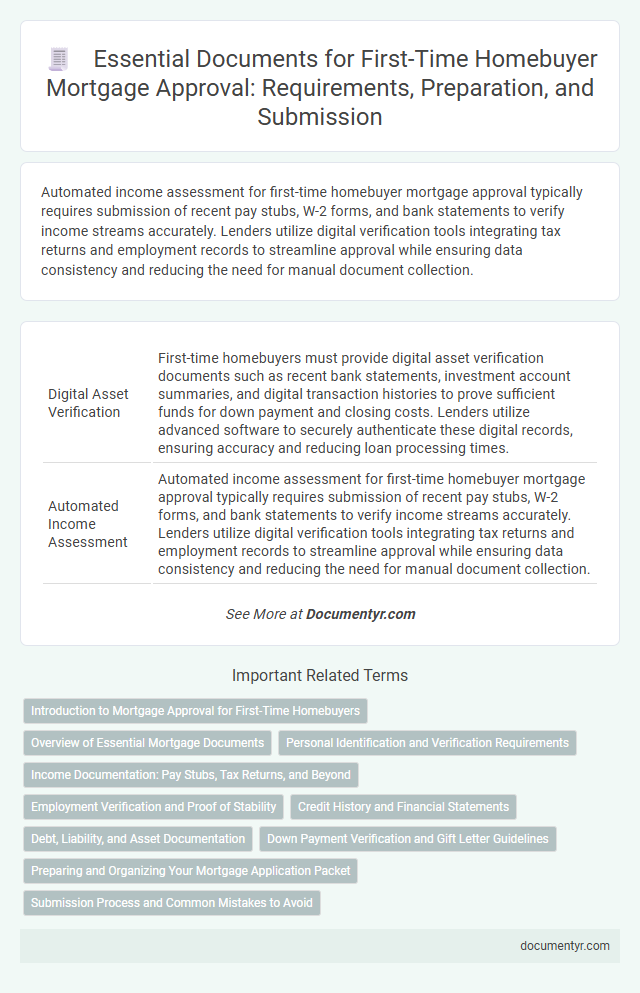

| 1 | Digital Asset Verification | First-time homebuyers must provide digital asset verification documents such as recent bank statements, investment account summaries, and digital transaction histories to prove sufficient funds for down payment and closing costs. Lenders utilize advanced software to securely authenticate these digital records, ensuring accuracy and reducing loan processing times. |

| 2 | Automated Income Assessment | Automated income assessment for first-time homebuyer mortgage approval typically requires submission of recent pay stubs, W-2 forms, and bank statements to verify income streams accurately. Lenders utilize digital verification tools integrating tax returns and employment records to streamline approval while ensuring data consistency and reducing the need for manual document collection. |

| 3 | Employment Blockchain Records | Employment blockchain records provide a secure and verifiable source of income history critical for first-time homebuyer mortgage approval, reducing the risk of document fraud. Lenders prioritize these immutable records alongside traditional employment verification documents to streamline the approval process and enhance data accuracy. |

| 4 | eClosing Disclosure | For first-time homebuyer mortgage approval, the eClosing Disclosure is essential as it provides a detailed summary of loan terms, projected monthly payments, closing costs, and other critical financial information. This digital document ensures compliance with federal regulations and allows buyers to review all charges and terms before finalizing their mortgage agreement. |

| 5 | Smart eVault Storage | First-time homebuyers need to submit key documents such as proof of income, credit reports, bank statements, and identification for mortgage approval, all of which can be securely stored and easily accessed through Smart eVault Storage. Utilizing Smart eVault ensures encrypted storage, organized document management, and quick retrieval, streamlining the approval process and enhancing data security. |

| 6 | Source of Funds Traceability | Lenders require detailed documentation to verify the source of funds for a first-time homebuyer's mortgage approval, including bank statements, gift letters, pay stubs, and tax returns to ensure traceability and legitimacy of deposits. Clear, consistent financial records demonstrating the accumulation and legality of down payment funds are critical to satisfy underwriting criteria and prevent loan delays or denials. |

| 7 | Remote Online Notarization (RON) | First-time homebuyers seeking mortgage approval must provide key documents such as proof of income, credit history, and identification, which can be securely verified through Remote Online Notarization (RON) to expedite the process. RON technology enables legally binding notarization of mortgage documents electronically, reducing delays and enhancing accessibility for remote applicants. |

| 8 | Income Stream Diversification Report | First-time homebuyer mortgage approval requires thorough documentation of income stream diversification, including recent pay stubs, tax returns, and bank statements showing multiple sources such as employment income, freelance work, and investment dividends. Lenders prioritize a stable and varied income profile to assess the borrower's ability to consistently meet mortgage payments. |

| 9 | Electronic Consent Forms | Electronic consent forms are essential documents for first-time homebuyers seeking mortgage approval, enabling lenders to verify credit history and employment details securely and efficiently. These digital authorizations streamline the approval process by allowing electronic access to financial records, reducing paperwork and expediting decision-making. |

| 10 | Borrower Identity Biometric Scan | Borrower identity verification through biometric scans, such as fingerprint or facial recognition, is increasingly required for first-time homebuyer mortgage approval to enhance security and prevent identity fraud. These biometric documents complement traditional identification methods, ensuring accurate and reliable borrower authentication throughout the mortgage process. |

Introduction to Mortgage Approval for First-Time Homebuyers

Mortgage approval is a critical step for first-time homebuyers seeking to secure financing. Lenders require specific documents to evaluate your financial stability and creditworthiness. Understanding these requirements helps streamline the approval process and increases the chances of obtaining a loan.

Overview of Essential Mortgage Documents

First-time homebuyers must prepare a set of essential documents to secure mortgage approval. These documents verify financial stability, identity, and creditworthiness to lenders.

Key documents include proof of income such as pay stubs, tax returns, and employment verification. Lenders also require credit reports, bank statements, and a valid government-issued identification.

Personal Identification and Verification Requirements

First-time homebuyers must provide valid personal identification to verify their identity during the mortgage approval process. Commonly accepted documents include a government-issued photo ID such as a passport or driver's license. Lenders also require proof of Social Security number, often through a Social Security card or tax documents, to ensure accurate verification.

Income Documentation: Pay Stubs, Tax Returns, and Beyond

Income documentation plays a critical role in first-time homebuyer mortgage approval. Understanding which documents lenders require helps streamline the mortgage application process.

- Pay Stubs - Recent pay stubs verify consistent income and employment status over the past month or two.

- Tax Returns - Complete tax returns provide a comprehensive view of your annual income and verify self-employment earnings.

- Additional Income Documentation - Documents such as bank statements, profit and loss statements, or award letters are essential for income sources beyond traditional wages.

Providing accurate and thorough income documentation increases the likelihood of mortgage approval for first-time homebuyers.

Employment Verification and Proof of Stability

Employment verification and proof of stability are essential documents for first-time homebuyer mortgage approval. These documents establish the borrower's income consistency and reliability to lenders.

- Employment Verification Letter - Provides official confirmation of current employment status, position, and salary, typically issued by the employer.

- Recent Pay Stubs - Demonstrates regular income over the past month or two, supporting ongoing employment and earnings.

- Tax Returns or W-2 Forms - Verifies income history and stability over the previous one to two years, reinforcing the borrower's financial reliability.

Credit History and Financial Statements

What documents are necessary for first-time homebuyer mortgage approval regarding credit history and financial statements? Mortgage lenders require detailed credit reports to assess creditworthiness, including credit scores and payment history. Financial statements such as recent pay stubs, bank statements, and tax returns verify income and financial stability.

Debt, Liability, and Asset Documentation

Preparing the correct documents related to debt, liabilities, and assets is crucial for first-time homebuyer mortgage approval. Lenders assess these documents to determine financial stability and repayment capability.

- Debt Documentation - Includes recent credit card statements, student loans, auto loans, and any outstanding personal loans to verify monthly obligations.

- Liability Documentation - Provides details on ongoing financial responsibilities, such as child support payments or court-ordered obligations, ensuring a comprehensive liability profile.

- Asset Documentation - Covers bank statements, retirement accounts, investment portfolios, and proof of funds for down payment and closing costs to demonstrate financial resources.

Down Payment Verification and Gift Letter Guidelines

First-time homebuyer mortgage approval requires specific documentation to verify the down payment source. Lenders prioritize clear proof of funds and acceptable gift letter guidelines to ensure financial transparency.

Down payment verification typically includes bank statements, savings account records, or investment account summaries demonstrating the availability of funds. Gift letters must clearly state the donor's intent, specify that the money is a gift without repayment obligations, and include the donor's contact information. This documentation helps confirm the legitimacy of the down payment and satisfies lender requirements for mortgage approval.

Preparing and Organizing Your Mortgage Application Packet

| Document Type | Description | Purpose | Tips for Preparation |

|---|---|---|---|

| Proof of Identity | Valid government-issued photo ID such as passport or driver's license | Confirms borrower's identity and legal status | Ensure ID is up to date and clear; submit copies as required |

| Proof of Income | Recent pay stubs, W-2 forms from past two years, tax returns for self-employed borrowers | Verifies steady income to assess loan repayment ability | Gather documents from all income sources; organize chronologically |

| Credit Report Authorization | Signed consent form allowing lender to access credit history | Helps lender evaluate creditworthiness and risk | Review credit report beforehand to correct any errors |

| Bank Statements | Statements from last 2-3 months showing checking, savings, and investment accounts | Demonstrates financial reserves, funds for down payment and closing costs | Highlight consistent savings and large deposits for explanation |

| Employment Verification | Letter from employer or contact information for verification calls | Confirms employment status and length of job history | Request letter early; ensure contact details are accurate |

| Debt Information | Details on existing loans, credit cards, and monthly obligations | Calculates debt-to-income ratio to assess loan eligibility | List outstanding debts clearly and provide statements if possible |

| Purchase Agreement | Signed contract for the home purchase | Indicates property details and agreed sale price for loan underwriting | Keep a signed copy accessible within your application packet |

| Mortgage Application Form | Completed lender's application form with personal and financial information | Central document compiling borrower's profile for evaluation | Double-check for accuracy and completeness before submission |

What Documents are Necessary for First-Time Homebuyer Mortgage Approval? Infographic