Veterans Affairs home loan applications require several key documents including a valid Certificate of Eligibility (COE), proof of military service such as DD Form 214, and personal identification like a driver's license or passport. Lenders also typically request income verification documents, including recent pay stubs, federal tax returns, and bank statements to assess financial stability. Proper documentation streamlines the loan approval process and ensures compliance with VA requirements.

What Documents are Needed for Veterans Affairs Home Loan Application?

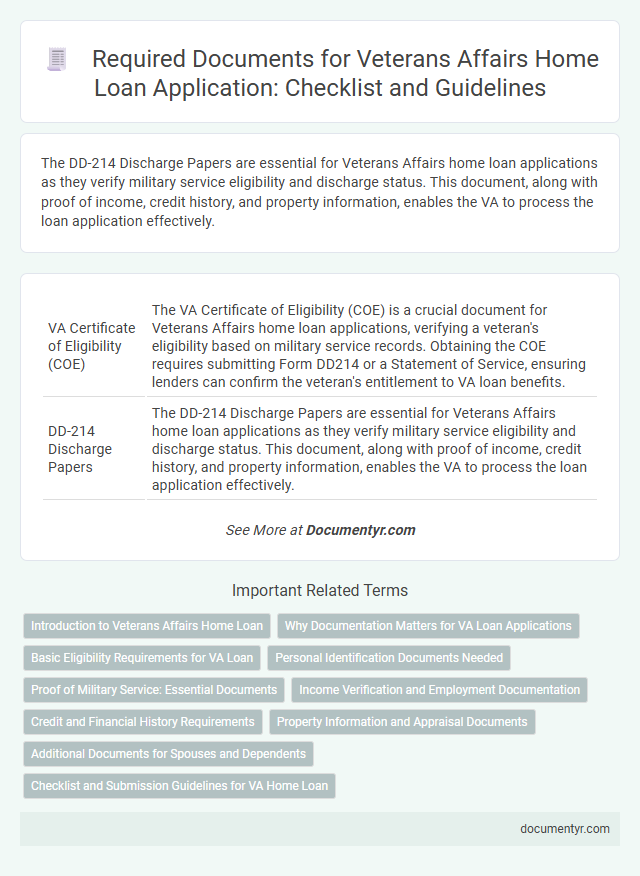

| Number | Name | Description |

|---|---|---|

| 1 | VA Certificate of Eligibility (COE) | The VA Certificate of Eligibility (COE) is a crucial document for Veterans Affairs home loan applications, verifying a veteran's eligibility based on military service records. Obtaining the COE requires submitting Form DD214 or a Statement of Service, ensuring lenders can confirm the veteran's entitlement to VA loan benefits. |

| 2 | DD-214 Discharge Papers | The DD-214 Discharge Papers are essential for Veterans Affairs home loan applications as they verify military service eligibility and discharge status. This document, along with proof of income, credit history, and property information, enables the VA to process the loan application effectively. |

| 3 | Statement of Service (Active Duty) | The Statement of Service (Active Duty) is a crucial document for Veterans Affairs home loan applications, providing official verification of active military service necessary to determine eligibility. This document must be an original or certified copy from the military branch, detailing the service member's full name, Social Security Number, entry date, and current status to support the loan approval process. |

| 4 | Automated Underwriting Findings | Automated Underwriting Findings require submission of credit reports, income verification, and debt-to-income ratios to evaluate eligibility for Veterans Affairs Home Loan applications. Supporting documents often include recent pay stubs, W-2 forms, and DD214 discharge papers to verify veteran status and financial stability. |

| 5 | Residual Income Worksheet | The Residual Income Worksheet is a critical document for Veterans Affairs home loan applications, as it helps determine the borrower's ability to cover monthly living expenses after paying debts. Applicants must provide detailed financial information, including income, expenses, and family size, to accurately complete this worksheet and meet VA loan eligibility requirements. |

| 6 | VA Loan Funding Fee Exemption Letter | Veterans applying for a VA home loan must provide a VA Loan Funding Fee Exemption Letter to confirm eligibility for exemption from the funding fee, which is a crucial part of the application process. This document verifies service-connected disability status or receipt of VA pension benefits, ensuring veterans avoid unnecessary loan costs. |

| 7 | VA Form 26-1880 | VA Form 26-1880, Request for a Certificate of Eligibility, is a crucial document required for Veterans Affairs home loan applications to verify a veteran's eligibility for VA loan benefits. Applicants must also provide proof of military service, such as discharge papers (DD214), and financial documents including pay stubs, tax returns, and credit history to complete the application process. |

| 8 | Entitlement Restoration Statement | The Entitlement Restoration Statement is a critical document for Veterans Affairs home loan applications, verifying the restoration of a veteran's VA loan entitlement after a previous loan payoff or assumption. This statement ensures the applicant's eligibility for a new VA-backed loan by confirming unused or re-established entitlement with the VA. |

| 9 | Automated Certificate Remittance | The Automated Certificate of Eligibility (COE) system streamlines the Veterans Affairs home loan application by providing immediate digital verification of a veteran's eligibility, eliminating the need for paper-based Veterans Affairs loan documentation. Essential documents for this process include a valid DD214 or other proof of military service, as well as personal identification and income verification to support the loan application. |

| 10 | VA IRRRL (Interest Rate Reduction Refinance Loan) Checklist | The VA IRRRL checklist requires documents including the current VA loan statement, the Certificate of Eligibility (COE), proof of income such as recent pay stubs or tax returns, and a completed application form. Borrowers must also provide a credit report authorization and a valid government-issued ID to verify identity and eligibility for the Interest Rate Reduction Refinance Loan. |

Introduction to Veterans Affairs Home Loan

Veterans Affairs home loans offer significant benefits for eligible service members, veterans, and their families. These loans provide favorable terms, such as low or no down payment options and competitive interest rates. Understanding the required documents is essential to streamline your VA home loan application process.

Why Documentation Matters for VA Loan Applications

Accurate documentation is crucial for a Veterans Affairs (VA) home loan application to verify eligibility and ensure a smooth approval process. Documents such as the Certificate of Eligibility (COE), proof of military service, and income verification establish the borrower's entitlement to VA loan benefits.

Providing proper documentation reduces delays and mitigates the risk of application denial by confirming the applicant meets specific criteria set by the Department of Veterans Affairs. Clear and complete records help lenders assess creditworthiness and loan amount accurately, facilitating a faster closing.

Basic Eligibility Requirements for VA Loan

Applying for a Veterans Affairs (VA) home loan requires specific documents to verify eligibility and support the application. Meeting the basic eligibility requirements is essential to proceed with the VA loan process.

- Certificate of Eligibility (COE) - Verifies your service history and confirms eligibility for the VA home loan program.

- Proof of Military Service - Documents such as DD Form 214 or current active duty orders demonstrate qualifying military service.

- Credit and Income Documentation - Recent pay stubs, tax returns, and credit reports verify financial stability and loan repayment ability.

Personal Identification Documents Needed

| Document Type | Description | Purpose |

|---|---|---|

| Government-Issued Photo ID | Valid driver's license, state ID card, or passport | Proof of identity to verify applicant's personal details |

| Social Security Card | Original or photocopy of Social Security card issued by SSA | Verification of Social Security Number for credit and background checks |

| Birth Certificate | Certified copy of birth certificate | Confirms date and place of birth for eligibility validation |

| Marriage Certificate (if applicable) | Certified document proving marital status | Used to establish spousal information and loan eligibility for veterans |

| Discharge Papers (DD Form 214) | Official military discharge document | Confirms veteran status required for VA Home Loan qualification |

| Proof of Residence | Utility bills or lease agreements with applicant's name and address | Verifies current address for loan application processing |

Proof of Military Service: Essential Documents

Proof of military service is a crucial part of the Veterans Affairs home loan application process. Providing the correct documents helps verify eligibility and expedites loan approval.

- Certificate of Release or Discharge from Active Duty (DD Form 214) - This document confirms your active duty status and character of service.

- Statement of Service - A letter from your military unit verifying current active duty status and service dates.

- Report of Separation - Documents the nature of discharge and ensures you meet service requirements for VA loan benefits.

Submitting these essential documents will strengthen your application and ensure accurate assessment by Veterans Affairs.

Income Verification and Employment Documentation

When applying for a Veterans Affairs Home Loan, income verification is crucial to demonstrate your ability to repay the loan. Required documents include recent pay stubs, tax returns, and W-2 forms to provide a clear financial picture.

Employment documentation must confirm your current job status and stability. This typically involves a letter from your employer verifying your position, length of employment, and income. Both income verification and employment records ensure lenders assess your eligibility accurately.

Credit and Financial History Requirements

Understanding the credit and financial history requirements is crucial for a successful Veterans Affairs home loan application. This report outlines the necessary documents to demonstrate your financial stability and creditworthiness.

- Credit Report - A comprehensive credit report from all three major credit bureaus shows your credit history and current standing.

- Income Verification - Recent pay stubs, tax returns, and W-2 forms verify your income and employment status.

- Debt Documentation - Statements for existing debts such as credit cards, loans, and other obligations illustrate your current financial liabilities.

Property Information and Appraisal Documents

For a Veterans Affairs (VA) home loan application, submitting comprehensive property information is essential. Required documents include the purchase agreement, proof of property insurance, and a VA appraisal report. The VA appraisal ensures the home meets minimum property requirements and establishes the loan amount eligibility.

Additional Documents for Spouses and Dependents

What additional documents are required for spouses and dependents in a Veterans Affairs home loan application? Spouses must provide a marriage certificate to establish the legal relationship. Dependents should submit birth certificates or adoption records to verify their status for the loan process.

What Documents are Needed for Veterans Affairs Home Loan Application? Infographic