To apply for a student loan, you need to gather key documents including proof of identity, such as a government-issued ID or passport, and proof of enrollment or admission from your educational institution. Financial documents like tax returns, income statements, and bank statements are essential to assess your financial need and repayment capability. You may also need your social security number or taxpayer identification number, along with any co-signer information if applicable.

What Documents Do You Need for a Student Loan Application?

| Number | Name | Description |

|---|---|---|

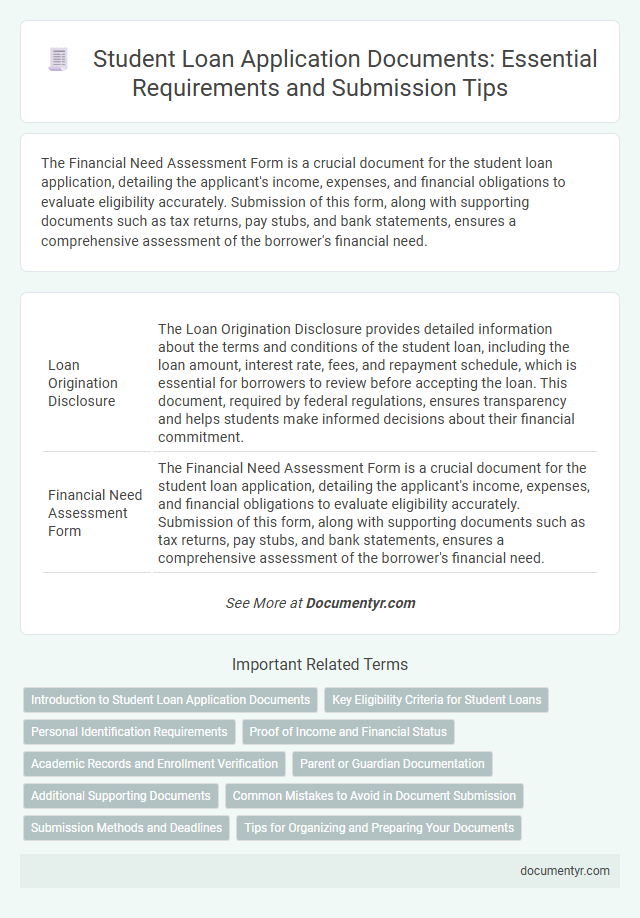

| 1 | Loan Origination Disclosure | The Loan Origination Disclosure provides detailed information about the terms and conditions of the student loan, including the loan amount, interest rate, fees, and repayment schedule, which is essential for borrowers to review before accepting the loan. This document, required by federal regulations, ensures transparency and helps students make informed decisions about their financial commitment. |

| 2 | Financial Need Assessment Form | The Financial Need Assessment Form is a crucial document for the student loan application, detailing the applicant's income, expenses, and financial obligations to evaluate eligibility accurately. Submission of this form, along with supporting documents such as tax returns, pay stubs, and bank statements, ensures a comprehensive assessment of the borrower's financial need. |

| 3 | FAFSA Dependency Override Letter | A FAFSA Dependency Override Letter is required when a student cannot provide parental information due to exceptional circumstances, allowing the financial aid office to consider the student as independent for loan eligibility. This document must be submitted alongside the standard FAFSA application and supporting financial records to ensure accurate assessment for student loan approval. |

| 4 | Satisfactory Academic Progress (SAP) Documentation | Satisfactory Academic Progress (SAP) documentation typically includes transcripts, progress reports, and academic evaluations that verify a student's compliance with institutional SAP standards. These documents are crucial for demonstrating eligibility and maintaining financial aid eligibility throughout the loan application process. |

| 5 | Statement of Educational Purpose | The Statement of Educational Purpose is essential for verifying that the student loan funds will be used exclusively for educational expenses, ensuring compliance with federal loan requirements. This document must be signed by the student in the presence of a financial aid administrator or a notary public to confirm the applicant's identity and intent. |

| 6 | Selective Service Registration Proof | Selective Service Registration Proof is a critical document required for male student loan applicants aged 18 to 25 to verify compliance with federal registration requirements. This proof can be a registration card, a copy of the Selective Service registration acknowledgment, or an official letter of exemption. |

| 7 | Credential Evaluation Report | A Credential Evaluation Report is essential for verifying international academic credentials to meet student loan eligibility requirements. This report ensures that foreign qualifications are accurately assessed and recognized by lenders during the application process. |

| 8 | Parent PLUS Loan Endorser Addendum | The Parent PLUS Loan Endorser Addendum requires a completed endorsement form signed by a qualified endorser along with the primary borrower's financial documents, including employment verification and credit history. Submission must also include the student's FAFSA confirmation to verify dependency status and eligibility for the PLUS loan program. |

| 9 | Tax Return Transcript (IRS Data Retrieval Tool Confirmation) | The Tax Return Transcript, accessible via the IRS Data Retrieval Tool, is a critical document in a student loan application as it verifies accurate income and tax information directly from the IRS, streamlining the verification process. This transcript ensures the financial data submitted matches official records, reducing processing errors and expediting loan approval. |

| 10 | Digital Citizenship Verification | Digital citizenship verification for a student loan application requires submitting valid government-issued identification, proof of enrollment from an accredited institution, and a recent utility bill or bank statement to confirm residency. These documents establish identity, enrollment status, and address, ensuring compliance with lender verification standards. |

Introduction to Student Loan Application Documents

Applying for a student loan requires submitting specific documents to verify your eligibility and financial status. These documents typically include proof of identity, income statements, and enrollment verification from your educational institution. Preparing these materials in advance can streamline the application process and increase your chances of approval.

Key Eligibility Criteria for Student Loans

What documents are essential for a student loan application? Proof of identity such as a government-issued ID and Social Security number is mandatory. Applicants must also provide admission letters and academic records to verify enrollment and course details.

Which financial documents support loan eligibility? Income proof or tax returns of the applicant or co-signer establish repayment capacity. Bank statements and credit history reports further validate financial stability for loan approval.

Are additional forms required to meet eligibility criteria? Loan applications generally require completed application forms and signed loan agreements. Statements of purpose or financial need may be requested to support eligibility and loan terms.

Personal Identification Requirements

| Document Type | Description |

|---|---|

| Government-Issued Photo ID | Valid passport, driver's license, or state-issued ID card to verify identity and age. |

| Social Security Number (SSN) | Social Security card or official document displaying your SSN for credit and eligibility verification. |

| Birth Certificate | Official birth certificate for proof of citizenship or residency status if required by the lender. |

| Proof of Residency | Recent utility bills, lease agreements, or official mail confirming current address. |

Proof of Income and Financial Status

Proof of income is a critical document in a student loan application process. Lenders require evidence to verify the applicant's ability to repay the loan, commonly in the form of recent pay stubs, tax returns, or bank statements.

Financial status documentation provides a comprehensive view of the borrower's current economic condition. This includes records such as credit reports, debt statements, and asset valuations to assess loan eligibility and risk.

Academic Records and Enrollment Verification

Academic records and enrollment verification form the foundation of any student loan application. These documents confirm your educational status and eligibility for financial aid.

- Official Transcripts - Detailed records of your completed courses and grades provide proof of academic performance.

- Enrollment Verification Letter - A formal document from your institution verifying current enrollment status and course load.

- Proof of Degree Progress - Documentation indicating your advancement toward degree completion helps lenders assess your commitment and loan risk.

Parent or Guardian Documentation

When applying for a student loan, parent or guardian documentation is essential to verify financial information and support the application process. These documents ensure accurate assessment of the borrower's eligibility and loan amount.

- Proof of Income - Recent pay stubs or tax returns from parents or guardians demonstrate their financial capacity and stability.

- Identification Documents - Valid government-issued IDs such as driver's licenses or passports confirm the identity of the parent or guardian.

- Proof of Residency - Utility bills or lease agreements establish the current living address of the parent or guardian.

Additional Supporting Documents

Additional supporting documents for a student loan application often include proof of residency, such as a utility bill or lease agreement. Financial statements like recent tax returns or pay stubs may be required to verify income and repayment ability. Academic records, including transcripts and enrollment verification, help confirm eligibility and loan purpose.

Common Mistakes to Avoid in Document Submission

Submitting the correct documents is crucial for a smooth student loan application process. Avoiding common mistakes ensures timely approval and reduces processing delays.

- Incomplete Documentation - Missing or partially filled forms can lead to application rejection or delays.

- Expired Identification - Submitting outdated IDs can cause verification issues and slow down approval.

- Incorrect Financial Information - Providing inaccurate income or expense details can result in loan denial or reassessment.

Careful review and accurate submission of all required documents enhance your chances of securing the student loan successfully.

Submission Methods and Deadlines

When applying for a student loan, it is essential to gather all required documents such as proof of identity, income statements, admission letters, and financial statements. These documents verify your eligibility and help streamline the approval process.

Submission methods typically include online portals, postal mail, or in-person delivery at the financial institution. Meeting the specified deadlines ensures your application is processed on time, preventing delays or missed funding opportunities.

What Documents Do You Need for a Student Loan Application? Infographic