A small business loan application should include key documents such as a detailed business plan, financial statements (including profit and loss statements, balance sheets, and cash flow projections), and personal and business tax returns. Lenders often require legal documents like business licenses, registration certificates, and articles of incorporation to verify the legitimacy of the business. Including collateral documentation and a clear explanation of the loan purpose strengthens the application and improves the chances of approval.

What Documents Should Be Included in a Small Business Loan Application?

| Number | Name | Description |

|---|---|---|

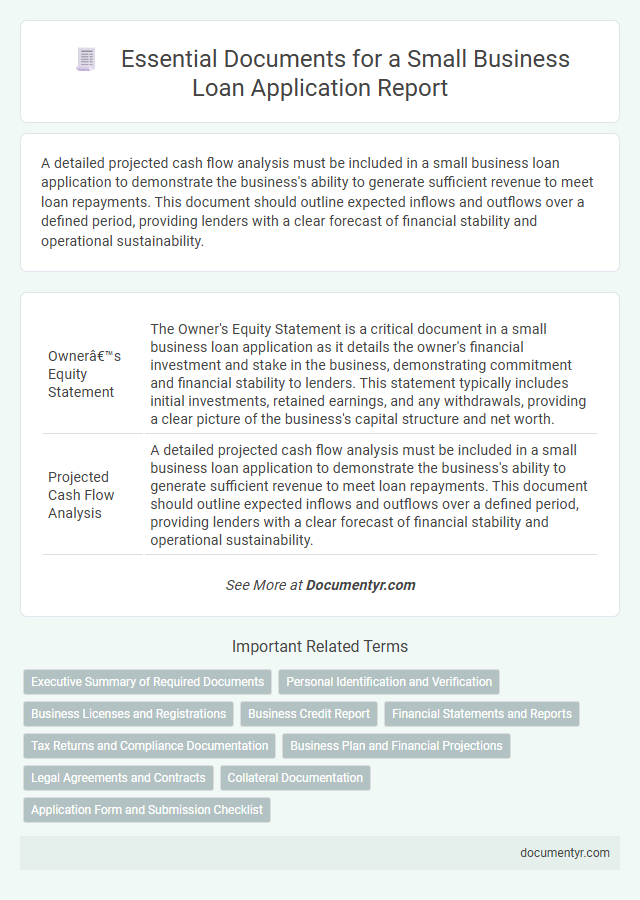

| 1 | Owner’s Equity Statement | The Owner's Equity Statement is a critical document in a small business loan application as it details the owner's financial investment and stake in the business, demonstrating commitment and financial stability to lenders. This statement typically includes initial investments, retained earnings, and any withdrawals, providing a clear picture of the business's capital structure and net worth. |

| 2 | Projected Cash Flow Analysis | A detailed projected cash flow analysis must be included in a small business loan application to demonstrate the business's ability to generate sufficient revenue to meet loan repayments. This document should outline expected inflows and outflows over a defined period, providing lenders with a clear forecast of financial stability and operational sustainability. |

| 3 | Business Debt Schedule | A comprehensive Business Debt Schedule is essential in a small business loan application, detailing all current liabilities, including loans, credit lines, and payment terms. This document provides lenders with a clear overview of the company's financial obligations, helping assess creditworthiness and risk. |

| 4 | Personal Financial Statement | A personal financial statement is crucial in a small business loan application as it provides lenders with a detailed overview of the applicant's assets, liabilities, income, and net worth, demonstrating their financial stability and ability to repay the loan. Including accurately completed personal financial statements helps establish creditworthiness and supports the business's overall financial profile. |

| 5 | Collateral Documentation | Collateral documentation in a small business loan application includes detailed asset appraisals, ownership titles, insurance policies, and proof of value for property or equipment used as security. Providing these documents accurately enhances lender confidence by validating the asset's worth and legal standing. |

| 6 | Business Continuity Plan | A comprehensive small business loan application must include a detailed Business Continuity Plan outlining strategies for operational resilience during disruptions, risk management protocols, and recovery procedures. This document demonstrates the business's preparedness to lenders, enhancing the credibility of the loan application by mitigating potential financial risks. |

| 7 | Environmental Impact Disclosure | A Small Business Loan Application must include an Environmental Impact Disclosure outlining potential ecological effects related to the business operations or project activities, such as emissions, waste management, and resource usage. This document helps lenders assess environmental risks and compliance with regulatory standards, ensuring sustainable business practices and reducing financial liabilities. |

| 8 | Business License Verification | Business license verification is a critical document in a small business loan application, establishing the legitimacy and legal authorization to operate. Lenders require a valid business license to assess compliance with local regulations and ensure the business is officially registered and operating within legal parameters. |

| 9 | Digital Bank Statement Extracts | Digital bank statement extracts are essential documents in a small business loan application, providing lenders with real-time insights into cash flow and financial stability. Including these digital statements enhances transparency and accelerates the loan approval process by offering accurate, up-to-date transaction histories directly from the business's financial institution. |

| 10 | UBO (Ultimate Beneficial Owner) Declaration | A Small Business Loan Application must include a UBO (Ultimate Beneficial Owner) Declaration to identify all individuals who own or control 25% or more of the business, ensuring transparency and compliance with anti-money laundering regulations. This declaration typically requires detailed personal information, ownership percentages, and supporting identification documents of each UBO. |

Executive Summary of Required Documents

The executive summary of required documents for a small business loan application provides a clear overview of essential paperwork lenders expect. These documents establish your business credibility and financial health.

Key documents include your business plan, financial statements, tax returns, and legal registrations. Preparing these materials thoroughly improves your chances of securing loan approval.

Personal Identification and Verification

What personal identification and verification documents are required for a small business loan application? Lenders typically request government-issued photo IDs such as a passport or driver's license to confirm the applicant's identity. Proof of Social Security number, like a Social Security card or tax documents, is also essential to verify legal eligibility and credit history.

Business Licenses and Registrations

Business licenses and registrations are essential documents for a small business loan application. They verify the legal operation and compliance of the business within its applicable jurisdiction.

- Business License - Confirms that the business is authorized to operate legally within the city or county.

- State Registration - Demonstrates the business's official registration with the state government, validating its legal existence.

- Industry-Specific Permits - Shows compliance with regulations tailored to the business's particular industry, ensuring lawful operation.

Business Credit Report

A Business Credit Report is a critical document in a small business loan application. It provides lenders with detailed insights into your company's creditworthiness and financial history.

The report includes credit scores, payment history, outstanding debts, and public records related to your business. Presenting a strong Business Credit Report increases the chances of loan approval and favorable terms.

Financial Statements and Reports

Financial statements and reports are critical components of a small business loan application, providing lenders with a clear view of the company's financial health. These documents demonstrate the business's ability to generate revenue, manage expenses, and repay the loan.

- Balance Sheet - Summarizes the business's assets, liabilities, and equity at a specific point in time to showcase financial stability.

- Income Statement - Details revenue, expenses, and profit over a defined period, illustrating operational performance.

- Cash Flow Statement - Tracks cash inflows and outflows to reveal liquidity and the ability to meet financial obligations.

Providing accurate and up-to-date financial statements increases the likelihood of loan approval and favorable terms.

Tax Returns and Compliance Documentation

| Document Type | Description | Purpose in Loan Application |

|---|---|---|

| Tax Returns | Complete business and personal tax returns for the past 2-3 years, including all schedules and attachments. | Tax returns verify the business's income, financial stability, and ability to repay the loan. Lenders assess profitability and consistency through detailed tax records. |

| Compliance Documentation | Licenses, permits, certificate of good standing, and other regulatory documents that prove the business operates within legal requirements. | Compliance documents demonstrate the business's adherence to local, state, and federal laws. Lenders require these to minimize risk and ensure lawful operation. |

Business Plan and Financial Projections

A comprehensive small business loan application requires several essential documents, with the business plan and financial projections being among the most critical. These documents provide lenders with insight into the business's goals and expected financial performance.

The business plan outlines the company's mission, market analysis, and operational strategy, demonstrating its potential for growth. Financial projections, including cash flow statements, profit and loss forecasts, and balance sheets, offer a detailed view of the business's expected financial health over time. Together, these documents help lenders assess the viability and risk of lending to the small business.

Legal Agreements and Contracts

Legal agreements and contracts play a critical role in a small business loan application by providing proof of business obligations and stability. Lenders require documents such as partnership agreements, lease contracts, and supplier agreements to evaluate the reliability and legal standing of the business. Including these documents ensures that your loan application demonstrates transparency and builds lender confidence in your business operations.

Collateral Documentation

Collateral documentation is essential in a small business loan application as it demonstrates the ability to secure the loan with valuable assets. Providing clear and complete evidence of collateral increases the likelihood of loan approval.

- Appraisal Reports - Professional valuations detail the current market value of the collateral assets.

- Title and Ownership Documents - Legal papers proving ownership of property or equipment used as collateral are required.

- Insurance Policies - Documentation showing collateral assets are insured protects the lender's investment.

What Documents Should Be Included in a Small Business Loan Application? Infographic