Medical malpractice insurance requires essential documents such as your medical license, proof of Board certification, and a detailed curriculum vitae outlining your professional experience. It is also important to provide any prior claims history, risk management training certificates, and a completed application form specific to the insurance provider's requirements. These documents help assess your risk profile and ensure appropriate coverage tailored to your medical practice.

What Documents are Necessary for Medical Malpractice Insurance?

| Number | Name | Description |

|---|---|---|

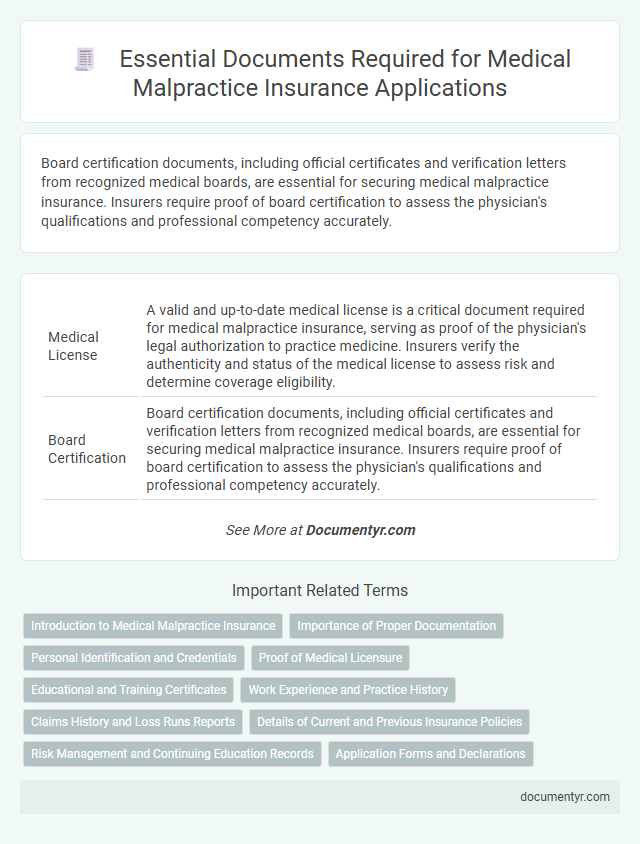

| 1 | Medical License | A valid and up-to-date medical license is a critical document required for medical malpractice insurance, serving as proof of the physician's legal authorization to practice medicine. Insurers verify the authenticity and status of the medical license to assess risk and determine coverage eligibility. |

| 2 | Board Certification | Board certification documents, including official certificates and verification letters from recognized medical boards, are essential for securing medical malpractice insurance. Insurers require proof of board certification to assess the physician's qualifications and professional competency accurately. |

| 3 | Curriculum Vitae (CV) | A detailed Curriculum Vitae (CV) is essential for medical malpractice insurance as it provides a comprehensive record of a healthcare professional's education, training, certifications, and work experience. Insurers use the CV to assess risk factors, verify credentials, and determine appropriate coverage terms and premiums. |

| 4 | Proof of Hospital Privileges | Proof of hospital privileges is a critical document required for medical malpractice insurance applications, demonstrating that a healthcare professional has been granted permission to provide services at a specific hospital. Insurers rely on this evidence to assess the practitioner's credentials and ensure compliance with institutional standards, directly impacting coverage eligibility and premium rates. |

| 5 | Claims History Report (Loss Runs) | A Claims History Report (Loss Runs) is essential for medical malpractice insurance as it details past claims, settlements, and pending lawsuits against the healthcare provider, enabling accurate risk assessment and premium calculation. Insurance underwriters rely on this document to evaluate exposure and determine appropriate coverage terms based on the provider's claims frequency and severity. |

| 6 | Previous Insurance Policies (Declarations Page) | Previous insurance policies, specifically the declarations page, are essential documents for medical malpractice insurance applications as they detail coverage limits, policy periods, and claims history. These documents enable insurers to accurately assess risk and determine appropriate premiums based on prior protection and any reported incidents. |

| 7 | Completed Insurance Application | A completed insurance application for medical malpractice insurance must include detailed personal information, medical licensing details, claims history, and practice information to accurately assess risk. Supporting documents such as certificates of prior insurance, curriculum vitae, and risk management certifications are often required to ensure comprehensive coverage evaluation. |

| 8 | Hospital Credentials Verification | Hospital credentials verification requires submission of valid medical licenses, board certifications, and proof of hospital affiliation to ensure compliance with medical malpractice insurance policies. These documents validate the practitioner's qualifications and institutional endorsement, minimizing insurance risk exposure. |

| 9 | Proof of Continuing Medical Education (CME) | Proof of Continuing Medical Education (CME) is essential for medical malpractice insurance as it demonstrates a physician's commitment to maintaining current knowledge and skills. Insurers often require CME certificates or transcripts to verify compliance with state licensure boards and reduce liability risks. |

| 10 | State and Federal DEA Certificates | State and federal DEA certificates are essential documents required for medical malpractice insurance as they verify a healthcare provider's authorization to prescribe controlled substances legally. These certificates demonstrate compliance with drug enforcement regulations and are critical for insurers to assess risk and coverage eligibility accurately. |

| 11 | Practice Location Details | Practice location details for medical malpractice insurance require precise documentation, including the physical address of the healthcare facility, the type of practice (e.g., hospital, clinic, or private office), and any satellite or additional practice sites. Insurers also need information on the geographical risk factors associated with the location to assess liability exposure accurately. |

| 12 | Ownership or Partnership Agreements (if applicable) | Ownership or partnership agreements are essential documents for medical malpractice insurance applications, as they detail the legal structure and responsibilities of the medical practice. Insurers require these agreements to assess liability exposure and determine appropriate coverage limits based on ownership stakes and decision-making authorities. |

| 13 | Risk Management Training Certificates | Risk management training certificates are essential documents for medical malpractice insurance as they demonstrate that healthcare professionals have completed specialized education to minimize patient risks and improve safety protocols. These certificates significantly influence insurance premium calculations and coverage approval by showcasing proactive efforts to reduce malpractice claims. |

| 14 | Procedure and Treatment Logs | Procedure and treatment logs provide detailed records of all medical interventions, serving as critical evidence in medical malpractice insurance claims by documenting standard of care and patient outcomes. Accurate and comprehensive logs ensure proper evaluation of liability and support the insurer's risk assessment process. |

| 15 | Disclosure of Pending or Past Disciplinary Actions | Medical malpractice insurance applications require full disclosure of any pending or past disciplinary actions from medical boards or regulatory agencies. Accurate reporting of these incidents ensures compliance with insurer policies and influences coverage terms and premiums. |

Introduction to Medical Malpractice Insurance

Medical malpractice insurance protects healthcare professionals against claims of negligence or errors during patient care. Understanding the necessary documents ensures you have appropriate coverage in place.

- Application Form - This document collects personal and professional information required to assess risk and eligibility.

- Proof of Medical License - Verification of your active medical license confirms your credentials to provide healthcare services.

- Claims History Report - A record of previous malpractice claims helps insurers determine your risk profile and premium rates.

Having these documents ready simplifies the process of obtaining comprehensive medical malpractice insurance.

Importance of Proper Documentation

Proper documentation is crucial for securing medical malpractice insurance, as it provides clear evidence of your professional qualifications and practice history. Essential documents include your medical license, board certifications, and proof of completed training or continuing education.

Accurate records of prior claims, if any, and detailed patient treatment notes enhance the credibility of your application. Proper documentation protects your legal and financial interests in case of future malpractice claims.

Personal Identification and Credentials

Medical malpractice insurance requires specific documents to verify personal identification and professional credentials. Providing accurate information ensures proper coverage tailored to the healthcare provider's qualifications.

- Government-issued ID - Valid passports or driver's licenses confirm the insured's identity and legal status.

- Medical License - Current and active medical licenses demonstrate legal authorization to practice medicine in the specified jurisdiction.

- Board Certification - Documentation of board certification proves specialized training and expertise recognized by medical boards.

Proof of Medical Licensure

Proof of medical licensure is a crucial document when applying for medical malpractice insurance. Your valid and current medical license verifies your legal authorization to practice medicine in a specific state or region. Insurers require this to confirm your credentials and ensure compliance with regulatory standards.

Educational and Training Certificates

Educational and training certificates are essential documents for obtaining medical malpractice insurance. These certificates verify your qualifications and demonstrate compliance with industry standards.

Insurance providers require copies of your medical degrees, residency completions, and specialized training certificates. Maintaining updated records of continuing education courses strengthens your application and supports your professional credibility.

Work Experience and Practice History

Medical malpractice insurance requires detailed documentation of your work experience and practice history to assess risk accurately. Records such as employment verification letters, credentialing certificates, and a comprehensive malpractice claims history are essential. These documents help insurers determine your eligibility and coverage terms effectively.

Claims History and Loss Runs Reports

| Document | Description | Importance for Medical Malpractice Insurance |

|---|---|---|

| Claims History | Detailed records of all past malpractice claims filed against a medical professional or practice. | Helps insurers assess risk by reviewing the frequency, nature, and outcomes of previous claims. Accurate claims history reduces underwriting uncertainties and can influence premium rates. |

| Loss Runs Reports | Summaries from previous insurers showing paid and reserved losses, claim dates, and claim status. | Provide an in-depth view of your claim patterns and potential liabilities. Loss runs enable insurers to verify claims history accuracy and understand exposure to future claims. |

Details of Current and Previous Insurance Policies

When applying for medical malpractice insurance, detailed documentation of your current and previous insurance policies is essential. This includes Certificates of Insurance and Declarations Pages that outline coverage limits, policy periods, and any claims history.

Providing information about prior medical malpractice coverage helps insurers assess risk accurately. You should supply policy numbers, insurer contact information, and copies of any claims reports or settlements related to previous policies. Accurate documentation ensures seamless coverage continuity and supports appropriate premium determination.

Risk Management and Continuing Education Records

Medical malpractice insurance requires specific documentation to ensure comprehensive risk management and proof of continuing education. Maintaining organized records helps healthcare professionals demonstrate compliance and reduce liability exposure.

- Risk Management Policies - Detailed documentation of risk management protocols illustrates adherence to patient safety standards and preventative measures.

- Incident Reports - Records of any adverse events or near misses provide evidence of proactive risk identification and corrective actions taken.

- Continuing Education Certificates - Proof of ongoing professional development ensures that medical practitioners stay current with clinical best practices and regulatory requirements.

What Documents are Necessary for Medical Malpractice Insurance? Infographic