Health insurance claims require key documents including the original medical bills, detailed discharge summaries, and physician's prescriptions to validate treatment and expenses. Patients must also provide claim forms filled accurately and copies of valid identity proof and insurance policy documents for verification. Submitting these essential documents ensures smooth processing and timely reimbursement of health insurance claims.

What Documents are Needed for Health Insurance Claims?

| Number | Name | Description |

|---|---|---|

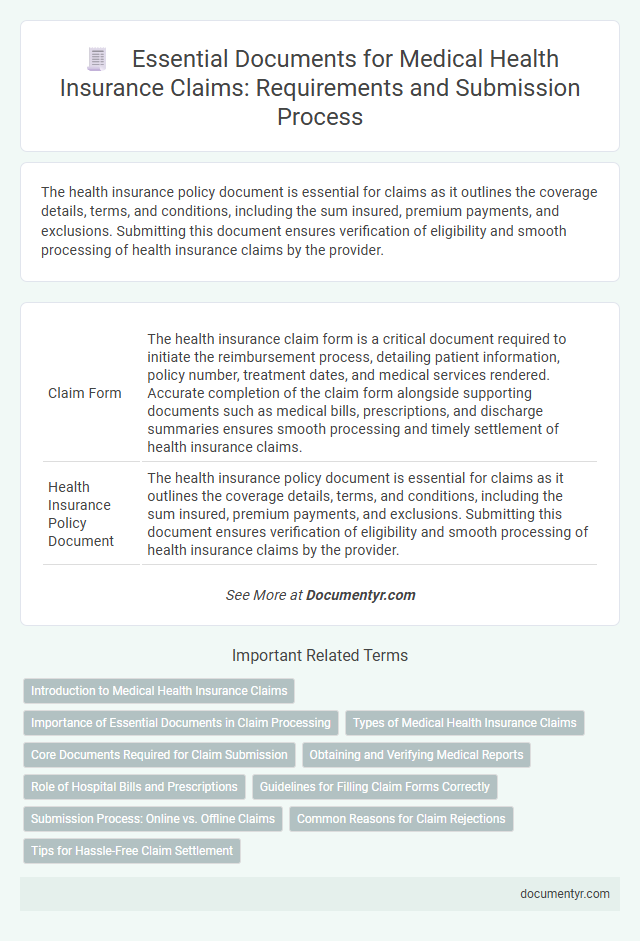

| 1 | Claim Form | The health insurance claim form is a critical document required to initiate the reimbursement process, detailing patient information, policy number, treatment dates, and medical services rendered. Accurate completion of the claim form alongside supporting documents such as medical bills, prescriptions, and discharge summaries ensures smooth processing and timely settlement of health insurance claims. |

| 2 | Health Insurance Policy Document | The health insurance policy document is essential for claims as it outlines the coverage details, terms, and conditions, including the sum insured, premium payments, and exclusions. Submitting this document ensures verification of eligibility and smooth processing of health insurance claims by the provider. |

| 3 | Hospital Discharge Summary | Hospital discharge summaries serve as a crucial document for health insurance claims, detailing the patient's diagnosis, treatment provided, and duration of hospital stay. Accurate discharge summaries, including test reports and physician's notes, facilitate claim approval by validating the medical necessity and scope of hospital care. |

| 4 | Doctor’s Prescription | A doctor's prescription is a critical document for health insurance claims as it verifies the medical necessity of the treatment or medication prescribed. Insurers require the prescription to validate the claim, ensuring that the expenses are directly related to a diagnosed health condition. |

| 5 | Medical Bills and Receipts | Medical bills and receipts are crucial documents for health insurance claims, providing detailed itemization of treatments, medications, and services rendered, along with associated costs. These documents must be original, itemized, and include dates of service, healthcare provider information, patient details, and payment proofs to ensure accurate claim processing by insurers. |

| 6 | Hospitalization Bills | Hospitalization bills must include detailed charges for room, diagnostics, treatment, medicines, and doctor's fees, accurately itemized and dated to support health insurance claims. These documents should be accompanied by discharge summaries, hospital reports, and original payment receipts to ensure claim verification and fast processing. |

| 7 | Diagnostic Test Reports | Diagnostic test reports, including lab results, imaging scans, and pathology findings, serve as essential documents for health insurance claims to verify the necessity and extent of medical treatment. Insurers require these detailed diagnostic reports to assess the validity of the claim and determine appropriate reimbursement based on the diagnosed condition. |

| 8 | Pharmacy Bills | Pharmacy bills are essential documents for health insurance claims as they provide detailed records of prescribed medications, including drug names, quantities, dosages, and costs. Accurate submission of pharmacy bills ensures proper reimbursement and verification of eligible pharmaceutical expenses under the insurance policy. |

| 9 | Identity Proof | Health insurance claims require identity proof documents such as government-issued photo IDs, including passports, driver's licenses, or national identity cards, to verify the claimant's identity. These documents ensure accurate processing by linking the claim to the correct insured individual and preventing fraudulent submissions. |

| 10 | Health Card or Policy Card | Health insurance claims require presenting a valid health card or policy card, which contains essential details like the policy number, insured member's name, and coverage specifics. This card serves as proof of insurance and is crucial for claim verification and processing with healthcare providers and insurance companies. |

| 11 | FIR or Medico-Legal Certificate (for accident cases) | For health insurance claims involving accident cases, submitting a First Information Report (FIR) or a Medico-Legal Certificate (MLC) is essential to validate the incident and facilitate claim processing. These documents provide critical legal and medical evidence required by insurance companies to assess the claim's legitimacy and expedite approval. |

| 12 | Referral Letter (if required) | A referral letter from a primary care physician or specialist is essential for health insurance claims when the policy mandates prior authorization for specialist consultations or treatments, ensuring coverage eligibility. This document confirms the medical necessity and proper coordination of care, preventing claim denials due to unauthorized visits. |

| 13 | Pre-authorization Form (for cashless claims) | A Pre-authorization Form is a critical document required for cashless health insurance claims, detailing the proposed medical treatment and estimated costs, and must be approved by the insurer before hospitalization. This form ensures that the insurer verifies coverage eligibility and processes the claim seamlessly without upfront payment by the insured. |

| 14 | Investigation Reports | Investigation reports are essential documents for health insurance claims as they provide detailed medical evaluations, test results, and diagnostic findings crucial for claim verification. Accurate and comprehensive investigation reports ensure timely processing and approval of health insurance reimbursements. |

| 15 | Surgery/Procedure Report | Surgery or procedure reports are essential documents for health insurance claims as they provide detailed information about the medical intervention performed, including the type, duration, and outcome of the procedure. These reports help insurance companies verify the necessity and scope of the surgery or procedure for accurate claim processing and reimbursement. |

| 16 | Attending Physician’s Certificate | The Attending Physician's Certificate is a crucial document for health insurance claims as it provides detailed medical information and confirmation of the diagnosis, treatment, and duration of illness as observed by the treating doctor. This certificate, often required alongside hospital bills and claim forms, ensures accurate validation of the medical condition for claim processing by insurance providers. |

| 17 | Cancelled Cheque (for reimbursement claims) | A cancelled cheque is essential for health insurance reimbursement claims as it verifies the insured's bank account details, ensuring accurate and timely fund transfer. Submitting this document along with medical bills and claim forms facilitates smooth processing and avoids payment delays. |

| 18 | Death Certificate (if applicable) | Health insurance claims related to death require a certified death certificate to verify the insured's passing, which is essential for processing benefits and nominee claims. Other documents may include the original health insurance policy, identity proofs of the claimant, medical records leading to death, and a claim form submitted to the insurer. |

| 19 | Employer’s Certificate (for group insurance) | The Employer's Certificate is a crucial document required for health insurance claims under group insurance policies, verifying the employee's eligibility and coverage details. This certificate typically includes employment dates, designation, salary information, and confirmation of enrollment in the group insurance plan, facilitating accurate claim processing. |

| 20 | Authorization Letter (if submitting on behalf of insured) | An Authorization Letter is essential when submitting health insurance claims on behalf of the insured, as it grants legal permission to act on their behalf and access confidential medical and billing information. This document must be duly signed by the insured, specifying the claimant's details and the scope of authorization to ensure smooth claim processing. |

Introduction to Medical Health Insurance Claims

Health insurance claims require specific documents to process and verify medical expenses. Proper documentation ensures timely reimbursement and reduces claim rejections.

Essential documents include the health insurance policy, medical bills, and doctor's prescription. Additional papers such as discharge summaries and diagnostic reports may be necessary for comprehensive claims.

Importance of Essential Documents in Claim Processing

What documents are needed for health insurance claims? Essential documents such as the insurance policy, medical bills, and doctors' reports play a crucial role in claim processing. These papers verify the treatment received and help ensure timely reimbursement for medical expenses.

Types of Medical Health Insurance Claims

Health insurance claims require specific documents depending on the type of medical service utilized. For hospitalization claims, important documents include discharge summaries, hospital bills, and doctor's prescriptions. Outpatient claims typically need medical reports, test bills, and consultation receipts to ensure smooth processing.

Core Documents Required for Claim Submission

Submitting a health insurance claim requires specific documentation to ensure smooth processing. Gathering all necessary papers beforehand helps avoid delays and rejections.

- Claim Form - Completed and signed claim form provided by the insurance company is mandatory for processing.

- Medical Reports - Detailed medical reports and diagnosis from the treating physician validate the treatment and expenses.

- Hospital Bills and Receipts - Original itemized hospital bills and payment receipts confirm the charges incurred during treatment.

Your claim will be processed faster when all core documents are accurately submitted with the claim application.

Obtaining and Verifying Medical Reports

Obtaining and verifying medical reports is crucial for successful health insurance claims. Accurate documentation supports the claim process and expedites settlement.

- Medical Reports - These include diagnosis details, treatment history, and doctor's notes issued by the hospital or authorized medical professional.

- Verification Process - Ensure the medical reports are authentic, clearly legible, and correspond to the dates and type of treatment claimed.

- Patient Records - Your complete patient records may be required, including test results and discharge summaries, to substantiate the claim.

Role of Hospital Bills and Prescriptions

Submitting health insurance claims requires specific documents to verify medical expenses and treatments. Hospital bills and prescriptions play a crucial role in validating your claim effectively.

- Hospital Bills - Detailed invoices from the hospital provide proof of the medical services and treatments received, including dates and costs.

- Prescriptions - Doctor's prescriptions confirm the medical necessity of prescribed medications and treatments, supporting the claim's authenticity.

- Claim Form - A completed claim form summarizes the treatment details and personal information required for processing the insurance claim.

Guidelines for Filling Claim Forms Correctly

| Required Documents for Health Insurance Claims |

|---|

| Medical reports detailing diagnosis and treatment |

| Original hospital bills and receipts |

| Prescriptions from the attending physician |

| Discharge summary from the healthcare provider |

| Claim form duly filled and signed |

| Guidelines for Filling Claim Forms Correctly |

| Use clear, legible handwriting or type to avoid errors |

| Fill all mandatory fields accurately with consistent information |

| Provide your full name and policy number exactly as on the insurance card |

| Attach all relevant documents securely to the claim form |

| Double-check the form for completeness before submission |

| Sign the claim form where required to validate the request |

Submission Process: Online vs. Offline Claims

Health insurance claims require specific documents such as the claim form, original medical bills, prescriptions, diagnostic reports, and discharge summaries. Proof of identity and a copy of your insurance policy may also be necessary to process the claim efficiently.

Submitting claims online offers faster processing and easy tracking through the insurer's portal or mobile app. Offline claims involve physically submitting documents at the insurance office or hospital, which may take longer due to manual verification and handling.

Common Reasons for Claim Rejections

Health insurance claims require specific documents such as the insurance policy, hospital bills, discharge summary, medical reports, and prescription slips. These documents verify the authenticity of the treatment and ensure smooth claim processing.

Common reasons for claim rejections include incomplete or incorrect documentation, policy lapses, and claims for non-covered treatments. Submission of duplicate bills or missing pre-authorization approvals can also lead to denial. Ensuring all necessary documents are accurately submitted helps avoid rejection and speeds up claim approval.

What Documents are Needed for Health Insurance Claims? Infographic