Freelance photographers must maintain organized records of invoices, receipts, and expense reports to accurately document income and deductible costs for tax filing. Keeping copies of contracts and client agreements helps verify the nature of services provided and income sources. Additionally, tracking mileage logs and equipment purchase receipts is essential for claiming business deductions and maintaining compliance with tax regulations.

What Documents Does a Freelance Photographer Need for Tax Filing?

| Number | Name | Description |

|---|---|---|

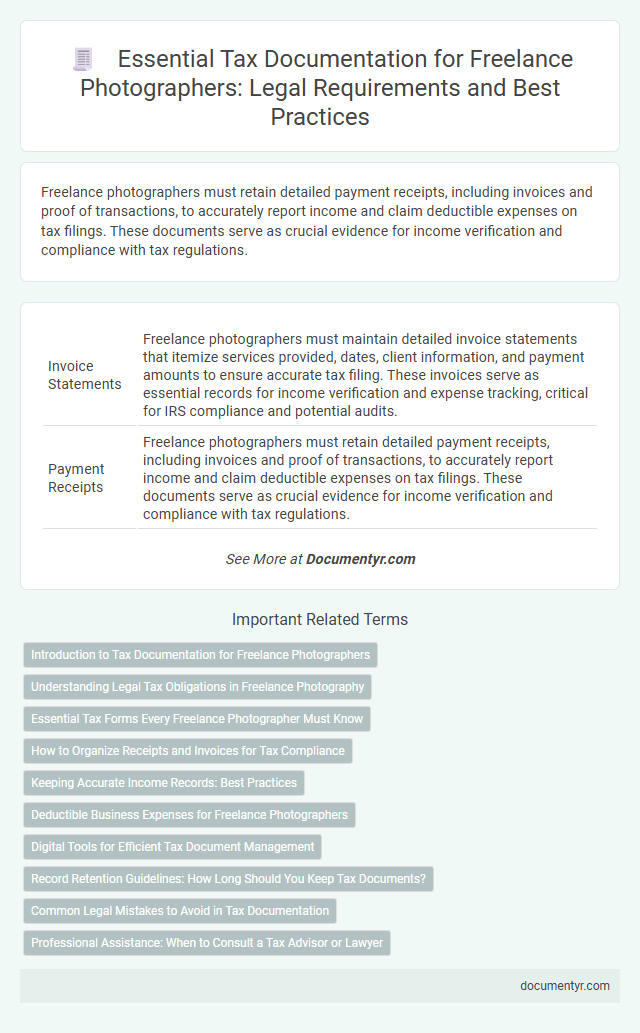

| 1 | Invoice Statements | Freelance photographers must maintain detailed invoice statements that itemize services provided, dates, client information, and payment amounts to ensure accurate tax filing. These invoices serve as essential records for income verification and expense tracking, critical for IRS compliance and potential audits. |

| 2 | Payment Receipts | Freelance photographers must retain detailed payment receipts, including invoices and proof of transactions, to accurately report income and claim deductible expenses on tax filings. These documents serve as crucial evidence for income verification and compliance with tax regulations. |

| 3 | Bank Statements | Freelance photographers must retain detailed bank statements to verify income deposits and track deductible business expenses for accurate tax filing. These statements provide essential financial evidence required to support reported earnings and justify expense claims during tax audits. |

| 4 | 1099 Forms (US) | Freelance photographers must collect all 1099-MISC or 1099-NEC forms received from clients to accurately report income on their tax returns. These forms document payments of $600 or more and are essential for both income verification and expense deductions during tax filing. |

| 5 | W-9 Form (US) | Freelance photographers must provide a completed W-9 form to clients to report income accurately and ensure proper tax withholding and reporting to the IRS. This document includes essential information such as the photographer's name, address, and Taxpayer Identification Number (TIN), which is crucial for filing 1099-MISC or 1099-NEC forms at year-end. |

| 6 | Expense Receipts | Freelance photographers must meticulously organize expense receipts related to equipment purchases, travel, and client-related costs to accurately report deductible business expenses on their tax filings. Maintaining detailed, categorized receipts supports legitimate deductions and helps prevent audits by providing verifiable proof of business expenditures. |

| 7 | Mileage Logs | Freelance photographers must maintain accurate mileage logs to substantiate vehicle expenses for tax deductions, detailing dates, destinations, purposes, and miles driven for business use. Properly documented mileage logs are essential to comply with IRS requirements and maximize allowable deductions on Schedule C or equivalent tax forms. |

| 8 | Equipment Purchase Receipts | Freelance photographers must retain equipment purchase receipts, including invoices for cameras, lenses, and lighting gear, as these documents serve as proof of business expenses for tax deductions and depreciation claims. Accurate records of purchase dates, costs, and vendor details are crucial to substantiate claims during IRS audits and maximize eligible write-offs. |

| 9 | Home Office Deduction Records | Freelance photographers must maintain detailed home office deduction records, including receipts for utility bills, mortgage statements, property tax documents, and evidence of the square footage used exclusively for work. These documents substantiate the portion of home expenses deductible on Schedule C, reducing taxable income accurately and complying with IRS requirements. |

| 10 | Contracts/Agreements | Freelance photographers need to maintain detailed contracts or agreements outlining the scope of work, payment terms, and usage rights as they serve as critical evidence for income and expense verification during tax filing. These documents help substantiate business deductions, clarify ownership of images, and provide a legal foundation for client relationships in tax audits. |

| 11 | Proof of Insurance | Freelance photographers must provide proof of insurance, including liability insurance and equipment coverage, to ensure compliance with tax filing requirements and protect against potential claims. Maintaining accurate records of these insurance policies supports deductible expenses and helps validate their business status during tax audits. |

| 12 | Tax Return Copies | Freelance photographers must retain copies of their completed tax returns, including Schedule C or Schedule F forms, to document income and deductible expenses accurately. These tax return copies are essential for verifying reported earnings, supporting deductions, and providing evidence during IRS audits or future tax filings. |

| 13 | Previous Year Tax Filings | Freelance photographers must gather previous year tax filings, including past income tax returns, Form 1099 for freelance income, and expense receipts related to photography equipment and business costs. Maintaining organized records of prior tax documents ensures accurate reporting and maximizes deductions during the current tax filing process. |

| 14 | Income Summary Sheets | Freelance photographers need income summary sheets that detail all earnings from client projects, including invoices, receipts, and digital payment records, to accurately report taxable income. These documents serve as crucial evidence for tax deductions and support the preparation of comprehensive financial statements required by tax authorities. |

| 15 | Client List with Payments | A freelance photographer must maintain a detailed client list with corresponding payment records to accurately report income for tax filing purposes. This documentation includes invoices, receipts, and bank statements that verify the amounts received from each client throughout the fiscal year. |

| 16 | Schedule C (US - for sole proprietors) | Freelance photographers must compile accurate records of all income and expenses related to their business to complete Schedule C for tax filing, including invoices, receipts for equipment purchases, software subscriptions, travel expenses, and home office deductions. Maintaining detailed logs of client payments, mileage, and business-related costs ensures precise profit calculation and compliance with IRS requirements for sole proprietors. |

| 17 | Business License (if applicable) | A freelance photographer should include a valid business license as part of their tax filing documents if required by their local jurisdiction, as it verifies the legal authorization to operate. Maintaining this license along with income records and expense receipts ensures compliance and accurate reporting to tax authorities. |

| 18 | PayPal or Payment Platform Statements | Freelance photographers must retain PayPal or other payment platform statements detailing all received payments, fees deducted, and transaction dates to accurately report income on tax returns. These documents serve as critical evidence for IRS verification and help ensure compliance with tax regulations. |

| 19 | Travel Expense Documentation | Freelance photographers must retain detailed travel expense documentation, including mileage logs, receipts for transportation, lodging, and meals incurred during business trips, to accurately claim deductions on tax filings. Maintaining organized records with dates, locations, and business purposes ensures compliance with IRS requirements and maximizes allowable expenses. |

| 20 | Marketing Expense Receipts | Freelance photographers must keep detailed marketing expense receipts, including costs for online ads, print promotions, website hosting, and social media campaigns, to accurately claim deductions during tax filing. Proper documentation of these expenses ensures compliance with tax regulations and maximizes allowable deductions for business marketing efforts. |

Introduction to Tax Documentation for Freelance Photographers

Freelance photographers must maintain accurate tax documentation to comply with tax regulations and maximize deductions. Proper record-keeping simplifies income reporting and expense tracking during tax filing season.

Essential documents include income statements, expense receipts, and contracts with clients. These records ensure transparency and support claims made on tax returns filed with the IRS or other tax authorities.

Understanding Legal Tax Obligations in Freelance Photography

Freelance photographers must maintain accurate records such as invoices, receipts, and contracts to comply with tax filing requirements. Keeping detailed documentation of income and business expenses helps in claiming deductions and calculating taxable earnings accurately. Understanding your legal tax obligations ensures proper reporting and avoidance of penalties in freelance photography.

Essential Tax Forms Every Freelance Photographer Must Know

Freelance photographers must understand the essential tax documents required for accurate tax filing. Proper organization of these forms ensures compliance with tax laws and maximizes deductions.

- Form 1099-NEC - Used to report non-employee compensation received from clients for freelance work completed.

- Schedule C (Form 1040) - Details income and expenses related to freelance photography business operations.

- Form W-9 - Submitted to clients to provide taxpayer identification information for accurate income reporting.

Maintaining these essential tax forms aids freelance photographers in efficient and lawful tax filing.

How to Organize Receipts and Invoices for Tax Compliance

Freelance photographers must organize receipts and invoices meticulously to ensure smooth tax filing and compliance with IRS regulations. Maintaining categorized folders, either digitally or physically, helps track business expenses such as equipment purchases, travel costs, and client payments. Using accounting software for receipt scanning and invoice management further streamlines record keeping and simplifies reporting deductible expenses during tax season.

Keeping Accurate Income Records: Best Practices

Keeping accurate income records is essential for a freelance photographer to ensure proper tax filing and avoid legal issues. Organized documentation supports your income claims and simplifies tax preparation.

- Maintain detailed invoices - Document every client transaction with clear invoices outlining services and payment dates.

- Track payment receipts - Save all payment confirmations, whether digital or physical, as proof of income received.

- Use accounting software - Leverage tools designed for freelancers to categorize income and expenses systematically.

Deductible Business Expenses for Freelance Photographers

| Document Type | Description | Relevance to Deductible Business Expenses |

|---|---|---|

| Income Records | Invoices, receipts, and payment confirmations from clients. | Essential for reporting gross income and verifying taxable earnings. |

| Expense Receipts | Receipts and invoices for business-related purchases such as camera equipment, software, and props. | Supports claims for deductible expenses that reduce taxable income. |

| Equipment Purchase Documentation | Purchase agreements and receipts for cameras, lenses, lighting, and computers. | Used to calculate depreciation or immediate expense deductions under tax law. |

| Home Office Records | Documents detailing the portion of home expenses used exclusively for business, such as rent, utilities, and internet bills. | Allows deduction of home office expenses proportionate to business use. |

| Business Mileage Logs | Records of miles driven for business purposes, including dates, destinations, and purposes. | Enables deduction for vehicle expenses at the IRS mileage rate or actual expenses. |

| Business Insurance Policies | Contracts and payment records for liability insurance and equipment insurance. | Premiums are deductible as necessary business expenses. |

| Professional Service Fees | Invoices or statements from accountants, lawyers, or consultants related to the freelance photography business. | Allows deduction of expenses for professional services used in managing the business. |

| Advertising and Marketing Expenses | Receipts and invoices for ads, website hosting, business cards, and promotional materials. | Deductible as ordinary and necessary business expenses. |

| Continuing Education Expenses | Receipts for photography workshops, courses, and training materials. | Deductible if related to maintaining or improving professional skills. |

| Tax Forms | Copies of prior year tax returns, Schedule C, and IRS form 1099-MISC or 1099-NEC. | Required for accurate filing and reporting of income and expenses. |

Digital Tools for Efficient Tax Document Management

Freelance photographers must maintain accurate tax documents such as income records, expense receipts, and 1099 forms to ensure proper tax filing. Digital tools like cloud storage and expense tracking apps streamline the organization of these documents, reducing errors and saving time.

Using software like QuickBooks or FreshBooks allows photographers to automatically categorize expenses and generate financial reports. These tools enhance efficiency by providing easy access to essential tax documents during tax season.

Record Retention Guidelines: How Long Should You Keep Tax Documents?

Freelance photographers must retain tax-related documents to comply with IRS regulations and support accurate tax filing. Proper record retention ensures preparedness for audits and the ability to substantiate income and expenses.

The IRS generally recommends keeping tax documents for at least three years from the date of filing, covering income statements, expense receipts, and deduction records. However, if there is a claim of a loss from worthless securities or bad debt deduction, retain documents for seven years. Records should be stored securely, organized by tax year, and backed up digitally when possible to prevent loss or damage.

Common Legal Mistakes to Avoid in Tax Documentation

What are the essential documents a freelance photographer must keep for accurate tax filing? Freelance photographers need to organize invoices, receipts for equipment purchases, and expense records to ensure proper tax reporting. Maintaining a clear record of contract agreements and payment proofs helps avoid discrepancies during tax audits.

Which common legal errors should freelance photographers avoid in their tax documentation? Misclassifying deductible expenses or failing to retain proper receipts often leads to tax penalties. Overlooking income sources or neglecting to report all freelance earnings can result in underreported income and legal issues with tax authorities.

What Documents Does a Freelance Photographer Need for Tax Filing? Infographic