Forming an LLC in California requires submitting the Articles of Organization (Form LLC-1) to the Secretary of State, which officially registers the business. An Operating Agreement outlining the management structure and member responsibilities is highly recommended, although not mandatory. Additionally, the Initial Statement of Information (Form LLC-12) must be filed within 90 days of formation to provide updated contact and management details.

What Documents Are Required for an LLC Formation in California?

| Number | Name | Description |

|---|---|---|

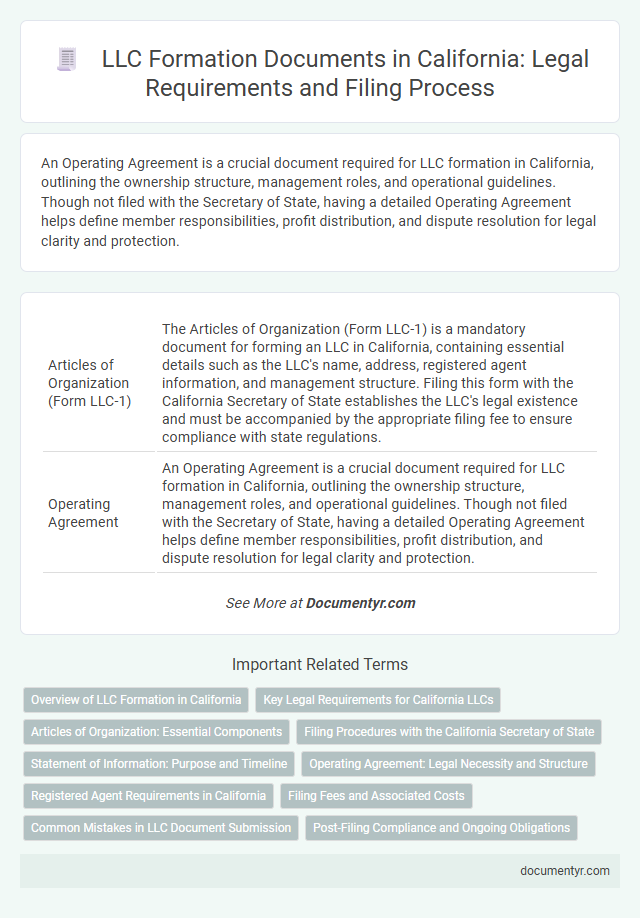

| 1 | Articles of Organization (Form LLC-1) | The Articles of Organization (Form LLC-1) is a mandatory document for forming an LLC in California, containing essential details such as the LLC's name, address, registered agent information, and management structure. Filing this form with the California Secretary of State establishes the LLC's legal existence and must be accompanied by the appropriate filing fee to ensure compliance with state regulations. |

| 2 | Operating Agreement | An Operating Agreement is a crucial document required for LLC formation in California, outlining the ownership structure, management roles, and operational guidelines. Though not filed with the Secretary of State, having a detailed Operating Agreement helps define member responsibilities, profit distribution, and dispute resolution for legal clarity and protection. |

| 3 | Statement of Information (Form LLC-12) | The Statement of Information (Form LLC-12) is a mandatory document that must be filed within 90 days of forming an LLC in California, providing updated details about the company's address, management, and agent for service of process. Filing this form is essential for maintaining good standing with the California Secretary of State and avoiding penalties or suspension of the LLC's rights. |

| 4 | Registered Agent Acceptance Document | The Registered Agent Acceptance document is a mandatory form that confirms the appointed registered agent's consent to receive legal documents on behalf of the LLC in California. This document must be filed with the California Secretary of State during the LLC formation process to ensure compliance with state regulations. |

| 5 | Initial Franchise Tax Payment Voucher (Form 3522) | The Initial Franchise Tax Payment Voucher (Form 3522) is required for LLC formation in California to submit the initial $800 franchise tax payment to the California Franchise Tax Board. This payment must accompany the LLC's formation documents or be submitted shortly after filing to ensure compliance with California state tax regulations. |

| 6 | Employer Identification Number (EIN) Application (IRS Form SS-4) | The Employer Identification Number (EIN) application requires completion of IRS Form SS-4, essential for LLC formation in California to identify the business for tax purposes. This federal tax ID enables an LLC to open bank accounts, hire employees, and file taxes, making it a critical document in the registration process. |

| 7 | Business License Application | To form an LLC in California, submitting a completed Business License Application to the local city or county government is essential for legal operation. This document typically requires detailed business information, including the LLC's name, address, owner details, and nature of the business to ensure compliance with local regulations. |

| 8 | Local Permits and Zoning Clearances | Obtaining local permits and zoning clearances is crucial for LLC formation in California to ensure compliance with city or county land use regulations. These documents typically include a zoning clearance certificate and specific business operation permits, verified through the local planning department. |

| 9 | Statement of Information Filing Fee Receipt | The Statement of Information Filing Fee Receipt is a crucial document required for LLC formation in California, confirming payment of the mandatory filing fee to the Secretary of State. This receipt verifies the LLC's compliance with initial reporting requirements and is necessary for maintaining the company's good standing during the registration process. |

| 10 | California LLC Name Reservation Request Form (Optional) | The California LLC Name Reservation Request Form is an optional document that allows entrepreneurs to reserve a specific LLC name for up to 60 days, ensuring its availability during the formation process. Submitting this form along with the $10 filing fee helps secure the desired business name before filing the Articles of Organization with the California Secretary of State. |

Overview of LLC Formation in California

Forming an LLC in California requires submitting specific legal documents to the Secretary of State. The primary document is the Articles of Organization, which officially registers the LLC.

Additional documents include the Initial Statement of Information, filed within 90 days of formation. An Operating Agreement is highly recommended to outline ownership and operating procedures, though it is not mandatory for filing.

Key Legal Requirements for California LLCs

To form an LLC in California, the primary document required is the Articles of Organization (Form LLC-1), which must be filed with the California Secretary of State. An LLC operating agreement, although not mandatory, is highly recommended to outline the management structure and operating procedures. Additional legal requirements include obtaining an Employer Identification Number (EIN) from the IRS and filing the Statement of Information (Form LLC-12) within 90 days of formation.

Articles of Organization: Essential Components

Forming an LLC in California requires specific documents to ensure legal compliance and proper registration. The Articles of Organization is the foundational document that outlines key information about your LLC.

- LLC Name - The official name of your LLC must be unique and comply with California state naming rules.

- Purpose of the LLC - A brief description of the business activities your LLC will engage in.

- Registered Agent Information - The name and address of the person or entity designated to receive legal documents on behalf of the LLC.

Filing Procedures with the California Secretary of State

| Document | Description | Filing Requirements |

|---|---|---|

| Articles of Organization (Form LLC-1) | Official document to legally create an LLC in California. Includes LLC name, address, agent for service of process, management structure. | Filed online, by mail, or in person with the California Secretary of State. Filing fee is $70. |

| Statement of Information (Form LLC-12) | Contains updated LLC information such as addresses, management, and agent for service of process. Required within 90 days of formation. | Filed online or by mail. Filing fee is $20. Must be filed every two years thereafter. |

| Initial Franchise Tax Payment | California requires an annual minimum franchise tax of $800, payable to the Franchise Tax Board. | Payable within 75 days of LLC formation. Proof of payment may be required during filings. |

| Operating Agreement (Internal Document) | Defines management, ownership, and operating procedures for the LLC. Not submitted to the state but essential for legal compliance. | Retain internally. A signed copy should be maintained by the LLC members. |

Statement of Information: Purpose and Timeline

The Statement of Information is a mandatory document for LLC formation in California that provides updated details about the company to the Secretary of State. It ensures transparency and public access to key information regarding the LLC's management and business activities.

- Purpose - The Statement of Information discloses the LLC's address, management structure, and agent for service of process to maintain accurate state records.

- Initial Filing Timeline - LLCs must file the initial Statement of Information within 90 days of formation to comply with California state requirements.

- Ongoing Filings - The Statement of Information must be renewed every two years to keep the LLC's information current and avoid penalties.

Timely filing of the Statement of Information is crucial to maintain good standing and legal compliance for LLCs operating in California.

Operating Agreement: Legal Necessity and Structure

An Operating Agreement is a crucial document for LLC formation in California, outlining the ownership and management structure of the company. While not legally required by the state, having a well-drafted Operating Agreement protects your limited liability status and helps prevent internal disputes. This agreement defines members' roles, profit distribution, and procedures for changes, ensuring clear governance and legal protection.

Registered Agent Requirements in California

Forming an LLC in California requires filing specific documents with the California Secretary of State. The key forms include the Articles of Organization (Form LLC-1) and the Statement of Information (Form LLC-12).

Your LLC must appoint a registered agent who has a physical address in California. The registered agent is responsible for receiving legal documents and official government communications on behalf of the LLC. This requirement ensures that the state and third parties have a reliable contact point for service of process.

Filing Fees and Associated Costs

What documents are required for an LLC formation in California, and what are the filing fees and associated costs? To form an LLC in California, you must file the Articles of Organization (Form LLC-1) with the California Secretary of State. The filing fee for this document is $70, and there are additional costs such as the Statement of Information (Form LLC-12) with a $20 fee, due within 90 days of filing.

Are there any ongoing fees associated with maintaining an LLC in California? Your LLC must pay an annual minimum franchise tax of $800 to the California Franchise Tax Board. Failure to pay this fee can result in penalties and suspension of your LLC's good standing.

Common Mistakes in LLC Document Submission

Forming an LLC in California requires submitting the Articles of Organization (Form LLC-1) and paying the appropriate filing fee. You must also prepare an Operating Agreement and obtain an Employer Identification Number (EIN) from the IRS for tax purposes.

Common mistakes in LLC document submission include incomplete or inaccurate information on the Articles of Organization. Failing to sign the forms or neglecting to file the Initial Statement of Information (Form LLC-12) on time can cause delays or rejection of your application.

What Documents Are Required for an LLC Formation in California? Infographic