Essential documents for LLC formation include the Articles of Organization, which officially establish the company and outline its basic details. An Operating Agreement is also crucial, defining ownership structure and management procedures to prevent future disputes. Other necessary filings may include obtaining an Employer Identification Number (EIN) and registering for state and local business licenses.

What Documents are Necessary for an LLC Formation?

| Number | Name | Description |

|---|---|---|

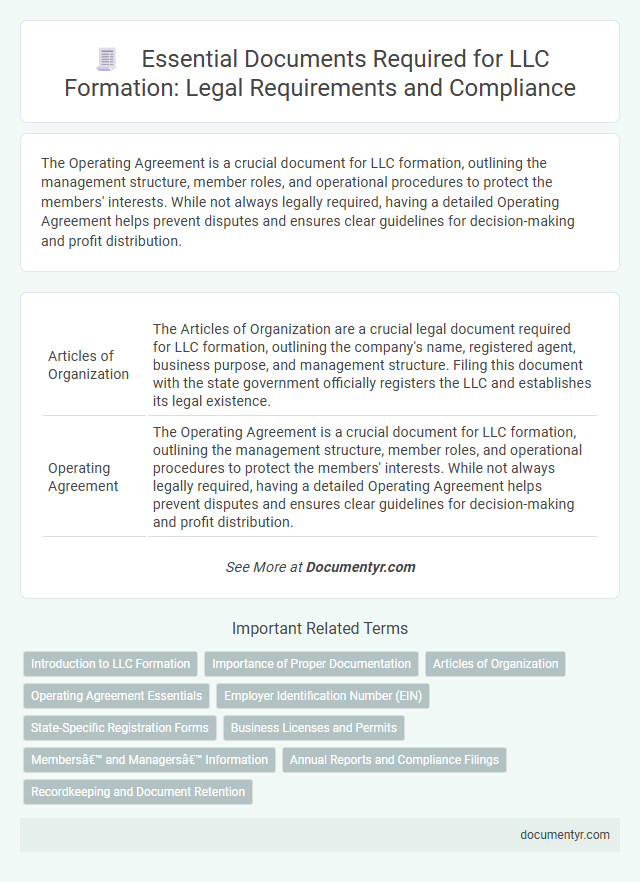

| 1 | Articles of Organization | The Articles of Organization are a crucial legal document required for LLC formation, outlining the company's name, registered agent, business purpose, and management structure. Filing this document with the state government officially registers the LLC and establishes its legal existence. |

| 2 | Operating Agreement | The Operating Agreement is a crucial document for LLC formation, outlining the management structure, member roles, and operational procedures to protect the members' interests. While not always legally required, having a detailed Operating Agreement helps prevent disputes and ensures clear guidelines for decision-making and profit distribution. |

| 3 | Member/Manager Resolutions | Member/Manager resolutions are essential documents for LLC formation, detailing decisions such as the appointment of managers, approval of operating agreements, and authorization of initial actions required to establish the company. These resolutions provide a formal record of internal decisions, ensuring compliance with state laws and clarifying the roles and responsibilities within the LLC's management structure. |

| 4 | Initial Statement of Information | The Initial Statement of Information is a crucial document required for LLC formation, containing essential data such as the LLC's principal address, names and addresses of members or managers, and the registered agent's contact information. Filing this statement within the state-mandated deadline ensures compliance and maintains the LLC's good standing with the Secretary of State. |

| 5 | Registered Agent Acceptance Form | The Registered Agent Acceptance Form is a critical document in LLC formation, confirming the agent's consent to receive legal and tax documents on behalf of the company. This form ensures compliance with state law by officially designating the registered agent's responsibilities and contact information for service of process. |

| 6 | EIN Application (Form SS-4) | The EIN application for LLC formation requires submitting IRS Form SS-4, which includes details such as the LLC's legal name, address, responsible party's name and Social Security Number, and business structure. This Employer Identification Number is essential for tax reporting, hiring employees, opening bank accounts, and ensuring compliance with federal tax obligations. |

| 7 | Business License Application | The essential document for LLC formation related to business licensing is the Business License Application, which verifies the company's compliance with local, state, and federal regulations. This application often requires submitting the Articles of Organization, Employer Identification Number (EIN), and proof of registered agent to authorize the LLC's legal operation. |

| 8 | Publication Affidavit (if required) | The Publication Affidavit is a critical document for LLC formation in states where publication requirements exist, serving as proof that the LLC's formation notice was published in designated newspapers for a statutory period. This affidavit must be filed with the state's business authority to comply with local regulations and finalize the LLC registration process. |

| 9 | Certificate of Good Standing (if converting or merging) | Forming an LLC requires filing Articles of Organization and an Operating Agreement, and when converting or merging an existing entity, a Certificate of Good Standing is essential to verify the business's compliance status in its original jurisdiction. This certificate ensures the LLC is legally authorized to conduct business and facilitates smooth registration with state authorities during the formation process. |

| 10 | Membership Certificates | Membership certificates are essential legal documents that verify ownership interests in an LLC, detailing member names, ownership percentages, and issuance dates to establish clear membership rights. These certificates support accurate record-keeping and provide formal proof of membership crucial for operational transparency and dispute resolution. |

| 11 | Banking Resolution | A Banking Resolution is a crucial document for LLC formation as it authorizes designated members or managers to open bank accounts and handle financial transactions on behalf of the LLC. This resolution ensures the bank recognizes the authority of individuals to manage company funds, safeguarding the LLC's financial operations and compliance. |

| 12 | State Tax Registration Forms | State tax registration forms are essential for LLC formation as they enable the business to comply with state tax regulations, including sales tax, employment tax, and income tax obligations. Filing these forms with the appropriate state tax agency ensures the LLC obtains necessary tax identification numbers and maintains good standing for tax reporting and payment purposes. |

| 13 | Foreign LLC Registration (if operating in multiple states) | Foreign LLC registration requires submitting a Certificate of Authority or Application for Registration to the Secretary of State in each additional state where the LLC operates, along with a Certificate of Good Standing from the LLC's home state. Other necessary documents include the LLC's Articles of Organization, a registered agent designation in the foreign state, and payment of applicable filing fees. |

| 14 | Franchise Tax Registration Form | The Franchise Tax Registration Form is a mandatory document required for LLC formation in many states, used to register the business with the state's tax authority and establish tax obligations. Submitting this form ensures compliance with franchise tax laws and enables the LLC to legally operate within the state. |

| 15 | Professional Licenses (if applicable) | Professional licenses are essential documents for LLC formation when the business involves regulated professions such as healthcare, legal, or financial services, ensuring compliance with state licensing boards. These licenses must be submitted alongside the Articles of Organization to validate the LLC's authority to operate within the specific professional field. |

Introduction to LLC Formation

Forming a Limited Liability Company (LLC) involves specific documentation to establish your business legally. Understanding these essential documents ensures a smooth registration process.

The Articles of Organization is the primary document filed with the state to officially create the LLC. An Operating Agreement outlines the management structure and operating procedures, protecting your business interests.

Importance of Proper Documentation

Proper documentation is essential for the successful formation of an LLC, ensuring legal compliance and protecting your business interests. Without the correct documents, the LLC may face operational and legal challenges.

- Articles of Organization - This foundational document officially registers the LLC with the state and establishes its existence.

- Operating Agreement - Defines the ownership structure and operational guidelines, preventing internal disputes among members.

- Employer Identification Number (EIN) - Issued by the IRS, this is necessary for tax reporting and hiring employees.

Articles of Organization

| Document | Description |

|---|---|

| Articles of Organization | The Articles of Organization is the primary document required to officially form an LLC. It outlines the basic details of the company, such as its name, principal address, registered agent, and management structure. Filing this document with the state secretary or relevant authority legally establishes the LLC. |

| Operating Agreement | Although typically not required by law, the Operating Agreement defines the ownership, rights, and responsibilities of LLC members. It serves as an internal document for governance and dispute resolution. |

| Employer Identification Number (EIN) | An EIN is issued by the IRS once the LLC is formed, enabling tax reporting and hiring of employees. It functions as the company's federal tax ID. |

| Initial Report | Some states require an initial report or notice shortly after filing the Articles of Organization to provide updated contact and ownership information. |

| Business Licenses and Permits | Depending on the industry and location, obtaining necessary permits and licenses is essential to comply with local, state, and federal regulations. |

| Registered Agent Consent | A document confirming the consent of the registered agent to accept legal documents on behalf of the LLC may be required in certain jurisdictions. |

To complete your LLC formation, securing and correctly filing the Articles of Organization plays a crucial role in establishing your business's legal identity.

Operating Agreement Essentials

Forming an LLC requires specific legal documents to establish the company's structure and governance. The Operating Agreement is a key document that outlines the roles, responsibilities, and operational guidelines for members.

- Member Roles and Ownership - Defines the ownership percentages and responsibilities of each LLC member to prevent disputes.

- Management Structure - Specifies whether the LLC is member-managed or manager-managed to clarify decision-making authority.

- Profit Distribution - Details how profits and losses will be allocated among members according to their ownership interests.

Employer Identification Number (EIN)

Forming an LLC requires several key documents, with the Articles of Organization being the foundation of the process. An Employer Identification Number (EIN) is essential for tax purposes and opening a business bank account.

The EIN is issued by the IRS and identifies your LLC for employment and tax obligations. Without obtaining your EIN, your LLC cannot legally hire employees or manage federal tax responsibilities effectively.

State-Specific Registration Forms

State-specific registration forms are essential documents required to legally establish a Limited Liability Company (LLC). These forms vary by state and must be accurately completed and submitted to the appropriate state agency.

- Articles of Organization - This primary document officially registers the LLC with the state and includes key details such as the company name and address.

- Operating Agreement - Although not always mandatory, this internal document outlines the management structure and member responsibilities specific to the LLC.

- Initial Report or Statement of Information - Some states require this form shortly after formation to provide updated contact and ownership information.

Timely submission of these state-specific forms ensures compliance with local laws and confirms the LLC's legal status.

Business Licenses and Permits

Forming an LLC requires obtaining the proper business licenses and permits to operate legally within your jurisdiction. These documents vary based on industry, location, and local regulations but often include a general business license, zoning permits, and health or safety permits. Ensuring you have the correct licenses and permits protects your LLC from fines and legal issues.

Members’ and Managers’ Information

What documents are necessary for an LLC formation regarding members and managers? You must prepare detailed information about each member and manager, including full names and addresses. This data is crucial for the Articles of Organization and the Operating Agreement to establish clear roles and responsibilities.

Annual Reports and Compliance Filings

Forming an LLC requires submitting foundational documents such as the Articles of Organization and an Operating Agreement. Maintaining compliance involves regular filings that vary by state, including Annual Reports and other compliance documents.

Annual Reports are mandatory for most LLCs to update the state on ownership, management, and contact information. Compliance filings ensure that your LLC remains in good standing and avoids penalties or administrative dissolution. You must check your specific state's requirements and deadlines to keep your LLC compliant and active.

What Documents are Necessary for an LLC Formation? Infographic